The squeeze is on big time for New Zealand businesses, with firms reporting soaring costs, soaring prices charged - and yet falling profitability.

That's the upshot from the latest NZIER Quarterly Survey of Business Opinion released just a day before our Reserve Bank (RBNZ) has to make key decisions about whether to hike - and by how much - interest rates.

ANZ economists have been calling for a 50 basis point rise in the Official Cash Rate, which would take it to 1.5% (from 1.0% currently).

And they doubled-down on that call again following the result of the NZIER survey, which showed similar results to those in the most recent ANZ Business Outlook Survey.

ANZ economist Finn Robinson and senior economist Miles Workman said the NZIER survey confirmed what was seen in the most recent ANZ Business Outlook.

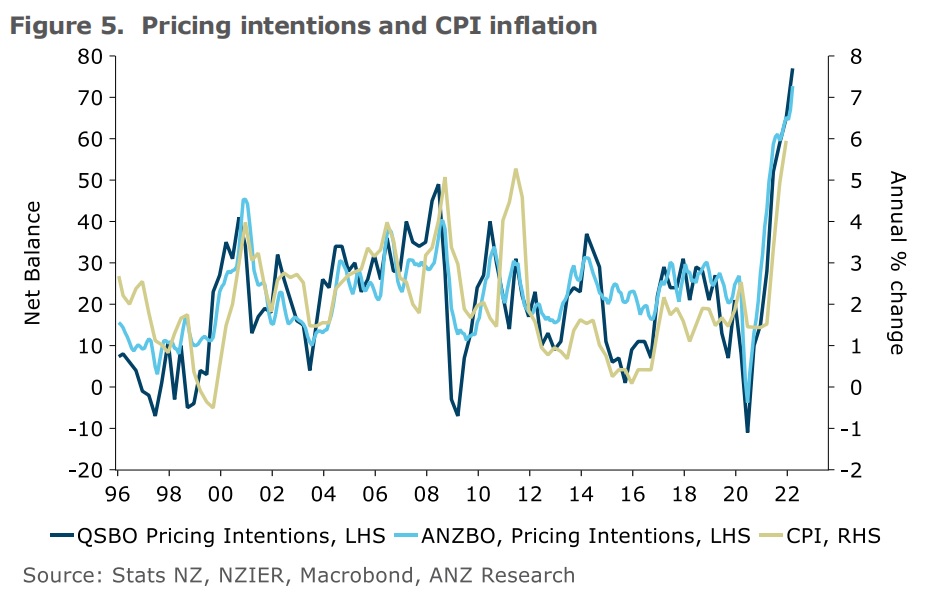

The NZIER survey showed that a net 77% of firms surveyed expect higher prices over the next three months, up from 65% previously.

"Our current forecast is that annual CPI inflation hit 7.1% in Q1 [quarter ending March 2022] – but the ANZBO and QSBO reports for Q1 indicate upside risk to that," Robinson and Workman said.

Annual inflation hit 5.9% as of the December 2021 quarter. Statistics New Zealand is set to release the March quarter CPI figures on Thursday, April 21.

