Summary of key points: -

- RBNZ ignites more volatility in NZD currency market

- Kiwi dollar rise to 0.6900 “too far, too fast”?

RBNZ ignites more volatility in NZD currency market

Following the two elections (NZ and the US of A) through October and early November, the next big risk event that stood out as influencing the NZD/USD exchange rate direction was the RBNZ monetary policy statement last Wednesday.

Last week’s commentary opined that the RBNZ would “stick to the script” of the previous statement in August, as not much had changed in respect to the outlook for the economy, inflation and employment and the monetary policy stimulus requirement in response.

I should have known better!

The current RBNZ Governor is not that predictable and does like to surprise and catch the markets off-guard.

True to past form, he delivered a statement that was not as dovish as the markets expected and did not attempt to jawbone the Kiwi dollar done as had been the consistent policy in all previous statements.

As a result, the NZD shot upwards instead of the expected short-term sell-off.

The only conclusion one can arrive at is that the most consistent thing about the RBNZ is their inconsistency!

The RBNZ messaging and signalling seems to lurch around from one quarter to the next and this has been the case for more than two years now since Adrian Orr became Governor.

Subsequent to the monetary statement last Wednesday, Assistant Governor Christian Hawkesby tried to explain that the RBNZ did not cause the NZ dollar to appreciate, it was the markets concluding that their previous pricing-in of negative interest rates next March needed to be adjusted back as the new Funding for Lending Programme, if effective, would in a way replace the need for negative interest rates. A rather poor excuse and explanation in my view.

If the RBNZ are doing their job, they should have good market intelligence in advance of all monetary policy statements as to how the markets will react to their words.

They should have known that any lowered level of threat about negative interest rates would send the Kiwi dollar higher.

Perhaps all the personnel restructuring at the RBNZ has reduced this important financial markets resource/presence and they are relying more heavily on the academics who sit as externals on the Monetary Policy Committee instead. I was expecting that by January/February time the RBNZ would be forced by the economic evidence to change their view on the need for negative interest rates. Instead, they essentially delivered that change last week!

An example of the RBNZ’s inconsistency is that fact they delivered several grave warnings about how any appreciation in the Kiwi dollar would damage exporter’s profit margins and restrict the export-led economic recovery when the NZD/USD rate was in the 0.6400/0.6500 region through the June to October period.

When the NZD lifted to 0.6800 in recent weeks (on election results and a weaker USD offshore) the RBNZ abandoned any comment about the exchange rate value! Perhaps they realised that the majority of our major USD exporters are already hedged against a weaker USD and thus their profits are somewhat insulated for the next two years.

One matter the RBNZ have been consistent on is that they have always been prepared to take the risk of doing too much monetary stimulus in response to the Covid economic shock, rather than finding out that they have not done enough.

My view is that they are already past that point of no return with too much stimulus for the current and future economic conditions.

They have flooded the economy with so much cash that out of control asset bubbles like the housing market are fuelled to the point that LVR credit controls will be required again.

Home mortgage interest rates are set to move lower as the banks’ own funding costs are lowered by the RBNZ’s Funding for Lending Programme.

Surprisingly, there were no strings attached to the banks’ lending of the cheap RBNZ funds, free to go into housing loans instead of being restricted to commercial and business lending.

In their attempt to meet their employment objectives, the RBNZ are throwing low-cost credit at the economy in the hope that business will finance new investments/expansion with extra debt.

The clear message from the corporate world, and also the banks themselves, is that business firms do not want to borrow any more (most are reducing debt levels).

The RBNZ’s policy is futile and potentially creating dangerous distortions in the economy.

A more practical message from Governor Orr should have been an admission that monetary stimulus is a blunt instrument and is not effective when additional business debt is not wanted/desired and some industry sectors need it, but most do not.

Governor Orr should have been insisting that the new Government does much more with micro-economic reforms to protect jobs in the industry sectors that need help and to stimulate stronger GDP growth.

To date there is far too much reliance on monetary policy to achieve the employment objectives and both the RBNZ and Government need to recognise this.

Kiwi dollar rise to 0.6900 “too far, too fast”?

The three cent ascent of the Kiwi dollar from 0.6600 to 0.6900 against the USD over the first two weeks of November certainly appears to be “too far, too fast”.

The NZD buying is more of the short-term speculative variety, thus prone to unwinding when new NZD highs fail to materialise.

Adding to the probability of a sizeable pullback in the NZD/USD rate from the current 0.6840 level is the potential for a weaker Euro value against the US dollar over the next few weeks.

Europe is going into much stricter Covid lockdowns than the US, therefore economic outcomes are going to be more negative for the Euro in the short-term.

Whilst the medium term outlook/forecast is for a weaker USD against all currencies in 2021 with the EUR/USD rate moving to $1.2500 and higher, in the shot-term in the lead-up to Xmas the EUR/USD rate is more likely decline to $1.1500 from the current $1.1800 level. The consequential impact on the NZD/USD rate from the stronger USD will be drift back to the 0.6600’s.

