By David Hargreaves

It was one of those curious twists of timing this week that saw news of further falls in business confidence coinciding with new figures showing first home buyers continuing to roar into the market.

The two pieces of news are at first flush entirely unrelated. But the point is they very easily could become related - and worryingly so.

First up, I would reiterate that I'm very leery of surveys and opinion polls. In different lives (in the world of PR) I have actually been involved in phrasing questions and content for surveys that were actually designed to guarantee a certain outcome.

It's all about how questions are asked.

The other thing is, opinions can be disingenuous. It was to be expected that business confidence would fall once a Labour-led Government came in. The classic dummy spit.

However, after you've said all that, the one area that needs to be taken pretty seriously is the firms' own intentions. To the extent that you can believe people are genuinely saying what they will do, any findings that show businesses intending to cut back on investment and hiring need to be taken on board.

Just the very fact that people say these things can become self-fulfilling.

Independent economist Cameron Bagrie (who for a long time was of course ANZ's Chief Economist) was typically pithy: "The economy is now clearly tracking around 2% and not 3%," he said.

"The difference between 3% and 2% growth is a $800m potential loss of tax revenue. Treasury is expecting growth to rebound to 3-3.5% - that’s a country mile off. We need a solid looking economy to deliver on the social policy agenda. That solidity is looking shaky."

Excellent cut-to-the-chase comments that boil down the situation nicely.

Okay, let's move aside from businesses being ratty that the lefties are in the House - the real story is this is starting to look like a meaningful slowdown.

And yes, into this environment are stepping big numbers of first home buyers.

How do we view that?

On the one hand, I think it's great. The FHBs had to stand by helpless while investors drove up prices higher and higher - particularly in Auckland.

Now, courtesy of RBNZ lending restrictions the FHBs are being given a chance.

But they are stepping into a market that's flat at best.

Logic might tell you that now is not the time to buy. But let's face it, any would-be FHB that took advice in 2013 to not buy into a then rapidly rising Auckland market would now need to find $300,000 more for the median priced house than they did then.

And of course anybody who took out even as much as a 90% mortgage on a $550,000 median Auckland house in mid-2013 would now - assuming no repayments at all (which is unlikely) - be in a house worth $850,000 and in which their equity has gone from a slightly scary 10% to a comfy 42%.

So, who is to tell anybody that 'right at this minute' is the wrong time to buy a house?

Except of course that now it might be the wrong time.

Who knows? I don't expect to see big falls in house price values. But just because that's not really happened in New Zealand doesn't mean it can't.

And it is worrying to think that now increasing numbers of presumably young buyers are fully exposing themselves to the vagaries of the market at a time when uncertainty is rampant.

How geared are these people buying now? You only have to look at how much it costs to buy a house in Auckland to know that some people must be getting into eye-watering amounts of debt.

Where are they getting their money for a deposit?

Well, at least some of it is coming from Kiwisaver - which is a bit of a worry in itself. Taking your nest egg, putting it with your other eggs and depositing it all into one basket.