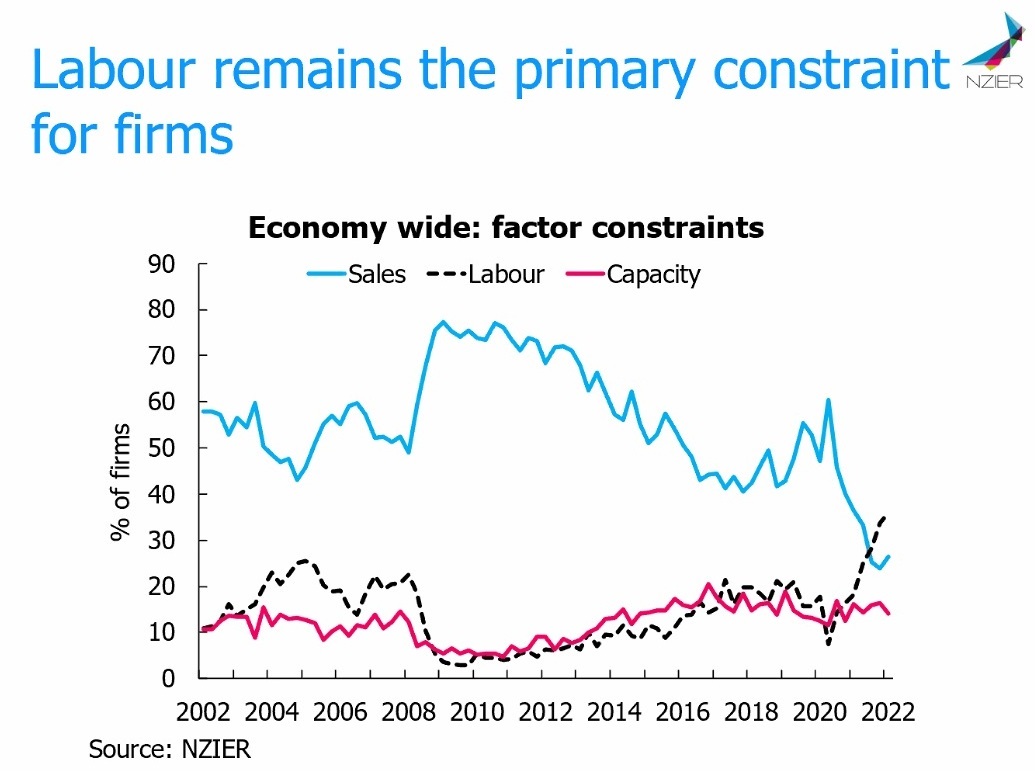

"Real economic activity is struggling to make headway as cost pressures and shortages of labour and supplies continue to worsen. These constraints are reflected in multi-decade highs for pricing intentions."

The NZIER survey was "another piece of data pointing to the need for aggressive interest rate hikes, despite downside growth risks – consistent with our expectation that the RBNZ Monetary Policy Committee (MPC) will conclude the best approach is to hike 50bps at tomorrow’s Review", Robinson and Workman said.

"Economic activity is struggling against surging costs, shortages, and other Covid disruptions. Simultaneously, inflation pressures (and expectations) continue to accelerate. For the RBNZ, it’s clear that aggressive action is needed to stop inflation spiralling – and we think today’s report reinforces the need to hike the OCR by 50bps tomorrow to really start to gain traction on inflation pressure."

Westpac senior economist Satish Ranchhod said the survey "highlighted the rocky start to the year for many New Zealand businesses, as well as ongoing price pressures".

"This doesn't change the arithmetic for the RBNZ ahead of Wednesday's OCR decision. We continue to expect a 25bp rise, but it is a close call."

ASB senior economist Mark Smith in reviewing the survey said the inflation outlook "is looking increasingly problematic".

"...And it looks to be a coin toss between a 25 and 50bp OCR hike tomorrow. Tomorrow’s RBNZ hike looks to be towards the start of what looks to be a concerted degree of monetary tightening."

BNZ head of research Stephen Toplis noted the falling profit expectations of firms.

"Expectations are plummeting and portending recession," he said.

"Sure, currently growth remains positive and employment intentions are robust. And, sure, the profit reduction is cost-based and will flow into heightened inflation. But if profit expectations remain this low for much longer, businesses will start to fail. Failed businesses will not have the option to raise prices, hire staff, nor invest."