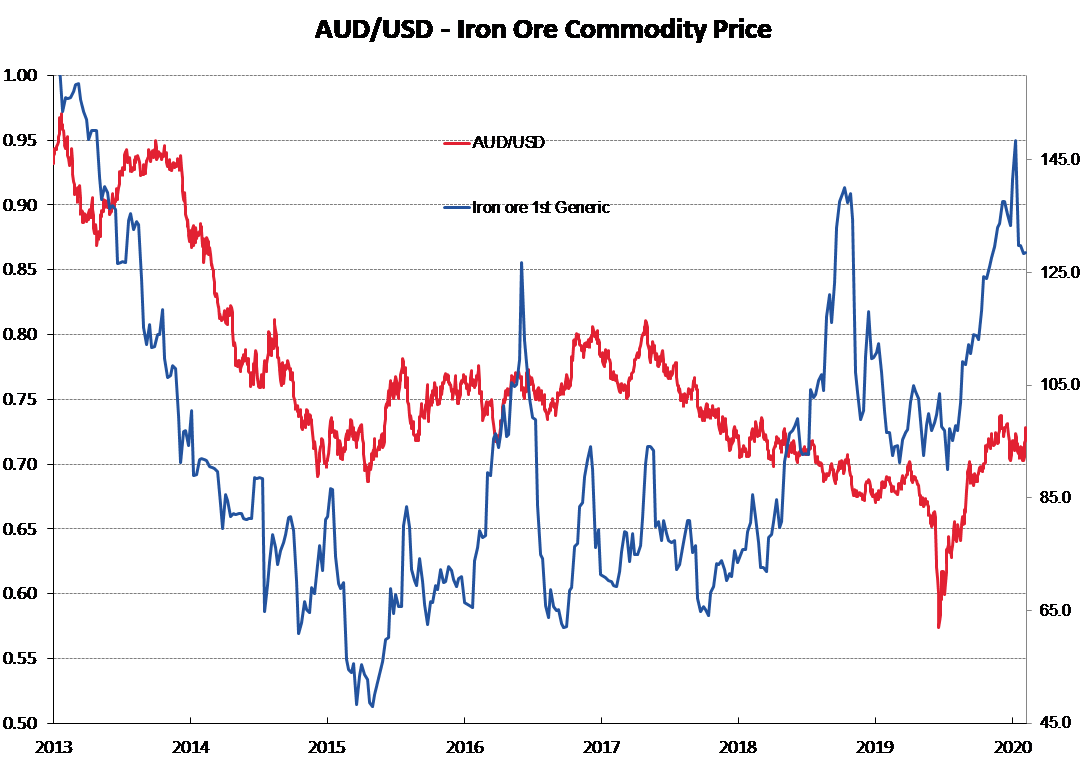

The Australian dollar has not made the gains the Kiwi has achieved in recent weeks. The NZD/AUD cross-rate has lifted to above 0.9400 as a result. At 0.7270, the AUD/USD rate is still more than one cent below its highs recorded in September. The news for the Aussie economy and thus currency has not been that positive of late. The Chinese have them under pressure with trade bans and with the Biden victory in the US, Australia has become the international outlier when it comes to climate change policies.

Further AUD gains to 0.7500 against the USD seem likely in the New Year on the basis of the high iron ore commodity prices, however in the short-term book-squaring before year-end may take the AUD back a little.

The risk of the NZD/USD rate rising to well above 0.7000 in 2021 remains elevated on the weakening USD forecast, however both EUR and AUD influences suggest a corrective phase lower before that.

As is the normal pattern with the NZD/USD rate over the Christmas/New Year period, daily NZD buying by the meat exporters in thin/illiquid FX markets will push the exchange rate upwards in the absence of seller son the other side.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

17 Comments

Where is the Helicopter Money ?

Exactly.

The Fed doesn’t do money, therefore there’s no way the Fed can have its monetary inflation. Monetary officials – in name only, MOINO – have sunk to believing that pretending to print money and having the media write story after story after story declaring as much, as well as how ultra-loose and ultra-accommodative it is, that such belief alone will be enough to convince consumers and businesses to act accordingly (in a predictably inflationary manner). Link

Can u explain why u might believe that...."the FED doesnt do money"... ? ( Author is implying... FED does not create money?)

I read the whole article .... and apart from the author saying that the FED cant control CPI inflation ( stating the obvious )...he says nothing at all..??

Banks create money that you and I can use (inside money), central banks create reserves (settlement cash/monetary base) that are limited to banks to settle interbank liabilities between themselves (outside money).

Three structural features of monetary systems form the starting point for this paper. They include (1) a two-layer structure comprising a private sector agent deposit system with commercial banks, parallel to a commercial bank deposit (reserve) system with central banks, with the two being separate and not allowing transfers between the two, that is, reserves cannot be “lent out” to the private sector (Sheard 2013); (2) the fact that money is created upon the creation of bank loans (Werner 2014/16) while repayment implies money destruction, both of which are an accounting reality, and implying that banks would better not be called “intermediaries”; and (3) the fact that the money stock is endogenously and elastically driven by demand and constrained loosely by regulation. The constraints to the provision of new credit include capital regulation, banks’ conditionality on an incremental profit prospect, and, eventually, demand (McLeay et al. 2014)1. Link

A recent Bloomberg article described central bank easing with the phrase “pumping money into the economy.” That’s a misconception. Monetary easing is actually an asset swap. The public was holding savings in one form, and now it holds it in another. The Fed buys Treasury securities from the public, and replaces them with currency and bank reserves (base money) that someone has to hold, at every point in time, until the Fed sells its bonds and retires the cash. All monetary policy does is to change the mix of government obligations held by the public. Only fiscal policy – specifically deficit spending – changes the total amount of those obligations.Link

The only thing you need to know about reserves: they go up, it's bad.

