Research analysts with investment services company Forsyth Barr are seeing "elevated" downside risks for the housing market and more generally expect the next year to see continued supply chain problems and further inflation.

In a year ahead equity strategy review, research analysts Andy Bowley, Aaron Ibbotson, Rohan Koreman-Smit, Matt Montgomerie and Andrew Harvey-Green say that higher mortgage rates, lower credit availability and increasing supply, given the generational boom in new build rates, "suggests an easing of the tail winds that have propelled house prices over the past few years".

"We recognise that sharp corrections are rare in developed countries and expect slow steady real price erosion," they say.

However, they also say the "risk" of outright house price declines has increased.

"A review of house price corrections in OECD countries since 1970s shows that sharp nominal reductions in house prices are rare unless there is significant excess inventory (i.e. post GFC US, Spain, Ireland).

"However, slow steady real price erosion is common and is our base case view."

They note that only one third of NZ homes are mortgage free with the remaining two thirds carrying about $320 billion of mortgage debt of which 72% has a tenor of less than one year.

"Mortgage rates are up 1.0–1.5ppts across the curve over the last six months and re-pricing of this short term debt could result in $2.3–3.5 billion more interest being paid," the analysts say.

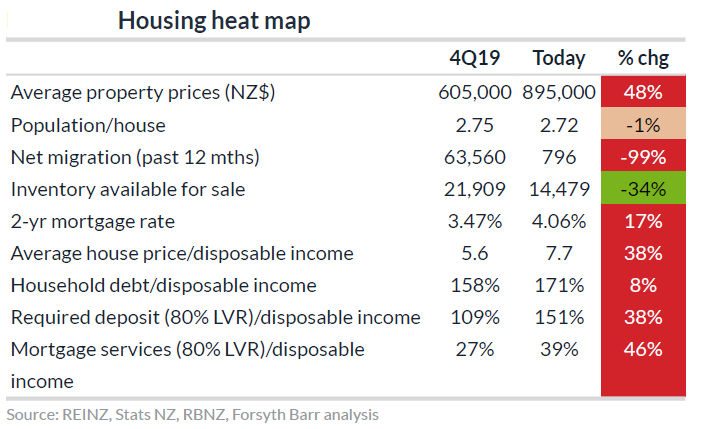

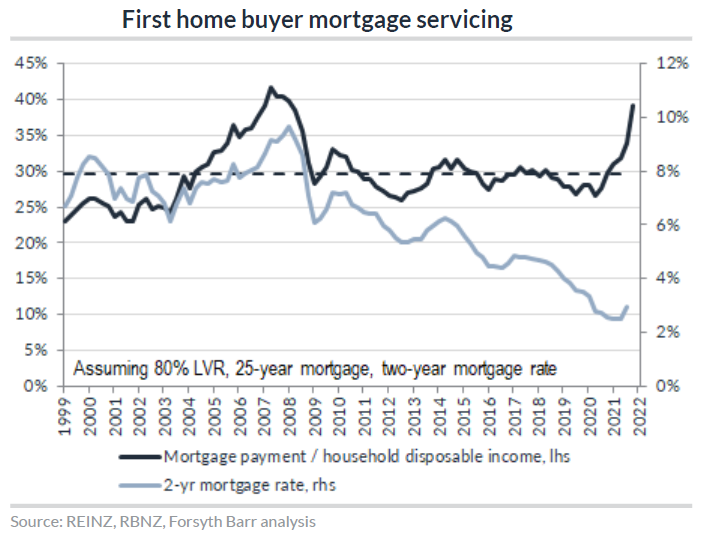

They say the average NZ house is now 7.7x household disposable income and that it now takes 39% of household disposable income to service the average mortgage, the highest level since the GFC.

The analysts have named stocks they see most at risk from downside house price risks. In terms of building materials they view Fletcher Building (FBU) and Steel & Tube as most exposed to NZ construction activity and Vulcan the least.

