The National Party's kicking off election year with an attack on the Government's economic credentials, saying it needs to "come back from holiday with a real economic plan".

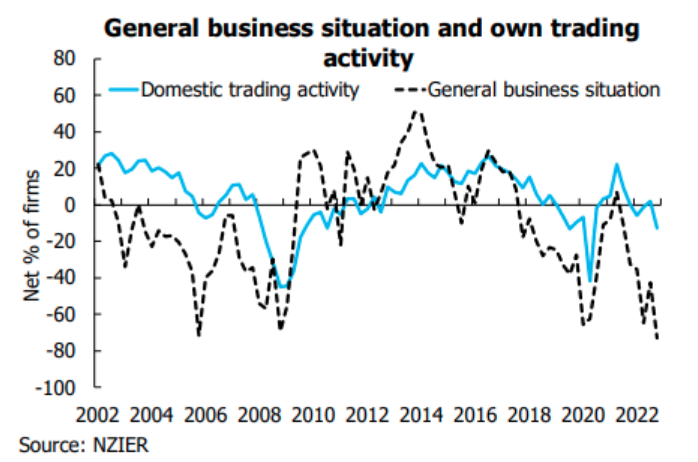

The comments from National's Finance spokesperson Nicola Willis follow release on Tuesday of the latest NZIER Quarterly Survey of Business Opinion, which shows that a net 73% of businesses expect worsening economic conditions in coming months. That's the weakest result ever in a survey that was first conducted in 1961.

ASB economists say the results of the survey show the economy has "run into a brick wall". BNZ economists say "it's all starting to look like stagflation on steroids".

Willis said a record number of businesses were "bracing for pain in coming months".

“The Government’s failure to rein in spending and address labour shortages mean Kiwis are being slammed by rapidly rising interest rates. It’s no surprise that the cost of that failure has left businesses feeling gloomy.

“Alarmingly, the number of businesses expecting higher costs and higher prices have increased since the last survey – suggesting more cost of living pain is on the way in 2023."

Willis said Kiwis deserved a Government with an economic plan. "National would rein in wasteful spending that's adding fuel to the inflation fire, stop adding new costs and taxes, refocus the Reserve Bank on price stability, address worker shortages and let Kiwis keep more of what they earn."

In terms of the actual NZIER QSBO results, these had been expected to be bad, given that this survey was conducted in the aftermath of the Reserve Bank's last Official Cash Rate (OCR) Review and Monetary Policy Statement in late November. The statement then from the RBNZ was much more 'hawkish' than anybody expected and among many surprises had the RBNZ forecasting inflation to rise to 7.5% in the December quarter and suggested that the OCR (currently 4.25%) would go as high as 5.5% by the middle of this year.

NZIER principal economist Christina Leung said the business mood was "downbeat across the sectors".

"The building sector was the most pessimistic of the sectors surveyed, with a net 77% of firms expecting worsening economic conditions over the coming months.

"The decline in the sector’s new orders and output points to a softening in demand over the longer term. While most building sector firms still reported intense cost pressures, the proportion of firms that increased prices continued to fall in the December quarter," she said.

ASB senior economist Mark Smith said the survey's weak readings for the demand side of the economy were "consistent with recessionary conditions".

"Despite this, capacity pressures remain marked, with firms continuing to report extreme difficulties in obtaining skilled and unskilled labour, and with labour shortages still the major constraint on boosting production.

"Rather than falling, experienced and expected price rises ticked up, which along with increasing pressures on profitability and costs and the still-tight labour market highlights the risk of protracted above 3% rates of inflation.

"This, and the possibility of the economy actually proving to be more resilient than signalled by dire sentiment measures, should see the RBNZ to follow through with OCR hikes (a further 125bps expected by mid-2023 and a 5.50% OCR peak)," Smith said.

"Nevertheless, there is no sugar coating the fact that 2023 is turning out to be a difficult year. OCR cuts should follow in 2024, but not until the RBNZ is 110% confident that inflation will settle in the 1-3% target range. This still looks a long way off."

BNZ head of research Stephen Toplis said the results of the QSBO were the "worst of all worlds".

"It’s all starting to look like stagflation on steroids. There is no sign inflation is abating in any meaningful way yet the survey adds more weight to our long-held argument that the economy is headed for recession. Moreover, that recession could come faster, and be much deeper, than many care to believe."

Toplis said while he understood the importance of the "actuals" in terms of hard economic data as opposed to the leading indicators, "we maintain our view that the leading indicators are so weak that the Reserve Bank should now be moderating its approach. Such softness in activity will almost inevitably lead to an easing labour market and lower inflation.

"We have never believed that a 75 point rate hike at the February meeting would be necessary, we are even more convinced of that now."

ANZ senior economist Miles Workman said if the RBNZ was looking to "spook the horses" with the November MPS, then the latest QSBO data suggest "mission accomplished".

"Now the big question is whether or not this sharper downwards momentum is maintained, or if the economy goes back to surprising us on the more robust side after the dust has settled," Workman said.

He said at face value, the latest QSBO data confirmed the RBNZ’s forecast that a softening in the economy is unfolding.

