By Roger J Kerr*

It was inevitable that the Kiwi dollar would undergo some form of downward correction against the USD in the currency markets after the spectacular five cent surge from 0.6440 in early October to 0.6960 last week.

What has been somewhat surprising is the movement back down has not been as large as normally would be expected, given the dominant Australian dollar has depreciated 1 ½ cents against the USD following their very poor GDP growth result.

The NZD/USD has pulled back to 0.6860; however it appears to be displaying some solid resistance at this time amidst a cluster of concerns in global investment and financial markets. Volatility continues in US equity markets and higher volatility is normally associated with a weaker NZD.

The Australian economy only expanded by 0.3% in the September quarter against prior expectations of a +0.6% increase.

The response to the disappointing result was very swift in the FX markets with the AUD falling sharply.

Much weaker than anticipated exports and lower government spending numbers were behind the “shocker” result.

The Kiwi dollar had been out-performing the AUD against the USD ahead of the release, the sudden AUD drop propelling the NZD/AUD cross-rate higher still from 0.9400 up to 0.9500.

The debate over the direction of the Australian economy is now centred on whether this slowdown is purely due to temporary factors, or it is the start of something more permanent and severe.

The former seems more likely, as there is not really any evidence of Aussie consumers tightening their belts due to the decrease in property values over the last 12 months.

Both business and consumer confidence survey results are due in Australia this coming week, together with house price data. Weaker than expected outcomes would see further pressure build on the Reserve Bank of Australia (RBA) to cut their official interest rates as inflationary forces fall away in that scenario.

However, a change in stance from the RBA is not expected as they still anticipate positive growth in the economy coming from the mining/resources export sector.

Australia’s commodity prices have not reduced as much as the AUD exchange rate this year, resulting in higher AUD sales and profits for the mining sector.

The view of this column is that the AUD has been oversold in the short-term due to the soft GDP number. The hedge fund currency speculators will take the opportunity of the lower level of 0.7200 against the USD to reduce their “short-sold” AUD positions before year-end, thus become AUD buyers. Local AUD importers should now have their hedging percentages at the maximum of their policy limits at 0.9500 on the NZD/AUD cross-rate.

Whilst the AUD is likely to recover back up against the USD over coming weeks, the NZD may struggle to keep up as local speculators sell the NZD against the AUD on the cross-rate at 0.9500.

Local fund managers with AUD denominated investments and currency hedges in place for a rising NZD against the AUD would be advised to reduce their hedging percentages.

The risk they hedged against (the NZD/AUD cross-rate moving up from 0.9000 to 0.9500) has now occurred and therefore there is now no reason to maintain the same high level of hedging.

The same could be said for local AUD exporters who hedged to maximum percentages at 0.9000 and 0.9100 a few months ago. They should be either holding off from any further hedging at these levels or actively cutting hedge percentages back to policy minimums. In a similar vein, at 0.9500 on the NZD/AUD cross-rate, it is a good time for NZ companies with AUD denominated debt to repay the AUD loans and refinance in NZD.

The more positive development for the Kiwi dollar over recent weeks has been the stabilisation of both oil and whole milk powder (WMP) prices after their recent price declines.

The Russians managed to broker a deal to cut oil supplies between arch rivals Iran and Saudi Arabia, thus further recovery upwards in oil prices from US$50/barrel seems likely over coming weeks.

The global dairy product market now appears to have absorbed the additional supply volumes coming out of New Zealand over recent months, so a recovery in WMP prices back to US$3,000/MT is forecast rather than further falls below US$2,600/MT.

The US dollar itself has only weakened marginally against the Euro to $1.1380 despite a plethora of negative news for the currency of late. The slower pace of interest rate increases in 2019 signalled by the Federal Reserve was a major USD negative, as was the ceasefire in the trade wars between the US and China. A requirement by global fund managers to buy USD’s before the end of the year is one factor holding the USD up for the meantime. However, the US dollar resilience may only be short-lived with the ballooning US budget deficits still standing out as a big reason for a sliding USD value next year.