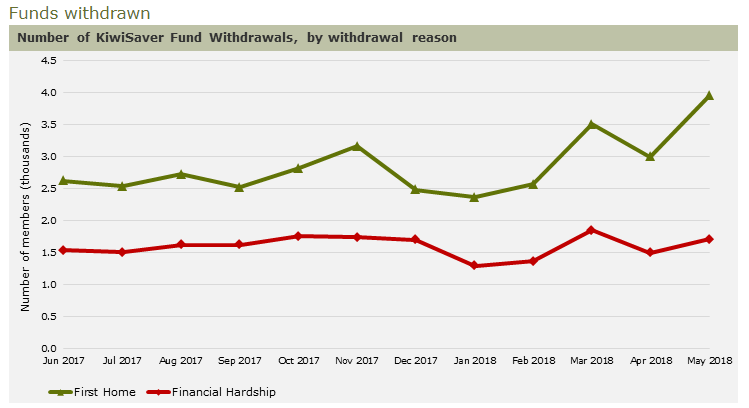

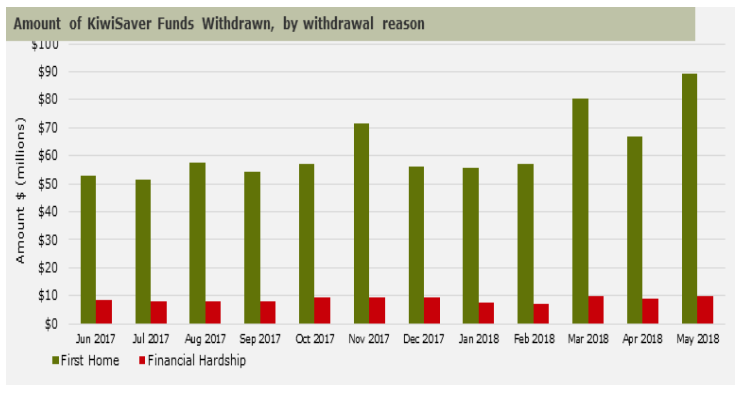

According to the official figures $89.4 million was withdrawn from Kiwisaver accounts for first home purchases last month - up over 40% from the same month a year ago. In terms of numbers of withdrawals, it amounted to 3950 members making withdrawals for a first home, up by a third from the 2970 withdrawals at the same time a year ago.

Even if you assumed that the people taking that money out had no savings at all and just used all that as deposits, the nearly $90 million could, on a normal 80% value of the property loan, raise about $400 million in mortgages.

That's food for thought when looking at the overall figure of $1.1 billion borrowed by FHBs in May. Presumably a fairly significant portion of that money was borrowed against Kiwisaver (IE retirement) funds. Literally, people are mortgaging their futures.

The one good thing in all this is that interest rates are real low and set to stay there for the foreseeable future.

Despite the fact that household debt has continued to climb, the cost of servicing the debt has been going down and is currently at historically comfortable levels.

So, all things being equal, it doesn't matter if house prices do dip. It's your home, you sit tight in it. Even if you get into the dreaded negative equity, all is well as long as you keep servicing the mortgage - which is doable when interest rates are low.

However, the big potential spanner in the works would be a substantial slowdown in the economy - resulting in job layoffs.

That's when it would get hairy.

And that's why - making the loop back to the start of this piece - the business confidence surveys are now becoming a worry. This is particularly so in the expectations around hiring of staff.

With seemingly so many people making the leap into the housing market for the first time now it means that a significant percentage of our young people are vulnerable.

If a lot of people start losing their jobs they might be forced to sell their house - even if their equity position is not good. And that of course would put further downward pressure on prices, increasing the pressure on heavily leveraged homeowners as they see their equity shrink.

This is all possible and it's not a good thing.

Providing the house market stays reasonably solid and the economy doesn't go into a sharp fall then hopefully we can ride this out and in a few years all will be well. It's just right at the start when the FHBs have low equity and are so exposed.

But it does mean we are arguably more vulnerable as a nation right now than we have been in the past to any external shocks. And external shocks can come from anywhere at any time. Right now the climate looks ripe for a shock.

As the Auckland experience of a few years ago would tell you, advising people that 'now is not a good time to buy' is not a good idea.

But it is really to be hoped that those taking the plunge into deep water right now do have their eyes open.

Otherwise I fear the worst.

114 Comments

Young people need to realise that Auckland is mutton dressed as lamb.

Australia offers much better bang for buck.

More like a wolf in sheeps clothing

What about a wolf dressed as mutton dressed as a lamb wearing a sheep-hat.

Nailed it

Not bad, you finally up skilled to identify good from bad

Amazing, insightful comments, as per usual

Do you copy and paste? Shows your level of talent..

More like a 3 week old, rotting, fly blown, mutton carcass dressed as a golden goose

From a distance, Auckland is more like 70 years old dressed like a funky 18 years old, until that person started to move or turned around!

Auckland is a nice harbour and some nice parks, but essentially it's a pile of suburbs in which it's always a rainy Sunday. Almost everything still operates 9-5 Mon-Fri hours, and the selection is weak to say the least. Late night dining options are McDonald's drive-thru and gas station pies. In 2018.

Why anyone thinks the place is worth mortgaging themselves to the end of time for is simply unfathomable. Most everywhere else, Auckland is the kind of hick town you long to escape.

but if you are looking to move your career forward as fast as possible you need to change jobs every couple of years, and for specialists that means you need to be in the biggest population centre.

you mean Sydney, Melbourne..?

Aucklands not a patch on the City it was 10 or 15 years ago, it just doesn't have that Dominion Rd feeling anymore...I blame it on the Exponents splitting up!

It puzzles me why anyone would buy into our over heated housing market.

1. Highest in the world based on income/house price ratio

2. Interest rates going up

"courtesy of RBNZ lending restrictions the FHBs are being given a chance. But they are stepping into a market that's flat at best."

Historically house prices go up with inflation, so not sure why the author made this statement. The past ten years have been an anomaly which will revert to the mean.

