Recession? What's that?

New Zealand easily avoided the 'R' word with a 1.7% rise in GDP for the June quarter. This reversed a 0.2% fall in GDP in the March quarter and meant we avoided two consecutive quarters of a shrinking economy, the 'technical' description of a recession.

The latest figures were strong enough to have ASB economists quickly revising their forecasts of the likely peak Official Cash Rate. They now see it peaking at 4.25% early next year, having previously forecast 4.0%.

ASB chief economist Nick Tuffley said the second quarter GDP "was stronger than our expectations, with signs that momentum in the second half of 2022 will be also stronger than we have been anticipating. This adds up to the risk that inflation pressures will be even more persistent."

The Reserve Bank (RBNZ) has had some pretty big misses with some of its recent economic forecasts, but it was closer than most of the economists to picking this result. It had picked 1.8%. The average forecast rise among economists was 1.0%. Westpac economists were close, also, with a 1.6% pick.

The latest figures will presumably give the RBNZ a lot of comfort that its current monetary policy stance - including a whole heap of recent 50 point rises to the Official Cash Rate, taking it to 3.00 - is the right one to have been taking, with more still needed.

Thursday's GDP result therefore is a clear green light for another 50 point rise in the OCR at the next review on October 5.

As Kiwbank chief economist Jarrod Kerr said, the GDP outcome doesn't mean much for monetary policy.

"It simply confirms what we know," he said.

"The RBNZ is not yet done. They’ve made that unambiguously clear."

Kerr said the RBNZ is "on an inflation fighting path" with an end goal an inflation rate back at target. The RBNZ targets inflation between 1% and 3% with an explicit targeting of 2%. As the June quarter annual inflation stood at 7.3%. Figures for the September quarter are due out on October 18.

Getting inflation back on track requires domestic demand to ease back, restoring balance in the economy, Kerr said.

"Between weak confidence and deteriorating firm investment intentions, signs of slowing domestic demand are already emerging. But the RBNZ has signalled that further increases in the cash rate are needed.

"We expect the RBNZ to deliver its fifth successive 50bps hike at the monetary policy review in October. And we see the cash rate reaching 4% by the end of the year."

Economists' estimates varied widely due to the Covid-related volatility expected in the figures, but the average of the forecasts was for a 1.0% rise. The Reserve Bank's 1.8% forecast rise was top of the range.

The latest GDP figures show a clear bounce-back from the impact of Covid.

Statistics New Zealand said the services industries, which make up about two thirds of the economy, were the main contributor to the GDP increase, up 2.7%.

"The reopening of borders, easing of both domestic and international travel restrictions, and fewer domestic restrictions under the Orange traffic light setting supported growth in industries that had been most affected by the COVID-19 response measures," national accounts – industry and production senior manager Ruvani Ratnayake said.

"In the June 2022 quarter, households and international visitors spent more on transport, accommodation, eating out, and sports and recreational activities."

Overall household spending declined by 3.2%, driven by lower spending on goods such as used motor vehicles and audio-visual equipment, with a similar fall seen in retail trade activity. Specifically, spending on durable goods was down 8.6%, while non-durable goods spending was down 2.3%.

Key facts June 2022 quarter compared with the March 2022 quarter:

