Summary of key points: -

- Kiwi dollar moves higher post-election

- Sideways shuffle for the USD going into the US Presidential election

- RBNZ’s dismal economic outlook under some scrutiny

Kiwi dollar moves higher post-election

One of the scenarios for the NZ dollar from the NZ general election result proffered by this column a few weeks back was that a majority Labour Party victory, with no reliance on the Greens to form a coalition government, would be “neutral to positive for the NZD”. The view being that downside risk for the Kiwi of the Greens holding the balance of power would be removed. Currency market movements over this past week have been volatile, however the end result is a stronger NZD against the USD (as expected) to 0.6690 from rates below 0.6600 before the election. A dip in the Aussie dollar against the USD to 0.7020 on Tuesday 21 October due to bearish comments from RBA officials did briefly pull the NZD/USD rate lower to 0.6556. However, as we have seen with the RBNZ attempted jawboning of the NZD currency lower over the last two years, the impact on the FX markets is never too long-lasting. Unless the monetary authorities follow up their words with action, the markets rapidly ignore their barks.

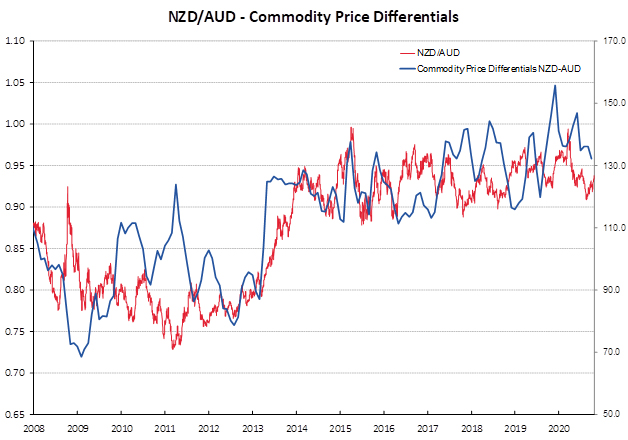

The NZ dollar has made strong gains against the AUD on the NZD/AUD cross-rate over the last three months from rates below 0.9100 in mid-August to 0.9380 currently. Local AUD exporters who had to discipline to increase hedging percentages with orders placed in the 0.9200/0.9100 region have been well-rewarded yet again.

It is difficult to see the NZ dollar continuing to gain further against the AUD from current levels. On an economic well-being and performance basis the Australian economy has come through the post-Covid period in better shape than New Zealand. The mining states of WA and Queensland are rocking again as AUD referenced mining commodity prices soar. However, despite the economic positives, the Aussie dollar has taken a couple of knocks in recent weeks that have taken the gloss of its spectacular appreciation this year from below 0.6000 to 0.7400 against the USD. The Chinese are disrupting imports of Australian coal and cotton (following on from earlier wine and beef import bans) as some form of retaliation for diplomatic spats and Australia always siding with the US on global trade issues.

After earlier ruling out using negative interest rates as a monetary stimulus tool in 2021, the RBA seem to be softening their stance over recent weeks.

The new NZ Labour Government overseas trade and foreign affairs cabinet ministers will need to tread very carefully with our trading relationship with China over coming months. The last thing NZ exporters need right now is some naïve politician causing a block on our goods on Chinese wharves. Thankfully, Winnie is no longer around to upset our largest export customer, the Chinese.

Sideways shuffle for the USD going into the US Presidential election

On the global stage, the US dollar itself has just move sideways (above and below $1.1800 against the Euro) over recent weeks in the lead-up to the US Presidential elections. In an attempt to stop their Yuan currency strengthening too much, the Chinese PBOC have been buying Japanese Yen, selling Yuan. They are no longer buying USD denominated US Treasury Bonds. The Chinese demand has caused the Yen to strengthen to below 105.00 against the USD, which in turn has upset the Japanese as their exports become less competitive. One of the major factors behind the forecast weaker USD value over coming years is the fact that Chinese and European sovereign wealth funds and other fund managers will no longer be buying the same volume USD’s to invest in US markets as they have done over recent years. They need a lower USD value entry point before committing to higher cross-border capital flows.