In terms of the retirement sector they view Summerset (SUM) as most exposed to unit price changes (and shifting sentiment) given its portfolio mix skew toward independent units while Oceania Healthcare (OCA) is least exposed given its care based focus.

Regarding the share market itself, the analysts say the "long market bull run" since the Global Financial Crisis appears to be ending as the structural decline in interest rates has reversed.

"The NZX is facing its first down year in a decade; the benchmark NZX50 index is down about -2% year-to-date.

"Looking ahead into 2022, we believe some trends from this southern spring such as inflation, congested supply chains and re-opening will continue to influence stocks.

"We believe that the ever present theme of interest rates may shift from primarily being one of valuation to also include a focus on a few stretched balance sheets."

They have cited five 'investment themes' for 2022, which are as follows:

1: Reopening vs restrictions — New Zealand (and Australia) should enjoy greater freedoms in 2022, relative to the domestic restrictions in place in recent months and the closed border all year. A gradual phased opening of the border bodes well for the recovery in travel and tourism stocks, while retailers should have more favourable operating conditions through the year.

2: Inflation not so transitory — Inflation has accelerated through 2021 and will likely remain high through 2022. This supports our view of constrained market performance as equities generally perform poorly during inflationary periods, as margins typically contract, uncertainty increases and valuation multiples ultimately fall.

3: Interest rates and the return of the balance sheet — Higher interest rates will increase balance sheet risk for more indebted companies and/or those where Covid-19 has impacted earnings. While one major capital raise - Air New Zealand (AIR) - has been flagged for early 2022, others may also be necessary.

4: Congested supply chains to only partially ease — Supply chain congestion intensified through 2021 as the boom in consumer demand for products (as opposed to services) together with the existing disruption in container shipping led to a freight rate super-cycle. Freight rates have likely peaked, but will remain elevated through 2022 as congestions eases gradually.

5: House price risks increasing — Which covers the material mentioned higher up this article.

The analysts' five stocks "to watch" next year include "deep value" Sky TV (SKT) and "beneficiaries of reopening" Skycity (SKC). They also like "pass through" business models that are largely sheltered from inflation and have included both EBOS (EBO) and Vulcan Steel.

"Arvida Group (ARV) is our "coming of age pick" as it is on track to deliver its first green field village and start to reap the benefits of maturing previous acquisitions."

56 Comments

We'll all have a clue soon.

"As goes January, so goes the year"

We had the perfect storm situation when Covid started and house prices should have dipped however we all know the RBNZ and government came to the rescue and sent house prices through the roof. It took the RBNZ and government far too long to act and now they have created their own perfect storm with the CCCFA, inflation, boarders etc etc. Majority of people can easily cut back spending to handle higher interest rates but then businesses will start to suffer again and when they have already suffered enough through lockdowns.

As lending is drying up or harder to come by how is the RBNZ and Government going to be able to save themselves this time around and how long will it be before they act.

Also the billions the Government has borrowed, we have to pay this back somehow aswell.

We are paying it back already. Seen your grocery bill lately?

the old playbook of inflating the debt away

Unlike households, governments and large corporates rarely pay back debt, they just roll it over endlessly. Where the debt is used to invest in things that grow GDP like education, transport etc, then it more than pays for itself anyway. The NZ government should increase debt to upgrade our ageing and inadequate infrastructure and services.

An unpopular view but i absolutely agree. The return on quality infrastructure is too good to pass up.

The next 12 months is going to seriously test the resilience of the property market. I genuinely have no idea how it’s going to pan out but I feel we may have a stale mate for a while whilst the lack of lending fire power versus vendors price expectations soaks in. My guess is a flat market for 3 months followed by a 20% drop (sudden drop). A new normal will be reached and market will then be flat for a number of years.

I think Jacinda might not be a mile away with her desire for the market

I agree with your comments. I would also have to say agents will need to work there charm with their vendor and give them a reality check on what their house will sell for. It will be the vendor vs the banks. The buyer wont pay the vendors price because they don't want to, it will be simply because they can't and the bank wont lend them the money that they used to be able to lend. The banks hands are tied in this and they will also be affected by the new lending restrictions.