- GDP was up 1.7%

- expenditure on GDP rose 2.1%

- service industries rose 2.7%

- goods producing industries fell 3.8%

- primary industries rose 0.2%

- GDP per capita rose 1.7%

- real gross national disposable income rose 1.0%

- average annual GDP to June 2022 rose 1.0%

- current price expenditure on GDP rose 3.4%

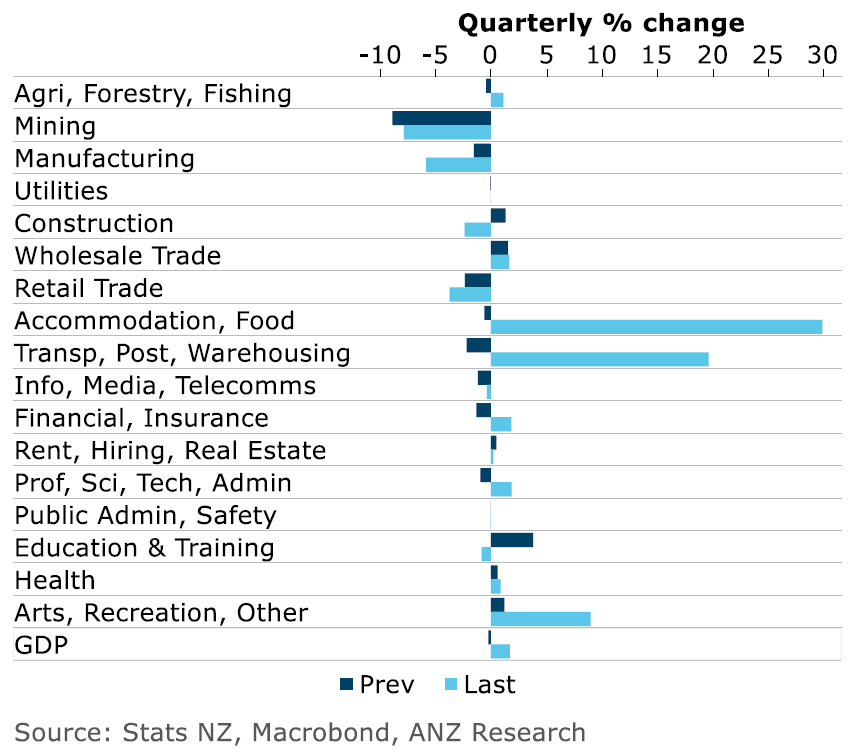

ANZ economists provided this table highlighting the various sectoral changes ('Last' refers to June quarter, 'Prev' the March quarter)

Economic growth

Select chart tabs

156 Comments

RBNZ - will also be happy with the fall in household spending - which is what they are aiming to do with increasing interest rates. They will be happier if that reduction in household spending translates to lower inflation levels as businesses lower prices to attract customers.

If that occurs then we may get a soft landing for the economy - even if we have a hard landing for housing. Yes a 10% fall which is where we are currently at (ignoring Wellingtons 20%) - is a hard landing.

A 10% correction nationally (see post above) is hardly a hard-landing, given the level of capital appreciation since the GFC……

The very low level of mortgagee sales bears witness to that.

in any case, after a chilly winter 🥶 there are signs that the housing market is beginning to thaw.

Essentially, we’re looking at a short and shallow downswing - as FHBs and investors are now cottoning onto.

TTP

Can you back this up with statistics?

Crickets... 🦗🦗🦗

... tumbleweeds rolling across a dusty deserted street ...

TTP won’t, because his comments aren’t based on statistics.

Here is the current housing correction compared to several major housing bubbles bursting in other countries

While 12% down doesn’t seem like a lot, it’s the rate of falls that people should take note of. Housing corrections often take years to fully play out

Every word I write here seems to put the fumbling DGM into a tailspin……

See their distorted and disgruntled comments above and below - as they become increasingly anxious.

TTP

GDP growth is great for those wanting cheaper houses. Should flow on to wage growth, and locks in more interest rate rises which will act to bring down house prices. The result is more affordable houses and a happier, healthier society.

How is the affordability index that gets published by interest.co, I have not seen it for a long while. Since the increasing interest rates and the falling HPI maybe the index is level pegging

Block houses for sale this weekend, could be very interesting. I'm picking 2 out of 4 will sell on the day which really would be an outstanding result.

Probably doesn't look great, high rates certainly impact affordability today. Less important over the lifetime of the loan though - much better to have the smaller loan and hope for lower interest rates later. Worst case is the poor buggers buying a year ago at high prices and low rates, finding the payments have skyrocketed once the 1-2 year fixed rate expires. We never should have let it happen.

You would never agree with my perspective so I will leave it 🤣

You predicted the "soft landing" for the New Zealand market would be similar to 2016/17/18. In that period there was a slowdown in price growth, and prices were relatively flat over the year. But instead what we are seeing is a correction where prices falling faster than any similar historical scenario, yet you continue to claim your "soft landing" prediction is coming to pass.

As I said, you aren't basing your comments on statistics or data. Its all spin and deception.

I can see the argument for a soft landing at the moment. Although high % drops, the month on month decreases are less than the increases preceding, so it's all relative I guess.

Just curious, did you look at the chart Miguel linked?

If so, what's your interpretation of it?

Actually...Noncents makes a good point above - is there a version of this chart that also shows the lead-up in prices prior to the downturn?

Yes, or even better, put that alongside the median house price to median income then we get a rough idea for how expensive houses were in each market (a la demographia stats for all its faults).

