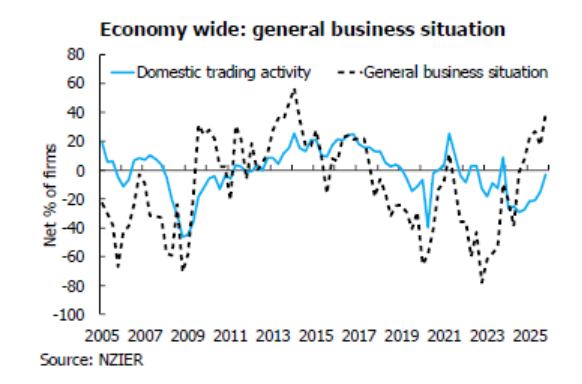

Business confidence is at its highest level since March 2014, according to the latest New Zealand Institute of Economic Research (NZIER) Quarterly Survey of Business Opinion (QSBO).

The QSBO, released on Tuesday morning, shows a strong increase in business confidence in the 2025 December quarter. A net 39% of firms surveyed expect better general economic conditions over the coming months on a seasonally adjusted basis. That's a substantial increase from the net 17% expecting an improved general economic outlook in the 2025 September quarter, with business confidence at its highest level since March 2014, NZIER says.

"There was also a marked improvement in firms’ own trading activity, with only a net 3% of firms reporting a decline in activity in their own business in the December quarter on a seasonally adjusted basis. Although the gap between business confidence and firms’ own domestic trading activity remains, the latest results suggest that New Zealand’s economic recovery is starting to take shape as the effects of lower interest rates flow through to the broader economy," NZIER says.

"Given these positive developments, firms’ hiring and investment intentions have increased. A net 5% of firms increased staff numbers in the December quarter, and a net 22% are planning to hire in the next quarter. A net 11% of firms plan to increase investment in buildings over the coming year, while a net 7% plan to increase investment in plant and machinery. This contrasts with the negative investment appetite reported by firms in the September quarter."

"There are also early signs that spare capacity in parts of the New Zealand economy is reducing. This is reflected in the NZIER QSBO labour market indicator, which showed a small proportion of firms reporting it was more difficult to find skilled workers in the December quarter. Meanwhile, firms continue to report it being easier to find unskilled workers," NZIER says.

Inflation pressures 'broadly contained', no further OCR cuts seen

The QSBO has been running since 1961 making it NZ’s longest-running business opinion survey. Every quarter about 10,000 firms are asked whether they think business conditions will deteriorate, stay the same, or improve. The QSBO is closely watched by the Reserve Bank, which is due to review monetary policy for the first time in 2026 on February 18. The Official Cash Rate (OCR) is currently at 2.25%.

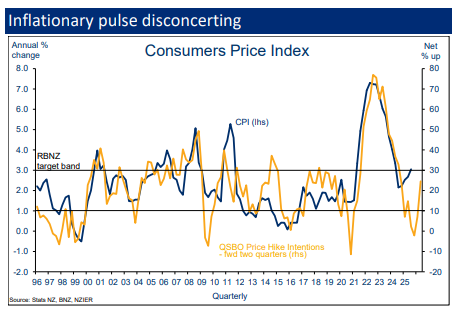

NZIER says cost and pricing indicators suggest inflation pressures within the NZ economy remained "broadly contained" during the December quarter. It says cost pressures eased, with a net 37% of surveyed firms reporting higher costs in the December quarter. However, there was "a small pick-up" in firms raising prices in the quarter.

"However, the building sector was the exception across the sectors. A net 31% of building sector firms reported they had cut their prices in the December quarter in the face of continued weak construction demand."

"These developments suggest spare capacity remains in the New Zealand economy, especially in construction. This spare capacity is keeping inflation pressures in check. With demand starting to recover but inflation remaining contained, we expect no further OCR cuts in this monetary policy cycle. We forecast the OCR to trough at 2.25% until the Reserve Bank commences increasing the OCR in the second half of 2026," NZIER says.

