Oops it did it again. The New Zealand economy blew all expectations out of the water once more, with GDP rising by 2.8% in the June quarter.

The figures were released by Statistics New Zealand on Thursday.

That smashed market expectations of 1.2% and obliterated the Reserve Bank's pick of 0.7%.

The latest quarterly rise compared with a revised figure of +1.4% for the March quarter.

The hot state of the economy prior to the latest Level 4 lockdown will back up the belief that the Reserve Bank will soon - probably next month - hike interest rates through raising the Official Cash Rate (OCR), which is still at the emergency setting of 0.25% it has been on since March 2020 .

ASB chief economist Nick Tuffley and senior economist Mark Smith said the most recent lockdown is set to add further volatility to GDP figures through the remainder of the year.

"Uncertainty is high, but we expect the sharp Q3 dip to be short-lived and followed by a strong Q4 rebound.

"We expect the RBNZ to ‘look through’ near-term volatility and reduce monetary stimulus, with a series of 25bp hikes starting from next month. We envisage a gradual path of OCR hikes and a low 1.50% OCR endpoint."

This was the Stats NZ release:

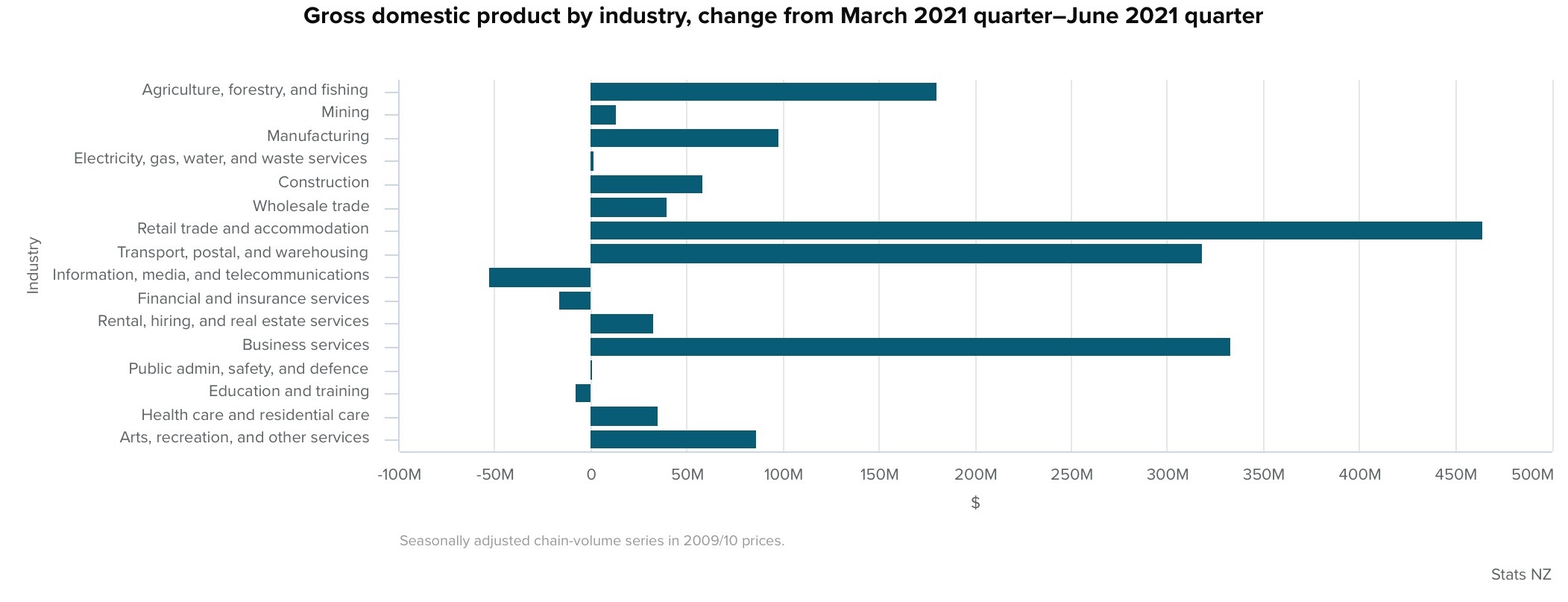

Stats NZ said the 2.8% rise in June 2021 quarter GDP was led by the services industries. The primary and goods-producing industries also contributed to growth in the quarter.