Took a year and a half for prices to bottom out about 10% down here in the GFC, and 4-5 years to exceed the previous peak. This looks much worse.

https://www.interest.co.nz/charts/real-estate/median-price-reinz

For any buyers who buy exceptionally well during this period then they will make an immediate gain. As we did when bought during GFC for 800k and within 12 months valued at 1.2m. Was mortgagee enforced sale so maybe that is the difference. There is now about 10 percent the volume of mortgagee sales compared to then 🤑

As we did when bought during GFC for 800k and within 12 months valued at 1.2m

So are you buying now and predicting a 50% increase in value by Sep 2023?

No way

There are plenty of properties that have tripled in value (or more) since the GFC.

TTP

Sure, there'll be opportunities, especially when we reach the bottom. You must have found a good deal or made some kind of improvement (or both). We both know most investors can only make money by following the tide of the market rather than paddling their own way.

We still have very high employment at the moment, so I guess we won't see as many mortgagee sales unless the situation deteriorates. This is quite a different situation - we flew so high and interest rates are rising so fast we were bound to lose some altitude. The call now is when we can pull out of the death dive.

To future FHB and younger generation in general it’s not a “death dive” but a growing glimmer of hope that they may yet be able to buy their own homes like as their parents did, and enjoy the long term stability and sense of community that brings

But New Zealand is special. It will just level out 18 months sooner than the US and recover 48 months earlier and at a greater rate. Just you wait! /s

We have a unique superpower of hordes of unimaginative investors who are too frightened to buy shares or invest in a business, but will happily borrow 80% of the value of a house when allowed.

... if 120 % mortgages were a thing we as a nation would be off to the races ... boooooyah !

TTP two minutes into a 2 hour long movie: "Well this was boring"

You are now officially a resident expert. Someone with little to no relevant experience who makes large pronouncements 🤦♂️

.....you take the 🍰

What would relevant experience look like?

We appear to be in uncharted waters. None of us have ever experienced a housing market like this.

So you see banks increase their OCR forecast and you think that is a bullish signal for the housing market? Good for you, maybe you can convince some weak hands to fold and purchase now so I have less competition buying next year :D

Am thinking more like 2024, but too early to tell

You, today, as usual couched amongst unverified weasel words and with no numbers backing you up:

Essentially, we’re looking at a short and shallow downswing

REINZ, yesterday:

These are the greatest six month drops in prices each has experienced since REINZ records began in 1992

"A 10% correction nationally (see post above) is hardly a hard-landing"

🤡 we're still in free-fall. It will be hard to pull the nose up when you're plunging at this rate. Best of luck to you.

Dumb question but are these figures adjusted for the inflation that's screaming away at present?

Yes, they typically publish the figures in 2009/10 prices.

Not a dumb question!

Time to go finance that new BMW!

Why when I can just pay cash?

So for a 3 month period nearly 3 months ago our economy grew a little bit. But in those 5 and 1/2 months there have been thousands of households effected by doubling mortgage interest rates. It usually takes those households three months post refix/rise to finally realise what is going on and start to curtail their spending. First warning is when you don't have enough left in your revolving credit to clear your credit cards for the month.

So for a 3 month period nearly 3 months ago our economy grew a little bit. But in those 5 and 1/2 months there have been thousands of households effected by doubling mortgage interest rates. It usually takes those households three months post refix/rise to finally realise what is going on and start to curtail their spending. First warning is when you don't have enough left in your revolving credit to clear your credit cards for the month.

If what you describe is representative of the attitudes and behavior many NZ h'holds, I think trouble lies ahead. But do you really believe it will take 3 months for these people to realize that they're living beyond their means?

Even if they realise it takes a lot more time to adjust…

Especially if they have a modest stash of savings on call. $50 here, $100 there, with the intention of replenishing..... until the pay comes in and the mortgage goes out.

People have been trained to live beyond their means, by the RBNZ.

That is what the "wealth effect" was all about. It was literally about making people feel wealthy because the paper value of their assets were up... and like Pavlov's dogs, they were trained to borrow beyond their means, and trained to spend beyond their means.

This has been a deliberate, long running strategy by the RBNZ. People are well trained, and well conditioned to it now. It will take a lot to break the psychology of it... some real tough times... before people will willingly live within their means again.

The "wealth effect" is in reality just living off debt you expect the next generations to pay. The essence of entitlement mentality.

The RBNZ isn't smart enough to come up with this strategy.

All reserve banks work in cahoots, which is why they meet at Worm Hole or wherever, strategising how to transfer wealth to the rich.

They are not independent. We are the victims of them being conditioned like dogs.

Whenever I see Orr, I am reminded of a dog that knows it has done wrong, but just can't help itself.

Looks like the RBNZ just got the green light for a 75bp rise in OCR for October. Hold on to your hats ladies and gents.

