By David Hargreaves

The amount of total outstanding mortgage borrowing grew in dollar terms by the smallest amount for exactly three years last month, according to the latest Reserve Bank figures monitoring sector credit.

As at the end of July, the total outstanding on mortgages was $238.234 billion, up $442 million on the $237.792 billion reported as outstanding at the end of June.

While last month is obviously always a quiet month for the housing market, the $442 million increase in the borrowing total is the smallest since July 2014 and falls way short of the sort of growth that was being seen before the RBNZ clamped down on lending to investors last year.

For example, in May last year at the height of the lending boom and shortly before the RBNZ announced (in July 2016) 40% deposit limits for housing investors the month on month outstanding total rose by just over $2 billion.

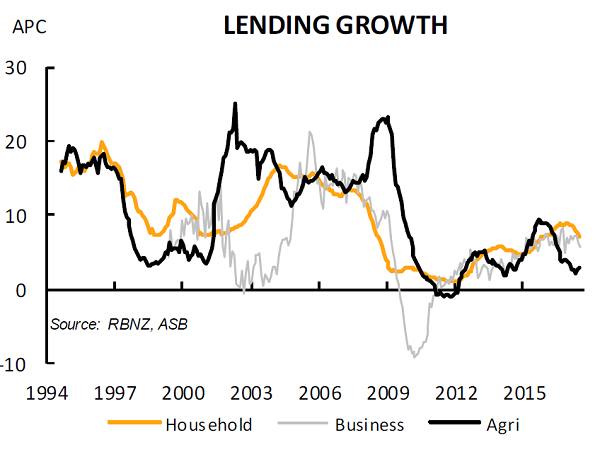

ASB economist Kim Mundy said July marked the seventh consecutive month that annual housing credit growth has slowed.

"The 7.1% year-on-year growth is also the lowest annual rate since October 2015. The pullback in housing demand over the past year (reflecting the tightening in the RBNZ LVR restrictions and higher mortgage rates) is evident in these mortgage growth figures. We are expecting household growth to remain subdued over the remainder of 2017, in line with the soft housing market."

With the sharp slowdown in lending growth in July 2017, this means the annual rate in growth of total lending has swiftly dropped to the current 7.1% as of July, from 7.7% as of June. At the end of the March quarter the annual rate of growth had been 8.9%. The figure peaked in this cycle at 9.3%.

In July last year the annual growth rate stood at 8.9%, while two years ago - during the period it was rising quickly - it stood at 5.8%.

To put the current rates of mortgage growth into perspective, in 2011 the rates of annual growth were in the low 1% range.

Notwithstanding that, the latest figures will nevertheless raise further questions about when the RBNZ might look at loosening the LVR limits.

Outgoing Governor Graeme Wheeler indicated this week that any such move by the RBNZ was not imminent.

But with both National Party leader Bill English and Labour Party leader Jacinda Ardern, expressing dissatisfaction over how LVRs were perceived to be impacting first home buyers, the issue is likely to be ramped up in terms of public debate after the September 23 election. English and Ardern's comments followed the Real Estate Institute of New Zealand calling on the Reserve Bank to remove LVR restrictions for first home buyers.

Among other figures released by the RBNZ, total household borrowing (including consumer lending) rose to $253.717 billion in July from $253.219 billion in June, with the rate of annual increase in July falling to 7.1% from 7.6% as of June.

Business borrowing was at $103.771 billion in July down from $104.527 billion in June, but was up 5.7% in the past year, while agricultural borrowing in total stood at $60.419 billion in July, up from $60.014 billion in June and up 2.9% in the past year.

3 Comments

"Filling the gap between stagnant wages and higher expenses with more debt works for a while, but it isn't a permanent solution, as eventually, the costs of servicing the higher debt eats the borrower alive--and when they default, the bad debt eats the lender alive, too." (CH Smith)

A slower rate of debt accumulation is nothing to be excited about. When it is being repaid...then get excited!

And whilst the growth rate in borrowing may be lower, it is still growing. The debt burden relative to incomes is much more insightful.

Credit is still growing faster than per capita incomes.

Sustainable house prices are possible only when they grow at the same pace .

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.