There may yet be further small gains in short term mortgage interest rates, according to BNZ chief economist Mike Jones.

In a BNZ Eco-pulse publication, Jones said BNZ economists had been highlighting that, even though mortgage rates for some (longer) terms may have peaked, "significant mortgage rate relief is unlikely this year".

"Recent events play to the grain of this view. If anything, the risks are tilted towards further small gains in shorter-term (one and two year) mortgage rates," he said.

He pointed to the "eye-catching jump" in wholesale NZ interest rates through February.

"One and two-year rates rose 40-70bps to hit fresh 15-year highs. While it’s tempting to pin this on the Reserve Bank meeting, it’s mostly a story of rising offshore interest rates sweeping NZ rates higher. In the US, financial markets have reluctantly caved to the view of the US Federal Reserve that stubborn US inflation warrants at least another three rate hikes, and hopes for cuts this year are… just that."

Jones said a less gloomy global backdrop, a "more upbeat data tempo", and a marginally firmer inflation outlook all fall on the "higher for longer" side of the interest rate risk ledger.

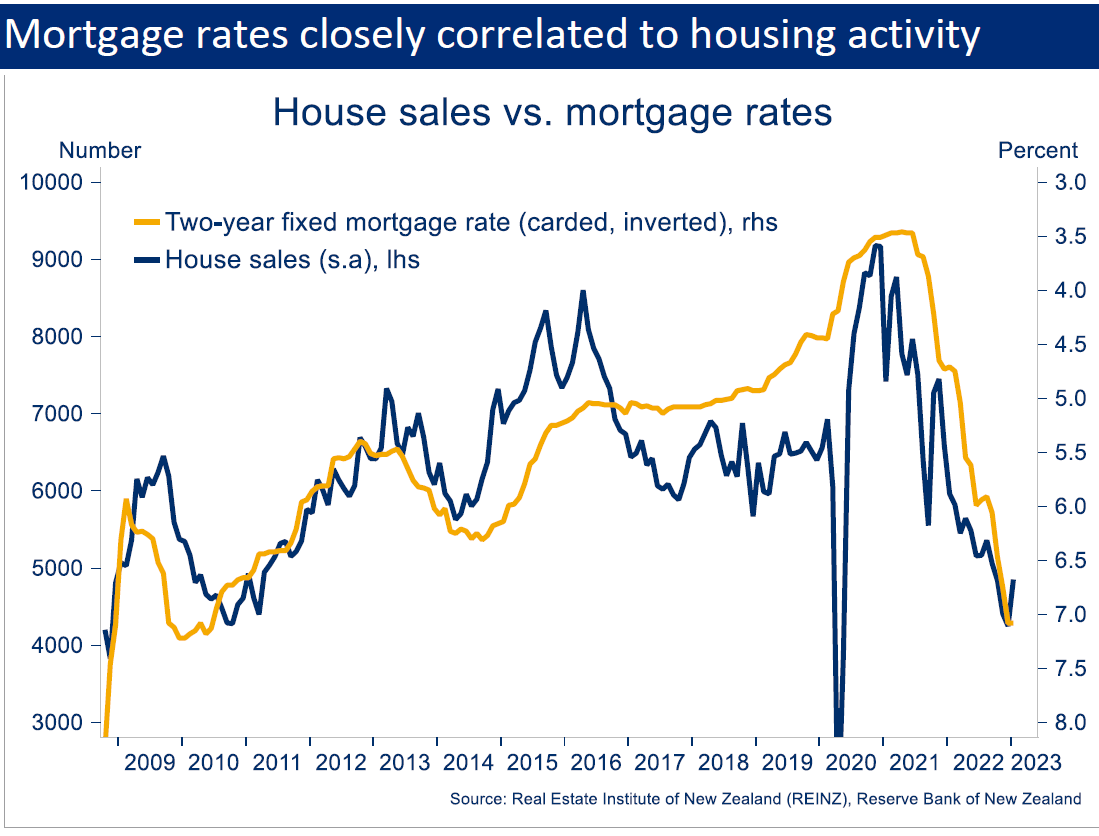

And this is all of relevance to the housing market.

"Just when we were starting to think the housing market may turn a corner a little earlier than our roughly mid-year expectations, we’ve become cautious again.