Toplis sees 'clear signs' inflationary pressures are rising

BNZ Head of Research Stephen Toplis says the QSBO shows "clear signs" inflationary pressures are rising.

"In particular, a net 25% of [QSBO] respondents said they intend raising prices. This will certainly garner the attention of the Reserve Bank."

"This level of pricing interest is a big jump from the 7.0% who thought they’d be raising prices a quarter ago and the net 2.1% who indicated prices would be declining a quarter before that. It was also the highest reading since June 2024 and consistent with annual CPI [Consumers Price Index] inflation moving into the top half of the Reserve Bank’s [1% to 3%] target band. To cap things off a net 43% of merchants said they intend raising prices. As it’s merchants that dominate the CPI this is disconcerting," Toplis says.

"By itself we don’t think there’s enough in these data to have the Reserve Bank reaching for the trigger to hike its cash rate. But the data are strong confirmation that the next move in interest rates is up and that the balance of risk is that this happens earlier than the first quarter 2027 suggested in the Reserve Bank’s November Monetary Policy Statement."

"We currently have a first hike pencilled in for February 2027, the market is pushing for October 2026 with a hike by December seen as a certainty. We would not argue strongly that the market is mispriced given what we have seen in today’s data but would need further confirmation of rising inflationary pressure for us to formally shift to an expectation of an earlier Reserve Bank response. The direction risk, nonetheless, is clear," says Toplis.

"Overall, we see nothing in the December QSBO to deter us from thinking that 2026 will be a happier New Year. For that we are grateful!"

Statistics NZ's September quarter CPI showed an annual increase of 3%. The December quarter CPI is due for release on January 23.

Manufacturing the most optimistic sector, weak construction demand

Confidence rose across all sectors surveyed in the QSBO. Manufacturing is now the most optimistic sector, with a net 56% of the manufacturers surveyed expecting better times ahead. Manufacturing was the least optimistic sector in the September quarter.

"This lift in manufacturers’ confidence appears to be supported by increased domestic and export demand in the December quarter. Although costs remained high, manufacturers reported improved profitability for the quarter," NZIER says.

"The building sector is feeling much more upbeat about the outlook, with over half of the firms surveyed expecting general economic conditions to improve in the coming months. However, actual demand remained soft, with building sector firms continuing to report reduced new orders and output in the December quarter."

"The measure of architects’ work in their own office also reflects weak construction demand, with architects expecting a reduced pipeline of housing, commercial and government construction work over the coming year. The longer-term outlook is more positive, with expectations of recovery in the pipeline of housing and commercial construction work for the next 12 to 24 months," NZIER says.

It says the soft construction demand further reduced the pricing power of building sector firms, resulting in a further deterioration in building sector profitability.

"The continued softening in the building sector’s cost and pricing indicators suggests construction cost inflation will remain low in the near term."

Retail and services sector sentiment also improved.

"For retailers, although domestic sales were weak in the December quarter, new orders picked up, and retailers feel hopeful about a recovery in demand over the coming months. Although the proportion of retailers whose prices increased in the December quarter rose, profitability remained weak as cost pressures intensified," says NZIER.

"As for the services sector firms, the lift in their confidence appears to have been supported by a pick-up in demand and expectations of a further decline in interest rates. Against this backdrop of improved confidence and demand, some services sector firms increased staff numbers in the December quarter. Nonetheless, profitability in the services sector remained subdued."

8 Comments

"Get your kicks in '26"

🥂

is this pent up demand? all over again

Although the gap between business confidence and firms’ own domestic trading activity remains...

This is the gap that has to close if the hype is to become the reality.

It's almost as if there is an 18 months lag between OCR reduction and an improving economy (sarc)

Is the RBNZ able to increase/decrease the OCR by amounts less than 25bps? Eg 10bps or 5bps.

I often wonder why they don't do this myself because as the rate gets closer to zero a 25bps is a greater and greater percentage change. Surely it would make more sense to adjust it x% rather than 25bps or 50bps no matter how close we are to zero?

Then once we get into negative rates, increase the reduction size back up as the percentage reduces again.

If you keep them in the dark, what is it exactly that you're monitoring?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.