I was talking to a first home buyer recently who said "we probably purchased at the peak and prices will fall *nervous laughter*". I said "oh no, you'll be fine, it sounds like a great buy". Didn't have the heart to say what I was really thinking.

The bank of mum and dad is on the hook for a good proportion of these purchases as well. Either as a guarantor or by forgoing a chunk of retirement savings - yep that money won't be spent in the economy either.

back in the 80's we used to know that once Queenstown got out of hand (10x local wages) a crash was coming, sure enough a typical 40% QT crash would occur.... Now Auckland has these multiples....

This one will be a Doozy. China won't rescue us this time, IMHO they will be the cause of this one.

Yep. Queenstown has history of boom and long busts. Get rid of overseas cash in queenstown and the emperor definitely has no clothes.

A suckers market pure and simple. In a low inflation environment, what harm comes from patiently saving? Watch the boasting hare get snared I'd say.

A sucker's market. I wonder whether now is the time to force prices down by low balling?

Appreciate the article David. Well written and balanced, the trouble is that none of this is communicated by the mainstream media because there are so many with a vested interest in maintaining the status quo on the Ponzi. Some of what is said on housing is blatantly reckless, but sadly the whole country has been brainwashed. I just hope that the first time buyers take heed and that it is those that 'should have known better' that take the flack when things turn to custard.

Nic are you old enough to remember Tasman Properties, Ariadne (personal favourite example of madness) , Renouf Corporation and Kupe,

Probably old enough but may not have been in the Southern Hemisphere then.

Equity corp!

If that nice commissioner's recommendations cause a reduction in the amount of credit that can be extended to each household (due to a prudent bankers accesment of each households income and expenditure.... and their ability to repay the debt), then we will see a coyoto cartoon drops. The sellor may well be free to not accept the lower offers, the buyers just WONT have the cash to offer higher.... Clearance will be painfull for those involved in Death Divorce or DeBank. Obvious shorts would be those with big mortgage books or those who rely on home equity ie Rest home villages.......

Dominick Stephens is implicitly saying FHB should hold off from purchasing;

https://www.oneroof.co.nz/news/property-forecast-what-should-buyers-and…

"in Auckland there's been no capital gain in the last two years"

He's the only bank economist who doesn't seem hopelessly compromised. Prepare for attacks on the man instead of the ball in 3, 2, 1....

Is that an average across Auckland over the 2 year period? Because I know of quite a few houses in Auckland that have in fact seen considerable capital gain over the last 2 years.

Yeah he will be talking about regional price movements.

But are they FHB type houses.. ie purchased for under say $700K. Or are they more upmarket places in better areas that were out of the price range of typical FHBs?

Why the sudden switch from talking about getting people on the property ladder, to now worrying about FHB's equity growth?

If prices grow, it gets less affordable for new buyers, but buttresses existing homeowner balance sheets. The inverse is true for price declines, and there's no escaping that tradeoff. The deeper you go in the first cycle, the more %@$^ed you are down the road.

The direction of house prices has also been presented as irrelevant for FHBs though, insofar as the decision is not so much an investment one, and more about life stability (which is what has always been touted). They're also all starting out with at least 20% equity.

The goldilocks scenario is gently declining house prices (~5% p.a.) over a multi year period.

How many have already spent their kiwi-saver propping up the debt this year? Will there be anyone left for next years house sellers?

FHBs should be discouraged from buying until the global debt crisis explodes.

Maybe NZ will survive it mostly intact, maybe not, but given that most experts expect it to happen within the next 18 months, its not too long to wait before blowing you kiwisaver into the land of negative equity.

theglc, well said. I believe behind the scenes the RBNZ wants to reduce the risk of FHB and Johnny cm lately speculator from becoming underwater. LVR proved helpful in the face of a Government that was in a convenient self nesting denial. The risk of consumer spending falling of a cliff with this is huge. As you know, RBNZ publically disclosed the risk of needing unconventional tools is the highest in history here; https://www.interest.co.nz/news/93891/rbnz-says-possibility-needing-unc…

The young/FHBs are definitely exposed.

A few of thoughts:

• First, the way we speak about the business cycle is really strange. We had the recession, then the rockstar economy (more branding than reality), now things have tapered off a bit. We are close to full employment and now the author is worried about recession. I’m not saying he’s wrong, I’m just wondering where interest rates are in this story. If we’ve passed the peak why are they are recent lows? Seems to me we don’t know where the hell we are at. If we hit capacity at some point shouldn’t interest rates have gone up? If we haven’t hit capacity why are we having a recession?

