The Reserve Bank (RBNZ) will probably push the pause button in its next review of the Official Cash Rate (OCR) coming up in the next week.

But the 'probably' appears in italics because it's not a sure fire bet. At all. The reality is the decision the RBNZ's Monetary Policy Committee (MPC) has to make on Wednesday, July 9 is, as economists like to say 'finely balanced'.

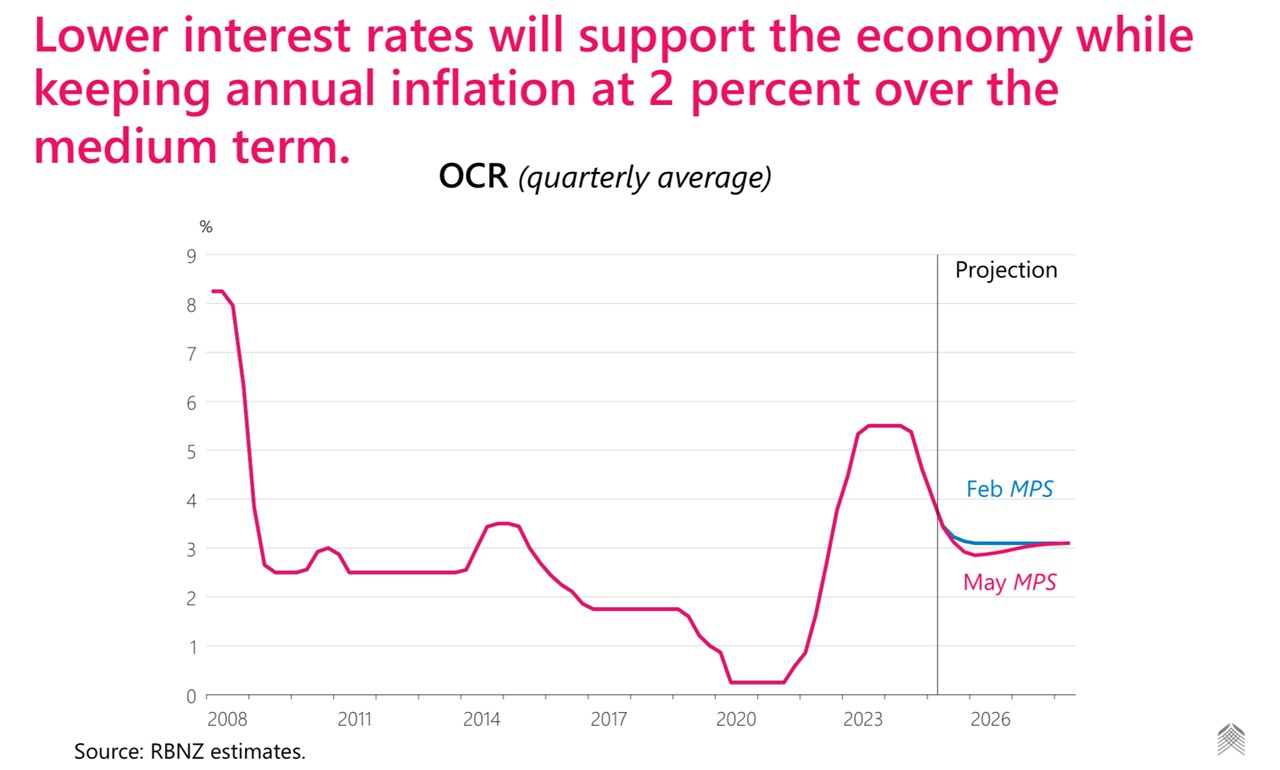

Assuming the decision is a 'hold', this will park the OCR for now on 3.25% and end a sequence of six consecutive cuts, starting in August last year when the rate was at its cycle high of 5.5%. And for those enthusiastic on details, the cuts have in sequence been: 25 basis points (August), 50bps (October), 50bps (November) 50bps (February), 25bps (April) and 25bps (May).

While the general belief is that the decision in the coming week will be a 'hold', this is definitely the most uncertain lead-in to an OCR review since the current easing cycle started last year.

It's not being far-fetched to say that the RBNZ could actually justify any outcome - a pause, another 25bps cut, or even a rise - not that the latter is even remotely on the table.

However, it just emphasises how all the economic indicators are suddenly moving in conflicting directions, making the decision on what to do next real tough.