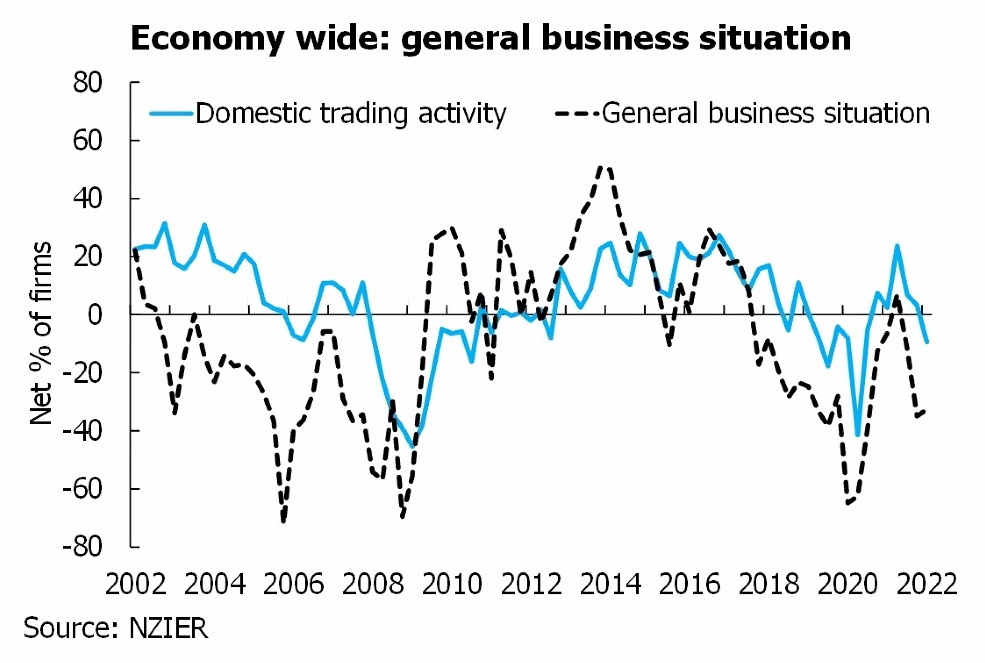

The NZIER survey showed that a net 33% of businesses surveyed expect a weakening in general economic conditions over the coming months on a seasonally adjusted basis, while a net 9% of businesses reported weaker activity in their own business in the March quarter.

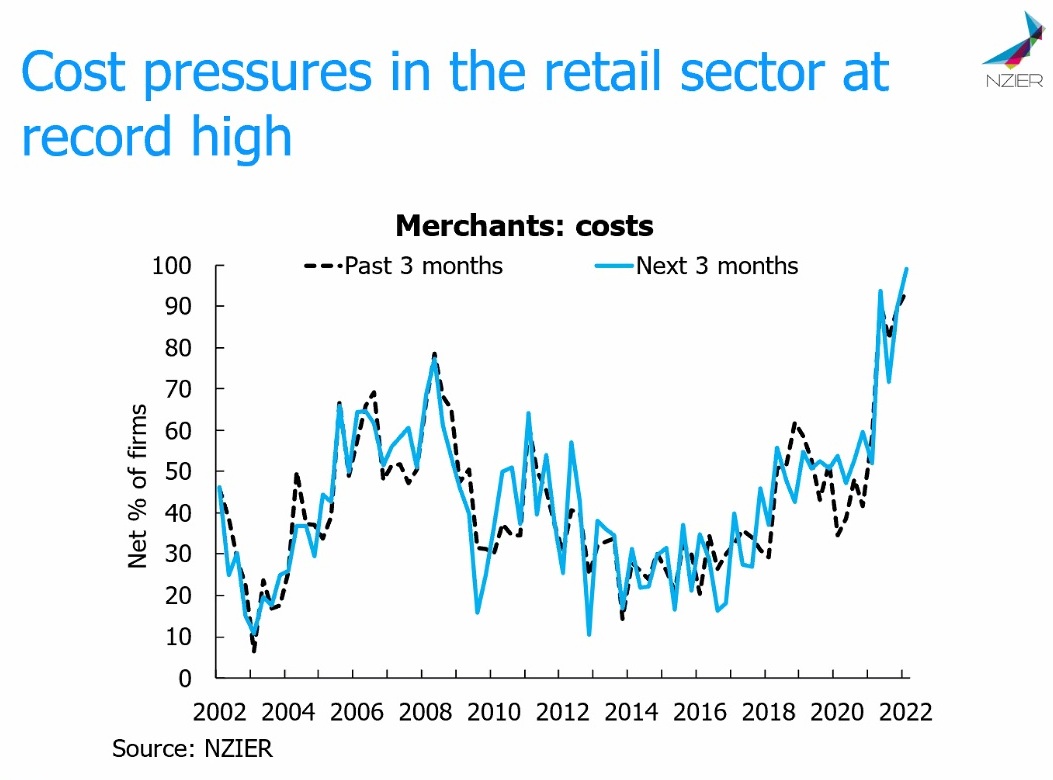

NZIER principal economist Christina Leung said the retail sector is now the most downbeat. Cost pressures in the sector are at a record high.

"A net 60% of retailers surveyed are expecting a deterioration in general economic conditions over the coming months.

"This pessimism likely reflects the relatively greater negative impact the spread of Omicron has had on the retail sector, as people stay home out of fear of (or actual) infection. The retail sector also bore the brunt of worker shortages that arose from the Omicron spread, given the limited ability of its workforce to work from home.

"Overall, businesses are feeling more cautious in an environment of acute labour shortages and intense cost pressures. Although firms have generally found it easier to increase prices, profitability is weakening. A net 34% of firms report reduced profitability in the March quarter, while a third expect weaker profitability in the next quarter."

Leung said with the negative impact of the Omicron spread becoming more apparent and continued uncertainty over how the Covid-19 outbreak will evolve, firms have reduced investment plans for the coming year.

"A net 7% of firms plan to pare back on investment in buildings, while 6% of firms plan to reduce investment in plant and machinery over the coming year. This weakening in investment intentions points to a slowing in business investment over the coming year."

