Summary of key points: -

- Federal Reserve on-track to taper – USD positive

- Risks and challenges ahead for the NZ economy

Federal Reserve on-track to taper – USD positive

The highly anticipated US Federal Reserve monetary policy meeting on 22 September came and went with the US dollar exchange rate largely unchanged, as it transpired.

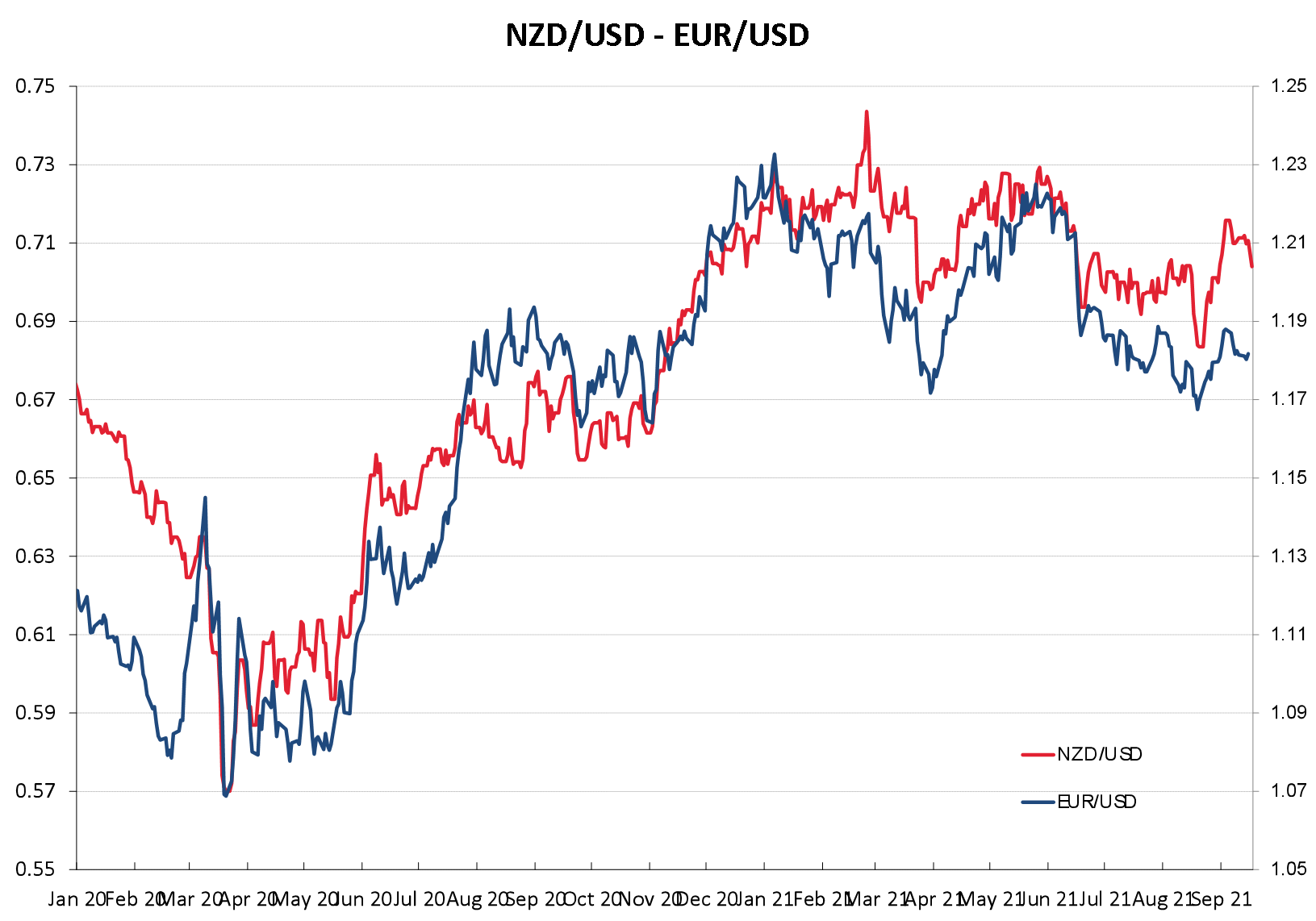

Therefore the NZD/USD rate has traded in a relatively stable fashion just above 0.7000 over recent weeks. Global FX markets sold the US dollar from $1.1700 against the Euro to $1.1900 following the weaker than expected August jobs numbers in early September as they priced-in a view that the Fed would take longer to start their tapering programme.

However, brighter economic data in the form of stronger than forecast August retail sales, prompted a USD recovery on book-squaring ahead of the Fed meeting.

So, no surprises and no fireworks for the markets as the Fed inch towards a consensus that the US economy no longer needs such a high level of monetary policy support and the tests to start tapering back the stimulus in the form of inflation and employment metrics are close to being met.

The next signpost for the Fed and the financial markets is the September Nonfarm Payrolls employment number on Friday 8th October.

There were some disruptions to the expected massive hiring increases over the month of September as Hurricane Ida impacted the normal course of business and the Covid delta strain slowed things up in the low-vaccinated southern states.

It seems that Fed Chair, Jerome Powell will only need a moderate jobs increase in September, somewhere north of 400,000, to start pressing the taper button in October or November.

The component parts remain in place for one last bout of US dollar strength against the Euro to $1.1600/$1.1500 over coming weeks.

Should that USD appreciation occur as forecast, the NZD/USD rate will once again find itself in the lower 0.6900/0.6800 trading range, despite the RBNZ lifting the OCR interest rate by 0.25% on 6th October (typically a Kiwi dollar positive factor).

Over and above positive US economic data, the US dollar should also gain some strength in the short-term from investment markets turning more towards the “risk-off” mode due to a number of uncertainties intensifying, namely: -