I think people will just not sell if they don't have to and the people who do need to sell may be in for a roller coster ride

Haven't we seen a massive amount of speculation in the property market? In my experience speculation is backed by people leveraging something, usually their houses. Now if the leveraged bets unwind because asset prices drop... we could be in for a bunch of forced sales, which will hammer prices. And since house prices are calculated at a neighbourhood level, it could quickly run away...

I'm a bit more optimistic about property than you guys. A few months of "Omicron not so bad" news and then more open borders, and a surge of immigration from young hopefuls, outweighing the fleeing young despondents will keep the Ponzi ticking over. Sure, rate increases will rise but people will slash spending, cram more people into houses and garages, get wealthy parents to help out for a while - it'll struggle on OK next year.

Nah. The goose is cooked.

I agree, but I wouldn't put any money on what the fall will be (although my best guess is 5-10%)

Of course you guys could be right. Property downturns tend to take years to play out which is why I'm leaning towards next year limping on with all available resources being funneled into keeping the market up as long as possible.

What resources do you think they have? Normally I’d agree with you, but if people can’t access enough credit to pay the high prices… it’s a game changer. Think of it like a game of chess. Inflation, rising interest rates and increasing supply= chess mate.

I think investors getting hammered could also add to it as they’ll be offloading soon too to cash in on capital gains. Apparently 25% of homes sold recently were for this very reason.

The resources I have in mind are:

1) Property owning parents gifting/lending to kids to buy, or to stay in their property when they might otherwise have to sell up (thereby dampening downturns in areas that have them)

2) Property owners with tons of equity and spare cash waiting to snap up bargains (again, putting a floor under any losses)

3) Everything a surge of immigrants can bring in and borrow (multiple generations all piling in), or at least rent (thereby underpinning values)

4) A govt willing to steal more purchasing power from savers and more income from current and future tax payers to be "accommodating" when they need to bolster voter support

5) The best heeled FHBs that are still in with a chance to be able to buy something

If I'm right, those offloading investors will soon be replaced by others happy to just grab stuff and sit on it, given they will have not much else to do with their investment funds as share markets turn down.

I think resources like the above need to be worn through for a while before we see general price falls. 2022 is just the start of a multi-year saga.

All good points Rob.

Funnily enough I was chatting to my partner last night. She has multiple investment properties and the recent complications have certainly given her food for thought. With capital gains drying up… cash flow becomes king, and as long as the numbers make sense, yeah sure, those houses will be purchased and held. I still feel that part of the housing crisis solution should be limiting the amount of properties people can own. It’s an extreme step but we are dealing with a 3 decade old headache. I guess if I had a spare couple of million in the bank, what would my options be??

let inflation erode it or take a punt on the property market, very likely the later, and that is fundamentally the crux of what’s caused this.

I appreciate you taking the time to reply to my question Rob, ATB.

Some interesting points and I would generally agree except for the one fact - if any of them need to use the bank to get any funding then that will probably change alot of peoples expectations on what they thought they could achieve. The changes with CCCFA will change the landscape and there are plenty of signs that its already having an effect. Talking to my mortgage broker, developers and agents they are all facing problems due to the CCCFA.

I think the changes with CCCFA will settle down and won't have a big impact, it's only impacting now as its a new process and brokers are making a big deal about it as its more work for them when its been easy money for them recently. Ultimately the big banks need to keep up new lending to maintain profits.

There are also a heap of people with significant amounts of equity gained over the past 5 years that could borrow to prop up the market. Wage growth expected to be higher as well for the next few years

Young hopeful coming into NZ? What in NZ is there for someone elsewhere that provides them hope for a better future? I can't imagine there is anything much. The game is well an truely over for young people in NZ and next year we'll have many more leaving than arriving.

A beautiful, safe country where hard work is still rewarded?

If you follow a reasonable budget you can still get ahead in NZ. If you don't then people who leave NZ for greener pastures won't find them.