"The constraints to the provision of new credit include capital regulation, banks’ conditionality on an incremental profit prospect, and, eventually, demand"

I guess capital regulation is RBNZ through capital adequacy rules, and there is just about unlimited demand for credit(money). Am I right in thinking that as the cost of credit cheapens, banks will have to extend more and more volume of credit to achieve the same volume of profit?

.. the most important macroeconomic variable cannot be the price of money. Instead, it is its quantity. Is the quantity of money rationed by the demand or supply side? Asked differently, what is larger – the demand for money or its supply? Since money – and this includes bank money – is so useful, there is always some demand for it by someone. As a result, the short side is always the supply of money and credit. Banks ration credit even at the best of times in order to ensure that borrowers with sensible investment projects stay among the loan applicants – if rates are raised to equilibrate demand and supply, the resulting interest rate would be so high that only speculative projects would remain and banks’ loan portfolios would be too risky. Link

Banks are reducing interest rates to flush out those with pristine income generating mechanisms and excess collateral to borrow to speculate - hence access to credit for the majority is tight and reducing.

The collective NZ bank balance sheet contracted in the month ending 30 September 2020. A drop in retained earnings will curb lending if regulatory capital capacity is constrained.

So does that basically mean that banks are reducing their 'price' in search of customers who can afford their 'product', this being limited by customers with sufficient collateral and income?

If so are the banks leading interest rates down, or is it the RBNZ driving rates down? It has always seemed to me that the RBNZ reacts rather than acts.

And if interest rates keep trending down, can the banks continue to make the same income/profit?

Yes and,

RBNZ follows commercial/market interest rates down and bank profitability is constrained as they fall.

Thanks Audaxes.

My view is that private bank created credit ( inside) is a claim on money ( outside money).

To argue that central bank money is not money is wrong ... In my view.

RBNZ like many other reserve banks in so called developed countries have lost the plot and are so nervous and unsure of future that are going in extreme with monetary policy along with government stimulus, we are now living in unreal world where people are looking jobs and businesses are shutting but because of reckless policy by reserve bank stock and housing market are touching all time high on a daily basis.

"The RBNZ’s policy is futile and potentially creating dangerous distortions in the economy."

Yeah, it's what we have all been saying for the past year, if not decade.

Best thing now the RBNZ could do for the currency is to print money and give it to all and sundry. In fact, they should do this for a year, set it at about $250 pw. The bill for that would be about $50b. Can't afford it though right? Well, they are already giving $100b to banks and asset owners, so they definitely can.

Spot on, a temporary UBI would work as a means of increasing economic activity, the policy of giving more to the rich so the poor can gather the breadcrumbs falling off the table is yet another neoliberal fantasy that has been proven wrong again and again and which nobody in their right minds should keep believing in the 21st century.

They are not being "given" money, they are having their money returned to them. The government is repurchasing its debt and paying back borrowed money. This money was created by previous government deficits as all government spending involves the creation of money. The government spends first and then borrows afterwards or there would be nothing to borrow.

As explained here.

The common view is that QE is “printing money” and “injecting money into the economy”. It is of course no such thing. MMT shows that QE is merely an adjustment of the liabilities of the government sector.

https://gimms.org.uk/fact-sheets/quantitative-easing/

I completely agree with you treadlightly. However I have to put it into common parlance that we are "printing money" or people don't get it.

"The clear message from the corporate world, and also the banks themselves, is that business firms do not want to borrow any more (most are reducing debt levels).... the RBNZ’s policy is futile and potentially creating dangerous distortions in the economy".

Exactly right. The RBNZ's policy is not just futile, it is reckless, dangerous and against the very reason why the RBNZ exists in the first place: to ensure the soundness and solidity of the NZ financial system.

How long do we need to wait before Orr and Co. are sacked and replaced by somebody with some competence and sense?

They are not just further inflating an already inflated bubble, they are doing it when the economic conditions do not justify a further increase in asset bubbles at all. Utterly irresponsible and preparing the ground for a potentially catastrophic realignment and re-balance in the future. Savers, watch out for OBR events once this happens.

The unpredictability is the one thing I like about Orr's approach!

There's a paradox: if the RB's actions are too predictable and the signals too reliable, they get priced in immediately, which leaves the RB with little room to move.

Imagine if the RB was brave enough to raise rates without warning tomorrow. Just a little -- to jerk the chain, and remind the markets that rates can move in both directions. It would force investors to think more about fundamentals and where real growth will come from.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.