Retail trade and accommodation was the largest contributor to GDP growth in the June 2021 quarter, driven by higher activity in accommodation and food services.

The transport, postal, and warehousing industry was boosted by rises in air transport and transport support services. This industry has been significantly affected by restrictions on international travel in response to the Covid-19 pandemic, as well as continued disruptions to the international transport of goods.

Despite the increase in activity this quarter, transport, postal, and warehousing has fallen 7.0% since the pre-Covid -19 December 2019 quarter.

Business services also contributed to the growth in services and total GDP in the June 2021 quarter, rising by 4.8% due to higher activity in engineering, architectural and consulting services.

Exports of services also increased in the June 2021 quarter, rising by 63.0%. This was driven by rises in exports of travel services, transport services, other business services, and also film exports. However, exports of services remain significantly affected by international travel restrictions due to Covid-19 and are still 43.0% below the levels of the December 2019 quarter.

“The June 2021 quarter experienced fewer Covid-19 restrictions than previous quarters affected by Covid-19. Many industries experienced activity at or above pre-Covid-19 levels, while some remained below,” Stats NZ's national accounts senior manager Paul Pascoe said.

Most of New Zealand was in alert level 1 for the entire June 2021 quarter, apart from Wellington, which spent six days in alert level 2 at the end of June.

"Prior to the Covid-19 pandemic, the June quarter traditionally showed a large decrease in international travel related activity, following the peak summer season in the March quarter,” Pascoe said.

“However, Covid-19 has interrupted that seasonal pattern markedly.”

Covid-19 restrictions have caused significant changes to typical patterns of activity, with international travel and related expenditure currently at very low levels and not showing the normal large decline from the March quarter peaks. This has muted overall GDP growth in the March 2021 quarter, and contributed to growth in the June 2021 quarter, when we account for the usual seasonal effects.

“Opening the trans-Tasman travel bubble with Australia in the June 2021 quarter also contributed to services industries with links to tourism, such as retail and accommodation, and transport,” Pascoe said.

Household consumption expenditure fell 1.4% in the June 2021 quarter, due to a 1.9% decline in household spending on services. This was partly offset by increases in spending on durable goods (such as electronics and furniture), which were similarly reflected in growth in the retail trade subindustry (up 2.6%).

When compared with the pre-COVID-19 December 2019 quarter, household spending increased by 6.0% with spending on durable goods 19.7% higher.

Economic growth

Select chart tabs

69 Comments

Nominal seasonally adjusted GDP(E) rose 7.2042% on an annual basis from Jun20 to Jun21. The spoils of government deficit spending? If so there is plenty left on account lodged at the RBNZ's Crown Settlement Account.

A sovereign can inflate away debt if the average interest rate on the debt falls below the growth in nominal GDP. (It doesn’t matter whether it’s volume growth or inflation driving GDP.) It's called covert default. Link.

Don't you mean Covid default?

Are we seeing a real increase in productivity, or simply a reflection that inflation is here and exploding.

If we measured inflation correctly, and adjusted these figures as such, one wonders where we actually at in real terms.

The GDP per capita statistic is out of date but it shows we'd still be in negative territory in comparison before covid. Not all that surprising with tourism shut and all the other things going on.

They calculate real GDP by first calculating the nominal gdp then adjusting it by the gdp deflator. The gdp deflator is a price index which suffers from the same flaws as the CPI & can't be trusted. It understates the rise in nominal gdp attributable to a rise in prices. It overstates the rise in nominal gdp attributable to a rise in output.