Exactly, lots more interest rates are required to cool off this debt-fueled economy. The commentators who forecast a peak in interest rates are sadly mistaken once again.

A lot of noise around the peak of interest rates back in June/early July. It's been fairly quiet out there for the last month or two...

On a nominal basis annual Jun. 22 GDPE grew 5.0643%.

Deflated annual GDPE for the year ending June 22 was $272,314m compared to Jun 21 at $272,830m

Worth noting that the actual increase in quarterly GDP was 0.7% - it was the seasonal adjustment that pushed it up to 1.7%. Whilst Stats were right to use a consistent seasonal adjustment methodology, they should have included a disclaimer given how depressed spending was in Q1 (i.e. it was non-seasonal!)

Am I right in remembering that this print is rather strongly at odds with your real time indicators from not so long ago?

Yes, to be honest I under-estimated the seasonal variation - and didn't spot how big the boost in exports was. Basically, exports and seasonal variation offset the sharp drop in collapse in consumer spending that I thought would produce a lower figure. A bit of refinement to the model needed!

This is good news. It means interest rates will stay at least this high for the next couple of years. The housing price will continue to come down which makes them more affordable for first home buyers. Investing in property will be less attractive in future and more investment will go to productive industries. The economy will slowly correct itself and becomes healthier. Let's hope there won't be any interference from the vest interest group. I think NZ is on the right track at the moment.

It is generally changes in interest rates that push house prices up or down. If rates stay steady, house prices will stabilise pretty quickly (and are likely to edge up slowly).

Hmm, not too sure about that. It depends on where the house price is sitting after rates start to stay steady, and it also depends on people's confidence in property investment. Low interest can certainly push the housing price up but is not the only factor that causing it. We've had such a good run for our property market during last 6 years, mainly due to the great momentum we've had after vast foreign investment being injected in our property market before 2017 in my opinion. However, as we lost our momentum now, there will unlikely be another similar opportunity in next 10 years. I think it will be hard to restore the confidence.

by Audaxes | 16th Feb 22, 7:42pm

On our planet earth – as opposed to the very different planet that economists seem to be on – all markets are rationed. In rationed markets a simple rule applies: the short side principle. It says that whichever quantity of demand or supply is smaller (the ‘short side’) will be transacted (it is the only quantity that can be transacted). Meanwhile, the rest will remain unserved, and thus the short side wields power: the power to pick and choose with whom to do business. Examples abound. For instance, when applying for a job, there tend to be more applicants than jobs, resulting in a selection procedure that may involve a number of activities and demands that can only be described as being of a non-market nature (think about how Hollywood actresses are selected), but does not usually include the question: what is the lowest wage you are prepared to work for?

Thus the theoretical dream world of “market equilibrium” allows economists to avoid talking about the reality of pervasive rationing, and with it, power being exerted by the short side in every market. Thus the entire power dimension in our economic reality – how the short side, such as the producer hiring starlets for Hollywood films, can exploit his power of being able to pick and choose with whom to do business, by extracting ‘non-market benefits’ of all kinds. The pretense of ‘equilibrium’ not only keeps this real power dimension hidden. It also helps to deflect the public discourse onto the politically more convenient alleged role of ‘prices’, such as the price of money, the interest rate. The emphasis on prices then also helps to justify the charging of usury (interest), which until about 300 years ago was illegal in most countries, including throughout Europe.

However, this narrative has suffered an abductio ad absurdum by the long period of near zero interest rates, so that it became obvious that the true monetary policy action takes place in terms of quantities, not the interest rate.

Thus it can be plainly seen today that the most important macroeconomic variable cannot be the price of money. Instead, it is its quantity. Is the quantity of money rationed by the demand or supply side? Asked differently, what is larger – the demand for money or its supply? Since money – and this includes bank money – is so useful, there is always some demand for it by someone. As a result, the short side is always the supply of money and credit. Banks ration credit even at the best of times in order to ensure that borrowers with sensible investment projects stay among the loan applicants – if rates are raised to equilibrate demand and supply, the resulting interest rate would be so high that only speculative projects would remain and banks’ loan portfolios would be too risky.

The banks thus occupy a pivotal role in the economy as they undertake the task of creating and allocating the new purchasing power that is added to the money supply and they decide what projects will get this newly created funding, and what projects will have to be abandoned due to a ‘lack of money’.

It is for this reason that we need the right type of banks that take the right decisions concerning the important question of how much money should be created, for what purpose and given into whose hands. These decisions will reshape the economic landscape within a short time period.