• Regarding the right time to buy. If someone does some analysis (like 2013) and determines it is the wrong time to buy and then prices increase (like 2017) and then someone says it’s the right time to buy, that history provesit’s never the wrong time buy. That is what bulls assert - ‘Bernard Hickey got it wrong for 10 years so anyone who says it’s the wrong time buy is wrong. There is no wrong time to buy.’ There is a wrong time to buy, it’s just hard to predict. But what you can be certain about is that if for example someone says 2013 is the wrong time to buy and prices go up and someone says 2017 is the wrong time to buy - the 2017 person is more likely to be correct. Your confidence in predictions it is the wrong time to buy should increase as prices increase not decrease. This is the mistake bulls make. Say TTP said in 2013 ‘no it’s a great time to buy’. Some might gain confidence in TTP and think his 2017 prediction holds more weight since he was right in 2013. But no, these are dependent variables, the very fact that TTP was right in 2013 makes him less likely to be right in 2017. This explains why bulls and bears don’t agree. Bulls think last house price increases are indicative of future increases while bears understand the longer the growth the bigger the correction.

Hardly, I don't think it's possible to truly forecast market movements. You can look at the debt cycle, affordability metrics, global movements etc and accurately call the future outcome... but the timing of the outcome will be completely elusive. If you've seen The Big Short and are familiar with that story, it shows that even the smartest super geek in investing couldn't time with any accuracy. He knew the crash would come, but he simply didn't know when. He was nearly utterly ruined by timing.

That is how I look at market cycles. You will never be able to predict the peak or the bottom

BUT you can observe the data on the other side of the top and bottom and make decisions as close as dammit. With the property market, if you are 3 or 4 months on either side of the top or bottom, the price differential will be marginal.

Translated to the NZ housing market. It looks like we're passed peak but it's anybodies guess where the bottom might be. There may never be a note worthy "bottom". *sniggers*

Some predict that the market will simply flat-line for decades, some are preaching property end times (and everything in between). All I think you can time with any accuracy, from this point, is the early stage of the next upswing. There are clear data points to look for when a market is heating up again, and if you see those data points coming in for 3+ months in a row, it's a pretty good indicator that the next upswing is starting.

Currently there is zippity squat indication of the next upswing, so FHB should take their sweet time. Buy for the right house, if they can comfortably afford it. Buy because it will add value to their lives. But NOT buy because of FOMO or because the MSM drums up the narrative that if you don't buy at the earliest opportunity you possibly can, you'll be fu%$ed. That just isn't true as the market currently stands.

Great comment Gingerninja, it's nice to have a few smart commenters on this site.

Hi Yvil,

Agree that Gingerninja's posts are intelligent/insightful. We're lucky to have her here. (I hope she's mentioned in the end-of-year awards this year.)

I'm one of the many people who believes the housing market will flat-line for the foreseeable future - fluctuating within a narrow price-band.

But I very much doubt the foreseeable future will extend to "decades". If I'm wrong, however, it hardly matters - as I expect to be dead within decades (and perhaps much sooner).

It would be nice if prices drop in Ponsonby to about one-third of what they are now........ Then I could spend my final years living in my own home in my favourite Auckland location - sitting in the sun drinking instant coffee and posting daily to this blog.

TTP

And by your standards is this insightful? Your like a kid craving for a lolly

Woohoo Negative equity here we come..........

yes, the Q is how negative? 5%? no biggee, 20%? getting a worry due to bank leverage, 50%(+)? now there is a world of hurt we will ALL be in.

regards

If Auckland property prices fall further, the owner-occupiers who purchased in around August 2016 are the most likely to be the first to hit negative equity and have an unrealised loss equivalent to all of their deposit paid when they purchased the house.

The median price in Auckland in August 2016 was NZ$850,000 and owner occupiers could borrow 90% of the purchase price for the purchase of existing houses. That means a deposit of 10% or NZ$85,000, and a mortgage of NZ$765,000 (for an LVR of 90%)

Assuming almost 2 years of mortgage payments on a P&I basis at a 4.5% per annum interest rate, then the amount of loan principal paid so far is approximately NZ$22,000, leaving a current mortgage balance of NZ$743,000.

So the owner occupier has paid a total of NZ$85,000 in equity deposit and reduced their mortgage by NZ$22,000 - this totals NZ$107,000 (excluding interest costs).

What is the value of the equity in the house now? The latest median house price in Auckland is NZ$820,000 (a drop of NZ$30,000 or 3.5% of the original purchase price). The outstanding loan principal is NZ$743,000, leaving current equity value of NZ$77,000

The LVR of the property sits at just under 91% (NZ$743,000 / NZ$820,000).

