Summary of key points: -

- Kiwi dollar’s sideways shuffle approaching an end-point?

- Will the RBNZ be the circuit-breaker to the NZ dollar impasse?

Kiwi dollar’s sideways shuffle approaching an end-point?

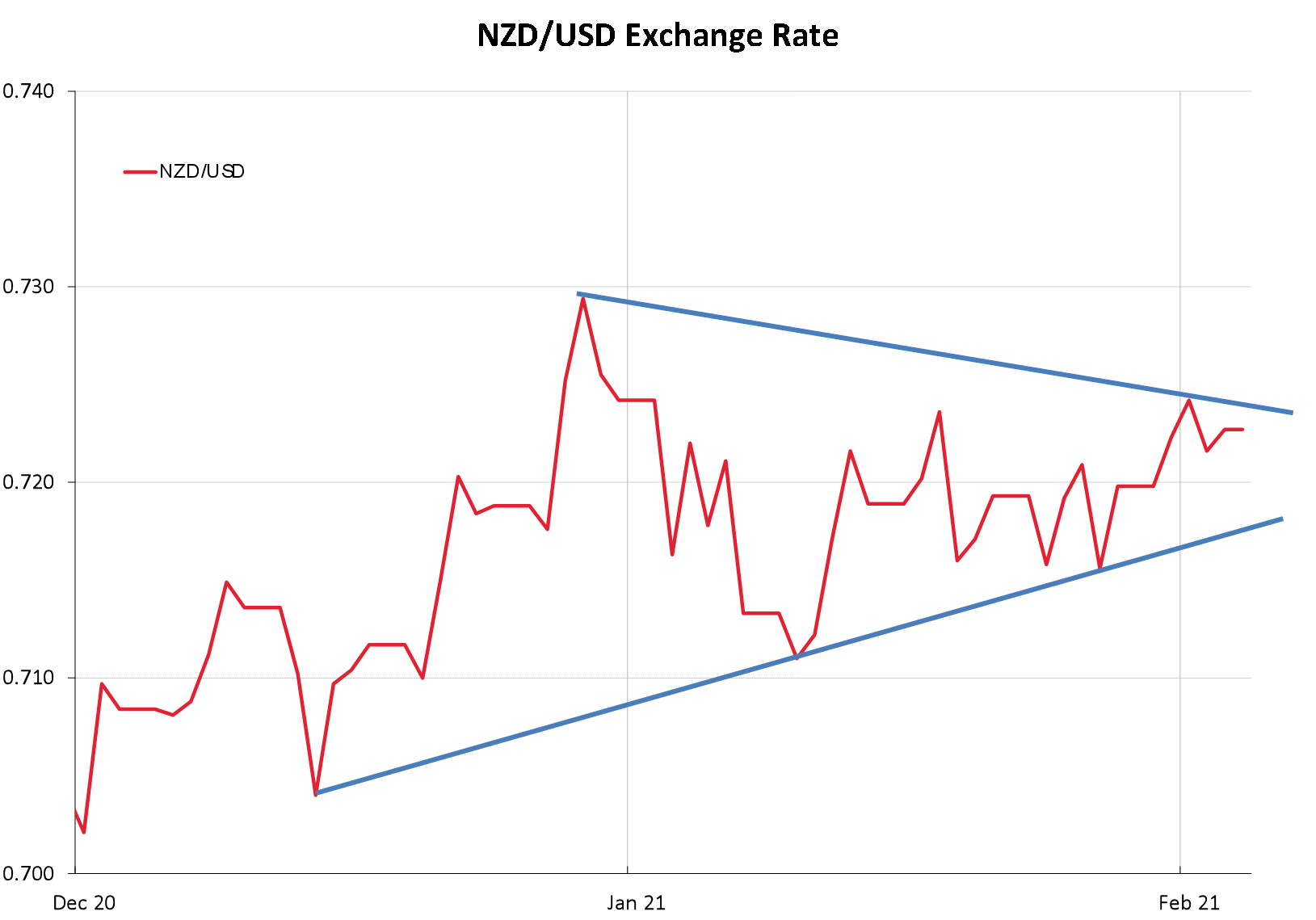

The sideways shuffle of the NZD/USD exchange rate across the page between 0.7100 and 0.7300 continues. The day-to-day price action is driving the rate into an ever-converging wedge shape and an ultimate end point that is not far away.

The Kiwi dollar is reflecting and following identical trading patterns and ranges in the AUD/USD rate (0.7600 to 0.7800) and the EUR/USD rate ($1.1950 to $1.2300).

These tighter exchange rate movements have been in train for six weeks now after the Kiwi and Aussie currency values raced higher over the Christmas/New Year period.