Moreover, it is for this reason that central banks have always monitored bank credit creation and allocation closely and most have intervened directly – if often secretly or ‘informally’ – in order to manage or control bank credit creation. Guidance of bank credit is in fact the only monetary policy tool with a strong track record of preventing asset bubbles and thus avoiding the subsequent banking crises. But credit guidance has always been undertaken in secrecy by central banks, since awareness of its existence and effectiveness gives away the truth that the official central banking narrative is smokescreen. Link Werner

They (central banks) may monitor, but they cannot control ...and therein lies the problem.

In part, yes, but the longer rates stay up, the more fixed term loans roll off their low rates. And for the first time in a long time, they'll be resetting at a rate that could be more than double.

Rolling of a 3 yr fixed rate loan at say 3% to BNZ current one at 5.69 = 2.69 increase in interest content which on a $500k loan is $1120 a month out of discretionery income so something is going to give especially with the large increases in fuel/energy/rates/insurance/food, that give will be big and the effects very ugly.

All of the power. None of the accountability.

The silence from mainstream media and the banking/finance community is deafening. It's actually becoming a bit of a joke, it's definitely time for ACT and Nats, and I do not say that lightly - never voted for them before.

There needs to be a royal commission of enquiry made into our COVID-19 response. Every single party in parliament seems to want one except for Labour.

I hope it goes ahead once Labour is shown the door after the next election.

... to date , Labour have set up more than 300 working groups and enquiries into all manner of things ... yet the one above all that ought to be investigated , the Covid19 response , nada .... silence ....

like Uffindells report

That's a Gnat's issue ... and Luxon has an independent QC investigating it ...

WOW - your comparison about ONE individuals past poor behaviour before entering office against the most significant restrictions on human freedoms for 5 million Kiwis, locking Kiwis out of their own country, borrowing 100 billion dollars -- way to go Comrade!

Whats the point, its water under the bridge and cannot be reversed now. Basically when National get in it is up to them to fix things and if they do a decent job then they will also get a second term. Kiwis have the memory of a Goldfish, the Labour disaster will be forgotten in a few years.

The point of an inquiry isn't to reverse anything. It's to figure out what went wrong and why, and to make sure that it can't happen again.

Absolutely. From locking our citizens out of the country and running a "1 in 10" lottery thtough to an eye-watering loss on a fixed income portfolio, we must never let this happen again. Not for a bad flu anyway.

... and , banning RATs test for 2 years .... then doing a 180 & stealing them from private companies ..

Bad flu? More like a mild cold.

Based on what Fossil, ..not for my family and others I know...

That was our experience. My wife and I are four jab protected. We sailed through the infection, I’ve had worse hangovers. Now in Europe where it’s a non event. NZ needs to move on, Ardern and her climate of fear are holding some of us back.

To be fair,you are only going to hear the good news stories about catching covid....the millions that died around the world aren't going online anymore... "dead men don't tell tales..."

I wonder if that's what happened to the housing spruikers that used to infest this site. Sadly it's likely to be cowardice not covid.

A few have dropped off, but a few persist.

And a couple - Yvil and Te Kooti - saw the errors in their ways, have repented, and turned to the dark DGM side.

Could have been worse, you could have been in Australia during covid, you had to apply for an exemption to leave the country (and they weren't easy to get), in NZ, you could leave anytime you wanted if you were unhappy with they way things were being run.

Well civilization has been going at least 2000 years and how often do you hear the words on TV "So this will never happen again" you may as well save the money of an inquiry which will result in nothing anyway and spend it on a Tui billboard instead.

This majority government needs to have an enquiry for what they have done behind closed doors, so that the public may judge for themselves on what happened without their knowledge. Will they be just incompetent, or will they be exposed for their unprecedented overreach of power. Too many things need to be explained and we don't ever want to allow this level of reach or incompetence again.

Happy for the inquiry to begin with their moves on He Puia. I don't see any mention from Labour on their plan to Maorify everything in NZ in their 2020 election manifesto.

We were promised fairness and transparency but the opposite is being delivered by creating 2-tier public service and voting systems.

Just to be clear, I am not against indigenous rights. All I am saying is Labour has sneaked this bifurcation into every public reform without being clear and upfront about it.

I feel for you guys as even the weatherman is now speaking Te Reo.."We were promised fairness and transparency"..lol ..by who?

Who watches broadcast TV news anymore? It’s like a South Pacific Pravda.

South Pacific Pravda, LOL. I'm going to use that :)

Is that like the NZ$ ?