Current equity value of NZ$77,000 vs the NZ$107,000 paid so far, so an unrealised loss of about 28% of their cash investment so far due to to NZ$30,000 price drop in the house price from NZ$850,000 to NZ$820,000. If the owner's circumstances changed and they needed to sell, then they would potentially incur real estate agent's costs of say 3% (based on the current NZ$820,000 price, this is NZ$24,600) - that would mean that the after commission proceeds would be NZ$52,400 (compared to the NZ$107,000 that they have paid so far).

If the person had not purchased and deposited the NZ$107,000 into a bank account, that amount would be NZ$111,000 due to the interest earned at 2.5%. Furthermore, the renter could have saved additional funds. The owner occupier has also paid interest of approximately NZ$62,000 over the period compared to the cost to rent of NZ$52,000 for the same period (a difference of NZ$10,000 that a renter could have saved). The owner occupier would also incur costs of ownership such as rates, insurance and maintenance - assuming 0.5% per annum of the original house cost then this is approximately a further NZ$7,800 for the 22 month period since August 2016. Total additional cash that the renter did not have to pay, that the owner occupier had to pay is NZ$17,800 (being the NZ$10,000 difference between rent and interest cost and NZ$7,800 in rates, insurance, maintenance)

So a renter could have NZ$111,000 plus the NZ$17,800 additional savings - totalling NZ$128,800 equity value vs NZ$77,000 currently for the owner occupier.

Of course this situation for the owner occupier can improve quickly if the house price rises, or deteriorate much quickly if the house price falls - such is the power of leverage magnifying the effect of underlying asset price changes on equity.

Leverage is a real bastard whens its working against you most NZers will have never experienced that feeling....

Debt is an accelerant like rocket fuel. Under certain conditions, debt can accelerate you towards your financial wealth and financial security, however under other conditions can be potentially explosive and can potentially be financially fatal.

Yep consistent with my modelling. I calculated a 1 million dollar house with a 200K deposit would lose just over 25K of equity in the first year if house prices declined by 1.5%.

IT GUY is a DGM - and a sadistic one at that.

TTP

Foreign Buyers Made Me Do It: Canada Reflects Back on its Housing Bubble

https://wolfstreet.com/2018/06/27/foreign-buyers-made-me-do-it-canada-r…

I blame the bankers. And psychomacho world leaders who curtail economic freedom for their people, creating thousands of economic refugees.

LOL, "economic freedom" as in the freedom to rape, pillage tand pollute he planet with no restraint or sense or care for the future generations.

maybe not.

I'm talking about the currency manipulators and the strongmen. People are trying to get their money into countries where their property rights are respected.

No one is innocent of your definition of economic freedom.

Is it me, or was there a tsunami of property listings in Chch this June?

Probably a third on trade me listed with prices.

The price floor is collapsing.

Businesses should move there. Lower house prices gives you a massive competitive advantage.

Yes, and a glut of brand new office space = better quality buildings at lower rents

Heh, Auckxit.

A timely and excellent article.

However, there is fault in that the premise of the article is that buying (a first) home is solely based on an economic decision and the market position.

There are two basic faults with assuming this premise.

The first is that it fails to consider that buying home is a long term commitment and it will be for most of the remainder of one's life. Although one is likely to trade up it will be sell and buy in the same market hence market position is not really considerably significant. Given that home ownership is likely to be a commitment for 40 to 50 years, short term movements in the market are not relevant, as over such a period one should expect increase in value at least in line with inflation if not better. (A little tongue in check but, did the New Zealand Company pay too much in buying the whole of the Wellington region for two muskets, a couple of blankets and some beads?)

The second fault is that the premise negates to consider that buying one's first home (and continuing to own one's home) is more about intrinsic rather than economic values. What is the instinct value in knowing that you have security longer than 42 days (i.e. the landlord or family member decides to move in) and that you get to choose the wallpaper and paint rather than what the landlord picked up in a bulk lot clearance sale. (Yes, home ownership - as with a rental - has maintenance costs but there is a lot of discretionary and intrinsic value in DIY)

If we are to use just the premise that the article is based on; then for heavens sake do not buy a car (take public transport) or buy any modern gadgets - these are most certain to lose value.