43 Comments

Hold tight, wait 'til the party's over

Hold tight, we're in for nasty weather

There has got to be a way

Burning down the house

Burning down the house to protect speculator debt and bank profit. Labour party core values...

Some things sure can sweep me off my feet...

I cannot see a reason for the RB not to lift the OCR by 0.5% this week

... I can ... they'll get a stern looking at from Jacinda ... the death stare ....

I don't know what Adrian Orr's middle name is, but by god, she'll be using it.

If the stare gets missed because he is reading slowly off crayon notes he might look up into a full, no-holds barred frown...

You really think the PM has more effect on the RBNZ's decision here than NZ's giant property speculation debt bubble and the problem of its dependency on ever more government and reserve bank welfare?

The RBNZ doesn’t lower or raise the OCR in order to affect property values. The OCR's target is inflation and employment

The RBNZ doesn’t lower or raise the OCR in order to affect property values. The OCR's target is inflation and employment

Yes. Adrian Orr also said that housing is a consumption good. Don't say he didn't warn you.

Yes the operational objectives are to keep inflation between 1 and 3 percent over the medium term, and to support maximum sustainable employment.

But the remit also requires:

In pursuing the operational objectives, the MPC shall:

- have regard to the efficiency and soundness of the financial system; and

- seek to avoid unnecessary instability in output, interest rates, and the exchange rate; and

discount events that have only transitory effects on inflation, setting policy with a medium-term orientation; and

- assess the effect of its monetary policy decisions on the Government’s policy set out in subclause (3) (sustainable house prices).

RB can't bring themselves to do big jumps up, just down. Remember 0.5% drop Aug 19 as house prices had stalled & the dollar was strong.

They know the economy is so fragile and weak, a one trick pony based on credit growth

Inflation 7%

OCR 1%

Something's gotta give.

It is however slowing the commercial mortgage rate increases, so if they go slow on rate increases the blood might not splatter every wall (but the carpets are already ruined)

So far behind the curve, the world looks flat

The estimation of inflation of 7.1% is baseless it's way higher, and the cost of business is unsustainable in NZ.

Govt is giving unjustified payments to people and making them paralyzed by cutting their arms and legs, as they don't have right reason to work after they are getting the amount credited in their accounts while they are in bed doing nothing.

Whoever wants to work asking for unreasonable rates. The ground reality is its total chaos and the rates are still at an emergency level of 1% without any good reason.

The estimation of inflation of 7.1% is baseless it's way higher

Thanks for sharing your better data, how high is inflation please? And would you mind letting us know where your superior data comes from?

Thanks

I think what he is saying that actual inflation for things that matter for people to survive such as rent, food, fuel, electricity have gone up way more than 7.1% in the last year.

The CPI dilutes it all by adding things such as clothes, electronics, air fares etc.

Diesel 1 Year ago $1.41.9 today $2.34.9 = 39.6% increase (higher increase because Government shut down are only refinerary which produced most of our Diesel.

Petrol 91 1 Year ago $2.17.4 today $3.21.4 = 32.4% (I'm not including the government drop in fuel excise as that is only temporary, but if included it's a 21.3% increase

Source MBIE

Average Rent rentals Nation Wide have gone up 8.5% Feb to Feb, but that is region dependant, Takanaki had a whopping 22.2% increase, Wellington 12.1% Southland 17.6%, every region went up higher than the rate of inflation other than Auckland, Waikato and Hawkes Bay. But I suspect for people moving to a new rental the increase would be higher.

Source: Trade me rent index

Electricity = my electricity went up on April 1 by 20%, tried shopping around and no one was offering a better deal.

Food = this aritcle shows it clear as day that food prices are going up far higher than the CPI

Pak 'n Save's ageing shopping lists show steep rise in food prices | Stuff.co.nz

And that is even before we get into anything else like mortgage rates, council rates, insurance etc....

Reading alot of comments from business we are only just really seeing the beginning of price increase especially for Food as alot of the higher production costs have yet to filter through.

The government closed Marsden Point refinery? I thought that was privatised in the 80s, what's the government to do with it?

ok, I'll be more specific, the government allowed a strategically important piece of national infrastructure to close instead of ensuring it kept open because it doesn't fit in with their lets turn everything that has wheels goes electric.

And immediately diesel prices dramatically increased well above the impacts of the war in the Ukraine because most of the nations diesel was refined there. As a result it will cause a impact on inflation as everything from trains, to trucks and farm machinery depend on it.

I know it's not all beer and skittles but no one is seems to be panicking here is Brisbane Australia.

