Mortgage rates are still on the move down. With the many changes from almost all banks, this note is to assess where the market is now.

The first point to note is that for the first time ever, there are no banks with 'special' offers of 4% or above for any two year fixed term.

This gives a good sense of how far this market has actually moved.

Yes, there are standard two year fixed rates above 4%, but every bank has a fighting rate below that benchmark.

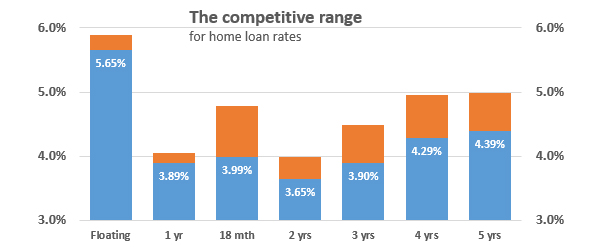

This chart shows where the current floor is, by duration.

And that shows another surprising benchmark: there are no banks offering their best five year rate at 5% or above. Every bank-best fixed rate on offer now is below 4% with the sole exception of BNZ's unique seven year rate of 5.95%.

Specifically, this is where the lowest rate offers stand:"

Floating - the institutions offering 5.65% currently are only Kiwibank and the Co-operative Bank.

Six month fixed: only the Co-operative Bank offers 3.99%.

One year fixed: BNZ and ANZ offer 3.89%, although TSB will match that.

Eighteen month fixed: only SBS Bank and HSBC offer 3.99%.

Two years fixed: no bank offers a carded rate above 3.99%, but China Construction Bank offers the lowest rate in the market at present for any fixed term of 3.65%. The next lowest offer is ASB's 3.89%, matched by TSB.

Three years fixed: Again, it is China Construction Bank with the low offer of 3.90%. After them, the next lowest is Westpac's 3.95%, also matched by TSB.

Four years fixed: Kiwibank has the lowest offer at 4.29%.

Five years fixed: Again, it is Kiwibank with their 4.39% offer rate.

And there's more ...

Keep an eye out for cash incentives as well.

As well as making its price-match promise for "any advertised home loan rate from ANZ, ASB, BNZ or Westpac", TSB, for example, will give you up to $4,000 in a cash back deal. Their fine print says "you’ll be eligible for a cash contribution of up to 0.50% of the total loan amount, up to a maximum of $4,000". But their offer "only applies to the purchase, refinance from another bank or building of residential properties". TSB's offers are slated to end on June 15, 2019.

Other banks may well match or better any offer. In a quiet winter market, unadvertised deal-making will be common for banks to meet their sales targets.

See all banks' carded, or advertised, home loan interest rates here.

Here is the full snapshot of the advertised fixed-term rates on offer from the key retail banks.

| below 80% LVR | Floating | 1 yr | 18 mth | 2 yrs | 3 yrs | 4 yrs | 5 yrs |

| as advised as at May 10, 2019 | % | % | % | % | % | % | % |

| some floating rates may not be effective yet | |||||||

| ANZ | 5.69 | 3.89 | 4.19 | 3.95 | 4.05 | 4.85 | 4.95 |

|

5.70 | 3.95 | 4.19 | 3.89 | 4.05 | 4.35 | 4.45 |

|

5.80 | 3.89 | 4.79 | 3.95 | 3.99 | 4.35 | 4.45 |

|

5.65 | 4.05 | 3.99 | 4.09 | 4.29 | 4.39 | |

|

5.79 | 3.89 | 4.09 | 3.95 | 3.95 | 4.35 | 4.45 |

|

5.65 | 3.99 | 4.09 | 3.99 | 4.15 | 4.39 | 4.49 |

| China Construction Bank | 5.80 | 5.10 | 3.65 | 3.90 | |||

| ICBC | 5.79 | 3.99 | 4.19 | 3.99 | 4.49 | 4.95 | 4.99 |

|

5.89 | 3.99 | 3.99 | 3.99 | 4.39 | 4.89 | 4.95 |

|

5.89 | 3.99 | 3.99 | 3.99 | 3.99 | 4.49 | 4.49 |

with price match promise with price match promise |

5.69 | 3.89 | 4.09 | 3.89 | 3.95 | 4.35 | 4.45 |

In addition to the above table, BNZ has a fixed seven year rate of 5.95%.

Update: An earlier version of this story ommitted to say that the Co-operative Bank has a 5.65% floating rate along with Kiwibank. This fact was in the table, but not in the story itself.

Fixed mortgage rates

Select chart tabs

5 Comments

You mean they actually encourage you to take out a mortgage, by giving you money in advance.......of the next 30 years of slavery. for both Ma n Pa ...this Mother's Day.................How could anyone resist....such a treat?

Happy Mother's Day...you freeholders... Should I hit the Save button..........by mistake....Oh well...here goes.

Well it's either that or property prices really be forced to drop (crash) in Auckland and that would be bad news for banks. I wouldn't be surprised to mortgage rate fall to 2% or even 1.5% mark in a year or two.

Unless RBNZ want regional property prices to continue to follow the Auckland bubble they really need to enforce some hard rules on affordability ratios at a 5%+ rate. A race to the bottom in mortgage lending doesn't benefit anyone in the medium term.

... cash is trash ! ... the world is awash with cheap munny , as every central bank on the planet is in the race to the bottom , trying to devalue the local currency ...

10 years of central banks promoting property and sharemarket bubbles leads to what ... a repeat of the GFC ?

... who knows ... they certainly don't ... so why should we be expected to make sense of it all ....

Can't see a repeat of the GFC - gotta be bigger next time.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.