Provided a FHB is able to service outgoings and allow for increase in expenses (such interest rate increases), then there is little to really fear over the long term. From an investment perspective, then any successful well-known investor will stress that buy wisely (look at the value and soundness of the property), that picking the timing for the top and bottom of markets is near on impossible, don't over extend yourself, and be prepared to be in for the long term.

printer8, whilst I agree with your overall point, I don't think you're addressing the rather major issue that the article highlights.

If you stretch yourself, to the absolute limit of affordability, to buy a property at the very top of the market... when unemployment is at historic lows, when interest rates are at historic lows, when you can only just afford your huge mortgage debt if interest rates stay as low and if you never lose your job, then you are extremely vulnerable to something much worse than not being able to chose your own wallpaper.

If you go into negative equity, but can keep affording the mortgage payments, there's some opportunity cost loss there on your capital, but otherwise, no biggie. You suck it up and carry on enjoying your home and wall paper choices. However, if you go into negative equity and can't afford to keep paying the mortgage, you're in a world of pain.

So then the question is really.... how high are the risks of the latter scenario?

Don't forget ginga. The downside of losing your job also applies when renting. If I was a renter I would be very nervous of that scenario.

printer8, I appreciate and agree that for most FHB a house is place to live in but they still have to pay the mortgage and if they lose their jobs or interest rates go up it's gonna be a very real "economic/financial" problem, hence the validity of the article stands

Interesting thought experiment: What percentage in value would you place on this intrinsic value, above fundamentals?

Not sure if people can see this clip from the ABC (Aust) - latest on ghost cities

http://www.abc.net.au/news/2018-06-27/china-ghost-cities-show-growth-dr…

Hopefully this issue won't drag the rest of the world down

good link, thanks

Chinese ghost cities only stay that way for a comparatively short time. There is still a large percentage of rural folk in China that need to live in cities if China is to truly become modern. Go back in ten years and you will find that these ghost cities have become bustling metropolises. They are thinking years ahead which is something we often fail to do.

Stuff that

This article nails it with thoughtfulness - bloody rare in NZ.

Yes, a lot of first-home fully-extended younger folk will fall over. The whole shebang is holding itself up by it's bootstraps - I'd call it a ponzi but the analogy is deeper than that; it's bidding for staterooms on a sinking ship. It can't not happen, it's just a matter of when.

Interestingly, though, those youngsters seem to be conditioned (by advertising?) to wanting brand new houses, bigger than ever. We started out taking on a 35 sq/m bach with one cold tap and no bathroom. Which we paid off before adding to. The rules - put in place largely by middle-class panic after the leaky homes debacle - have probably precluded such an approach nowadays, but there doesn't seen to be much of a demand for low-level entry either, tiny houses aside.

I do think for 2+ generations now we have been brainwashed into a "lifestyle" expectation we should be meeting. My wife tells me we have the worst / oldest car in the street this it seems is more important to her and the neighbours than having no debt due to owning what will be an expensive stranded asset.

"there doesn't seen to be much of a demand for low-level entry either" I get this impression also we might be able to put this down to the first paragraph.

Anyway a lot of ppl are going to learn the hardway via experience IMHO, unfortunately even the non-stupids will suffer as the collateral damage will be significant.

35 sq/m bach with one cold tap and no bathroom.

decades ago when interest rates were high you could afford to upgrade every few years, not now:

-sell-buy-shift costs now getting up towards a years average net income ($40k+).

-mortgage outgoings are a huge proportion of income, interest rates are low and wage/price inflation is low, you do not get significantly more financial manoeuvrability every few years to enable a shift - actually likely the opposite if you have kids and lose part or all of an income.

-modest house renovations (adding a room) cost also one or more years net average income ($50-100k). house modification is unaffordable

So there is a lot of inefficiency in trading up. If you are starting a family you have to plan for what you need to accommodate in 5-10 years time. FHB with families or intending on having families are being sensible holding out for something that can work long-term.

Also low decile schools have massive discipline problems that hamstrung teachers are unable to fix. You can do permanent damage to your kid (establish bad habits) sending them to school with kids of uninterested parents.

Foyle ^^ excellent point^^

And a point that many older Kiwis simply don't comprehend. Poor wage inflation but high house (and house related cost) inflation mean that climbing the ladder is much harder, renovating is harder and more expensive. Not to mention that young parents now are also paying back student loans.

I wouldn't go near the AKL market right now if I was a FHB. I will be astounded if there is not a huge correction over the next few years. It would be horrific sitting in traffic all day to go to your 9-6 office job everyday servicing a astronomical debt on a very average house that is not worth what you paid for it. Not a risk I would be wiling to take.

