ANZ economists say that despite rising construction and land costs, the high existing house prices in New Zealand have made building a house more attractive relative to buying an existing one.

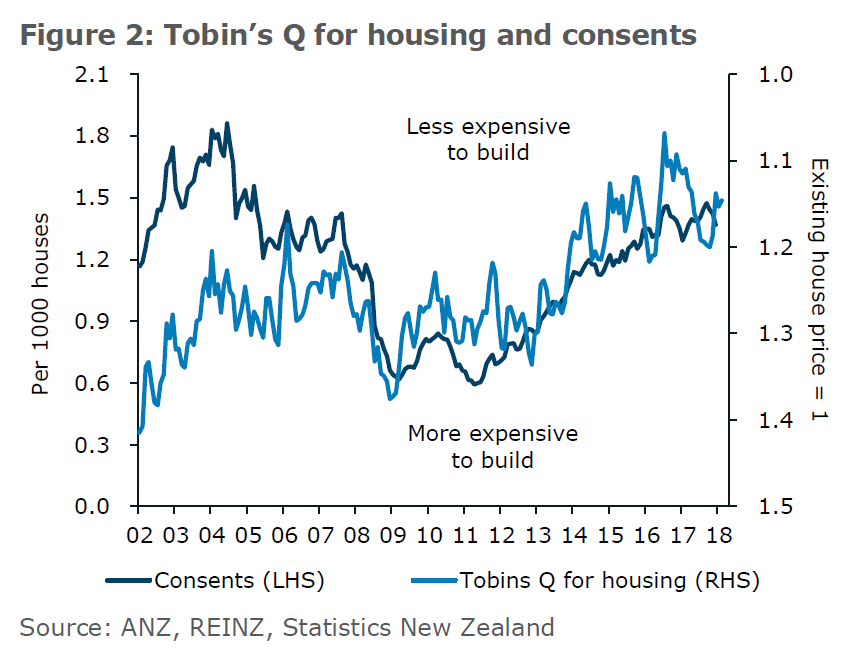

In the bank's latest Property Focus publication, chief economist Sharon Zollner, senior economist Liz Kendall and senior macro strategist Philip Borkin say the cost of building (based on the cost of a section and a new dwelling) can be compared with the cost of an existing house through a measure known as “Tobin’s Q for housing”.

"Building tends to increase when the cost of a new build becomes cheaper relative to buying an existing dwelling," they say.

"Prices for existing houses have increased 50% since the start of 2012, whereas we estimate that the cost of a new dwelling (including land and construction) has increased 30% over the same period.

"The location and composition of new versus existing housing can differ, of course, but this comparison gives a general indication of how relative costs have evolved.

"Building has become more attractive relative to buying and consents have risen accordingly."

The economists say, however, that cost increases, uncertainty and credit constraints are squeezing profits and limiting the degree to which the building industry can increase activity further.

"While activity levels are high, construction firms bear some of the burden of increasing cost pressures. In some cases, cost increases cannot be passed on to customers because contracts have already been negotiated. Unexpected cost increases or delays can squeeze profits and make the outlook uncertain, making it more difficult for firms to bear risks and make financing decisions."

They say also that banks are not necessarily willing to fund all projects, partly because of this uncertainty.

"Bank credit is thus a constraint for some, and due to the demise of the finance company sector, non-bank financing is not available to the extent it was last cycle. So although firms are very busy, profitability in the sector is strained, with firms struggling to pass on higher costs in a timely fashion."

In terms of the new Government's Kiwibuild programme, the ANZ economists say that the target of supplying 100,000 affordable homes is "ambitious".

"Increasing supply is good for affordability, but doing so will be difficult in practice.

The economists also say that building “affordable” houses will be difficult, given elevated costs.

"Given the current costs of land and construction in Auckland, it is difficult to deliver new housing for less than $900,000 – the price of the median house.

"The cost of construction (not including land) was $2,100/m2 on average for new dwellings consented in February.

"But even if the Government’s targets are met, the houses will still be unaffordable for many, with $600,000 just under 6 times the average income in Auckland.

"Compared with a median price of $900,000, this is certainly an improvement. With a 20% deposit, this equates to 33% of disposable income going to mortgage payments, rather than 50%. But $600,000 is ambitious, given high costs and strong demand. Tweaks such as multi-level “walk-ups” (no lifts) and cutting out car parks will help at the margin but aren’t a game-changer."

And the economists say that while 100,000 homes is ambitious, it isn’t actually going to solve the housing shortage.

"Demand has outpaced new supply for a number of years, leading to a significant shortfall. And population growth remains strong.

"New Zealand’s population is estimated to have increased by 100,000 people over the year to December 2017 to reach 4.8 million people.