"However, the big worry in the data is the fact that costs and pricing lifted for both the past quarter (Q4) and the next (Q1). That’s going the wrong way, and suggests near-term inflation pressures remain acute (and far too high for the RBNZ to call these data ‘comforting’)."

Kiwibank economists including chief economist Jarrod Kerr, senior economist Jeremy Couchman and economist Mary Jo Vergara said Tuesday's QSBO report "supports our opinion that the RBNZ may deliver too much in the way of rate hikes and monetary tightening".

"The report may not be enough to alter the RBNZ’s view on delivering another 75bp hike in the OCR next month to 5%. Although we would advocate a lesser move (25, not 75). And financial markets are moving in favour of reduced rate hikes. The economic pendulum is clearly swinging towards downside risks, rather than upside risks. We continue to forecast a peak in the RBNZ’s cash rate in coming months, and a likely cut to that cash rate by year-end."

NZIER's Leung said that regarding activity in their own businesses, a net 13% of firms reported a decline in activity over the past quarter.

"This was the weakest since the June 2020 survey when the full impact of the first Covid-19 lockdown was captured."

Leung said the survey showed that firms are preparing for tough times ahead.

"The survey results show firms have become much more cautious and are now looking to reduce staff numbers and pare back on investment plans.

"However, shortages of skilled and unskilled staff remain acute despite the decline in hiring, with finding labour remaining the top primary constraint for businesses.

"That said, a growing proportion of firms are also starting to report sales as the primary constraint for their business, suggesting weakening demand is beginning to impact more businesses."

Leung said despite a greater proportion of businesses passing higher costs on by increasing their prices, profitability has weakened.

"Nonetheless, the pick-up in costs and prices points to high inflation persisting into 2023."

Speaking to some specific sectors, Leung said the architects’ measure of activity in their own office points to a continued softening in the pipeline of construction work over the coming year.

"The pipeline of housing and commercial construction for the coming year continues to decline, while that for Government construction work has moderated. These results suggest construction activity, especially residential construction, will start to ease over the second half of 2023."

The retail sector is also feeling very downbeat, she says.

A net 76% of retailers are expecting a deterioration in economic conditions over the coming months.

"The weaker demand is limiting the ability of retailers to increase prices in the face of intense cost pressures, which has reduced profitability in the retail sector.

"With almost half of mortgages due for repricing over the coming year, many of those mortgages will be rolling off historically low fixed-term mortgage rates of around 2% to 3% on to significantly higher rates of 6% to 7%.

"Consequently, substantially higher mortgage repayments should drive a slowing in retail spending over the coming year."

•The New Zealand Institute of Economic Research has conducted its Quarterly Survey of Business Opinion since 1961. It is New Zealand’s longest-running business opinion survey. Each quarter NZIER asks around 4,300 firms about whether business conditions will deteriorate, stay the same, or improve. The responses yield information about business trends much faster than official statistics and act as valuable leading indicators about the future state of the New Zealand economy.

188 Comments

Ardern said yesterday that they will focus on the economy this year. I'm excited.

Fair enough since the fish and chip industry has been doing just fine since 2017

And how well has the airline industry been doing?

Not really, even the fish & chippies are being screwed over by Labour

https://www.stuff.co.nz/life-style/food-drink/130902549/cheap-as-chips-…

Can’t spin out of this one. This is a damning indictment, a vote of no confidence in this government by NZ businesses across the board. Worst one recorded in sixty years. Perhaps this government, always slow to wake up to anything, now realise that NZ businesses don’t like them because it has been made clear to them in no uncertain terms, that Labour doesn’t like them either.

Well it should be pointed out that the “sentiment” reading has been negative (expecting contraction) for most of the past two years, and the actual economic result was GDP expansion. One could very well make the argument that the sentiment survey is useless, especially as it instead more accurately seems to reflect the political bias of business owners (not a surprise), as it essentially just reflects which party is currently in power rather than being a good gauge for future economic activity (ie when national is in power, the sentiment survey trends positive, and when labour is in it trends negative, despite the resulting economic performance of the country not at all matching that pattern)..

the actual economic result was GDP expansion

Government expenditure had a massive role to play in this "expansion", much like in other parts of the world. This measure grew 6.8% in the year to September 2022 on top of a 8.9% increase in the prior period.

This is not true.

Govt spend is not responsible for inflation and hasn't increased massively when compared to GDP.

It's the huge expansion of private money in circulation by RBNZ (and national banks around the world!) due to very low interest rates.

Govt spend is not responsible for inflation and hasn't increased massively when compared to GDP

In the 2022 HYEFU, total crown spending jumped from 35.9% of GDP in 2019 to 43.6% in 2020 (7.7pp increase). It stayed at 42.0% in 2022, still 6.1pp higher than 2019 levels. Not massive, eh?

The same update says government fiscal decisions impact public consumption (government expenditure) and indirectly impact household consumption and business investments. Therefore, a net reduction in public demand helps to cool inflation.

Regardless the point still stands, this survey is a waste of time and tells you nothing other than who is elected (which you don’t need a survey for).

I'd be interested to see whether the sentiment is correlated more with GDP growth or which party is in the beehive. Based on the chart shown the correlation appears to be closer to the latter.

Yep similar sentiments expressed in the NZIER survey in 2021 and 2022 prior to many posting record profits.

