ANZ economists don't believe the recent uptick in house prices will result in a full-blown resurgence, and think that prices will be capped to a degree by affordability constraints and various measures proposed by the new Government.

In their weekly Market Focus publication the economists reiterate their earlier view that a number of opposing forces are likely to see house prices effectively stay ‘on ice’ for the foreseeable future.

"All else being equal, we expect this to be a headwind for consumption growth going forward, although perhaps to a lesser extent than history would suggest, given that the softer housing market has not been driven by a turn in the interest rate cycle, but rather by a more restrictive credit landscape, including macro-prudential policy.

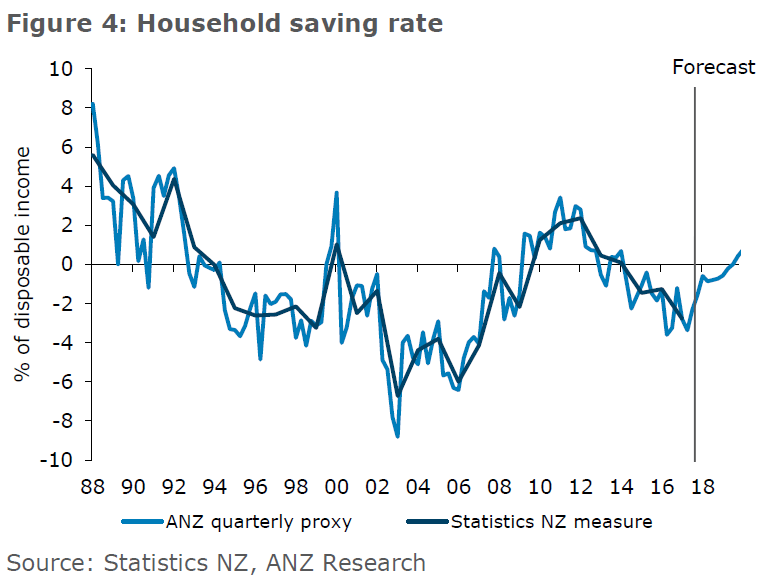

"Nevertheless, with the household saving rate having deteriorated over recent years (to an unsustainable level in our view), weaker house price performance is expected to see households look to rebuild precautionary saving, and this will be a headwind for overall activity growth," the economists say.

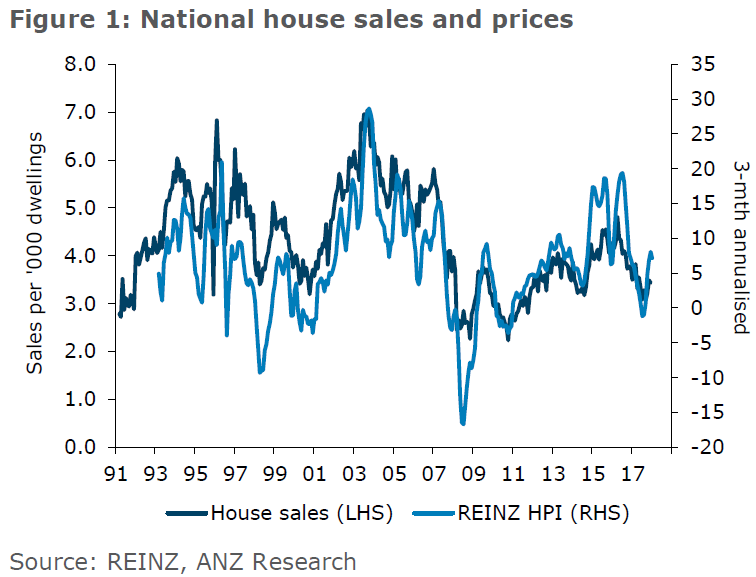

In noting that the housing market has "staged somewhat of a comeback of late, with turnover and house prices accelerating again", they say that this "bounce" has been large enough that it will reinforce in the minds of Reserve Bank officials that it was right to take a cautious approach when it comes to rolling back LVR restrictions [with a part-lifting of them in January].