"My grandparents suffered through the Great Depression and my parents lived through the Second World War, and they scrimped and saved to give me everything I deserve. Now my kids and grandkids must do the same. Because I'm entitled to it! All of it! It's all about MEEEEEEE!"

-- Every Babyboomer

You could add to that ‘My generation each paid 1/6 of the cost of our parents generations retirement so its only fair then next generation each pay 1/2 of ours.’ Boomer logic.

This article is a bit confusing, David ... not sure what are you saying and if was a FHB looking for some direction from this , I would feel quite confused.

On one hand you read the book from both ends and presented both arguments, on the other I felt that you concluded by promoting the lazy laid back guarantee seeking attitude which is holding most kiwis back. there is no such thing in real life ... we all take calculated risks.

When it comes to house buying, there will always be an amount of risk involved. That has been the case no matter what, where, and when people buy. One might consider Act Of God as a higher risk than interest rates rise and negative equity in Christchurch, but even that doesn't stop people buying and building houses there.

Home owners in NZ have never worried about any negative equity as our long history shows that even in the odd events recovery will correct any dips and then some ... today there are many stops inplace to prevent getting carried away with 100% leverages and poor serviceability of the loan like it was the case few years ago ...

It is all well to mention the risks involved in general, but all these need to be taken into perspective with the entire market conditions and the stronger factors pushing house prices in either direction.

It is hard to ignore the estimations of market appreciation in the next few years from the RBNZ, Treasury, and other professional institutions whose daily business is calculating and following risks...certainly these predictions are not a one man ( or an economist) opinion.

I would have liked this article to end up on a more objective note than planting doubts and confusion .

Really???it's absolutely clear. ..

Ah you do get confused quite easily. .

I agree with your 1st sentence but no need for the personal attacks

Oh my, have you woken from your deep slumber, it was pleasurable when you were away for a few days

“t is hard to ignore the estimations of market appreciation in the next few years from the RBNZ, Treasury, and other professional institutions”

Meh. I have found these predictions pretty easy to ignore, we can all form our own view on that. I assume when you say “other professional institutions” you mean real estate industry. Or.....banks!? Double meh

Eco Bird, this article is intended to provoke FHB to consider their biggest decision more carefully before committing. I'd suggest you try protesting why it sometimes rains in the middle of washing your car. Sh-t happens, so plan ahead for it. It would seem you question balanced fact backed articles that might come true and come between you and your bank - ooops, I mean "business partner". It breaches the core of your inner well being.

David Hargreaves and others are free to pontificate on what is going to happen to house prices. And they will do so - especially when they get paid to write articles on the topic (to an audience which will lap up every word).

But, ultimately, pontification counts for very little. It's evidence that matters.

Sure, there might be a correction in house prices at some point in the future........

But don't dismiss that the correction might be an upward one.

TTP

Hi TTP,

good point, I might add, that what is a small correction in Sydney when prises have been rising for 27 years to 5 fold , what would be the significance of a 5-10% correction ( if ever) in Auckland when house prices tripled in the last 15-20 years?

Half the truth is a lie , as they say

Then perhaps you will supply some evidence in the future rather than unfalsifiable claims.......

TPP, my partner is a licensed RE, so is my brother in law. I have friends at Head office Barfoots and Harcourts, I can assure you that the trend at the moment is down. The parrot is dead, kaput.... It is correcting right now as you breath....

Failure to see this probably implies willful blindness.,,, don't worry too much if you have this as its effecting many in Gummint as well

Hi IT GUY,

Nice to know you are so well connected.

Good for you.

TTP

Your response should have been "thanks for the valuable insights, now I'm running for the trees "

Hi Houses Overpriced,

I'd sooner run to buy a property than run for the trees.

TTP

Have you considered buying a treehouse?

I already live in a treehouse......

And I'm told you live in a glasshouse.

TTP

Willful ignorance right there

he is attacking the messenger not the message. its a game of wit... he lacks it...

I would not be inclined to see an upswing of FHBs as a sign of actual confidence in the market, I am more inclined to think that many people who have grown utterly sick to death of renting, always with the thought in the back of your mind that you could get 90 days notice at any time, that your rent kept going up, that you could not settle and consider yourself at home, have seen a window of opportunity to change that and have taken it. That house prices could fall might be secondary, aided and abetted by real estate agents and banksters seeking commission/interest.

They will be buying in the lower prices areas as well, which sadly, could really take a caning in any downturn

I am young too but I don't think I am exposed?

Do you mean your brain cells are yet to develop? :)

Ps: from the last couple of threads seems like there are only about 4 or 5 of you spruikers left who are trying hard to fight against nature's gravitational pull..