The entire problem seems to be a very low unemployment rate. People used to consider that a good thing. Are National going to come and “fix it” by making more people unemployed?

I think it was John Key that aspired to get NZ wages up to match those paid in Aussie. Yet now National and ACT have said that we need to import more workers to drive wages down. I guess you have to do as your donors ask.

Stand by... National about to connect the hose to the immigration and housing pump.

What's that word to describe a public official doing something against the public interest for personal gain 🤔

begins with c...no not that one, corruption

You mean allowing a housing market to inflate massively despite campaigning on solving the issue, and then quitting his post early to take a job at the helm of one of the biggest beneficiaries of said housing market inflation?

Why focus on the economy? Ain't her pals the Finance Minster & RBNZ Governor saying that the economy is running "too hot" and they are purposely creating a recession?

A bit contradicting, no?

-7

Businesses lack confidence because the environment they work in is rooted!

Businesses lack confidence because the economy is in bad shape.

Businesses lack confidence because they see sales falling, costs increasing and profitability lessening.

who are the Main influencers of these negative influencers that we the people can change....

1. Grant Robertson

2. Adrian Orr

Other influencers we cannot change, but the government can...

3, overseas influencers ( imports, freight issues, oil, workers ...)

Who is in charge of the bove and can make the changes but because of thier socialist/;green/ ideological stupidity cannot see the damage they have / continue to cause!

JACINDA ARDERN

And who controls Ardern...

The Maori Caucus.

And who controls the Maori caucus???

Rangi from Himitangi.

It will be a shock to many that the country is been run based on the advice of Bill Hohepa's fishing by the moon guide.

All DGM in the private sector. Wonder if the public sector desk jockeys are as donwbeat as their profit seeking counterparts.

Starting to feel this state of malaise may well be the thing that nixes hopes of another round of pay increases and rights the ship as far as the OCR goes and RBNZ is concerned. Which would really be quite telling, as it would be a de facto 7% haircut on incomes, borne by those who do not receive any other inflation-adjusted benefit to compensate, that actually did the trick. But when you put it like that, it almost sounds like a bad thing, so we probably just won't talk about it.

The Office UK version. David Brent about to announce branch merger and layoffs.

"I've got some good news and some bad news. The good news is that I've been promoted."

It does remind me of the NZ govt and seems common among MFAT and NZTE (where some of the plum jobs are).

Plus ça change in the land of milk and honey. It's always frontline public service that cops it.

Literally, should have plenty of milk and honey but the cost of a block of cheese makes me wonder. I guess the farmers gotta pay the fart tax somehow.

I guess once our dairy producers can't compete with international prices we may have excess domestic supply again.

What does DGM mean?

No idea. I have asked before on numerous occasions and no one explained it. From context I assumed something like “Doom Gloom & Melancholy”

Doom and gloom merchant

Death Goblin Metal ... it's a type of Scandinavian music that spins through my head anytime I hear Greta Thurnberg screaming her schtick ...

NZ is fine. Everyone are still going out for a 20 buck takeaway and a 30 dollar stirfry.

She'll be right.

... you'd know ... where's the best value for money Chinese takeaway here in Zealandia ?

I'm a big fan of Foo San , in Ilam , Chch ...

Can still get a $14 main at my favourite cheap and cheerful Chinese in Ellerslie.

Probably chicken?

I stopped buying Thai when the Chicken and cashew hit $24.90. I stopped buying beer when Macs IPA went over $23/dozen from Pak n Save. And I'm one of those privileged freeholders creeping into the top tax bracket.

Kiwis are consumers. No wonder so many struggle. Can't budget, can't plan and expect to have everything including avocado on toast, meals out, netflix/SKY and sun glasses that cost god-knows-what.

2002 Honda Jazz going well, 190,000km on the clock.

2002 Honda Jazz going well, 190,000km on the clock.

Yes, but Cindy wants you in an EV. Helps embellish her resume when NZ looks so progressively middle class.

EV owners should have no rights to the road. They're not paying any road tax and should be treated as second class citizens and generally looked down upon.

Is it any wonder Waka Kar-tyre can't afford to fix the roads. Start charging RUC

im sure that extra 4% is going to solve all the councils/WK problems with fixing the roads.

Time to splash out on that dream car before you croak. My last one got sold at 232,000km it was time to buy my first ever new car before the emissions regulations stuff that up totally. You literally have a window of 1 to 2 years now before the fun police put an end to it.

Idiotic comment. Everybody knows Teslas are way more fun to ride than any gas guzzler.

Toaster on 4 wheels as far as I'm concerned. Anyone who cannot drive a manual is the perfect contender for an EV.

I resisted parting with my manual for years, but now we have an EV the ICE's are sitting gathering dust - the EV is so good to drive and nearly free to run, it's the default vehicle.

Not free, when you try to sell it and get stuff all

Even second hand Leafs with their crappy batteries have good second hand value - I'd be more worried about the resale value buying a high-end new ICE passenger vehicle now.

I'm not sure that my Triumph Street Triple agrees with that assessment.

For carving the now rather rare, quiet, well formed twisty bits of road free of police supervision, nope, The tesla shows how much of a fat arse it has when you start trying to throw it into corner with anything less than great road surface/ grip conditions. Although I must admit I haven't tried setting the Tesla up at all, dropping tyre pressures 8 psi or so would be the first step for some corner carving action.

