A housing market that was boiling is now merely simmering - but still radiating heat like never seen before in winter.

Latest Reserve Bank figures show that in June, $8.526 billion was advanced for mortgages - easily outstripping the previous June high of $6.8 billion in June 2016.

And while the latest figure was down on the $8.92 billion borrowed in May it kept up the record of a string of months all ahead of what was the long time record for any month of $7.3 billion set in May 2016.

Since that May 2016 record was broken in September 2020, we've seen every month bar one break the May 2016 mark. The one month that didn't meet the old mark was January 2021. But nevertheless, the $6.36 billion advanced for mortgages this past January was very easily the biggest tally ever for this traditionally quiet month, and beat the previous record (set last year) by a whopping $1.646 billion.

The $8.5 billion borrowed in the latest month takes us to a heady $50.3 billion of mortgages taken out in the first six months of this year.

First home buyers are staying strong in the market.

They borrowed $1.649 billion in June, down from $1.757 billion in May, while their share of the total amount advanced slipped a little to 19.3% in June from 19.7% in May.

Investors were expected to be reined back in by the newly reintroduced RBNZ 40% deposit rules - and that is happening. Having killed the FHBs in the post-lockdown rush last year they are now taking back seat to them, with $1.436 billion borrowed in June, amounting to 16.8% of the total - the lowest total and share for this grouping since before and immediately after lockdown last year. In May investors borrowed $1.57 billion, which was 17.6% of the total.

So, the market is slowing a little. But all things are relative.

What is clear is that the FHBs and owner-occupiers have been more than willing to take up any slack provided by the retreat of investors.

These figures would again tend to suggest that the RBNZ is going to be well-out with its predictions of house price inflation virtually being snuffed out in this quarter.

In its May Monetary Policy Statement, the Reserve Bank predicted house price inflation of 28.5% for the June 2020 year and then falling all the way back to just 0.4% in 12 months time. In terms of quarterly figures it projected that quarterly house price inflation would drop from an actual 7.9% in the March quarter, to an estimated 5.5% in the June quarter and then just 0.2% in the September quarter.

If there aren't some serious signs of the housing market cooling considerably in July's housing sales and mortgage figures then the RBNZ may have to go back to the drawing board.

It could of course take more stringent action against investors - but they are now backing off. As stated above, the FHBs and other owner-occupiers have been more than happy to take up the slack.

30 Comments

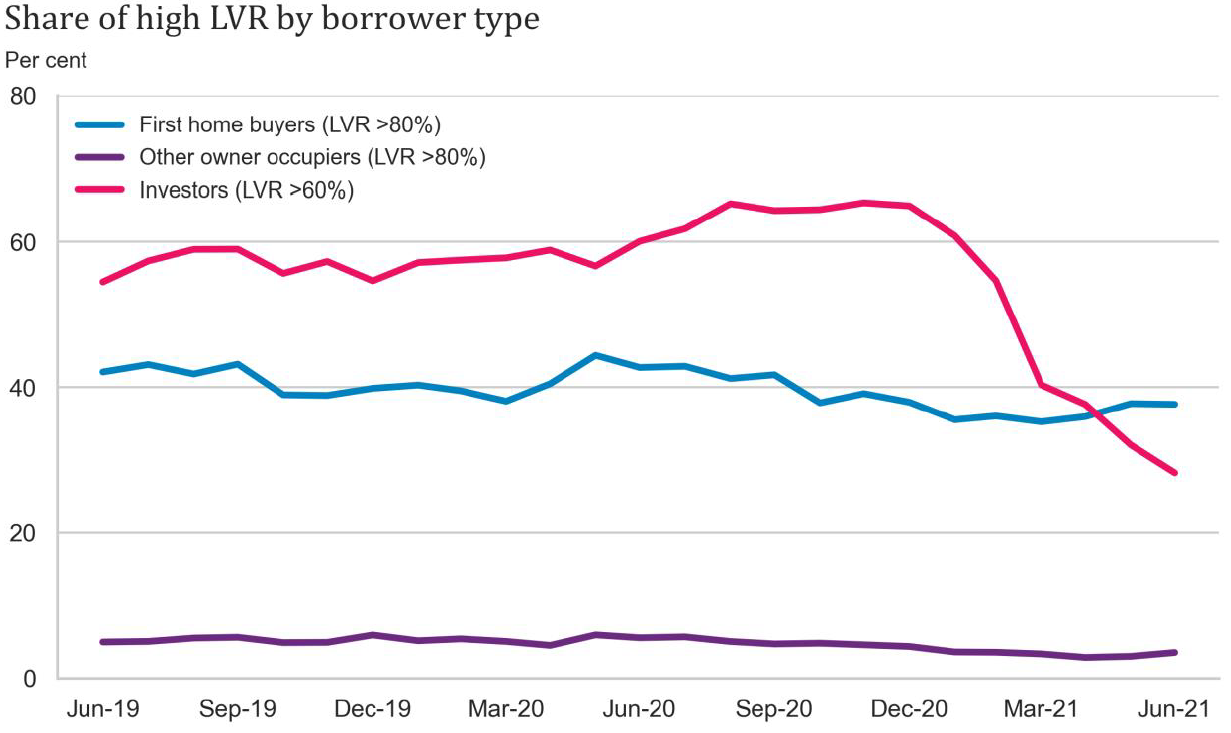

I'm confused by that graph...it says it's the percentage share of the high LVR loans but it doesn't total to 100, so is there another category of people not included?