It is interesting that those people who raise critical voices about the way governments and their agencies handle covid and mass vaccination fear mongering campaigns, are usually very literate in finance and monetary things. Literally all the usual economic news, blogs or commentators I have frequented over the last 10-15 years seem to be fairly unanimous in their critical assessments of Covid-19 to one degree or another. I know, perhaps boring comment. Nevertheless, a compliment to interest for being the only NZ news website I visit frequently, if not always daily, and happy to support financially.

Thanks David Chaston and your team!

This is a phenomenal number - its effectively a 11.2% annual growth rate for NZ. Those numbers are staggering - that growth rate is what China recorded in 2005-2008 when they were transitioning from a developing economy.

Keeping in mind in mid 2019 when the RBNZ cut interest rates - they were concerned that GDP was about to slip below a 2% annual growth and the economy would need stimulus to get GDP back to the average annual growth of 2.8% PER ANNUM - now this growth level is happening per qtr.

There is an argument to be made that the lockdown may have been a good thing - just to take some heat out of the economy. No wonder the government doesn't want to hand out money to struggling businesses - any more stimulus is only going to add fuel to the raging inferno.

Orr must be thinking 'wow, we've really overdone this COVID stimulus'....if not, well I don't have the words to describe what I'm thinking.

Still want to know the real reason that Bascand resigned.

Personal reasons. It's always personal reasons.

Talk about reasons, it's interesting that Bascand actually commented on Stuff's article "Reserve Bank cracks down on first-home buyers" about risks of a housing market correction just after the day RBNZ announced his resignation, here is what he commented:

"'Our analysis indicates that house prices are above their sustainable level, and the risks of a housing market correction are continuing to rise. The proposed tightening of LVR restrictions will over time help reduce the number of highly leveraged borrowers and help to build resilience in the financial system,' said deputy governor and general manager for financial stability Geoff Bascand.

'Lending at LVRs greater than 80 per cent has nearly tripled since 2017, with the large majority of this lending going to first-home buyers, followed by existing owner-occupiers. Although our stress testing indicates that the financial system is well-placed to weather shocks such as a downturn in the housing market, we are concerned about the potential future risks to economic and financial stability of allowing this higher risk borrowing to continue at its current rates,' he said."

https://www.stuff.co.nz/business/300402279/reserve-bank-cracks-down-on-firsthome-buyers

I would suggest that says everything we need to know! It would also not surprise me if RBNZ is well aware of some major issues in the global financial system hitting limits again behind the scenes. Evergrande in China being just one of several globally. Europe has its fair share of larger players with issues hidden for a long time. If you are in possession of knowledge that few if anyone else has, decisions may not make sense to others. I believe that the rolling lockdowns together with supply chain disruptions have interrupted the flow of money and energy too severely. Someone very smart said to me a very simple thing a long time ago: “It’s the flow, not the stock”… and that applies to any business or economic system.

The data has shown us that lock-downs were held in the period of this incredible growth. Correlation is not causation but drawing an opposite conclusion is not supported ether.

"There is an argument to be made that the lockdown may have been a good thing" Only from a health point of view not economically.

Lock downs have caused this inflation, would we have had this inflation without economic stimulus? Why do we have this stimulus? Why are interest rates still so low? "Lock down losers" are losing big time. Lock down winners whom happen to be the main drivers of inflation are still winning, houses, supermarkets, insurance companies....

Lock down winners whom happen to be the main drivers of inflation are still winning, houses, supermarkets, insurance companies....

You forgot the real key drivers in that small group! You know, the one’s who also create the vast majority of our money supply? Banks… have really cranked up their lending again. Otherwise the spike in prices would not be possible.