But at pretty much all all other times, yep. 1300km+ trip (Akl to Welly and back) next week in the Tesla, have done this trip many times in the old 6 spd Vtec screamer, and the Tesla is the better car for it, and for the morning commute.

The Tesla Model S will be a total dog at cornering. Just looked up the weight of it, naturally buried by the top speed and acceleration figures, over 2160Kg what a nightmare, it would try and kill me in the first corner.

TBH it worries me that you are pushing these cars so much on the open road. Go to a race track if you want to race. Me and my family want to get home safe regardless of how good your car can corner at high speed.

My MG EV handles really well, the battery gives it a low centre of gravity unlike many SUV's.

As would a bmw 7 series, both are Luxo-barges, not performance/sports cars. One just happens to have ridiculous power as well.

My 1962 chev only weighs in at 1900 kgs. Bench seat is a bit slidey at pace.

Electric cars are arguably much more fun.

Yep, no jack, no spare tyres to carry around or change , even when you've trashed a 40 profile on top of the Kaimais on a pothole in the rain at night.Just a can of flyspray to try, then it's thumb aloft hitchhiking...zoom splat

nobody changes tires on the side of the road anymore. If you try you'll end up surrounded by road cones and a traffic management bill.

They just sit there and ring the AA.

Call Tesla, sit back and watch Netflix in Air-conditioned comfort while they bring you a loan wheel and change it for you. Half the drivers on the road don't know how to change a tyre these days, so you're better off letting them get someone trained to do it than find the car coming towards you down the road is impersonating a Robin Relaint and there is an errant wheel heading your way.

Haha, your mention of the old Reliant Robin made me think of this GIF -> https://media.tenor.com/ZBoMPCQvWrgAAAAd/race-robin.gif

Good luck with that, I'm just paranoid about flats, and I do know how to change a tyre; just helped a driving instructor in a Suzuki Vitara change a wheel, needed trolley jack as supplied jack would not lift the wheel off the ground.

And sitting in a parked car on the open road could give your Netflix a bad ending

Could've stopped at 7 words there mate. Guess you're never upgrading, abot a third of petrol cars come without spares these days.

I love watching luddites reach for every weak excuse why they'll never get an EV, it all comes down to fear for most of them, very few have any real sound reasons.

Funny thing. My primary focus is early retirement (12-18 months away) and I'm happy to forgo cars or any other depreciating assets of notable value. The upside is being able to read and train (run, ride etc) at my leisure alongside the annual European vacation when I retire.

I'm a sanctimonious prick but when I look at people in expensive cars I think "how much of their lives have they traded by having the Audi S5, Tesla etc and having to work longer to meet its costs."

To each their own.

Cheetah's jazz gets him to work.

A Tesla will keep you at work.

Speaking of expensive depreciating assets. There was an article on the leasehold properties surrounding Cornwall Park, the renewals are coming up and 150k pa for lease cost is being talked about.

They say to rent the same house would cost you 65k, just over one-third

Its nuts the trust board can get away with charging this in a fair society

We have two Hondas, both high km, neither ever goes wrong. Remarkable build quality, better than Toyota IMO.

Two car household?

Two half car really. We don’t need to drive much. I would get rid of mine but with kids sometimes one is out with the kids while the other wants to get some jobs done.

"I stopped buying beer when Macs IPA went over $23/dozen from Pak n Save." ; me too at$23, but Brothers Mixed 6 is $20

Extravagant!

2002 Honda Jazz, great old car, apart from safety.

I hope you will not have an accident, and I do not mean it in a negative way but please pay a visit to https://www.ancap.com.au/

Was at my local chinese getting a $16 takeaway - the high end restaurant next door was rammed - on a Tuesday

National's finance spokesperson scalds Government after long-running NZIER business survey records the weakest result in its history

Here's an idea National, why don't you work out a plan yourselves and win the election.

Top comment ! (I suppose they will but maybe they don't want to hand the economic plan on a platter to Labour, 9 months prior to the election)

The Gnats know not to release their half good plans too far ahead of the election , lest Labour pinch them as their own ...

... the barking mad policies , boot camps ... that's already out there ... as was tax cuts for the rich ... geeez , they can be thick at times ...

The best economic plan would be one that urgently addresses our trade deficit before the chickens come home to roost and we are in real trouble.

To Winston's credit he did bang on about cranking up our exports. A pity he can't be trusted and so will be gone for good by year end.

We will never do that by trying to export more and more commodities and with only a fixed amount of land to produce them on and with too many of our profitable businesses having been sold off to foreign interests.

Exporting carbon credits is the way.

At least try to avoid importing them .

I don't think they need to roll anything out, just let the economy keep going how it is and they get in by default. As the pain is only just beginning, of course there be a short term pain relief when Grant rolls out Tax cuts this year hoping people have the short term memory syndrome which gets them some votes at election time.

They have said that they are going to cut government spending so that should boost economic activity, NOT.

That's their secret, don't come up with a plan so no one can poke holes in it

Well we have 21 days left apparently, even NZ gets a mention here.

Interesting piece. Don’t know if I agree with the notion that the USA will be screwed but elsewhere will be fine, hence Americans should buy international assets (as well as gold).