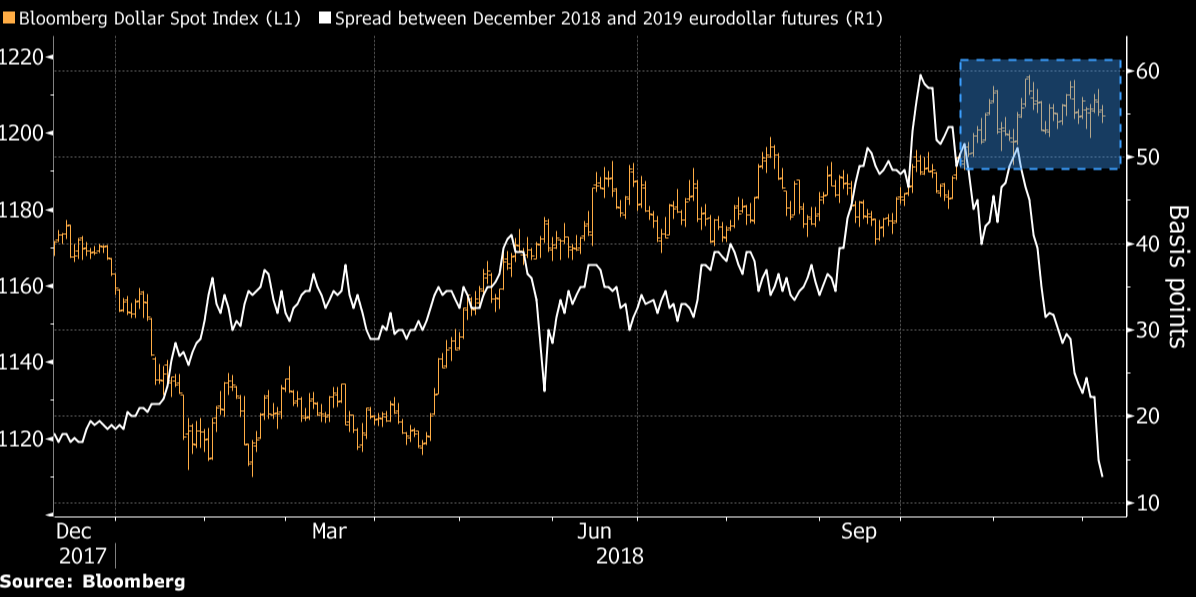

A weaker USD on global FX markets and the typical seasonal gains for the Kiwi dollar in the early New Year may well see the NZD/USD rate trading above 0.7000 again in January and February. As the chart below shows, it only seems a matter of time before the USD weakens to catch up to the market pricing in of reduced US interest rate increases in 2019.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

4 Comments

" the NZD may struggle to keep up as local speculators sell the NZD against the AUD on the cross-rate at 0.9500." Not my view, but that's what makes a market.

Ask yourself. If you were in Aussie and looked at your currency taking a quite substantial hit, for one reason or another, and you wanted a safe haven for your holdings in the face of very uncertain international events, where wud you park your money? New Zealand is my pick...

So your safe-haven currency of choice is a country of 4.5 Million, commodity linked currency with major exposure to it's No.1 export market a.k.a. China - which is currently in the middle of serious breakdown in trade relations with the world's biggest economy?

My pick would be go the historical route and look at the Swiss Franc/Japanese Yen if you are looking for a safe haven currency if things get rocky.

Noting however Japan also have heavy exposure to China.

Doing what everyone else does is what makes us 'the same as everyone else!"

Which currency pair do you reckon would be affected most by a significant safe haven currency flow from Aussie? Swissy or the Kiwi?

It's precisely because both Aussie and NZ are exposed to the same risks that I look at 'who'll suffer most?" and in that case I reckon it's not NZ. As I suggested, in a World of very unknowns at the moment, picking a 'pegged' pair as a safe haven looks a lot better than trying to pick the minor currency direction against a major(s).

It's Christmas! Strange things can happen over the Chrissy break....

With your understanding of the currency markets - hope you trade FX, as I need to generate some money to pay for the Kids Xmas presents...

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.