- The Evergrande debt default saga in China is far from over, despite some relief that they survived last weeks’ interest payments (or did they?).

- The Chinese government has decreed that trading cryptocurrencies is an illegal activity, thus many investors around the world are about to learn an expensive lesson in “regulatory risk”. Investor sentiment will be dented by this change.

- After 18 months of almost a straight line upwards, US equity markets have finally reached the point where their monetary policy candy (0% interest rates and QE) is about to be removed. Rising interest rates was always going to be “the” factor to cause an equity market downward correction and now there is much more certainty about US interest rate hikes in 12 to 18 months’ time.

Increasing NZ interest rates and a weaker US dollar on global currency markets in 2022 are certainly positive NZ dollar factors in the medium term that should deliver Kiwi dollar appreciation to above 0.7500.

However, whilst there is a risk of a significant correction down in global equity markets in the shorter-term, the Kiwi will be vulnerable to lower levels.

The US dollar generally appreciates on “safe-haven” flows when equity markets are tumbling, and the NZ and Aussie dollar rapidly lose their flavour in such market conditions.

Risks and challenges ahead for the NZ economy

A 0.25% increase in the OCR has to be read as a given from the RBNZ on the 6th of October. Anything else would be a shock to the markets.

What will be more important, and enlightening is how the RBNZ sees the NZ economy extracting itself from the massive fiscal and monetary stimulus it has been supported by over the last 18 months.

The question is whether there will be sufficiently strong business investment and consumer confidence to underpin economic growth when the Government is more fiscally constrained and the RBNZ are shoving interest rates up. The opposite impulse for the economy to the last 18 months.

We should expect that the RBNZ highlights the risks and challenges ahead for the NZ economy.

It is their job to forecast ahead where GDP growth and inflation will be in 12 to 18 months’ time, so as to set monetary policy well ahead in time and therefore giving the transmission mechanisms through the economy time to work.