You can try to use all the helium you've got, ain't gonna help

It is the insecure people who feel the need to attack and insult others. Why not focus on the issues?

Why don't you follow your own advice before dishing out to others, ah that's because you have nothing better to add

The only thing you expose yourself (and us) to is unhealthy amounts of property porn, I’m getting worried about you....

#sadpropertypornaddict

Transport Minister Phil Twyford backed his officials' ability to get the best bang for the taxpayer's buck when weighing up investments, ignoring the Treasury's advice as being too narrow in identifying wider benefits.

http://www.sharechat.co.nz/article/6a2210af/twyford-backs-transport-off…

RH photogenic PT knows best .. who the hell is Treasury to disagree with him?

Next election is in 27 months !!

I would like to see baby boomer property scalpers buy up a storm right now. It would speed up the crash and they would get what they deserve. Baby boomer property scalpers are destroying our young New Zealand Families. We need property developers, NOT scalpers.

Excellent analogy. Let's hope that that very few young people pay the inflated prices. Let's not make the ill gotten paper gains a reality.

Can understand the fear of FHB of not loosing the opportunity and to enter the house market but should realize that house price may or may not fall but one thing is for defenite that are not going up in near future so one need to wait instead of rushing.

Buying to stay for long term is good but one should wait and watch for time being. Investors - any who bought in 2016 are not able to get rid of the investment without taking a hit.

If one goes for open home and see that the vendor has purchased in 2016 or 2015 avoid as will not be able to sell at the market price today unless is ready for a loss and if the FHB buy at the 2016 price is paying too much in the current market scenario.

Ummm .. are you talking about NZ? Auckland? where exactly? your numbers do not make any sense .. check the property median graphs first..

Just watched an interview with Langone co founder of Home Depot.

Very bullish on the American economy,when asked about FHB finding it hard to get into houses he said

''''work harder,smarter and lower your expectations".

lol, and interest rates for FHBs there is about 5% ... go figure

What is their housing affordability compared to ours.. go figure

Funny, I saw another one where he said “let them eat cake”

Are you sure it wasn't Mr key

I think it’s easy to miss the point in terms of a property slowdown or slump.

Yes – a 10 or 20% fall doesn’t sound much when compared to recent year’s gains – but what about those that bought recently, or those "many years ago" buyers that have then aggressively taken out equity loans or bought yet another investment property based on that free equity.

Consumer confidence within some begins to wane, especially the above players – which then in turn becomes somewhat self-fulfilling – engulfing those that actually were, up until then, risk free – or at least thought so.

So beware writing off a 10 to 20% fall as “nothing to see”– the implications are far greater than the simple numbers suggest.

I paste below my comment of yesterday:

"Lending to FHB was +34% higher than in May 2017. Lending to investors is down -36%"

In my opinion a sure sign that the property cycle has peaked. Who knows more about house values,investors who have been buying for years or FHB's who by definition are new to the market? I fear a lot of FHB's are going to get hurt

You're re pasting as your upset it was ignored in the first instance..

Do you not get the message

The Oxford Dictionary is adding YVIL to their 2019 version. A synonym for “Autistic Screech”.

I would assume that doubling the required equity for investors, would have had a huuge impact on buying, I doubt they are buying less, because they think now is a worse time to buy than 2016. The longer prices stagnate, the sooner they will start rising again.

Exactly my earlier point, I wouldn’t take investor buying as a a proxy for smart money

Heh, nice oxymoron.

the quicker they drop the sooner they start rising again more like it.

As opposed to the longer they drop the bigger the splat?

"The longer prices stagnate, the sooner they will start rising again." I like that one, where did you get it from. .

Ron Hoy Fong

Woah, I hope you're not quibbling with Skudiv's assessment? You must be a pinko commie liberal, green voter.

The man's a legend, a hero, the bigliest of biglies, hugely intelligent, massive bigliness - Isaac Hayes wrote a song about him and everything.

"Who's the private dick

That's a sex machine to all the chicks?

(SkuDiv)

Ya damn right. Who is the man that would risk his neck

For his brother man?

(SkuDiv)

Can you dig it?

Who's the cat that won't cop out

When there's danger all about?

(SkuDiv)

Right on

They say this cat SkuDiv is a bad mother -

(Shut your mouth)

But I'm talkin' 'bout SkuDiv-

(Then we can dig it)"

Or

The Smoker you Drink the Player you get (Joe Walsh)

How's about The Joker? https://www.youtube.com/watch?v=FgDU17xqNXo

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.