By David Hargreaves

Fonterra's increasingly looking out on a limb with its current farmgate milk price of $6.75 per kilogram of milk solids - as global dairy prices continue to slide.

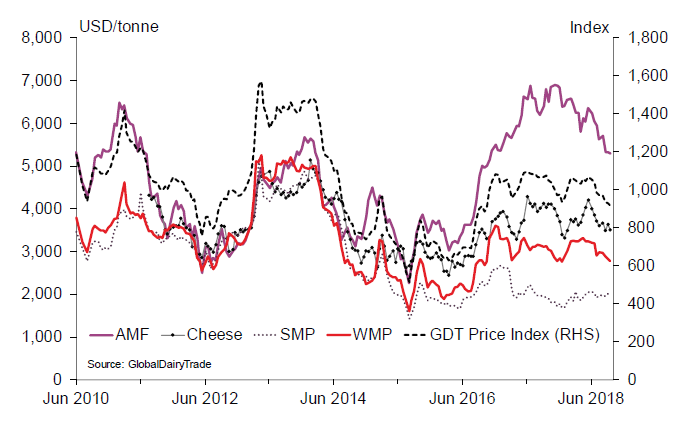

Overall prices dropped 1.3% and the key Whole Milk Powder price slipped 1.8% in the GlobalDairyTrade auction early on Wednesday.

This was enough for Westpac economists - who were already below Fonterra with their milk price pick - to drop their forecast price to $6.25.

Fonterra started the season with a $7 milk price, which appeared optimistic to economists when Fonterra first made it. Since then global prices have kept slipping and slipping.

It was therefore something of a surprise that when Fonterra reviewed its forecast last month, it dropped it only to $6.75 and not the $6.50 most economists were suggesting looked more on the money.

Any further reduction by Fonterra in the price may well be more politically loaded than usual, given the trials and tribulations the co-operative is experiencing, with a loss of $196 million reported last week and with various aspects of the business officially up for review, including the disastrous investment in China's Beingmate Baby and Child Food Co.

Westpac senior economist Anne Boniface said while the Westpac economists had long been factoring softer dairy prices into their outlook, "prices have slid further than we had been expecting in recent weeks".

"And with farmers pleased with pasture conditions in many parts of the country, at this stage prospects for NZ milk supply appear favourable. This may be one factor behind Fonterra’s 3% lift in the forecast volume of product it expects to offer on the GlobalDairyTrade platform over the next 12 months (driven by a lift in forecast whole milk powder supply).

"Consequently, we have lowered our milk price forecast to $6.25 (previously $6.50).

"As we noted last week, we continue to view Fonterra’s $6.75 forecast as too optimistic," Boniface said.

ASB senior rural economist Nathan Penny said in annual change terms, overall dairy prices have fallen 14.8%.

"Moreover, overall prices are now at their lowest since October 2016 in USD terms."

However, he said in NZ dollar terms (given the recent weakness of our currency) the annual fall is much more modest 3.7%.

"In the short-term, we expect dairy prices to remain soft."

Penny noted that New Zealand is approaching its seasonal peak in production in October and in line with this peak auction volumes are also increasing.

"This additional auction product will keep the downward pressure on prices."

Looking over the rest of the season, broader NZ production trends will be a key factor for prices, he said and he anticipated NZ production growth of 2% for this season compared to last.

"Production growth in excess of this level would likely lead to additional price weakness and vice versa. Implications

"For now, we stick with our 2018/19 milk price forecast of $6.50/kg, but continue to note the downside risks."

16 Comments

Synlait doubles profit. No dividend and shares continue to drop. But...they are forecasting a 2018/19 milk price the same as Fonterra.

https://www.stuff.co.nz/business/farming/107183908/synlait-doubles-prof…

Its not a good look when having announced a sizable loss there are stories of Fonterra continuing with large scale international conferences for staff at upmarket tourist destinations. Another example of where too many layers of management insulate those at the top from the real world.

The sad thing is, had it not been for the press release I imagine a good chunk of the people attending the conference would have been blissfully unaware of the posted loss.

Was probably an overseas trip for the Accounts Payable Team for all the hard work they have put in over the year, Accounts Receivable didn't work as hard or meet their KPI's so weren't invited.

As a farmer watching economists forecasts for this season I don't think their accounts payable team are doing that great a job either..

Nah the Farmers pay packets are handled by Human Resources who have a limited budget to work with.

Don't worry Wilco, you have Christina Zhu aka the Red Queen running the show in China:

https://www.stuff.co.nz/business/farming/107205232/fonterras-china-arm-…

Its a large global business. How else do you get key staff, sales teams, most of them not NZers, together from around the various markets to share, compare & learn?

I was about to concede to your argument when I realized the fatal flaw in your point of view. There is no limit to Fonterra's Human Resources budget as evidenced by management salaries. As a farmer I would be happy to be remunerated by their HR department. I would be well paid whether my farm made a profit or a loss.

You see, those management salaries are the reason the Human Resources department are cash strapped.

Fonterra is a price-smoother, so without knowing its internal positions re currency hedges, forward contracts, and other de-risking measures it may or may not have in place, everything is speculation.

Correct. It would be fascinating to know where they are sitting with their forex hedging. I’d be willing to bet that they had billions hedged at 0.73 and above, but as you say, I’m only speculating as well.

The Board Chair said in his interview with Jamie McKay that a 1c shift in the NZD/US rate = approx 5c impact on milk price. approx 5.56m in to interview https://www.nzherald.co.nz/the-country/listen/news/article.cfm?c_id=600…

At least Nzdan and I weren't talking about the bloody housing market.

Houses made of cowpats, it's the way of the future.

Pretty sure adobe huts are basically the same thing.. not sure "of the future" is how i'd describe them.

Fonterra...saved by Whittakers? ;-) https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=12…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.