I just moved into an over 55's apartment today and was pleasantly surprised that the electricity tariff is 8c/KWH for the next 5 years and the cheapest diesel pump price around here is $1.65/liter including the 23c excise tax.There is no road user tax.

Thanks for sharing your better data, how high is inflation please?

Let me answer that. Inflation is much higher than what you're told by the ruling elite.

Typical conspiracy theorist comment. It goes like this: "I don't like.... fill in the blank (wealthy people, vaccines, property etc...) therefore I'm going to state that data and facts are wrong and I'm going to make my own opinion sound like data and fact instead"

Typical conspiracy theorist comment.

Nope. The ruling elite typically use the CPI as a proxy for inflation when communicating with the sheeple. The CPI understates inflation.

Nothing conspiracist about it at all.

Yes.

The CPI has been cynically designed to avoid asset inflation.

That's very much in the interests of the well-propertied elite.

The cpi has been under reported for years due to imported deflation due to globalisation.

The chickens are now coming home to roost.

Emergency / Ventilator for life.

Who will the Jacinda Ardern blame for price raises this time?

Vladimir Putin. odds 2:1, a hot favourite: tagline "the war in Ukraine is causing globle supply issues. This is pushing up energy costs which is hurting kiwi's in the pocket"

China: odds 3:1, good on a rainy day, "China's agressive lockdown is affecting the global supply chain, these disruptions are causing a surge in prices of consumer goods"

National party: 11:3, tried and proven. "John Key did some things in 2012 that a causing other things to happen in 2022"

Adrian Orr: 17:2, outside chance, "the reserve bank is independent so I can't tell them what to do, they obviously made some silly monetary policy decisions which I don't actually understand, we need to review the RBNZ and the way they do things, as the system clearly isn't working"

Winston Peters: 68:1, trifecter with National pays well. "Decisions Winston made me take in the first term are clearly flowing though to prices in the second term. Lets talk about somthing else now".

Herself: zero, zero chance, zilch. ,"Me accept responsibility for something? Is that satire?"

... my guess is that she'll make a waffle fest which will include Vlad , global supply chains & the previous National government ...

Reckon she'll let Winston off ... the Roy Morgan poll looks ugly ... might need Winnie to gift her another election win , in 2023 ...

... she'll scowl at Barry Soper ... and slope off ...

Don't forget the head tilt, the frown and the shoulder shrug.

but she is saving the day by increasing the minimum wage... lol...lol...lol...

Plus the thoughtful touch of the lips / chin with the finger.

It will be 0.25% tomorrow. Social economical considerations will be the road block for an 0.5% increase which would be the sound monetary decision. Even the warning, the RBNZ will issue, that May most likely will see an 0.5% is worth nothing because of those social economical considerations it will not be eventuated. Only after Jacinda, Grant&Co have engineered some fiscal repair policies the OCR will increase more robustly. It will take a longer period of high inflation to clean up the mess.

So that means financial repression is the trade off.

In retrospect it seems foolish to have indebted ourselves by so much to buy our own houses during the emergency interest rate, can kicking, banker bail out post 2008 Era.

... I can understand big debt to build infrastructure , to create productive businesses , for scientific , medical & agricultural research ...

But , we've hocked ourselves to the eyeballs , deeply indebted to the Aussie banks for eternity .... just to trade houses amongst each other ... OMG , 100 % pure nuts ...

It also seemed foolish while it was happening.....but if you called people out about it you were/are a doom goblin (lol).

NZ copied what countries like Ireland, Spain, Iceland etc did in the 2000’s, and expected a different result.

Such poor leadership.

"ANZ economists say latest survey results shows urgent need for RBNZ to hike rates"

Everyone knows but TRUST Mr Orr will move as forced at lowest pace that is 0.25%

"ANZ sees likely annual inflation of 7.1% as of March quarter end"

Still Not in Double Digit.......So the message from Mr Orr's desk will be Chill just Chill.

And let me enjoy as much as before I too resign as is bound to get too hot, if not already out of control.

They should just raise the OCR by a full 1% to save having to come back in May

(Rock) RBNZ (Hard Place)

The graph says it all. Inflation is a huge problem.

Grant Robertson’s solution is to keep increasing government spending to levels this country has never seen before.

Stagflation will soon be here. Lots of financial pain to come over next 5 years.

... not to mention the possibility of a massive net migration loss ... I'm expecting unprecedented numbers of younger folk to depart within the next 12 months ... a combination of frustration at being cooped up & lectured to , for the past 2 covid years ... and the fact that overseas is much more fun , cheaper living costs , better wages , cheaper housing ...

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.