The South Pacific Peso .

There is definitely a narrative pervading everything coming out from the team of 55 million.

You have to go to Australia to see anything actually critical of this government.

As Winston says, our 4th estate have become 5th columnists.

I'm guessing you are getting your news from more reliable sources like Qanon websites & Voice for freedom lol...

He is the love child of John Banks and Judith Collins, but he does have a point about NZ Press - I made it earlier.

I spend a bit of time abroad and Ardern is ridiculed, she is loathed. Seen as a WEF puppet. A lot of it unfair but she really is disliked.

By whom, Te Kooti? The press or people you speak to?

By all the stable folk who rant about WEF. Always a good warning sign, as the ranting about WEF seemed to sweep across certain segments of folk at the same time. Like a lot of other rant topics, the stuff expressed by these segments of folk is very homogeneous, suggesting it's not the result of natural curiosity and independent inquiry.

But I'm different..."I did my own research..."

Wrong the enquiry should be about accountability and if necessary about how those responsible should be held to account - personally!

The inquiry should focus on decision-making and the risk framework. Why buy such long duration (20y), only the Govt funds out there? What risk limits were in place, what were the loss tolerances? I have seen no mention of limits or risk reporting by the RBNZ anywhere.

Amen brother, far too much secrecy, and with the high staff turnover in the Department of Prime Minister and Cabinet it begs the question of why.

What power: Quantifying "Quantitative Tightening" (QT): How Many Rate Hikes Is QT Equivalent To?

I show that a passive roll-off of $2.2 trillion over three years is equivalent to an increase of 29 basis points in the current federal funds rate at normal times.

Fed says, 'Quantitative Tightening does Nothing (QE too)' [Ep. 288, Eurodollar University]

AA, tell me why the RBNZ do not switch from OCR hikes to QT? If it was worth the effort of stimulating the economy at the time, surely it should be unwound now it is no longer required?

It has to be because of the optics of crystalising the entire loss rather than bleeding out over the next 20 years. What other reason is there? Shameful.

New Zealand Debt Management is buying the QE bonds held by RBNZ over 5 years.

Open market operations (D3) - xls Tab: "LSAP bond sales"

Is that an answer? Doesn't look like one to me.

Your supposition seems reasonable to me TK.

Interesting times are upon us.

If the Fed does go 1% next Wednesday, what does the RBNZ do in October? 0.5% doesn't seem plausible.

And how will The Fed react to "US railroad workers prepare for strike"? Inflation could soar if that happens.

Gdp per capita up 1.7% is the big news. Never sore that in the days of high migration.

Instead of the same sized slice from a bigger pie, we are actually getting a larger slice!

Dissecting the 1.7% doesn't exactly paint a good news story. Private expenditure ground to a halt on an annual basis but was more than offset by a 10% increase in government spending; maybe I am being to sceptical here.

The overall highlights for me are net exports and gross capital formation being in the positive territory since 2019 despite the pandemic disruptions to businesses. Yet no government support in sight for high-value exporters.

Spending in health and social services….everywhere else not looking that flash…why the stat really is not great and just encourages government spending…..

K shaped recovery. Broken monetary and banking systems.

Instead of actually fixing the broken systems, the government is spending on more bureaucrats and consultants to hold meetings and write meaningless reports. All this while, billions are being handed to those losing out from the broken system but isn't making them any better off either.

This s*itshow somehow gets picked up as a positive sign in the GDP stats.

We are under a government with no gumption who only wish to be in the limelight when they are trying to prove they have done something positive, and don't want to be held accountable for their failings. They will continue to pick selective stats, plan media releases etc in the way that suits them best, and not the NZ public. Even after they are voted out next election, they will need to be held accountable for the mess they have made, and the public wont buy the repeated "it's because of the war in Ukraine" or "COVID has put a lot of pressure on us that was outside our control"

I'm just trying to recall a government in history that put their hand up to be held accountable for their 'failings'

Am I the only one who feels a bit disappointed there will be no recession?

I feel the same Zach

No,you aren't the only one,Mike Hoskings will be gutted there is no recession...he will have to re-write tomorrows rant...sorry "editorial"

Writing from his little desk on his little chair

Patience...

no technical recession --- but look at wear the rises in expenditure are to give us this rise -- rents, mortgages, food, fuel --- all the extra spend is on simply staying alive and with a roof over your head -- So technically no -- but the reality and experience of the vast majority of Kiwis -- recession, hardship and reduced quality of life -

This is already shaping up to be a recession like no other before it -- with very little unemployment due to the huge lack of labour in this country, but yet despite anyone who wants to being able to find work -- the pain will be felt by millions

Next two quarters…

This is a dead cat bounce.