Unfortunately, the 18th of August RBNZ Monetary Policy Statement gave the impression of a knee-jerk reaction to unexpectedly stronger economic data in the June quarter, than a considered look-ahead.

The internal and external risks/challenges for the NZ economy over the next 12 months, in my view, are summarised as follows: -

- Slower than expected global growth (with China looking inwards) results in lower export commodity prices. Do not discount the risk of a double-whammy negative impact for primary exporters (and their grower/farmer suppliers) of decreasing commodity prices and a rising NZD/USD exchange rate as the RBNZ hike rates and the USD itself weakens in 2022.

- Depending on how long the Government takes to get itself organised on re-opening our borders, domestic consumer spending could be well down in 2022 and 2023 as everyone returns to overseas travel/holidays.

- House prices no longer increasing due to higher mortgage interest rates and new supply coming onto the market will also work to constrain consumer spending next year.

- Labour shortages due to Government ineptitude around immigration policies will continue to constrain export industry production and growth. An additional risk is trained-up younger people heading to the enhanced salaries and opportunities across the Tasman as the Aussie economy expands earlier and faster than we do.

It does not add up to +0.8%, +0.8%, +0.7% and +0.7% successive quarterly GDP growth outcomes over the next four quarters as the RBNZ are currently forecasting.

As the risks emerge into reality, the RBNZ will be forced to dial-back their aggressive monetary tightening plan.

It will be a NZ dollar negative when they do that.

In order to plan and risk manage their operations ahead of time, businesses require these types of scenarios and hypotheticals listed above so they can make informed and calculated decisions.

The same could not be said for our PM who “does not deal in hypotheticals” or the Director-General of Health who favours the “crossing that bridge when we come to it” management approach.

The New Zealand public, including the business community, have been poorly served by the inertia and roadblocks inherent in the Government bureaucracy as we manage our way out of the pandemic.

As Rob Fyfe succinctly pointed out last week, the politicians are asking the bureaucrats to undertake strategic management tasks they are not capable of doing.

The politicians failed to follow the advice of Sir Brian Roche 12 months ago to establish a stand-alone and properly resourced Covid response unit which could have done the strategic stuff.

Instead we have the Ministry of Health managing MIQ accommodation facilities and DHB’s administering vaccination centres (whereas GP practices have the patient information, systems and resources to handle such a task).

At the end of the day, it appears that business firms have now realised the limitations of the Government to extract the economy from lockdowns and labour shortages, so they are getting on with implementing their own vaccinations, Covid tests and quarantining arrangements.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

2 Comments

Agreed, The media and old guard economists have yet to accept there is a new normal. A long term, low interest rate economy.

The inability of this government to adequately plan for mitigating the risks associated with a suppressing Delta could have significant negative financial & health consequences for NZ over the next decade. Unfortunately not enough sensitivity analysis has been done by Treasury to look at the impacts of low vaccine effectiveness.

Whilst the Pfizer vaccine will provide significant protection against hospitalisation & death, it has had a poor record at preventing Delta infections/symptoms about 6 months after getting the second dose of the vaccine (known as waning effect). Vaccinated people that get infected with Delta (known as a break-through infection) are just as infectious as an unvaccinated person.

This problem means that there is a high risk that the virus will continue to keep circulating in the NZ community and will continue to keep infecting the unvaccinated. Israel is currently going through its 3rd wave because of this problem.

There is much debate on whether booster shots should be given after 6 months. USA has some concerns for people under 65 and currently is not recommending this. WHO raises inequity issues and wants poorer nations to get their vaccinations first.

Businesses need to prepare for the possibility of significant restrictions and an economic downturn because NZ’s infrastructure for looking after Delta patients in hospitals & managed isolation is woefully inadequate.

There is a possibility Delta cases will increase in NZ throughout 2022 because of the problems discussed above.

See last page of link below for graph showing waning effect depending on month you were vaccinated. (Link takes 30s to download)

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.