Residential construction will ‘start to ease’.

Big understatement!

Feels more dead stop

I was expecting a "slammed into the buffers"

New build sales are down something like 80-90% from the peak.

Yet plenty of people don’t see a residential building crash coming, or at least aren’t talking about it.

It is National's "economic plan " I'm interested in.

Has Mr Bishop completed National's purpose built MIQ - or has that been thrown in the bin with the rest of National's ever shifting brain farts.

There was never anything wrong with a dedicated MIQ, not only could it have saved us from multiple lockdowns that cost billions instead but an intelligent design could have been used between pandemics as emergency housing instead of us paying more billions on motels. The problem with this country is you have to invest up front and everything is running on a shoe string, there is no money and no foresight so we just lurch from one train wreck to the next. Notice I said next pandemic which is sure to happen and we are still in the same position we were for the Covid.

It would have taken too long to build and taken builders away from building houses. Funny how the media forgets these dumb ideas when it suits.

And we had 250,000 tourists visit each month before Covid.

That’s one large facility we would have needed.

125,000 beds for a 14 day stay…..two years of our construction capacity…..great idea National!

It wouldnt be for tourists, but to be able to repatriate citizens that were locked out of their country for 2 years. No tourist is going to quarantine for 2 weeks to be able to have a holiday (or quarantine another 2 weeks in order to get back into their home country).

Exactly.

And it could have been used for emergency housing once the need went away.

Note - just saw your comment below after I wrote this, in terms of utilising for emergency housing. I said this a lot early in the pandemic, and even wrote to ministers on it, but got the usual lame responses.

putting a whole lot of no hopers together just creates even less hope. The motel strips in Hamilton and Rotorua are pretty good evidence aren’t they. they need to be housed with normal people around so they can see what normal life looks like.

Nice and idealistic in theory, not convinced by the reality of it.

Could have been done easily, just ship in "dongas" from Australia - that's how they house workers in mining camps, and how their Howard Springs quarantine base was set up. https://lh3.googleusercontent.com/p/AF1QipM0uObY3UDQS9RZZhWxvyKYu8YGSr5…

In addition to being used post pandemic for housing the homeless, it could also be used as a minimum security detention centre - and start sending some of these criminals back to jail. Two birds, one stone ....

The Howard spring facility has a capacity of 850.

but we had 40,000 kiwis returning each month before Covid.

so about 25 Howard springs facilities housing 20,000 people at a time???

let me guess… all built in three months?

good luck with that plan

Power it up with a few car batteries and pipe the poos out to sea, job done.

All built in three months at a time when it was absolute chaos to get space on a shipping vessel, let alone have the ship want to sail to New Zealand.

The amount of cargo from China/Europe our company had dumped in Australia because it wasn't economical for the vessel to go via NZ. At least the "never happy brigade" will have something else wag finger at Labour about when these "dungas" arrive late.

National and Act, when they get elected this year, should not only refocus the Reserve Bank on price stability, as promised by both, but they should also sack Orr and put in charge somebody less woke, with a less over-inflated ego and more competence and much better focus on the real job that the RBNZ is supposed to do.

The only problem is that the necessary steps to get there go against the grain of their one announced policy to pump property speculation. I guess it won’t matter if you can deduct interest from your tax bill or not. if the interest on your mortgage is larger than the tax you pay you’re not getting a rebate.

I must have missed that policy, what did they say besides removing some of the stupider tax rule changes?

Don't waste your time NK

All of Nationals tax policies are currently under review since November OCR increase "surprise", repealing the removal of the 39% bracket for starters. I'm not promoting Labour here, both as bad as each other currently. For a while I was on the fence, now I'm looking elsewhere for some sanity. I wouldn't get caught up thinking National will swoop in and "fix" things, it will almost definitely be more of the same painted a different colour.

The return of interest deductibility for residential landlords will cost $650 million in 2024, according to Treasury. Leaves a bit of a hole in the budget.

Yes, Labour need to "come back from holiday with a real economic plan" so we can copy it.

They only just came up with the tax to take the heat off them a year ago. Have they already spent it all?

Won't cost anything, as the amount of tax paid in FY 2024 will be unchanged from when interest was fully deductible. Thats because deducting 50% of mortgage interest at 6% pa is exactly the same as deducting 100% of mortgage interest at 3%. Those with no mortgage and those who bought new builds will likewise be unaffected by any repeal. There might be a small number of investors who bought houses post March 2021 who might benefit but I highly doubt they will be collectively paying $650m in tax. In other words, the financial modelling done pre OCR raises is as out of date as the Oxford Covid modelling that predicted 80,000 New Zealanders would die from covid. It also means that anyone pinning their hopes on National "saving" the property market are barking up the wrong tree. At best, it might encourage investors back into the market to absorb some of the supply and to house those that are currently languishing in emergency accommodation or are one of the 30,000 on the public housing waitlist.

Orr was one of the first central bank governors to raise rates. Some of the “less woke” ones got it much more wrong than Orr.

Don’t know if I would give him much credit for that, weren’t we one if the earliest to see inflation surging higher?