What a lot of of hot air and breathless hyperbole. The last quarter may have been red hot, but the lock down of NZ 's engine room, Auckland, will put the country into reverse. Even if level 4 ends next week, level three will be little better. The Auckland economy has been smashed and a whole lot of collapses and job losses will follow as sure a night follows day. As that becomes clear, the property market will go into a death spiral with only one good out come - the riddance of that bunch of hopeless nincompoops masquerading as politicans who swan around Parliament on full pay - plus perks.

The Auckland economy has been smashed and a whole lot of collapses and job losses will follow as sure a night follows day

Similar predictions last year did not materialise. Instead unemployment dropped to 4%.

What you'll find this to be is property investor/speculator propaganda, which was also used last year during lockdowns, to tell the government and RBNZ how terrible things are, and how desperately we need to drop interest rates to keep the 'economy' from crashing.

But all the property investors want is to drop the cost of borrowing and keep it low in order to maximise their personal proft on their property portfolios.

Mr Orr the economy is terrible...drop the OCR please....which is code for I want lower interest rates so my property portfolio goes up by another 30%.

Ah the Reddell trick! Plunge the OCR deeply negative please!

It's still too early to tell. Yes, the lockdown will bring a huge impact on the economy. But with government's wage subsidy support, we might see another frenzy market after lock down. The retails market might be even hotter. Last year, economy bounced back fairly quick. That's probably why the predictions of economic data have been out of touch. Banks are still hiking rates. They have their reasons to do so.

I wish the public would hold politicians responsible but this is not what happens. Perhaps somewhat due to 1 in 5 (18%) of the workforce being in government, perhaps due to our political tribal leanings but all that is waiting in the wings is more of the same.

As a base effect tourism will be down from its previous 6.1% of NZ-wide GDP and the hospo' sector will be way down from its 1.7%. What effect Aucklands' closing has had on the other sectors remains to be seen. There will likely be a mix of good and bad, small businesses failing and those in service industries taking a dip in takings that may be helped by "forced savings" of others in the lock down.

THERE IS A TRICK TO THE STATS.

Basically, you get all the unemployed on the TTAF and put them on training and development so they don't contribute to the Unemployment Rate because they're not actively applying for jobs and not part of the labour force.

I'll be quitting my job soon and studying full time because I'm sick of those f--kers that I have to deal with and see in the office (even when WFH) on a regular basis. I'm not unemployed, I'M STUDYING

NEW ZEALAND FOR THE WIN!!!

More proof the COVID elimination strategy is the best economic response.

Yes. Labour have really nailed it.

Hi Jacinda,

Is it your practically perfect elimination strategy that's ruined contractors and small businesses?

Or is it the money printer go brrrrrrrr..... house prices go brrrrrrr..... interest rates go nrrrrrrrr.

Here comes Brock, looking for the cloud in every silver lining.

Hi Jacinda,

That's a typical non-answer. Some of us can see that the cloud and silver lining are really just smoke and mirrors.

Nation-wrecking amounts of money printing and asset inflation doesn't make you an economic genius.

It makes you the next Robert Mugabe.

Well, that comment comes complete with heaps of hyperbole.

Yes, Brock's comments always do.

Far more accurate than yours however.

It certainly looks that way, until you take your blinders off and realise that all the borrowed money we've been using to prop up the economy eventually needs to be payed back, the majority of which won't be getting done by you or me.

I'm sure we all feel like we've done comparatively well out of this whole pandemic thing. I'm not sure our children and grandchildren will feel the same way.

The secret is that most debt in the world is never going to be paid back, just defaulted on.

Agreed, but that comes with its own set of consequences.

the big thing is the most of the debt is owed to ourselves , so unless we resell it on the debt market we always have the option to forgive it

You get a customer for life when they default on your debt and you can put a default listing on their credit file so they can't refinance elsewhere.

They can nowhere and you have them by the balls.

If they don't pay, you can take away their home - WIN/ WIN.

What country do you consider in a better position?

