While borrowers are liking the recent home loan rate cuts, and looking forward to more as global rates slip and the Reserve Bank's October 9 Official Cash Rate decision gets closer with another rate cut expected, savers are watching their return offers shrink.

Friday, ASB was the latest bank to cut its term deposit rate card. It certainly won't be the last.

As rates fall, savers are challenged to balance the risks they take with the income they earn.

In the first instance, that brings challenger bank offers into play. But all banks have investment grade credit ratings. So the choice of a main bank often just hinges on convenience.

But that convenience gets challenged when rates are falling. And when rates fall so that after-tax returns butt up against the inflation rate, the squeeze gets felt acutely.

At present, the lowest rate offers tend to be from the main banks. Apart from Heartland's 5.10% three-month current offer, the highest current rates are all from Rabobank.

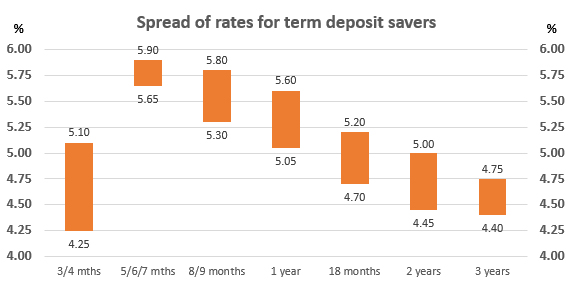

The spread between the lowest and highest current offers is about 50 basis points. Depending on the size of your deposit, 50 basis points can make a meaningful impact on your returns even if it is only to help keep inflation at bay.

The pressures come from falling rates. Why are rates falling? There are many reasons.

First, loan demand is weak, and most banks don't need the funds. So competitive pressure for retail funding is not strong. There is no real commercial penalty on banks for offering lower-than-necessary rates to savers.

Second, wholesale funding costs are falling due to a global shift of lower international policy rates by central banks.

Thirdly, inverted rate curves are unwinding - and that probably means shorter rate offers are going to fall faster than for longer terms.

Fourthly, savers have been aggressive seeking higher rates, and money has been shifting into term deposit savings.

And lastly, in the background, the Deposit Compensation Scheme (DCS) is getting organised by Treasury and the Reserve Bank. It will be in effect in about nine months (mid-2025). Institutions in that scheme (both banks and non-banks) will have to then pay into the scheme so they can say to their customers they are protected. That fee will undoubtedly be deducted from institution rate offers - the customer will pay.

Banks don't need the DCS cost issue to come up suddenly in mid-2025 with a noticeable drop in rates at that time. So in all likelihood, offer rates will start slowly being whittled back from now on so that the impact is hardly noticed.

When you invest, always check how interest is compounded. Depending on how much you are committing, compounding more often is materially better. But some banks advertise their "interest at maturity" rates different to their compounding rates, which for some can be set a little lower. Both Kiwibank and Rabobank do this, although most other main banks don't.

Use the calculator at the foot of this article to see the differences.

We should also point out that after-tax returns can be enhanced for some savers with higher tax rates, by the choice of PIE structures. Not all banks offer these, but most of the main banks do. For a nine month bank offer, they can be boosted by about 30 basis points going this way. In some cases that will make up any difference, or more.

Always ask a bank for a better rate. Many bank staff have discretion to offer more than the advertised rate. (And check your bank's app offers as they too are often enhanced to retain you). But in this environment don't get your hopes up for a positive response. Carded rates are likely to now be the 'best rate', except in quite special circumstances.

Use the term deposit calculator here, or the one below the table, to calculator your expected net returns.