Yep people still spending money they don't have that needs to be repaid down the track. The problems are only compounding, the implosion is coming in 2023 like a few here have already predicted. Watch the OCR go to 4.5%-5%.

I agree re: OCR peak. I think that everything is pointing towards an OCR peak of well over 4.5%, very possibly 5%. If I had to take a bet, I would pick a 4.75% peak, staying at that level for the whole first part of 2023, and progressively decreasing to 4% by end of 2024.

... as a house mouse , won't ya be celebrating that ?

Less cheese more squeaking

I wish I had taken a copy of your comment leading up to this. I believe you were accusing economists of being overly optimistic in their much lower GDP predictions!

The fall in Construction - is a little bit of a worry - will be interesting to see if that's because prices are too high and deterring construction or lack of supply of materials is resulting in less construction projects being delivered vs previous quarters.

Probably mostly the second one. Whatever the demand for construction is today, isn't realised as invoices for months or often years.

Cameron Bargie super know it all ecomonist was wrong again with his predictions .

Which predictions?

He predicted a GDP bounce in this article, but hard times ahead:

https://www.newshub.co.nz/home/money/2022/09/economist-cameron-bagrie-w…

I have a calibrated vernier caliper which can be used to accurately measure something to 0.01mm.

But it is possible to use them to measure something to whatever it needs to be.

There is also an art in selecting the right thing to measure to properly inform yourself on what is actually going on.

Seems relevant...

we have the situation of measuring a rubber O ring to .001.......

Hmm....If I combine this with yesterday's current account numbers, the conclusion comes to me, that Kiwi's are working ever harder to boost the bank accounts of overseas investors/owners of Kiwi assets!

Or....somebody is fiddling the stats because with tourism still a trickle compared with pre-pandemic, China not buying so much exports of us (See the trade deficit) and our real estate market has really slowed down, it is almost impossible to reach those GDP growth numbers.

Yet again many interest commentators predicted the end of the world and instead we got massive growth. Makes me wonder if the RBNZ etc should use this forum in their predictions (taking the inverse sentiment of course).

As above, it’s a dead cat bounce. The economy was whacked by Covid impacts in the previous quarter.

The reading for the next quarter will be telling.

I agree, most of this growth actually occurred in the previous quarter but was discounted by temporary Covid effects. But that was already known, yet commentators were outraged by "optimistic" economist predictions of 1% growth.

Who was outraged? I wasn’t, I predicted 0.7-0.8% growth.

lol I for one was definitely wrong, I was all but certain this quarter would reveal a slight recession.

It's very hard for me to believe anything I hear or read these days, especially if it comes out of a govt or their agency. Why do you think the RB guess was so close? Insider info? Don't get me wrong (no pun intended) I'm a fan of the good news as much as the next person, but we're still only half way through this. This pocket of air will need to sustain us for the next 12 months, so take a deep breath.

is nobody concerned that all the declines - manufacturing, construction etc are in productive sectors

and the very small number ( but huge in size and effect ) rises -- are in Food, Accommodation and Transport

Ie -- real inflation pressures on the basic essentials we all need -- Inflation is going nowhere and 4.25% is not going to be nearly enough to curb it

Ray Dalio sent his subscriber base an email this morning. His picks:

1. Inflation lasting longer and higher than the Fed predict

2. Interest rates/T-Bonds-to climb

3. Depressed equity markets

Doesn't sound promising.

I’m gloomy.

The data out of both the US and NZ this week give the reserve banks no reason but to keep on elevating the OCR. Our “rock star economy” will blink first while the US pushes on with tightening. The record low NZD will prevent Orr from oncoupling from the Fed. We will have a US high OCR while our main source of wealth (housing) burns.

The worst case scenario is that this divergence goes on for a couple of quarters and our economy reveals its true colours and the lack of a meaningful productive arm to it will be exposed. The housing correction will become a crash, leaving us vulnerable.

Summer and tourism may save us or at least soften the shocks this year but I wonder if in fact that revenue will add to the masquerade by shoring up GDP a little longer, glossing over the construction sector which will be in trouble.

I'm trying to think of a time where I've heard Ray Dalio sound upbeat and hopeful.

I have followed him for sometime. Bridgewater’s track record is pretty good. I give him a solid degree of credence when many economists sway around like a drunk on a skateboard.