"Ironically, the promise of these houses may have had a dampening impact on housing demand and hence prices already – why buy a $900,000 house today if a $600,000 option will be available in a year or two?

"Ultimately, though, we suspect any direct effect on house prices of the KiwiBuild initiative will be small. (But as is often the case in economics, we will never have the counterfactual to be sure.)"

The economists do, however, cite some potential positive spin-off's from the Government’s initiatives, namely:

- Sharing the financial burden: The Government’s books are in a solid shape and the Crown can borrow more cheaply than corporates, so government financing of projects may ease that constraint by sharing risk.

- Procurement: Government procurement could help reduce construction costs, though competition for labour resources will work in the opposite direction.

- Productivity: Use of prefabricated housing and modular units at scale could provide the productivity kicker that the residential construction sector so desperately needs (if it is consistent with buyers’ preferences).

- Streamlining consents: Initiatives to review council regulations and streamline consent processes would be useful for reducing costs and delays, but only if they are widespread.

- Land supply: Freeing up land for new building (or loosening land use restrictions) is the most important step the Government can make towards improving housing affordability.

"But it’s like the old joke when you ask the local for directions: 'Well son, I wouldn’t start from here.' Auckland is faced with a housing shortage that was years in the making, and it won’t be turned around overnight.

"In addition, exceptionally high house prices, particularly in Auckland, have become embedded in the financial system, something the Reserve Bank has been talking about in a financial stability context for years."

The economists say that increasing land supply is crucial in the face of strong demand.

"High house prices have been driven significantly by rising land values, with effective land supply relatively unresponsive to changes in demand. Increasing land supply is therefore crucial to making houses more affordable, in the face of strong population pressures.

"Estimates suggest that “In Auckland, land use regulation could be responsible for up to 56% or $530,000 of the cost of an average home”. This issue is not confined to the Auckland market, though. Land use regulation could be responsible for up to 48% of the cost of an average home in Wellington, 39% in Queenstown, and 32% in Christchurch."

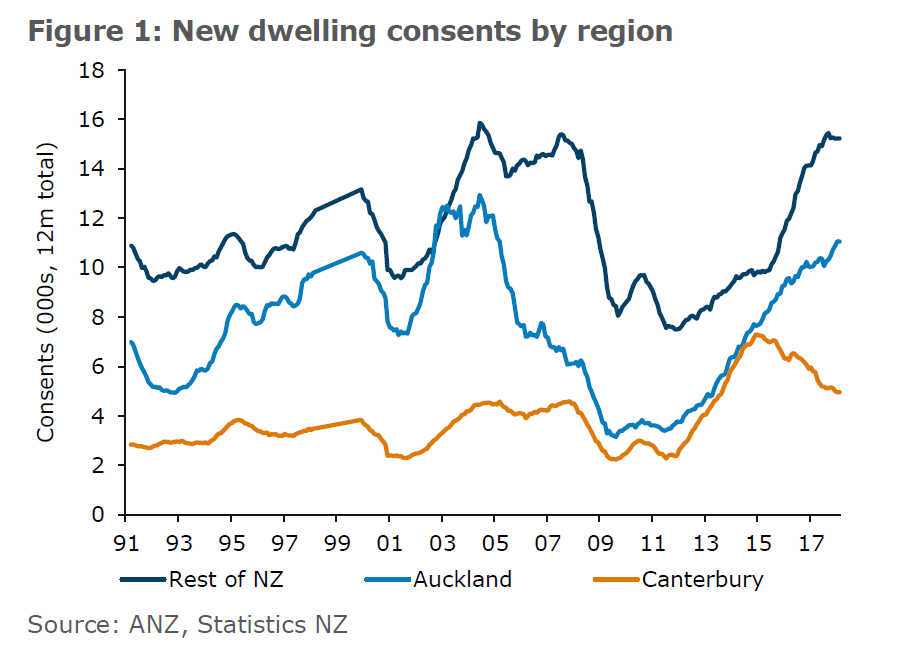

Looking to the immediate future the economists believe that housing demand is expected to remain solid, "but constraints are at play".

"We expect residential building activity will remain at high levels. Underlying demand remains strong, with a significant number of houses needed to keep pace with demand. Regional housing markets are playing catch up, filling the gap as rebuild-related activity in Canterbury continues to wane. The Canterbury market is expected to slow further going forward. The Government initiatives described above will also contribute to demand, while inevitably causing a degree of crowding out of private sector activity."

The construction industry more broadly is closely connected to economic activity, the economists say. Construction industry activity (which includes residential and non-residential investment along with other construction) is quite ‘cyclical’: it tends to pick up considerably when economic activity is strong and pare back a lot in downturns.