It was always going to catch up at some stage to the rapid house price inflation, would of been naive to think otherwise. Now wait for the pressure on wage raises, for the poor businesses already crippled from Lockdowns.

It's a good thing NZ businesses paid internationally competitive wages that definitely keep up with increases in living costs, or else people might not feel that sympathetic about it!

It didn't take the hortivulturalists long to develop mechanical pickers

a lot of developed countries overseas have machines for farming from milking machines to pickers but why would you invest in that when you can just import cheap labour

That's called improving productivity. That's what we should want. Using technology to improve productivity rather than exploiting migrant workers and paying them a pittance.

Yes. Ultimately the productive sectors of the economy must produce the money that is required to support the property ponzie. It is such a brilliantly clever way to run an economy!!!!

Can we have resource draw-down and energy-use and debt-incurred for the period too, please?

Or it's meaningless.

What a surprise.

Gov. Prints 10s of billions of $.

Then the economy goes boom.

I wonder if there is correlation

It’s not property speculator propaganda as a down market helps no one.

It’s more likely we will have stagflation with sky high interest rates and no one able to afford anything. Speculators have choices, to invest or not to invest. But developers, stuck in long term projects who fail one after another. This could well start from similar conditions overseas where super low interest rates have also encouraged crazy projects and mad prices for everything from Art to houses.

'A down market helps no one'.

There is a growing part of society who will benefit significantly from a down market - even if it means 12-24months of unemployment or reduced wages.

The longer term health and stability of the NZ economy and society do need a sustained and managed down market.

A down market, for as long as it does not assume catastrophic dimensions, is now necessary, and in the longer term it would only harm parasitic housing specuvestors.

The problem is that current house prices are so ridiculously over-inflated, and so completely out of sync with any economic fundamentals, that a down market could easily turn this housing Ponzi into a complete rout, if not managed with caution.

GDP

Why do we keep persisting with this totally silly measurement that values imports the same way as exports, doctors, nurses, engineers and teachers the same way as land agents, land lords and prostitutes?

What we measure, is what we get. Silly economic measurement, silly economy.

The govt wants to maintain the illusion that the rise in property prices is backed by sound economic fundamentals & not money printing.

Because it suits the interests of capitalists to use that as a measure of societal progress/output, and a large enough segment of the voting population either directly or indirectly benefit from this paradigm such that they won't vote to radically change it.

Another large segment of the voting population have been lied to enough to convince them that it is in their best interests, even if it actually isn't, and since no one has promulgated an alternative that has gained traction (see again, the first two groups of people), this segment of the voting population just stick with the status quo.

it must be a pretty good measure as all the obviously rich countries have a high GDP per capita while all the poor countries are low. I’m guessing when the GDP figures don’t meet your gloomy expectations they are pointless, but if today’s figures were negative you would all of a sudden find them meaningful.

This doesn't make sense to me.

Where has all the "productivity" come from?

How can real productivity happen with closed borders, industries shut down by govt decree for long periods, and huge restrictions in place?

Is it just govt money printing? That's not a real source of productivity. That's an illusion.

seriously ... dont question the economists

they know what they are doing

Of Two Minds - The Illusion of Getting Rich While Producing Nothing

I know a lot of places that are super busy, people who are working long hours, etc. the closed borders can actually help GDP, or at least in the short term. Also NZ has mostly been open to produce while most other countries have been in various states of lockdown for over a year.

Its a funny time out there and difficult to make projections.

Prices for many things are skyrocketing but that's hugely impacted upon by supply issues. The cost to move containers around is through the roof. Demand for various domestic goods and services is up, because no one's going anywhere so might as well treat ourselves to a new kitchen or car.

And it'll likely take a year or two at least before these issues are resolved, assuming the pandemic doesn't morph into something else.

Its interesting seeing the expectations of the RBNZ in both the speed to make new changes, and their ability to predict the future when the existing playbook is largely irrelevant.