"For one thing, there’s the firmer interest rate story noted above. We’re not confident that the housing market can right itself until it’s clear mortgage rates have stopped rising. We’re not quite at that point yet.

"There’s also the disruption from the recent North Island weather disasters to factor into the mix. This will lower housing market activity relative to what we would otherwise see."

Jones said the reality is that it will be a few months before the underlying trends can be properly assessed.

"...But, for now, we remain okay with our views that: 1) house price declines are expected to bottom out around mid-year; 2) the total peak-to-trough correction will amount to roughly 20%, implying additional falls of around 5% from here; 3) the recovery out of the other side of the correction will be tepid."

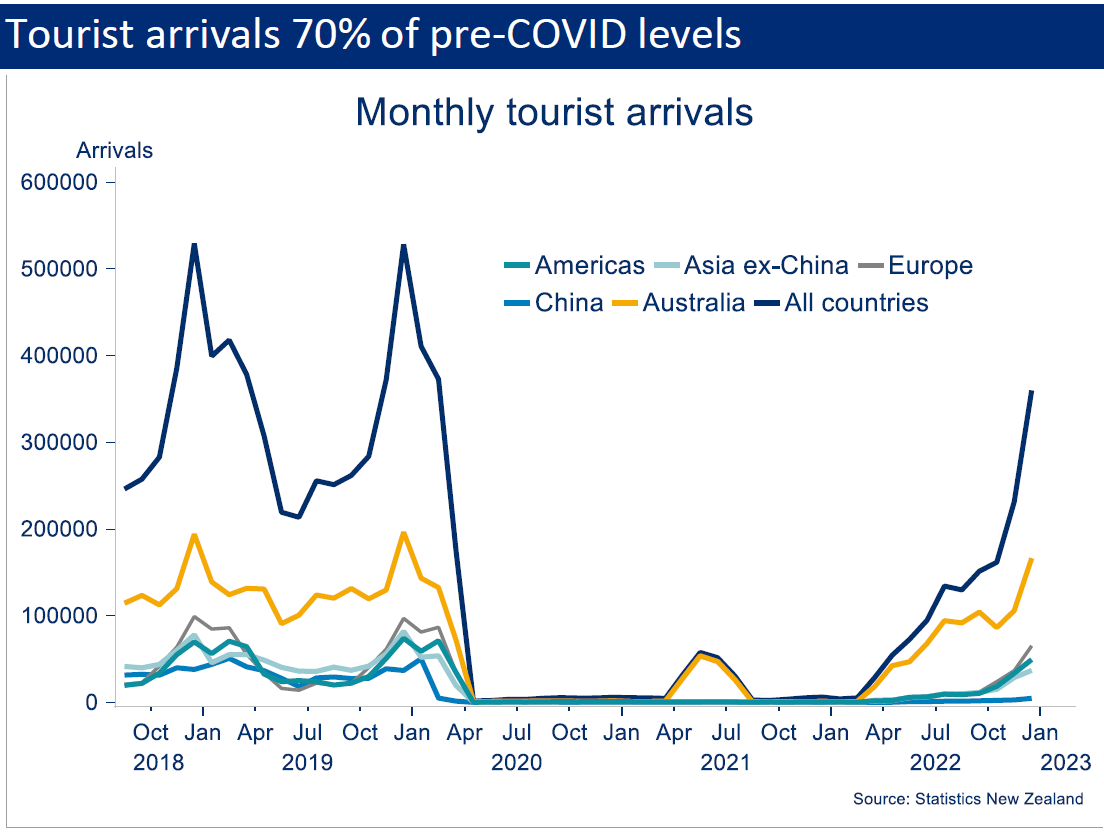

Jones noted that the "soggy" global backdrop certainly hasn’t deterred people from travelling.

"The trend towards so-called 'revenge travel' is showing up in NZ both via higher short-term tourism arrivals and longer-term migration swinging back to net inflows. Both are running stronger and, in the latter’s case, quicker than anyone might have expected.

"Tourism numbers for the December peak were back up to around 70% of pre-COVID levels. Further recovery looks likely as Chinese tourists – historically our 2nd largest source of tourism arrivals – start to hit our shores again.