"Construction industry activity is currently elevated as a share of total economic activity – and we expect this will continue for some time yet, with GDP continuing to grow at about-trend pace. It’s not just the outlook for residential building supporting this solid outlook for construction; demand for commercial property is also expected to hold up. Commercial and residential construction firms compete to some extent for workers (but perhaps not as much as one might expect).

The economists say, however that we are now arguably reaching a more difficult phase in the construction cycle.

"Activity levels are high, but we expect continued upward pressure on costs at a time when house prices are no longer increasing significantly – meaning cost miscalculations won’t come out in the wash. Cost pressures and delays could squeeze profits and put cash-flow pressure on firms in the industry.

"Current high levels of construction activity may also be allowing less competitive companies to stay in business, so the industry will need to adjust if growth softens. And if construction activity were to slow significantly, such firms could face difficulty."

The outlook though is solid, with demand expected to remain supportive.

"But pockets of pressure could emerge, particularly if house prices were to start to turn south. Given such pronounced housing shortages in Auckland, that is not our expectation. But nor can it be ruled out. House prices could start to fall if household debt serviceability were to take a hit, either due to reduced job security or interest rate rises.

"For now though, it’s all hands on deck."

23 Comments

Let's get these economists to build houses for us then OK?

Talk about ivory tower vs on the ground.

Quite true.

Maybe we could ask Shamubeel whether it's worthwhile even building houses.

Pretty obvious that they have no contact with anyone who is involved in construction or has had a house built.

Building a house for cheaper than buying is good. Except when the pricing is wrong and excludes critical items. Then once those items are added in (often during construction) the price delta is not so different. Then you have to remember it's not possible to live in a house while it's being constructed so you add in rent costs (which have also been left out) and maybe there is still a saving building new.

Of course construction time then runs past the official end date causing delayed occupation, families moving in while the building is still being constructed and there is no certificate of public use or code compliance certificate. Of course the delays are due to the builder losing time, overloaded contractors not showing up or delays due to the builder having cash flow problems. With the delays the cost blows out completely and the person building their family home realises that it's ended up costing more because of all the blow outs. The delays also add interest costs which make cash flow tight or illiquid due to paying rent, interest and forking out for construction.

By the time construction is underway it's the wrong time to find out the true price and risk that has been taken. Of course every Kiwi is an expert in housing so there's no way they could be wrong.

If you want a new house there are some developers that build and sell to the market. There's nothing wrong with buying a new house that's just received a CCC. You just pay the price and the developer has taken the risk. Unless, of course, you are in Tauranga.

https://www.stuff.co.nz/business/property/103210844/families-left-displ…

I am dismayed at the quality of tradies who have been doing work at my house in Ak in recent times. Some NZers are fantastic however others do not speak English well enough for me to understand what they are saying. And when doing simple things like nail in a dwang, its like watching a child attempt it. I am not enjoying this at all.

yep exactly the same as i observed on my folks building project a couple of years ago.

and the pain doesnt end on 'move in date' - 12-18 months and thousands of dollars battling with the builder for remedial work to fix errors during construction

My sincere commiserations Mr Uninterested

You can thank Sir Roger D for successfully destroying the old tried & true NZ apprenticeship system

along with the destruction of the tried & true Prescriptive reugulation of building houses in NZ for the anything goes BRANZ approach which was so successfully manipulated by NZs building supplies companies

What you have in NZ today is an even more fragmented building industry than ever before totally reliant on foreign skilled labour to fill in the gaps.

None of this matters because Auckland City is broke $6Billion in debt so it can’t even afford to build necessary infrastructure for new developments anyway

Building a house on a spreadsheet and AutoCad is very different from building an actual one.

Seems easy, but be prepared to have a generous and meticulous budget with 20% allowance on the upside. Not something for the faint hearted, and certainly unlike the good old days when Bob the builder could work out the cost on the back of a GIB board.

These numbers are unrealistic - $2100 / m2 is bare basic for an incomplete " caravan" with minimum and dirt cheap taps, electrical, carpets, appliances etc - Landscape, retaining walls, upgrade and Options for bathrooms / kitchen / Decks let alone high tech, are all extras.

Final Compliance costs are fluid , and will certainly exceed budget, Not to mention Time, Stress, and the Hassle !! -

An genuine error of less than a meter in the surveyor's elevation calculation costed me 20,000 for tipping the additional excavated soil while preparing the foundation - that was about 5% of the total building cost ... there are numerous last minute ugly surprises like these during a building project.

It is not cheaper to build than buy ATM.... unless someone has a specific idea, requirements, and design somewhere special... and have plenty of Cash to spend.

Most actually missed that window of opportunity at the beginning of this cycle in 2013 --

Usually, building cost look low compared to rapid rocketing of existing houses and they lag a bit behind the market... now it's too late and existing building prices have caught up with new built and will follow each other closely in the next few years, until next time.