The number of staff employed at the Reserve Bank since Labour took it over has doubled. Return the RBNZ back to its core job, sack the hundreds of people hired to undertake the new "diversity" work, and save money. Now repeat for every Govt department. The new Govt need to go full Elon Musk on Govt Depts and subsidiaries, I say give this job to David Seymour, lets see what small Govt really looks like. I suspect, like Twitter, we will notice no difference.

You won’t notice a difference because when they realise most of those people actually do something they will hire them back as contractors. But don’t expect a reduction in cost.

The RBNZ are independent aren’t they?

They are focussing on price stability. That’s why interest rates are going up.

great for savers, not so great for borrowers

I think that the failure of a lot of unproductive, inefficient businesses dependent on an endless supply of cheap immigrant labor would be very healthy. This way we can focus our people, infrastructure and assets on what is going to benefit our country the most. That is the way any efficient business would operate. Do the government and the NZIER think this way also?

3 Busy and profitable cafes in the town center instead of 5 that struggle to break even. Existing workers can be spread around the surviving businesses that are busier and because they are profitable they can afford to pay more.

You got it!

Better still we all have our own coffee machines and a few at work.

The last thing for our health that we need, are the treats that we buy with the coffee.

The shotgun is loaded. Get ready to shoot some zombies. Just be sure to get them in the brains, otherwise they'll be back soon.

Now we are back into it for 2023, anecdotal observations from talking to clients and colleagues so far:

- Company selling a cladding product used in residential construction - Inquiry has simply dropped off a cliff. A few of their customers have gone bust owing them.

- Company manufacturing homeware for sale via various retailers - Client reports their retail partners have seen a big drop off in activity. Main loss is from 'impulse' purchasers buying on store credit, Q card etc. Cash buyers at the higher end of the market still active.

- Company selling a safety product to resi and commercial construction - More inquiries for product hire as opposed to sale. More inquiries from homeowners wanting to DIY as it's hard to get tradies in.

- Far more "open to work" badges popping up on LinkedIn.

- Friend in used car sales says it has slowed a lot (personally, I have a few cars on my watchlist to replace my partner's old beater and all are having prices cut).

- My own business, I am noticing it's taking longer to get paid. Having to have some awkward conversations that I'm not so used to having. Inquiries still relatively robust. I'll be looking to trim expenses so extend cash runway.

On the other hand, try going out for dinner or brunch or grabbing a takeaway coffee. Everything is packed to the rafters! Waited 15 mins yesterday for someone to open the lunch cabinet and get two scones out because the place was so busy.

Does feel like hospo suffering lack of staff way more than lack of punters......

Agreed. This cafe was understaffed, and the very friendly employee on the till made it clear the had just started.

Although hospo spending is probably one of the easiest things to cut from a household budget (for example I've largely replaced a morning coffee with a self-made one) paradoxically I believe it will be the "last man standing" because grabbing a coffee, or some sushi for lunch is a relatively small expense that doesn't hit too hard - versus buying a new TV or having the house repainted - and it's a small luxury you can enjoy and reward yourself with.

Edit - also agree with what Housemouse is saying about people out and about enjoying themselves in what feels like the first period of genuine normality in some time. Why not go out for lunch or dinner when your family is back from overseas or your friends are in town?

Agree on your last point there. Cafes might do ok because of that, restaurants potentially less so.

Also doesn't help that restaurant dining is getting ever so expensive now. We went out to our favourite spot the other night - one small starter, a main each and a drink was $120. That would have been about $90 only a year ago (off the top of my head). Food was excellent but at those prices I'm not surprised it was quieter than I seem to recall.

Went down the road to the trendy ice cream shop for dessert and it was heaving ... little luxuries win out. Got two desserts for less than the price of one at the restaurant.

Yep we tend to go out during the week now as most restaurants have a special or two mid week, whereas Friday/Sat can easily set two back $120-$160.

Perhaps many people have given up on home ownership and are spending like drunken sailors, carefree since they no longer care

I’d say it’s the opposite: many people have no mortgage, a $200k plus household income and a $2 million house, why not go out for dinner?

The million dollar mortgage for some… but go on.

The modern day equivalent of the lipstick effect, inelastic demand because you gotta keep the small luxuries.

Kiwis are enjoying a summer of freedom without lockdowns, and I think there is an element of lots of family and friends coming back for the first holiday since the pandemic. I think come March/ April hospo will start struggling a bit.

Hospitality usually runs by employing young working holiday makers, and we don't have many of them because they have all gone to Australia. It takes 3 months to process a working holiday visa in NZ (blame Labour again), Australia does it in 24 hours. Australia opened their international border 8 months ahead of NZ (again, blame Labour for that too), and consequently they have soaked up all the staff - there are currently over 135,000 working holiday workers who have gone to Australia in 2022. They probably also applied to NZ for a WH visa but by the time they got approved they were happily settled in Australia, making better wages and enjoying a lower cost of living than if they come to NZ.

That UK recruiter was right when he said that no-one wants to come to NZ any more.

Rubbish…. If under 31 years and from a Schengen country they can do it online in five minutes

"With almost half of mortgages due for repricing over the coming year" those eggs benni and cappuccino may be regretted by year end.

It's the holidays and finally not raining. Hospo will be feeling it after Waitangi weekend.