The latest headline term deposit rate offers are in this table after the recent changes to start the week.

| for a $25,000 deposit September 20, 2024 |

Rating | 3/4 mths |

5 / 6 / 7 mths |

8 - 11 mths |

1 yr | 18mth | 2 yrs | 3 yrs |

| Main banks | ||||||||

| ANZ | AA- | 4.30 | 5.65 | 5.35 | 5.10 | 4.80 | 4.55 | 4.45 |

|

AA- | 4.40 | 5.65 | 5.30 | 5.10 | 4.80 | 4.50 | 4.45 |

|

AA- | 4.25 | 5.65 | 5.20 | 5.10 | 4.75 | 4.45 | 4.40 |

|

A | 5.00 | 5.80 | 5.35 | 5.15 | 4.60 | 4.50 | |

|

AA- | 4.50 | 5.65 | 5.30 | 5.05 | 4.80 | 4.60 | 4.50 |

| Kiwi Bonds. 'risk-free' | AA+ | 5.00 | 4.50 | 4.00 | ||||

| Other banks | ||||||||

| Bank of China | A | 5.30 | 5.90 | 5.60 | 5.50 | 5.10 | 4.90 | 4.90 |

| China Constr. Bank | A | 5.30 | 5.50 | 5.40 | 5.35 | 5.20 | 5.05 | 5.00 |

| Co-operative Bank | BBB | 4.30 | 5.80 | 5.30 | 5.25 | 4.80 | 4.55 | 4.50 |

| Heartland Bank | BBB | 5.10 | 5.75 | 5.40 | 5.25 | 4.85 | 4.70 | 4.55 |

| ICBC | A | 5.30 | 5.80 | 5.45 | 5.40 | 5.05 | 4.85 | 4.75 |

|

A | 4.55 | 5.90 | 5.80 | 5.60 | 5.20 | 5.00 | 4.75 |

|

BBB | 4.25 | 5.70 | 5.40 | 5.25 | 4.70 | 4.70 | 4.70 |

|

BBB+ | 4.25 | 5.90 | 5.50 | 5.50 | 5.00 | 4.70 | 4.60 |

Term deposit rates

Select chart tabs

Daily swap rates

Select chart tabs

Term deposit calculator

8 Comments

Which means you have to start looking elsewhere for a decent return again.. Can I see the property train starting to leave the station..

If you're using TDs and properties to get a decent return you're doing it wrong.

Even "stupid" stocks do a whole lot better: Microsoft +215%/5y, Apple +320%/5y.

Don't even have to dig for the next booming tech/company.

Ok, but stocks are riskier than Houses and definitely riskier than TDs. I personally have a 'saver' mentality and would therefore prefer to see slow and steadily rising returns such as the ones that come from TDs or rental income (from a good property in a desirable location), rather than feel the pain of the greater swings in the stock market and the inconsistency of the dividend offerings.

'Right' or 'wrong' are mostly as subjective as every individual's personal goals. For many investing isn't always just about money, it's ultimately about a peace of mind - Peace of mind in knowing that our savings are growing and that our retirement is sorted, etc.

People who don't know about stocks find them risky. Take any stock index and look for its growth over the past 10 years. As safe as houses. Of course there will always be black swan events, generally followed by a recovery if you can hold long enough.

You may be able to do OK with houses but you'll never become a multimillionaire. At least not with today's conditions.

The point anyway is no pain no gain.

"You may be able to do OK with houses but you'll never become a multimillionaire"

This is not true. One can easily become a multimillionaire through investing in real estate. It just takes a good strategy and time. I personally know some people who have become multimillionaires through real estate alone and they are not even baby boomers.

It can also just make what you referred to as a 'decent return' in your first post. It doesn't have to be multiple millions.

I don't mean to make this into a 'Stock market' vs 'Real estate' investing discussion. The only intelligent conclusion to such discussions is that it's good to diversify and invest in a bunch of things, including shares and houses, but also bonds and even TDs when the rates are good.

Death by a thousand cuts. Soon It'll be TD returns of 3%, same as property (on average) then what? Managed funds I guess.

Does anyone remember back in the 'good old days'?

When governments would offer TD rates above bank rates to constrain bank lending?

Ah. Those were the days.

edit: I expect most people reading this have absolutely no idea what I said. Like I said, most kiwis aren't that bright. ;-)

I have no idea what you said but I tend to appreciate your comments.

Could you please elaborate?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.