If you're an FHB and buying new, you should not be doing a custom build, just buy one of the turnkey solutions that some builders are churning out.

We did this, were promised three months from start of build, it was done after the three months, for exactly the price we agreed on.

Of course, having been through the process, we now have a massive list of things we would not do, or changes we'd make in our next build.

Even so, we have a new (2015) house, well insulated, warm, dry, and double the floor area compared to the crappy existing houses we looked at in the same price range (890k at that time), so yeah, it was cheaper to buy, and absolutely zero issues or surprise costs.

Well done, we looked at it but decided on buying existing home as the cookie cutter suburbs just lacked some soul. However warm and dry trumps everything I suppose...if only we could have both for a reasonable price?

This is interesting to hear. We went through a similar thought process in Hobsonville point/ West Harbour a few years ago. Ended up buying a 3bed 1 bath mid 80's renovated home on 700sq section. Was similar price to a 2bed 1 bath new build in HobPoint on 250ish sq.

OH .......... FOR ................ GOODNESS ............ SAKE

These economists need to stick to things they know and understand and not apply relatively unknown theories and discredited formulas to our complex housing market

Its clear that the author of this drivel has never attempted to build a house in Auckland , let alone attempted to split a section or buy one for that matter ........... geotech reports , town planning fees , survey costs , its a roller coaster of costs, fees, levies, taxes, rorts and who knows what else ......... and complexity not for the faint hearted .

The holding costs while getting approval , the approval risk ( of not getting approval ) professional fees and Council fee rorts, make this a minefield for everyone other than those with deep pockets and big balls .

The the sheer cost of building, overruns , unforseen stuff , builder dishonesty and sharp practice and all manner of nonsense like liquidations and so on make it a real battle zone and hugely costly .

The secondhand market is a much safer bet

Exactly --- well put

exactly - even a simple subdivision like chopping the back off a larger property very quickly brings up in excess of $100k to the council for 'contributions', geotech reports and a bit of drainage...

Some countries are now "printing houses in 3D" and although it is still in the developing stage, they have already drastically reduced the amount of time and resources to build houses the traditional way. This new technology could make alot of tradies redundant over the next couple of decades. Technology advances faster than the old ways of thinking that you and I, can even dream of. I don't think anyone will be taking a profit over old decaying homes in 20 years from now, because nobody will want them with their high maintenance bills. Our old homes will become a noose around the neck in maintenance costs compared to these new builds that can be printed up over a few days.

Some countries are now "printing houses in 3D" and although it is still in the developing stage, they have already drastically reduced the amount of time and resources to build houses the traditional way. This new technology could make alot of tradies redundant over the next couple of decades. Technology advances faster than the old ways of thinking that you and I, can even dream of. I don't think anyone will be taking a profit over old decaying homes in 20 years from now, because nobody will want them with their high maintenance bills. Our old homes will become a noose around the neck in maintenance costs compared to these new builds that can be printed up over a few days.

Look they "3D print" a few bits, with humans stepping to do lots of bits whilst the printing pauses, then does a bit more, then more intervention, then more printing etc.

It makes a couple of bits faster, but you can't print a whole house or anything. The machines can't print electrical wires in the walls or even steel reinforcing.

yes and no. The technology is improving by leaps and bounds. The key here is finding the right balance in using the technology, or not. Its like the "multitool" that came out a few years ago promising to do everything, reality check, no but it can do somethings no other tool does, or does well. I bought it for this reason and only use it a few times per year but its a lifesaver.

For myself my 3d printer is one of the best DIY tools I have. This becomes especially apparent when you want to start making specialist items that are not available in NZ or horrendously expensive. examples, currently I am making a $950 dollar item I couldnt justify the purchase of for about $200. I will follow that up by making a $600 item for about $50.

You still need reinforcing, electrical, plumbing, insulation etc. The cost of building is about 50% land, 25% materials, 25% labour according to a productivity commission report a few years ago. 3D printing would solve the Labour part. You'd still be using expensive Fletchers concrete and paying ridiculous fees for consents, soil reports, electricians, utility connections etc.

New houses? Only if they actually happen.

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=12035030

So they borrow $300m but can't build some roads?

Council consent fees, delays and unaccountable incompetent staff that don't know their own rules. Unnecessary soil tests. Contracts stacked against the customer with dozens of loopholes. Slow quoting. Slow drafting. Low ball PC sums. Health and safety costs. Poor workmanship. Material shortages. Weather delays.

What can go possibly wrong!

Builder who treats the plans "as a guide". Builder who doesn't work on a Saturday when the forecast for the Monday is rain. Ridiculous "variation" prices. Concrete layer who does not vibrate the concrete down into the foundation blocks so you have to do it yourself.....

The list will be endless.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.