"In fact, we believe a further softening in those restrictions is unlikely in the near term."

The economists say the housing market is still a long way off its "lofty heights" of 2016.

"Despite the recent bounce, sales volumes in January were still 12% below the 2016 monthly average. In three-month annualised terms, national house prices are currently growing at 7.2%. At the height of market strength in mid-2016, that pace was 20%. And at 37 days, the median number of days to sell is up significantly from around 30 days in February 2016.

"Importantly, we don’t see this recent bounce turning into a full-blown resurgence; our overall views on the market have not changed as a number of factors balance out.

"The topside should be capped to a degree by affordability constraints and the measures proposed by the new Government (banning of non-resident buyers, extension of the bright line capital gains test, and possible other tax changes). At the very minimum, we suspect this will keep sentiment contained and ensure investors are not the driving force they were when the market was at its lofty heights over 2016."

The economists do note, however, that there remain "supportive forces" too.

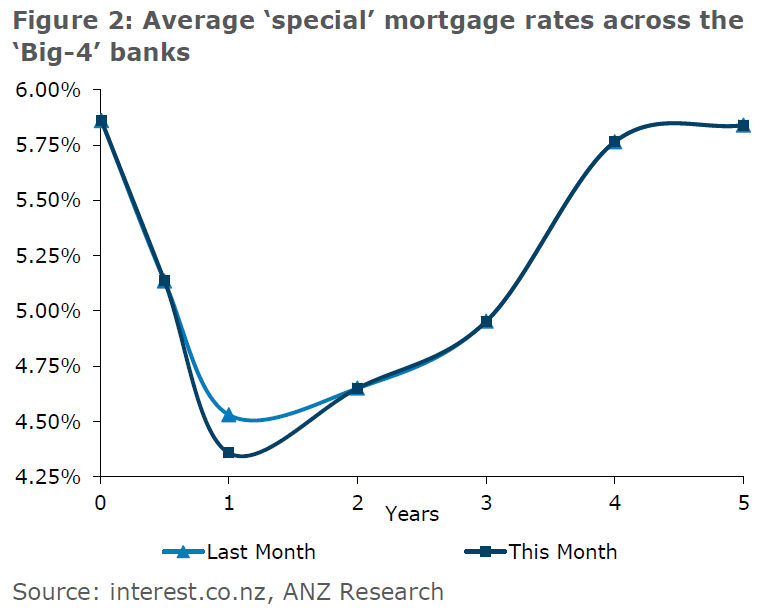

One of these is that a little more competition in the mortgage market has surfaced as banks’ funding pressures have eased.

"Short-term fixed mortgage rates have fallen a little over the past month, which perhaps could also be a sign that banks’ appetite to lend is increasing too (i.e. both a volume and price story). That will provide some support to the market (and probably already is doing so)."