"The bottom line is that the tourism recovery, in tandem with parts of the goods exporting sector, is helping to buffer the NZ economy against increasingly recessionary domestic demand conditions," Jones said.

He said the latest official retail spending figures were "instructive".

"Overall spending volumes declined 0.6% for the quarter, but that hid an almost two-speed pattern of spending. Strength in the more tourist-orientated accommodation and food & beverage categories caught our eye (up 2.3% and 2.4% for the quarter, 31% and 15% for the year). By contrast, there was clear signs of weakness in housing and durable-related categories like furniture & houseware, recreational goods, and electronics. Increasing evidence that cost of living and mortgage rate pressures are taking a toll on discretionary spending."

Jones said that "to be clear", 2023 still looks like a slog in many parts of the world, as last year’s global scramble to get interest rates higher catches up with the global economy, particularly the interest rate sensitive bits like housing, spending, and construction.

"But it’s taking longer than many expected for this impact to be felt. Economic data for the month of January roared ahead of expectations almost everywhere (NZ included), leaving analysts scratching their heads. Genuine resilience, or dead cat bounce?

"We suspect the pleasant data surprises may prove temporary. But, regardless, it’s clear that the odds of global recession have reduced."

16 Comments

1) house price declines are expected to bottom out around mid-year - X

2) the total peak-to-trough correction will amount to roughly 20%, implying additional falls of around 5% from here - X

3) the recovery out of the other side of the correction will be tepid." - √ (And that will be a lot further away and a lot lower in price than most imagine, for all of the reason that Mr Jones touches on above, and more, but is reluctant to break from the pack in his assessment)

Inflation is still persistantly way above the kpi, unemployment is still perssistently too low and geopolitics is still fraught and worsening. Not to mention all parties are desparate to spend and cut taxes.

The only future is that the Ocr will have to rise further. House prices will fall further. The only question is whether it will level off in 2025 or later.

Its basic economics. When we see a lot of mortgagee sales likely mid late 2025.. we will know we are nearing the btm

I think you're on the money, top comment!

Let hope it all works out sooner tho.

Add 6-9 months to point 1, and a further 5% to point 2

Look at the spike in sales in 2014-15, when interest rates dropped and FHBs were kicked out of the market. I'm going to guess there are a lot of leveraged speculators still sitting on capital gains since then, waiting and hoping that those low rates will return. I wonder how many of them were paying down principal during that time, or are still sitting on IO? There's a fair whack of room in the market cap for further price discovery...

A more worrying question might be:

"How many of those 2014-15 buyer, who saw appreciation in their existing holdings, went off and leveraged the lot up and bought more into 2021"?

I'll suggest, quite a few, or why else did prices rocket over the next year? It wasn't the desperate FHBers that did it all on their own. And those who did have effectively tethered themselves to the peak prices of that time

Exactly. Unless you've liquidated any gains and exited the property market, you've just recycled the gains into an overvalued property, which might or might not work out well for you, but you won't know until you achieve a sell. To that end, contrary to popular opinion, there are very few winners in an overheated market.

Our favorite kiwi resident property mogul Gary Lin preached to all his students to go interest only 1 year loans to get the "sick yields" and maximum equity efficacy.

Wonder how thats working out for him?

Datas old - January has 500k plus arrivals - back to 100% or close enough to pre-covid levels.

Nice link. it also showed $495k in departures in January.

9,199 NET gain.

Roughly 120k added people per year at that rate.

Hotels full and rents going up fast.

It's 220k net arrivals in the last 6 months, where are they all sleeping?🤔

I thought it was a reasonable assessment of property things now & the immediate future. Remember they're a bank so their view is top down. We on the other hand are plebs & our view is both narrow & bottom upwards.

In the context of a shaky planet generally, we hold our own. Many don't know that until they've seen something else & sadly half of us never see much else, therefore don't appreciate how lucky we still are. Living in the shadow of Australia can be bothersome but we're still in the top 30 (out of 200).

Yes, we're doing our best to stuff things up, just like the rest of them, but all said & done, people still buy our foods & want to come & live/holiday here so we can't be that bad, can we?

They obviously haven’t talked to their old mate Tony who says interest rates have peaked and there are 8 other reasons house prices are going to take off this year. He also didn’t seem to mention the extremely low yield compared to much higher term deposit rates.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.