November 2021 had 9 billion of new mortgage lending to 23K borrowers. December 21 8 billion to 20 k borrowers. Interest rate in that period was 3.5% for 1y and 4% for 2 y fixed. Any of those 43k borrowers that didn't take at least the 2 year fixed is going to have a bad New Year handover.

Exactly

I’ve seen nothing from National yet. Aside from the promise to undo most of Labours changes. I’m interested to see some depth (and numbers). The tactic seems obvious and predictable… get all the votes in from the cockroach class (landlords), and do very little else to stimulate the economy. Am I missing something here? I’m open to being enlightened….

...that we're still over half a year out from the election? Might I remind all that Ardern became leader of the Labour Party about two months out from the General Election. Not sure I'd expect Luxon to disappear but not unreasonable for them to keep their cards close to their chest at this stage.

The sitting Govt however have obligations to the wider community in a Ministerial capacity and shouldn't be playing politics with things like tax policies given the need for certainty, like a certain Finance Minister seems to want to do. Otherwise you can basically spend the last 12 months of a three year terms just foreshadowing the election and deferring any actual decision-making, by which point the policies you should have actioned months ago become part of a de facto election slush fund.

Cannot wait for the election debates. Luxon has so much ammo he can just hold down the trigger for half an hour. I expect to see JA crack under the pressure and cry out something about a prick again.

Popcorn ooooohhhhhh yeeeahhhhhhh

Ardern will walk all over him . That's not Nationals best chance by far.

Tom, if you were the National strategist, would you announce their economic plan now, so that Labour can copy it and claim it's theirs, or would you wait closer to the election date?

The Gnats have already foreshadowed cutting out wasteful spending ... there's a cool $ 1 billion annually that the consultants wont get anymore

I thought the consultants usually have even more of a field day under National, as a whole lot of ex government employees simply consult back to government (and National are not radical enough to permanently downsize the bureaucracy)

Probably why ACT bringing 10+ MPs in the coalition is the only way to keep National from turning into Labour-lite. Diverting funding away from bureaucracy and into frontline public services is in the ACT manifesto.

For example, the government has budgeted 11 billion in opex for the health centralisation and rebranding exercises. However, they instead are willing to cut services at the new Dunedin Hospital instead of funding a 110m capital increase request (1% of the rebranding cost).

Yeah but last time I looked at the ACT website they proudly claim to be "a pro immigration party". It's that extra million people these last 20 years that has caused the congested public services like healthcare.

Pro immigration- but not in Epsom, build the new houses elsewhere.

Well that got a seriously loud habark from me. Nearly scared the cows out of the shed. National cutting out consultants hah.

Yvil… I think this election is different. People are looking for certainty in very uncertain times. In my opinion it would be prudent to gauge public feedback on some potential new policies. It’s going to be economically challenging come election time and to announce bad policy too close might cost gaff prone Luxon the win.

... a " gaffe prone " Luxon might appear more authentic to voters than an uber slick Ardern ... just saying ...

So what if they copy it...if it;'s so bloody good then what does it matter? Plenty more to work on.

Whatever good plan Labour takes on board, wheter it's theirs or not, they won't be able to implement it, that's the problem rastus.

Yes i'd agree with you there. Very hard to run a country when you don't have a team of people or a leader who are experienced in getting things done.

You'd wait and watch the economy crash and burn even further while Labour twiddle their thumbs. What the Nats should really be doing is staying quiet - don't give Labour any ideas, let it become apparent that Labour have no ideas.

I think the Nats are just as weary of releasing policy with numbers attached in case there is a billion dollar hole in the figures like last time...they want to throw out policy at the last minute as a sound bite,reducing the amount of time for proper analysis.Rangi Goldsmith has been doing remedial maths for the last few years in preparation.

This sums up Nationals plan for the economy….

https://m.youtube.com/watch?v=rblfKREj50o

replace immigration with machine guns and a housing ponzi with the battlefield and you get the picture

if it wasn’t so sad it would be funny

Once this giving the tax breaks back to the Landlord class, gets a rev-up in the media and the Nats see how toxic this is to most Kiwis who expect a "fair go" to get on a reasonably priced, entry level house - I expect the Nats will drop it like a hot potatoe!

If they have any brains, they will.This policy was one of labours smartest moves - levels the playing field between homeowners and landlords.

I'm a swinging voter until Nat commit to retaining it.

This Labour government is simply unable to implement an economic plan. It's like asking a mute person to speak, can't do it!

... they have a team of consultants working on it ...

Cue 15 focus groups

You gotta love all the major political parties selection of finance spokes-people. Is this some kind of private joke amongst all the political parties? Some kind of back-room competition to select the most unqualified and useless candidate possible?

The Labour back-room guys managed to find a guy with a politics degree and zero business and finance experience, in fact, his predilection for printing money makes me wonder if he is carrying on the family business.

But wait, National have got someone with book-reading skills and zero business and finance knowledge.

and Act have found a social-awkward dude with some soldering skills.

I guess someone with a finance, economics or business background was too much to ask?

Exactly. I have said several times that I am unconvinced by Willis.

I wonder if behind the scenes Luxon will handle the finance role. He just needed to try to minimise the rich, white, middle-aged bloke vibe abit?

Isn't Seymour the finance spokesperson? He has a degree in electrical engineering.