I've always been rewarded better overseas than here though. And most of my old friends are still reaping those benefits overseas and are not coming back. Some even tried but soon left again.

Not sure what your point is?

You think that there is no hope for young people in NZ and there is nothing to gain for people to come to NZ? That is demonstrably false. If you are trying to say that there are some countries where there are better opportunities then yeah, sure, I agree.

"...sharp nominal reductions in house prices are rare unless there is significant excess inventory ..."

Sound right. But what's the important word in that sentence? Rare.

What caused the last rare, non-excess inventory, sharp nominal reduction - in Japan ~30 years ago? The BOJ tried to 'gently calm the property market down' with mortgage lending curbs, higher interest rates and changes to building codes etc. It worked! But it was anything but calm and gentle.

Rare does not mean Impossible or even Improbable, just that it hasn't happened for some time.

Some good reading on that: https://www.investopedia.com/articles/economics/08/japan-1990s-credit-c…

KEY TAKEAWAYS

- Japan's "Lost Decade" was a period that lasted from about 1991 to 2001 that saw a significant slowdown in Japan's previously bustling economy.

- The economic slowdown was caused, in part by the Bank of Japan (BOJ) hiking interest rates to cool down the real estate market.

- The BOJ's policies created a liquidity trap while a credit crunch was unfolding.

...

Equity values plunged 60% from late 1989 to August 1992, while land values dropped throughout the 1990s, falling an incredible 70% by 2001.

We're not exactly the same, but we are seeing rising rates and tightened rules around taking out credit. One potential difference is immigration. Japan never really had it, but we could see the taps get turned back on here soon.

Ironically, Japan tried to solve any 'housing shortage' problem with - fewer people! (It's not wholly that, of course. Japanese society is, well, let's just say, different. I have a friend who called in there 30 odd years ago, as part of his OE. He never left, and wouldn't today if you paid him to)

Why does he love it so much bw?

If we're lucky, we all find the place we want to be. He has. (Speaks and writes Japanese - a challenge in itself.)

Me? I thought it was New Zealand. Would I make that choice again today? No. But at some stage we all realise we've made an investment we can't abandon. Now...getting back to Property Speculation.....

The impact of the 1985 Plaza Accord cannot be discounted - a strengthening Yen disrupted export growth.

Indeed. I fondly recall standing in "Fanny's" wine bar and someone running in and shouting "the dollars' going to fall" (from DEM 3.15 or something like that. It's a long time ago!). And so it did.

It's Thursday evening in New Zealand - December 2021, and I don't recognise myself as the courageous, naive, enthusiastic young man that was staying at The Imperial Hotel in Tokyo in 1988 ( was it across the road from The Palace? Maybe that was Osaka. Anyway...). Dinner for the 4 of us at a mid-range restaurant had cost $1,000, and I was aghast at the bill; a bill that no one else seemed to bat an eyelid at. I was staying at the bank house in Roppongi (book value $48m, and about to plunge!) with my local counterpart and had a dusty 5am start to get to Narita to fly to Paris for more meaningful discussions. I look at myself today, trying to express my frustrations on a well-meaning blog and ask "What the Hell happened!"

Cheers.

It was a real shame the original Imperial Hotel designed by Frank Lloyd Wright was destroyed. I visited the lobby part of the building that was kept and is located at Meiji Mura near Nagoya:

https://en.wikipedia.org/wiki/Meiji-mura

Another thing, amongst many!, that wasn't aware of.

My recollections are of:

Great post. And I suggest that NZ currently has many of the factors that make us quite ripe for one of those rare events.

Doesn't mean it will happen, but I think our vulnerability is quite high.

Btw, if emigration to Aus and beyond does shoot up in 2022, we could have a milder version of the Irish excess inventory scenario.

Not to take this number very seriously but if you look at the departures vs arrivals for December so far and extrapolate it out to a year at this rate we'll have 160,000 fewer people here in a years time.

https://www.customs.govt.nz/covid-19/more-information/passenger-arrival…

I expect in the new year a lot of young people will leave. Our Covid free status is no longer and soon we won't be any different the rest of the world except for leading the pack in house prices.