The RBNZ's last OCR review was on May 28, which was accompanied by a full Monetary Policy Statement (MPS). The MPS indicated one more cut likely this year, with a chance of two.

Since then the biggest official economic data release has been the March quarter GDP figure, which was a 0.8% rise - double the growth the RBNZ actually forecast in that May MPS. All things being equal, such a figure (the 0.8% rise) might suggest that the RBNZ should put the cutting scissors away and leave the OCR on hold for the foreseeable future.

Would that life was so simple.

As we say a lot, our official data is quite dated - and that particularly applies to GDP. The figures for one quarter are released pretty much when the NEXT quarter is all but finished.

And it is that next quarter, the June one just finished, that looks entirely more problematic.

Here's some of the not-great news from that quarter so far.

May figures for both the Performance of Services Index and Performance of Manufacturing Index tanked badly, which taken on their own, would suggest a potential return to recession for the economy.

Electronic cards transaction data for May showed retailing spending levels still flagging.

Monthly filled jobs data is suggesting the unemployment rate, which was 5.1% as of the March quarter, may have risen again in the June quarter.

House prices are still subdued and several bank economists have pretty much halved earlier predictions of an up-to 7% rise this calendar year.

Migration levels are now subdued as well, which will not be supportive of extra economic activity.

And yet, going against all this, the most timely inflation information, provided by Stats NZ's monthly Selected Price Indexes is showing that inflation is very much alive and well, with food prices having lifted 4.4% in the 12 months to May.

Some good news for the economy is coming from the very strong performance from the primary sector.

A key input into the decision making for the coming OCR review has been the latest NZIER Quarterly Survey of Business Opinion (QSBO), released on July 1. This survey, which has been going since 1961, is much watched by the RBNZ. However, the latest survey will have given signals, which, much like other data around at the moment, have appeared rather conflicting.

Like the ANZ Business Outlook survey released the day before, the QSBO has been for some time now been reflecting a business environment in which businesses have optimism for the future, but reckon the present's pretty tough. In other words, things are going to get better. They just haven't. And as I say, this kind of tone has been going on in the surveys for a while now. How long is too long?

In truth, the RBNZ is not likely to have been all that surprised by recent developments. In its May MPS it forecast GDP growth of just 0.3% for the June quarter, and a measly 0.2% for the September 2025 quarter. It had actually reckoned there was going to be a slow down.

Inflation is, of course the biggie. The RBNZ is charged with keeping it in a 1% to 3% range, while explicitly targeting 2%. In the March quarter, annual inflation as measured by the Consumers Price Index (CPI) rose to 2.5% from 2.2%. The RBNZ's May MPS forecast annual CPI inflation of 2.6% as of the June quarter and 2.7% for the September quarter - and then falling again after that.

So, again, the RBNZ's not going to be too surprised by the indications that inflation is rising again. However, the RBNZ may well prove to be a little low in its forecasts. Some of the main bank economists now see a short term spike in inflation this year of above 3%. If it's short term that's not really a problem.

Where it becomes a problem is if the public starts to expect future inflation and begins to act accordingly. And 4.4% food price inflation is, let's face it, very noticeable and could lead to the dreaded 'inflation expectations' and therefore potentially inflationary pricing behaviour - the so-called vicious cycle of putting prices up because we expect prices to go up, and so on.

The RBNZ would be very wary of such behaviour re-emerging, given that it's only really recently dampened the inflationary expectation fires down that resulted from the last spike in inflation that saw the figure get as high as 7.3% in mid-2022.

Anyway, it's all a bit of a stew for the RBNZ to chew on.

The 'official' information currently in front of the RBNZ would definitely suggest holding the OCR at 3.25% - possibly for some while. But the more current 'high frequency' data is suggesting that the momentum that appeared in the first quarter has died in the second. And that might suggest more cuts are definitely needed.

The OCR decision on Wednesday will not be accompanied by an MPS, so, it will just be a pithy news release accompanied by the record of the MPC meeting.

The RBNZ doesn't generally like to substantially change tack at non-MPS OCR reviews, but it will do if it has to (as indeed it did last July after it got its view of the world horribly wrong in the May 2024 MPS).

Right now though, it doesn't look as though the RBNZ's assessment of the economy as per its May 2025 MPS was too far out. So, logic suggests the Monetary Policy Committee can sit tight on this one, watch developments, and then make any substantive changes to its outlook in the next MPS, which will accompany the August 20 OCR review.