You'd often see qualified engineers leave their hardcore technical roles for a career in finance. Many, with their logical brains coupled with on-the-job training, outperformed the top econ majors in financial/economic analysis.

I suppose all those years in coalition and on the crossbench arguing fiscal policy should make Seymour a decent candidate for the portfolio.

Also, ACT's deputy leader has a degree in econ.

Yup, Seymour is the finance spokesperson. He was who I meant by soldering skills.

Electrical engineers been able to solder . That's an old fashioned idea. electrical engineers been able to tell someone how to solder . that's the modern way .

And if he is an ACT electrical engineer,he will be telling someone from a third world country that we have imported to do the soldering for $18.50p/hr...minus admin fees for accomodation,passport retention etc.

Most of ACT's lineup actually have real world life experience in the portfolios they represent. It's part of the reason why they get my vote, because I see a party with competence and I'll take the bad with the good when it comes to their policies, also knowing full well that for the foreseeable future they're a coalition party so any radical "bad" policies will likely be tuned down when they co-govern.

Maybe its time that we stop treating the Deputy PM and Finance Ministry as the same thing. It seems they pick a person for one, and they automatically get the other. Winston made a good Deputy PM, and he was Foreign Minister (although I note he never actually got to leave the country as Jacinda did all the international travelling, so he spent most of his time as acting PM).

...firms continuing to report extreme difficulties in obtaining skilled and unskilled labour, and with labour shortages still the major constraint on boosting production.

That's kind of the kicker here, whenever we have face difficulties over the last three decades labour has been the shock absorber keeping inflation low and allowing the everything bubble to expand. However demographic changes mean Labour is in very short supply.

Buy Physical Silver, XRP and Quant (QNT). Thank me later. The great reset will happen this year. Ardern is one of one of Klaus Schwab's acolytes.......Ze will own nothing and be happy. They is destroying the present system

Buy Physical Silver, XRP and Quant (QNT).

Too late for silver. And XRP? Why? It's a security with no intrinsic value. And enough with the sh*tcoins.

I think the Govt should come back from holidays and call an early election. Why continue dragging out this pain trade?

Has labour ever had an economic plan? If they did it hasnt worked

What makes you say that? Is the high GDP growth and low unemployment rate a fluke? Aren’t those the two biggest economic indicators?

It's the usual:

- Blame them for all the bad stuff that happens, "no-no-no-no there's no excuses guys you can't blame global factors"

- Don't let them take credit for all the good outcomes "global factors and other things out of their control gave us this good result".

Yes, Davos this week I think. Ardern definitely on the short list to rise to the top there.

Back to the trenches, so far, lots of talk. Let's wait a bit for some action & see what happens. The scenarios from here are many, so no point playing your aces just yet. No one knows for sure what it will be come election time. In fact, no one knows for sure if there'll be an election with this current crowd in power.

Why need an economic plan? Isn't the economy booming and thus therefore we need to raise record breaking interest rates to tame inflation and manually create a recession? This as a result causes house prices to plummet (which is also what they want right? affordable housing for all?)

Record breaking economy, High GDP, Low Unemployment, housing prices plummeting! All promises made!

I don't understand. Labour is doing everything right! Arden for 4 more years!

-7

7jai… You make a good point. The problem is the obvious one… it wasn’t intended. Orr and Labour have forced us here (unintentionally!)

That is a problem for National . While everyone may moan about a downturn , a few months ago they were all saying it was necessary , and few would say the house price increase economy was sustainable.

They have to convince middle NZ that Labour has really stuffed up the economy, because Labour beats them on most other policy areas. Maybe not crime , but how much of middle NZ really think a few bootcamps is the answer?

Captain Conehead asleep in his bunk when the Natanic hits the first iceberg

Residential construction 'ease', gone over the cliff more like! My p/m2 build rate has dropped from $4,100 to $2,900. Got to fire one poor performing sub trade and replace them with ease.

But many great tradies are hurting. Work their butts off, bought new toys and now struggling for forwards work. Not all their fault either, someone opened up land available, put rockets on cheap cash and nuclear energised overly inflated profits that went to the land-holders and select others.

Not all their fault, sure, but if you had any sense you would have seen what was coming and plan for it.

I guess tradies under 35 would never have seen a real bust before, probably thought like I did in 07 that the good times would roll on forever.

the best way to make prices, especially house construction, cheaper ....

a deep recession..

post the last GFC house builds dropped from 2.5k per SqM down to 1.5k per SqM as builders and suppliers lessened their huge margins to get work.

I remember getting quotes and requote " sharpened" as builders shored up work to keep the " hounds from the doors"

Bring it on and the government shouldn't interfere... As they just make it worse!!!

Furthermore ... When I go to the boat ramp on Friday afternoon the carpark is full of $50k+ Utes that launch $70k Fizz boats,.. all owned by rich builders, plumbers, and sparkies...

Time to reign in the construction rort!

Says the party of do-nothing government.

Oh sorry Nicola - you meant “think of the helpless property investors, dairy farmers and Ute buyers”. I agree - government must always govern in their favour.

With all respect to the very talented Nicola Willis, the very last thing Nz needs is an economic plan from Labour because any plan they make will only make things worse, just like every other plan they've had in the past five years.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.