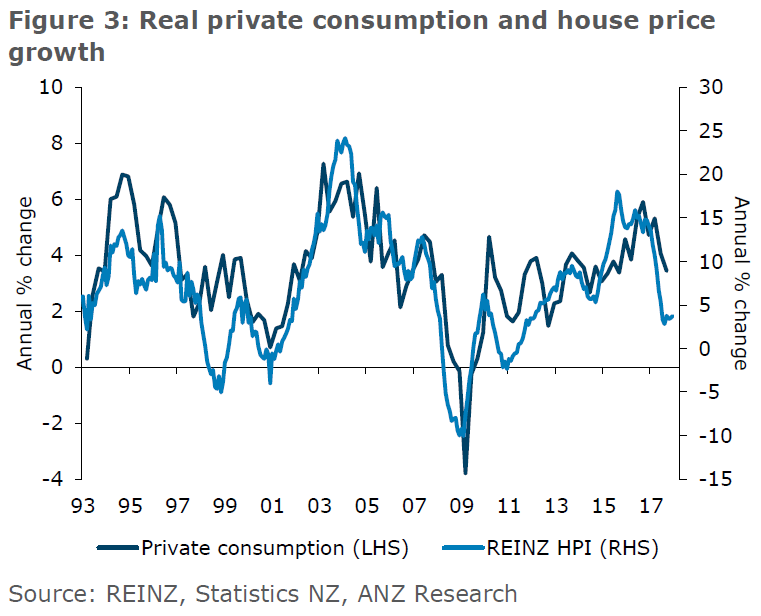

The economists say one of the "conundrums" of recent years was the apparent relative softness in household consumption growth.

"Now don’t get us wrong, consumption was reported to be growing at a decent pace overall, supported by reasonable income growth, low interest rates and strong population growth. It just was not growing as strongly as one would have expected given the strength in house price inflation. It appeared that households were showing far more spending restraint than had been seen in the past, which, at the time, was one of the reasons proposed for why the current account deficit had remained contained and domestic inflation pressures had not risen to the extent expected. Prudence was the new black.

"However, the revisions to GDP changed that story. Real consumption is now reported to have grown at close to a 6% y/y pace in Q3 2016, which is right around the time when the housing market was humming. It was the strongest growth since 2005. The household saving rate is now shown to have deteriorated more than initially thought, to be currently sitting around -3% of disposable income. So much for that household restraint!

"All else equal then, if the traditional relationship between the housing market and consumption is alive and well, one must conclude that the slowdown in house price inflation will be a real headwind for spending growth. In fact, real household consumption growth has already close to halved from the 6% pace seen in 2016, and perhaps has further to go."

However, the economists say there is a complicating factor.

"...Whereas the housing cycle historically has often been arrested by higher interest rates, this time around the cooling has been driven more by macro-prudential policy and arguably more restrictive credit conditions."

The economists go on to question whether this means that the observed tight relationship between spending and house price growth is actually just a correlation, a reflection that both variables are impacted by a third influence (interest rates)? Or does the house price cycle influence consumption directly through its impact on household balance sheet strength?

"We suspect it’s a bit of both. Perhaps the fact that interest rates remain historically low – and are expected to remain that way (short-term rates, at least) – means that consumption growth won’t follow the pace of house price growth down to the extent that has been seen in the past.

"After all, mortgage serviceability is at about historically average levels, despite record-high levels of debt.

"However, we still believe there will be some impact, especially as we don’t deem the deterioration in the household saving rate to be sustainable.

"At a time when the asset side of the household balance sheet (housing) is not performing as strongly as it was, we suspect households will look to rebuild precautionary saving, getting their net equity up, and debt-to-income ratios down (or at least no higher) the hard way.

"All else equal, that will be a headwind for consumption growth, and hence GDP growth more broadly."

25 Comments

Ha, always bet the opposite of what an Economist says!

...which economist?

No doubt the one that predicted 11 of the last 5 recessions?

The end times are here.

As I predicted the 99.99% drop in house prices is here. Cats will sleep with dogs, the dead shall walk the earth and you will be able to pick up a three beddy in Epsom for $1.50, a stick of gum and a pencil (used).

... so ... just a mild " technical " recession you reckon ... down for two quarters , then business as usual ?

If you were channeling Peter Venkman there I am impressed.

Oh yes, but it’s still a great time to buy if you can find the shoebox of your dreams

“Shoeboxes..... they’re not making any more of them!?”

Down Down and Down....don't be foooled.

I’m just an uneducated layman but within 2017 inflation in Q1 was 1%, Q2 was 0%, Q3 was 0.5% and Q4 was 0.1% (a total of 1.6% for those of you playing along at home)...so Q1 was more than half of the inflation last year and if they role under 0.4% for Q1 ’18 they are back under their target rate yet again, right? That seems like a probable scenario if what ANZ are outlining is correct.