Current financial market pricing sees a less than 20% chance that the OCR will be cut in the coming week, but the probability of an August cut is more than 70%.

However, while the markets are deciding that there will be no cut in July followed by a cut in August, I think its unlikely that the RBNZ will be giving out any hints. I think it will be very keen to keep its options open. The key part of the May OCR statement from the RBNZ was the deliciously vanilla "...the Committee is well placed to respond to domestic and international developments to maintain price stability over the medium term".

I could quite imagine this extremely functional sentence may be reused this time around.

So, assuming all this goes as expected, what does it mean?

Well, mortgage rates aren’t likely to be reduced much more in the short term - not without further OCR cuts. Which might be a bit of blow for the not inconsiderable numbers of people who appear to be waiting on short fixed terms or floating rates for further cuts.

The key question becomes whether the apparent stall in the economy in the second quarter (and let’s face it, at least some of this is likely a reaction, possibly over-reaction to the ‘Liberation Day’ tariff bomb) continues or worsens in the third quarter we are now in. And will this require further OCR cuts?

Kiwibank and ANZ economists are still forecasting a low for this cycle of 2.5%, which if it occurs will certainly give more room for further mortgage rate cuts.

Last year when the RBNZ started cutting the OCR, there was a fairly clear path ahead - inflation was tamed, the economy severely needed a pick up, and so large scale cuts were what the doctor ordered.

Now it's really no longer clear what's needed. It's a question of wait and see and act as necessary. And it's to be imagined that's exactly what the RBNZ's approach will be.

*This article was first published in our email for paying subscribers first thing Friday morning. See here for more details and how to subscribe.

9 Comments

So what we're going to get is another 6 months of a very average economy before the pundits say, "the interest rate settings don't seem to be low enough", and then do something about it. In this environment, waiting to see what happens is nothing more than wasting time delaying the inevitable.

The solution to our problem (in my opinion..) is lower private debt vs GDP (this will probably be painful).

Dropping rates and increasing mortgage lending is simply creating more of the problem and nothing of a solution.

If lower rates encouraged people to pay down debt faster then great - but the opposite appears to occur where people see it as an opportunity to greedily drown themselves in more debt (encouraged by the banks of course..) The result is higher house prices, more money spent on mortgage servicing and in general (in my opinion) places the country in a worse place than before dropping rates. Doubling down when in trouble isn’t a good idea..sometimes you actually need to change direction/behaviour to set a new course that leaves you in a better place.

I personally think we need a period of relatively flat rates to balance everything out..these highly aggressive drops then rises in rates create financial instability…and this is caused by the institution that is responsible for financial stability!!

Agreed. Giving addicts more of their drugs does nothing to fix the issue. To much debt is crushing the system and only benefitting bank shareholders.

Yes and holding the rest of the economy to ransom ie ‘we need rates to drop to save the economy!’ No that simply means we need rates to drop to save those holding excessive private debt.

As per the other article this week - raising rates may actually stimulate the economy by giving increased cash flows to those holding savings (while simultaneously reducing the private debt vs gdp risk we have).

I completely agree but the absence of a replacement is what concerns me. Not much of a willingness in the beehive to take the lollipop away in exchange for something more nutritious.

I think the National government will eventually realise they need to reverse course and increase government spending - whether they figure this out soon enough before next election is the unknown (in my view).

Agree, it seems the Reserve Bank is more worried about a growing economy rather than inflation

Any sober analysis of the economy would conclude that the current slump is not based on vibes or tariff scares etc; it is based on aggregate demand in the winter not being high enough to sustain jobs.

We are stuck in reverse - the trend is 100 jobs lost a day (36,000 a year). That's a million dollars of wages every week. Obviously this compounds - lower demand means fewer jobs etc.

I don't thing a 25pts cut will make much of a difference, but if RBNZ are basing their decision on the state of the economy rather than the inflation bump driven by global food prices then they will cut.

Remember it took nearly four years, a Bill English capital spending injection, and a big pulse of global reinsurance money to recover from the GFC. Bizarrely we think we can pull out of the dive this time by fiddling with interest rates and making corporate word salad speeches. It's embarrassing - macro students in the future will study this period in NZ and gasp at our incompetence.

Anyone here in contact with the previous Reserve Bank Governor? We could always ask his opinion on whether to cut the OCR or not

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.