RBNZ’s dismal economic outlook under some scrutiny

The next significant local influence on the direction of the NZD/USD exchange rate will be the RBNZ Monetary Policy Statement on 11 November. There will be a lot of market focus on the updated RBNZ economic forecasts. Prior to Covid whacking the economy in March 2020, the RBNZ were consistently flip-flopping between bearish and bullish on their economic outlook. Since the economic shock earlier this year, the RBNZ have been very negative in their May and August MPS statements on the outlook for consumer spending, employment, commodity prices, inflation and just about everything else that makes up the economic pie. Hence their threat of negative interest rates and the introduction of the bank Funding for Lending Programme (FLP) to provide additional monetary stimulus, as they clearly see the economy headed for a dark depression in 2021.

|

RBNZ May 2020 MPS “Even if New Zealand successfully contains the spread of disease locally, reduced world activity will mean lower demand for many of New Zealand’s exports. Weaker economic conditions abroad will reduce export income through lower export volumes and lower prices”. “We anticipate further falls in our export prices, as slower global growth weighs on demand” RBNZ August 2020 MPS “Relatively strong export prices have contributed to the TWI being stronger than otherwise, partly offsetting their impacts on exporters’ earnings. The outlook remains highly uncertain, and slower global growth continues to be a significant downside risk to demand for our exports” |

The facts are that over recent months, housing, consumer spending, manufacturing and exports have been considerably stronger than RBNZ forecasts and expectations. Dairy farmers are eyeing a higher $7/kg milk price for the 2021 season as commodity prices increase. The question is whether the RBNZ will recognise these positive trends or stick with their entrenched view of continued weak global demand for what NZ produces?

The RBNZ August Monetary Policy Statement included a forecast of our export prices decreasing by 9.9% over the year to 31 Match 2021. On current trends, the likely change to export prices (in NZD terms) over that 12-month period is closer to 0.0%. The world is looking down a barrel of some food shortages in 2021 for various reasons. As an exporter of protein New Zealand is sitting pretty. Let us hope a potential summer drought does not hurt agriculture production and take the gloss off the outlook.

If you think that forecast is well wide of the mark, last Friday’s +0.70% increase in inflation over the September quarter was 36% lower than the official RBNZ forecast of +1.1%. Petrol prices did not bounce back up as much as the RBNZ expected.

What is even more worrying in terms of forecasting performance and accuracy is the current RBNZ forecasts for quarterly inflation changes over the next four quarters i.e. 0.0%, -0.2%, +0.1% and +0.4% - which combined together drop the annual inflation rate to +0.3% by September 2021. Against the real-world evidence of consumers having to wait months for the delivery of items such as motor vehicles and e-bikes in the economy today, the RBNZ inflation forecasts appear totally under-cooked.

They have been expecting global deflation to hit our economy, it is not happening.

It is impossible to see retailers discounting anything too much this Christmas as they are running low on stock for just about everything and cannot meet the consumer demand. Non-tradeable inflation has been running at 3% pa for a number of years, and there is no evidence that this has changed. Tradable inflation will not be decreasing over the next 12 months to offset the non-tradable price increases given stock shortages. Therefore, it hard to fathom that the RBNZ will not be seriously adjusting their quarterly inflation forecasts upwards on 11 November. Rents and house building costs are being weighted to higher percentages in the calculation of the CPI index, so another reason for non-tradable inflation remaining up at 3%.

If the RBNZ maintain their current inflation forecasts for 2021, it will be confirmation that they are completely out of touch with current forces in our economy. Anecdotal evidence of labour shortages across the economy points to higher wages being required to be paid by businesses to get their output out the door. It does not feel anything like a downward deflationary spiral to me (and I did not even mention house prices!).

The NZ dollar can only have upside in early 2021 when the RBNZ are forced by the unfolding economic evidence to abandon all talk of negative interest rates as additional monetary stimulus.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.