As stated previously in this column, it is instructive for the future direction that the NZ dollar has been unable to record further gains despite more positive than expected local economic data for jobs, inflation and dairy commodity prices.

Whilst the speculative NZD long position holders and buyers may be exhausted and not prepared to aggressively bid the Kiwi higher above 0.7250, on the other side, no catalyst has emerged to prompt wholesale selling of the Kiwi dollar to take it lower.

A downward correction in US equity markets was identified as the likely candidate to turn the Kiwi dollar direction around, however to date, that has not materialised for the following reasons:

- US share markets were buoyed by the Covid vaccine roll-out and massive Government fiscal stimulus packages improving future economic conditions.

- Weaker than expected economic data (January employment numbers and a tame January inflation print) seducing the equity markets into believing that the Federal Reserve will need to announce additional monetary policy stimulus.

- Latest US company earnings reports generally stronger than the market had forecast.

With the equity markets continuing to rise to new record highs, the global forex markets have not been prepared to buy the USD and strengthen it below the key $1.2000 level against the Euro.

The US dollar is far more likely to make gains against all currencies if the equity markets are falling in a “risk-off” mode and it benefits from safe-haven inflows. However, it appears it is only a matter of time before the FX markets recognise that the forward-looking economic indicators (e.g. ISM manufacturing survey) are improving at a superior rate for the US economy as compared to a struggling Europe.

The US employment and inflation data that has temporarily halted the fledgling US dollar rally are historical and backward looking.

The Federal Reserve would only need to increase their monetary stimulus if there was conclusive evidence that the US economy was falling back into a second hole. That is certainly not the case, and upcoming economic data releases will evidence an improving trend. If Wall Street is expecting more candy from the Fed to support their outrageously inflated stock valuations, they will be disappointed.

Will the RBNZ be the circuit-breaker to the NZ dollar impasse?

What will be the circuit-breaking event or development that will end the current six-week sideways impasse in the NZD/USD exchange rate?

The Reserve Bank of New Zealand’s Monetary Policy Statement on Tuesday 24th February stands out as a likely candidate to break the Kiwi dollar’s shackles.

A dramatic break-out from the NZD/USD converging wedge trading pattern is building up, and in the opinion of the writer it is unlikely to be out the top-side above 0.7300.

A number of economic forecasting houses are predicting that the RBNZ will be the first central bank in the world to increase interest rates and therefore the local financial markets are starting to factor in a more upbeat assessment on the economy by the RBNZ next week.

To the contrary, the tone and inference in Governor Adrian Orr’s updated economic assessment is likely to be much more cautious, dovish and circumspect due to: -

- The V-shaped economic recovery in 2020 was largely due to the massive monetary (and fiscal) stimulus. They will not risk harming that economic recovery by removing the monetary stimulus too early. A continuation of the recovery will still require ongoing super-loose monetary conditions for some time yet in their eyes.

- The RBNZ’s visits to companies at the coalface of the economy will be telling them that there are still major challenges in the labour market, and they will not read anything positive into the “rogue” December quarter’s figures that reported a sharp drop in the unemployment rate.

- They will observe the current increase in inflation (well above their previous forecasts) as temporary in nature and largely due to the supply-chain/shipping problems causing shortages of imported product. The supply-chain issue will right itself by June by all accounts. However, a 14% local government rates increase will be of concern to them!

- The RBNZ will also point out that current monetary conditions in the economy are tighter than they desire due to the NZ dollar Trade Weighted Index being at 73.60, compared to the 71.50 TWI level that the RBNZ are basing their economic forecasts on.

- The last thing the RBNZ want is the housing speculative bubble bursting badly and adversely impacting on the economy (therefore threatening their inflation and employment targets). Loan to value ratios have been adjusted and they are still pushing the Government to allow the use of a debt-to-income ratio tool as well.

- With our borders remaining shut for a while yet, the RBNZ will be cautious with GDP growth forecasts for 2021. i.e. not expecting a repeat of the consumer spending frenzy we saw towards the end of 2020.

- Covid-related global economic risks will still be rated by the RBNZ as on the elevated side*.

- The Reserve Bank of Australia recently surprised the markets with increased quantitative easing as they do not see wage increases occurring to push up inflation. The RBNZ are unlikely to project a polar opposite viewpoint on this.

In summary, the RBNZ will be super careful not to say anything that would be interpreted by the financial markets to push the Kiwi dollar higher. If they deliver a statement consistent with the points listed above, the greater probability is the markets reacting by selling the Kiwi dollar on the day and thus a break-out to the downside.

*This article was written prior to the new reported community Covid cases in Auckland.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.