Dairy product prices are hitting stratospheric levels - but they are likely to head even higher in the immediate future.

In what's previously been described as a 'perfect storm' for dairy prices low NZ milk production has combined with a number of global factors to help drive up prices. And now there's the impacts of the Russia invasion of Ukraine to consider.

In the latest GlobalDairyTrade auction early on Wednesday the GDT Index hit a new high while several products were at or near highs.

The GDT Index has shot up 19.5% since the end of 2021, while Whole Milk Powder (WMP) prices have risen 23% so far in 2022.

Farmers are already set for a bumper milk price payout for the season ending in May.

Giant dairy co-operative Fonterra last week pushed its forecast Farmgate Milk Price range up to $9.30-$9.90 per kilogram of milk solids, giving a 'midpoint' price (at which advance payments to farmers are made) of $9.60. The current record high price for a season is the $8.40 that was paid in 2014, so whatever happens between now and the end of the season this year's payment will smash that record.

Westpac industry economist Paul Clark said the latest GDT result "cements our 2021/22 farmgate milk price forecast at $9.50/kg".

"The risks though are clearly on the upside, and as such we will continue to review the forecast," he said.

"Short-term, we expect that weakness in New Zealand dairy production due to unfavourable weather conditions will continue to support global dairy prices. Similarly, bad weather conditions and rising input costs are also likely to have affected production in other key exporters such as the EU and the US. Russia is a major exporter of wheat and of some of the raw materials used for making fertiliser. Fears of supply disruptions have seen feed and fertiliser prices spike higher, adding to the pressure on already constrained production levels. This should further support world dairy prices in the near term."

RaboResearch (Rabobank) senior agricultural analyst Emma Higgins said the milk supply situation in several key export regions continues to deteriorate.

"New Zealand milk production was down 6.1% [year-on-year] in January 2022, while US milk flows took a hit of 1.6% YOY in the same period too. The worsening supply is driven by crispy weather for the first month of 2022 here locally in NZ, while feed cost pressure impacting on margins in the US have hampered milk flows over there. Less milk in New Zealand translated into less product on offer at this GDT Event for SMP [Skim Milk Powder], with adjustments to WMP and SMP lower over coming auctions," she said.

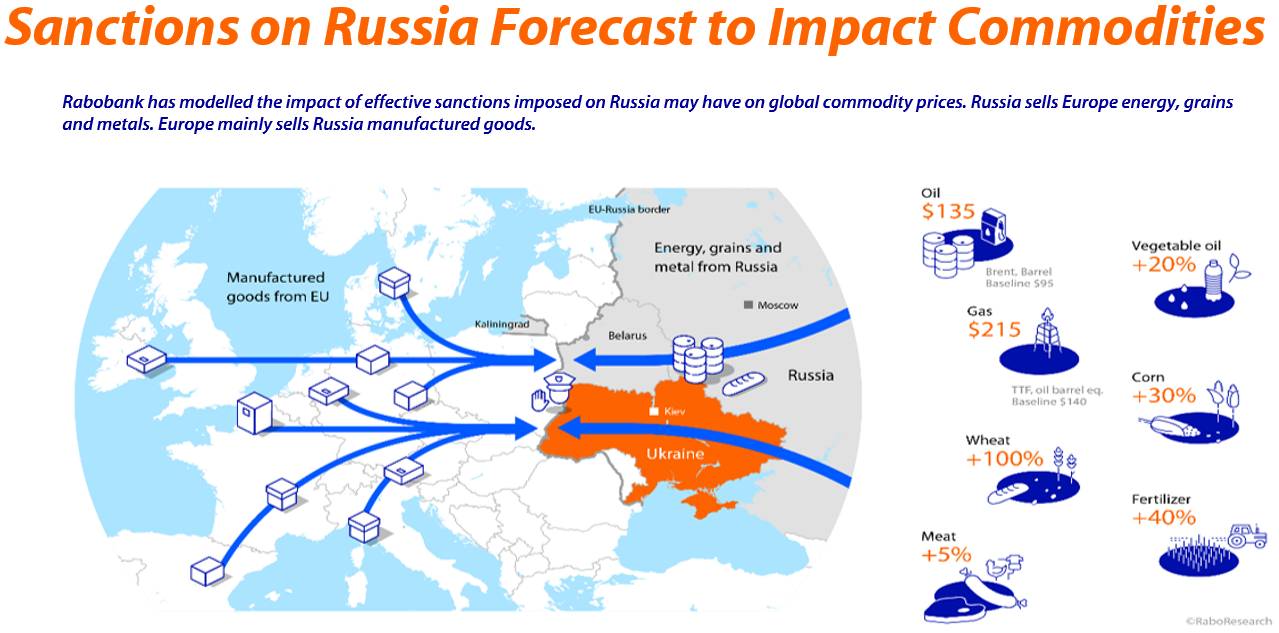

She noted that Russia and Ukraine are "significant players" in global trade of major commodities: grains, energy and metals. Combined, both countries are major exporters of grain (24% of global wheat, barley, corn), oil (5% of crude oil), natural gas (35% market share in Europe) and raw materials for fertiliser manufacturing (23% of world ammonia; 17% of potash; 14% of urea; & 10% of phosphates).

"These commodities are being swept up in the fighting – either physically or via the results of crippling sanctions on Russia. Rabobank anticipates more upside to come for global prices of grain, oil, natural gas and fertiliser over time. The flipside is that we also expect the same for food prices and inflation," she said.

"In the short-term at least it’s very likely there will be further upside to come for dairy commodity prices.

"Food security concerns for some buyers will be high, supporting demand in the short-term. It will be harder to quickly increase milk flows out of the Northern Hemisphere with more feed cost pressure expected as grain prices move higher from already elevated positions. The grain market was already tight prior to the invasion, and at the time of writing CBOT [Chicago Board of Trade] wheat prices are over 70% higher than the five-year average. A similar trend exists for CBOT corn and soybean prices, which are also 70% above 60% respectively above the five-year average price. All supportive factors for GDT prices in the coming weeks.

"The flip side is that fertiliser and fuel costs are likely to follow the same trajectory as rising oil and gas prices. New Zealand dairy farmers won’t be immune from these trends."

The global RaboResearch team have modelled a scenario assessing potential commodity price movements against a backdrop of war and the impact of effective actions on Russia (see graphic below). The duration of conflict between Ukraine and Russia, combined with the speed, extent and length of the sanctions will be key to understanding flow-on implications.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.