Well I have heard the goss first hand from Architects and they simply cannot guarantee materials costs for more than one week. That's right, massive cost overruns on anything designed months ago. No way house prices are going down when construction costs are still rising.

Why do you believe that it's not possible for house prices to fall while construction costs are rising?

House prices are dictated by what the market is willing and able to pay.

We might even see some fire-sales as out of control inflation starts sinking builders.

Good point.

And it might not just be the builders who sink. Those builder-buyers /Off-the-Plan buyers who have to come up with the additional payment may not be able or want to.

Sunset Clauses must work both ways?

Oh it's an absolutely potentially huge disaster in the making.

There's been a few articles in the media recently of these things turning to custard.

The big question is how often this will be an issue - I think it's going to become common and a big issue.

Surely the media stories will make people more nervous about buying off the plans, further denting the downstream prospect for residential construction.

I bought off the plans 2.5 years ago. Worked out well then. Wouldn't touch it with a barge pole right now.

Story for you.

I bought off-the-plan, London, SW4,1992. Contract price £200k. Terraced development, 3 stories, 4 bedroom, garage, gated access to new street. Settled the contract on completion, and moved in.

An identical property across the street, the HK buyer defaulted. They lost their 20% deposit (Yes. 20%. Things were already looking shaky). The Developer put the house they'd re-inherited on the open market at £160k, just to move it on.

Guess what all the rest of the identical houses in the development, including mine, were now worth in a lenders eyes? Yep £160k.

Today, that same house would be £2million, but that's no consolation to the failed buyers who didn't come up with the balance of their purchase price. (Oh, and I sold up some time back, when I decided that New Zealand 'was it'!)

Interesting.

It's going to be fascinating to see how the off the plan thing plays out. I expect developers will game it as much as possible to survive.

A standard clause on S and P agreements for off the plan purchases is to allow the developer to build the townhouse / apartment up to 5-10% smaller than the plans that the purchase was based on. Now acting in good faith they shouldn't be resorting to shrinking the floor areas, but if they can under a contract I bet many will...not that it will be enough to save many of them...

I bought an investment property off the plans about 4 months ago. I'll keep you posted!

Exactly.

Carlos is peddling a false narrative there.

Although material prices may be rising which will increase the cost of THE house. The Land value, being the greater proportion is the likely adjustment factor and a few percentage point drops there will far outweigh any increase in building costs. NIS

Carlos - but land prices can fall, and it is land prices that have driven the housing market price increases

"They say the average NZ house is now 7.7x household disposable income and that it now takes 39% of household disposable income to service the average mortgage, the highest level since the GFC."

Thats a problem then because the NZ median house price is in excess of $850,000 and the median disposable is $85,000....

And the Banks have been mumbling about 6 as being the new ratio.

3 being prehistoric and the UK's 4.5 looking quaint.

Exactly. And most probably it will be less that soon.

"However, slow steady real price erosion is common and is our base case view."

Actions speaks louder.

Would love to see Forsyth Barr shorting the NZ housing market.

Are you being quick and adding to your portfolio?

I see we have some believers in the efficient markets hypothesis.

So does this mean 4.8% house rises (just below the rate of inflation) or 31% inflation (just above the current run rate of house prices)?

Don't worry....Greg Ninness says house prices are going to continue racing.

We got 5+ years of capital growth in a calendar year so some pullback is only healthy. The real win for owners was the opportunity to lock in long and low and smash their mortgages. Stunned that so few took that up.

Anyone else find the Mortgage Payment / Household disposable Income plot compelling? I think the correlation here is strong and this is most compelling case for a correction I have seen.

The deviation from 2004 to 9 was tolerated but we are almost up to 40% again.

Interesting read!

I am planning to acquire property one of these years. So having analyzing the possible situation will help me a lot. - Jack, https://www.aucklandfencingpros.co.nz/

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.