It’s not the houses that set the prices

People who buy the houses set the price paid

Once interest rates tick upward affordability by purchasers will swing the pendulum back toward lower prices

The US stock market recovered but for how long is the question when 10yr treasury bonds yield ticks over 3%

it will be interesting to see what happens to both shares & interest rates

NZ is part of the global economy these days more than ever

Nice to see it’s taking in more than its share of refugees

The houses have become self-aware. I welcome our new overlords...

I only laugh at Tony Alexander now with BNZ I’m told

I think the ANZ economist has its head screwed on right

Remember economists use historical facts to predict

Predictions not much better than crystal balls

Much of the article is focused on the impacts on consumer spending. The economists know that the symbiosis between asset bubbles and consumer spending is crucial.

In your constant pursuit of trying to sound intelligent, you say some weird things.

Symbiosis in economics - correct me if I am wrong - but isn't symbiosis the cohabitation of organisms for mutual benefit?

Even if we abstracted that as an economic principle...How are asset bubbles and consumer spending symbiotic?

I mean. They are neither entities acting under some form of (ir)rational behaviour, nor are they mutually beneficial...

I think it fair to say, as has already been pointed out, we are really entering into unchartered territory. The Great Deleveraging has to occur, and given the inaction and actions, particularly of the fed over the last 20 or so years and the contrained position they are in is it conceivable this can be accomplished in a controlled and stable fashion? Based on their historical record and the currently out of step and deeply suspect machinations of the Trump administration one would be forgiven for contemplating, at the least, a bad case scenario. If it is somehow ‘managed’ with a modicum of nous it will be likely the result of accidental good fortune along the way rather than a well thought out and executed plan. Just crossing my fingers and hoping for the best.

well said, i assume the deleverage will be baby steps but even baby steps in the current environment can have a huge impact. The pullback of QE will tighten things up too. Over time things will correct to a sustainable environment but be prepared for a little bit of carnage along the way.

Have been reading some interesting history of international monetary policy this last week as I've been traveling for work. Had no idea it can be so apparently intentionally violent. Makes the present time look quite...well, obviously difficult to pick, but also apparently knife edge. It seems like we've had a massive build up in terms of monetary policy and something big is going to happen, it's just no one is quite sure how it's going to play out.

Would a decrease in house prices lead to a drop in consumer spending? Because it’s been noted elsewhere that the post GFC wealth effect from rising asset prices has been pretty muted. Perhaps we’ll see the inverse wealth effect on the way down. Falling house prices will make non home owners feel richer and they’ll go out and spend more. (tongue in cheek)

Maybe people will invest in factories or industries that export goods rather than importing money via mortgage debt.

The inverse speculation;

Since the GFC consumer spending has been muted, because demographically the main group to push consumer spending are younger generations. They have children, they fill houses with furniture, this is the group that all studies have shown drive consumer spending, retirees have a deflationary affect etc etc. Since the GFC, FHB's have become more and more of endangered species. And many, at least that I know, have buckled down, reduced spending and saved. The saving at least, has shown up in the data, where millennials have been shown to save more money than boomers.

So let's say a large number of people under 40 have become quite fiscally conservative, they are saving at a high rate and not spending so much because they can't afford to buy a house, so don't have a secure financial future. If this changes, and by some miracle affordable housing arrives in NZ, we could be looking at a huge amount of pent up spending.

Exactly! also all the wealth is accruing in an age group which has a low propensity to spend. The Piketty effect also plays a part. Case in point, John Key sells his house for a 10 million dollar tax free capital gain. How much of that wealth created additional economic stimulus? none probably!

Still don't see enough change at the local level to have a massive impact on house prices in either direction. Looks to me is that we have more of the same, be it at a slower rate of increase. Until those immigration numbers get slashed its a situation with no change, that can be made to happen overnight but building houses takes years.. Big change will have to come at an international level like another GFC or worse. Will that happen ? of course it will its just a question of when. Be careful what you wish for, it will come back and bite you in the arse.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.