The latest figures will presumably give the RBNZ a lot of comfort that its current monetary policy stance - including a whole heap of recent 50 point rises to the Official Cash Rate, taking it to 3.00 - is right on track.

To me, that's a lot of nonsense! The GDP figures for April, May and June do absolutely not reflect the higher OCR which happened in April, May July and August. The effect of the "50 point rises to the Official Cash Rate, taking it to 3.00" will only truely be felt in 2023

Jun-2019 to Jun-2022 (3 years)

CPI increased 12.5% from 1032 to 1161

GDP increased 6.05% from 64412 to 68310

https://www.stats.govt.nz/large-datasets/csv-files-for-download/

2% GDP per year is pretty good considering Covid and no immigration don't you think!! Must be our best per capita rate in god knows how long.

FYI GDP is inflation adjusted.

no, nominal GDP is not inflation adjusted. Also that's less than 2% pa when you consider its compounding year on year. Oh and when you factor CPI increased more than double nominal your real GDP (inflation adjusted amount) becomes -6.45% growth over a 3 year period.

FYI Inflation is going to stick around for some time and GDP is going to slide all the way into recession.

But this 1.7% QQ is real GDP is it not? Nominal is 3.4%.

Or am I looking at the wrong data?

https://www.rbnz.govt.nz/statistics/series/economic-indicators/gross-do…

QQ is 3months as opposed to 3 years

GDP bounce reflects largely catch up spending in accomodation transport and recreation whilst reductions in Mining Manufacturing construction and retail show a downward trend reflective of declining economic activity and confidence. The RBNZ and the Fed will increase interest rates probably in a pre recession climate that will result in a full blown recession as history records.I am relieved that we are not yet officially in recession.

Exactly, post-covid catch-up spending. A dead cat bounce.

I thought it was very stupid of GR to skite about technical recession being avoided. Because it could very well still be coming...

In April they let the 438,000 unvaccinated back into society after being locked out for 4 months. Thats a lot of catch up hair and beauty appointments, pub and restaurant catchups with friends, and whatever else people had been barred from doing. And opened the borders to Australian tourists and returning Kiwi's. That gives the figures for the June quarter an artificial bump. Its really only from the current quarter onwards that anything "normal" can be presumed. Lets see what the real GDP growth figure is in the Sept quarter.

Exactly.

Let’s see how smug Grant looks when the next GDP reading is released.

Real GDP growth was only 1.0% for year ending 30 Jun 22.

Excessive government spending on services has provided an illusion NZ has avoided a recession.

All that has happened is the NZ economy has been propped up by excessive borrowing by the NZ government. The problem will only get worse as interest rates continue to climb.

The reality is stagflation (no GDP growth, high inflation) is now raising its head.

NZ is living well beyond its means.

For the year ending 30 Jun 22 net capital inflows of $27 billion were needed to balance the external current account deficit (Exports - Imports). This sort of deficit is not sustainable for a country our our size.

The NZD is likely to continue its decline as overseas investors lose faith in NZ’s ability to grow its economy & pay back its debts.

Agree 100% and all the chickens are coming home to roost in 2023 right before an election. This will probably be the most important election decision you will have to make thus far in your life.

It was the last election. That gave us Ardern and the subsequent fall-out. The next one will be about damage control and who you'd like as the fireman.

GDP is great, have an earthquake GDP goes through the roof, borrow a few billion GDP goes up, increase the public sector GDP goes up. In these scenarios nothing extra is added for the cost, yet more money is injected into the demand side of the economy.

Funny how it is the increase in the non productive part of the economy, i.e. government and councils and a borrow and spend mentality is what will cause excess demand and price increases as they don't produce goods and services to the same level that they consume.

The productive sector can support the non productive sector, however there is a tipping point and once this is reached we now need to kill the productive sector to reduce inflation because the non productive sector works on a ratchet basis.

After all if we have imported inflation and we are no more productive then we have to tighten our belts and live within our means, a natural buffer to inflation, however if we borrow or increase our wages which means someone else has to tighten there belts than all is good, except we don't tighten our belts we borrow and then we wonder why we have inflation and we have to kill the productive sector as the non productive sector can't tighten there belts.

Please note I do not include frontline staff for the public facing roles, just the mail boxes that create reports and create work and grow there internal empires.

How much of the GDP increase is due to inflation?

My guess is all of it, looking at the categories that contribute most.

Is this a good thing, or bad. If it forces up interest rates and house prices decline to realistic levels, then I would say good.

But the GDP increase in itself is meaningless.

Whatever happened to the measure of "wellbeing".

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.