I can only guess they're three different metrics all on the same graph but not directly related to each other, i.e. x% of FHBs are at high LVR, y% of other OOs are at high LVR, and z% of investors are at high LVR, rather than saying "Of all high LVR borrowers, x% are FHB..."

Although at the start they do seem very close to 100%.

You are correct - three different metrics.

It is, I guess slightly unhelpful that at the left hand side of the graph the totals of the three lines do come quite close to 100! But they are not meant to.

Thanks. I get it now. The wording might need tweaking to make it clearer though.

Yes that graph is quite misleading, there is no way that main banks (and very few second tier lenders now) are lending more than 60% LVR to standalone investors. That graph will include O/O borrowers that buy an investment property which means their LVR can be roughly 70% when spread across the two different security types (80% on O/O and 60% on Investment).

The graph shows the share of high LVR lending by each borrower type. For example, out of total new lending to FHB what is the share that is High LVR? By definition, Investors are entities or persons borrowing for the purpose of building or purchasing residential property to rent.

Increasing prices requires increasing borrowing.

Mortgage borrowing growth has gone to zero. Prices will not be increasing further from here

Famous last words

What a weird claim to make.

It's entirely possible for total mortgage lending to stay the same, or even decrease, and have prices increase, for example if the number of houses being sold decreased, then each house would have to sell for more.

Borrowers are simply doing what the RBNZ continues to incentivise them to do – this is what happens when “watching and waiting” becomes some sort of default policy - doing nothing and just hoping for the desired outcome to turn up at some point - yeah, that'll work out fine?!?

Sadly Mr Orr appears further and further out of his depth with his continued inaction – all that debt being created – in the end, easier the credit creation, the bigger the mess – and that mess will be his legacy.

Do they care as long as they along with their children are set for life.

I can't see any solution to this, once the people in power decide what need to be done, it cannot be changed by any democratic society till next election.

Mr Orr or Cindy can't do anything to curb this madness as it is new normal. This happen because they played the game of wait & watch, from last 10 months we only get warnings & no real action, because they don't want to see price to fall 10% ,rising by 50% no problem. As someone rightly said labour should pass the law to give subsidy on travel ticket & house buying in OZ to young kiwis.

Many sensible house holds with single home will seriously consider leaving this place for better future of there kids. No point now, highly disappointed by the policies of this Govt.

it cannot be changed by any democratic society till next election.

Governments can change their minds, you know.

They could even put policy positions to referendums. Typically they don't, but there's nothing stopping them.

Trust me, it won't be changed next election either.

As I have said before, the proportion of people who own will need to fall below 50% before we *potentially* see any meaningful reform.

Labour have a found the formula. Talk a lot about housing affordability to capture the vote non home owners, then don’t do much about it to keep home owners happy. House price rises “are what people expect”.

Big queues on Sunday for a pretty average place in Strathmore, Wellington

This is the only economy and better than any other investment - safe as supported and promoted by Jacinda Aunty and Uncle Orr.

Until it isn't.

Looks like we might be competing with more cashed up investors - game on!

The market is still crazy. Everyone wants a bigger better house in a better location.

So it's the culture of kiwis buying from kiwis and prices going through the roof. Even the new houses being built are not in the range for a first home buyer.

The whole issue is the human nature of not being satisfied with what they have but wanting more, new and better.

Don't worry mate with three tweenagers this behaviour starts at primary school..so and so got the latest Iphone, so and so got the latest Ipad I want one etc etc etc..and it just morphs into adulthood, with the finance companies and banks more than happy to help them achieve the buy now, pay later mentality. then I start to sound like my parents..in my day we had jack...

A three bedroom unit or townhouse is fine for a couple with 1 or maybe 2 kids. Add in a third kid, parents who need support, a pet or other lifestyle choices and high density housing isn’t ideal so of course people want to upsize. Buying one house for the rest of your life isn’t feasible.

Not many people choose to have 3 kids these days.

A three bedroom unit or townhouse is fine for a couple with 1 or maybe 2 kids. Add in a third kid, parents who need support, a pet or other lifestyle choices and high density housing isn’t ideal so of course people want to upsize. Buying one house for the rest of your life isn’t feasible.

Investor: "I need a loan to buy a house."

Bank: "If it's for investment you'll need a 40% deposit."

Investor: "Well it's certainly not for investment then."

Bank: "Superb."

“Show me the incentive and I will show you the outcome.” - Charlie Munger.

'Stuff' is reporting Sydney and Melb houses to rise 21% and 17% respectively this year?

Correct.

Pathetic compared to our beautiful housing bubble.

Every open home I've been to recently is pumping, no sign of cooling. FOMO is alive and kicking.

The current boom's momentum is likely to extend well into 2022.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.