Perspective New Zealand's economy grows nominal 22 billion over the calendar year. New Zealand Housing "wealth" grows 375 Billion.

United Kingdom GDP grows 4.8 percent in June quarter and 22.2 percent over calendar year. Clearly their Covid strategy must have worked better than New Zealand's.

United Kingdom GDP grows 4.8 percent in June quarter and 22.2 percent over calendar year. Clearly their Covid strategy must have worked better than New Zealand's.

Or their economy got smashed harder than NZs, so comparing growth to a lower level makes it look better.

Or as other people in the comments are saying the growth here is just from money printing, so they must've printed more money than us.

Wow! Never thought of that . I must bear that in mind when I interpret (economic) data in future to ensure balance in my comments.

Looks like a huge increase in consumption spending i.e 1st quarter retail, trade and accommodation around $140m jumped to around $460m in this quarter. One big party

www.stats.govt.nz/information-releases/gross-domestic-product-march-202…

You posted a link to the GDP figures for the March quarter.

This is the June one: https://www.stats.govt.nz/information-releases/gross-domestic-product-j…

I wish Orr and Robbo's appetite for controlling house prices matched their appetite for food.

Can't see the trees for the Woods.

NZ wins another gold medal for exceeding expectations at 200%. Keep up the good work and spend big so we can all get a even bigger figure next quarter for Christmas.

The illusion continues. And from what we've heard recently (from within our own wider family) people actually believe them. It is sickening on two fronts: a) that they tell us this BS in the first place, but worse b) it would appear that most of the people believe them. Neither are ideal.

I said a day or two ago that I thought the OCR will be unchanged in October.

Having seen these figures, I have changed my mind. It will be lifted by 25 or 50 BPs, probably the former because of the 'optics' around Auckland only just coming out of lockdown by 6 October.

Yawn. It is not surprising that GDP is up. GDP is basically the amount of money in circulation multiplied by the speed (velocity) at which that money is circulating. Money supply has increased because (a) Government has been spending (creating) money into the economy, and (b) asset-rich households have been confident enough about their wealth to borrow more money, or spend their savings etc. The velocity of money has also increased as the people that have benefited from Government spending have spent it on, and people are spending more.

None of this means that much really - GDP is a crap measure of anything but consumption. And the last thing we need at the moment is more consumption.

There are some pretty rich countries at the top of the GDP per capita table, and some pretty poor ones at the bottom. It may not be a perfect measure but it’s significantly better than crap.

"That smashed market expectations of 1.2%"

I hope all of those bank economists who failed to predict where the economy is heading apologise and reconsider their positions.

Their predictions have been way out all the way through the pandemic from everything from unemployment rates, GDP, OCR to name just a few. How can banks rely on their economists' forecasts to run their operations when their forecasts are so off?

And the media who report these forecasts as fact need to be reconsidering their position as well.

The figures out today are massive, and really draw into question every single business who is in the media demanding Government support. The best performing industry in the June quarter was the hospitality sector. Do you remember when those restaurants decided to go "on strike" demanding the Government allows migrant workers in so that they can exploit them for profit and pay them a pittance? And demanding we open the borders for international tourism? And now they are on the news every night demanding Government support while we are in level 2 and 4. I didn't hear them praising the Government while "higher activity in accommodation and food services" was driving our GDP growth.

This GDP figure is truly world leading. The best growth out of many countries we like to compare ourselves to. Only the UK did better, with a 4.8% growth, but that figure came about as they were loosening restrictions.

GDP growth this quarter will be lower because of the lockdown, but remember that two-thirds of the country was only in level 4 for about two weeks, so I don't think this will be the death knell that the doomsayers in the media are already predicting as fact. As they were last time, they will be proven wrong once again.

I was amazed how far off the Economists and RBNZ growth predictions were from actual for that quarter. Maybe they should get out and about more to gauge what's happening in an economy - many knew intuitively that quarter was booming.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.