By Roger J Kerr*

After being sold down to a low of 0.6730 two weeks ago on supposedly weak NZ employment data, the Kiwi dollar has staged a rapid recovery back up to 0.6860 as the local forex market reacted to the RBNZ’s Monetary Policy Statement on Wednesday 13th February.

The “herd mentality” has proven to be alive and kicking in the local foreign exchange market (whom the former Prime Minister, the late David Lange once famously labelled as “reef fish”) as all and sundry were convinced ahead of the release that the RBNZ was going to issue a dovish statement and forecast OCR cuts.

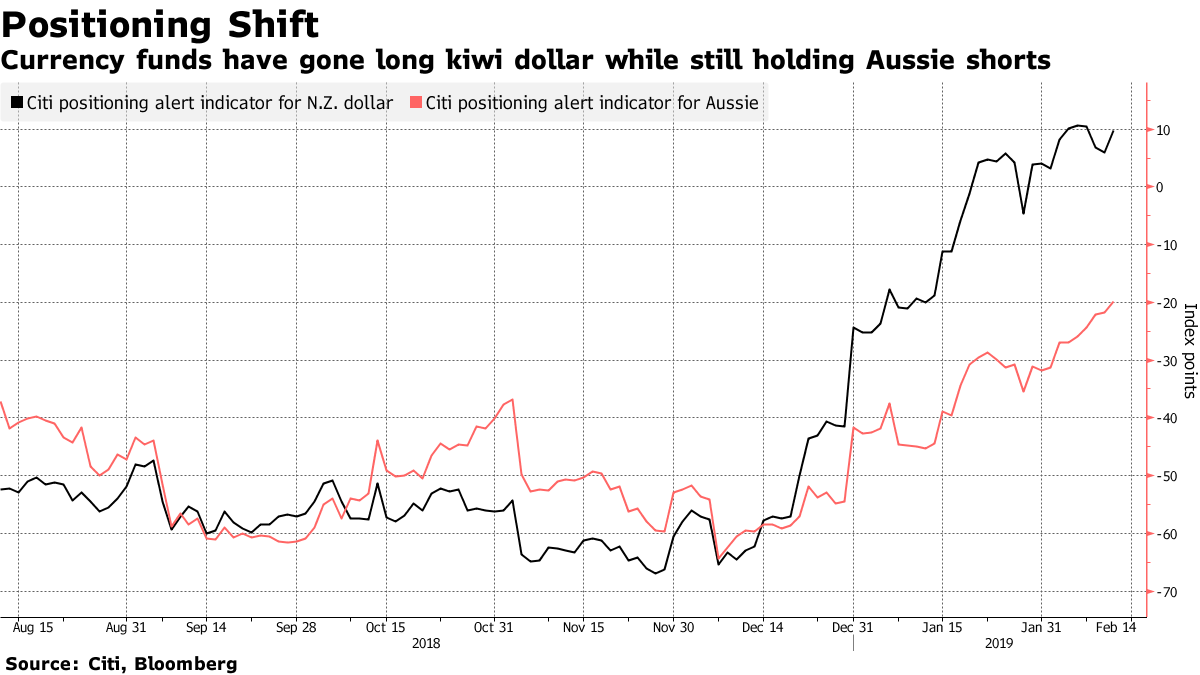

The currency market went into the statement heavily “short-sold” Kiwi dollars in high expectation that the RBNZ would signal interest rate cuts, and thus the Kiwi would further depreciate.

Unsurprisingly (to readers of this column at least), the RBNZ was not as dovish and negative on the outlook of the economy as most expected.

All the “short-sold” punters were forced to buy back their Kiwi dollars, causing the immediate reversal in direction to above 0.6800.

The RBNZ did however return to their April and August 2018 mantra that there was an equal probability of the next OCR change being both up and down.

Two weeks ago, this commentary suggested that the RBNZ would not surprise the markets in 2019 with their monetary policy signals and statements to cause NZD/USD exchange rate movement volatility. On this occasion, the FX market were the ones who caused the surprise on themselves as they worked themselves into a frenzy about likely interest rate cuts, mainly because the US Fed Reserve and RBA has recently changed their monetary policy signals/outlook.

When the RBNZ delivered a fair and balanced assessment on the economy, the markets were forced to back-track.

The previous medium-term view of a 0.6800 to 0.7000 trading range for the NZD/USD rate remains intact.

Global risks lower and dairy prices higher

The RBNZ still see positive GDP growth in New Zealand through 2019 and 2020 with loose monetary policy and Government fiscal spending being two factors supporting the continued expansion. Inflation is not being forecast to decline below 1.00%, so there is no justification for forecasting or expecting OCR interest rate cuts. Whilst some local economic data has been marginally weaker of late, there is nothing to suggest that the NZ economy is stalling or at risk of a major downturn this year. In their statement, the RBNZ appear to be somewhat behind the eight-ball with their talk of “softening in our commodity prices” and global “economic risks increasing”. To the contrary, over the last six weeks our dairy prices have zoomed up 19% from US$2,700/MT to US$3,200/MT (whole milk powder). The international risk environment has arguably reduced over recent weeks with share markets recovering strongly from the October to December rout and trade war risks also reducing as the Chinese and US negotiators make productive progress in their meetings. Commodity and growth currencies like the NZD and AUD stand to gain the most if the US and China reaches a trade deal to cut tariffs. The next few weeks will be a crucial time in this respect. President Trump now more desperately needs a win, thus a compromised deal with the Chinese looks far more likely than what it did three months ago.

Hallelujah! RBNZ finally see competition as key inflation control

One encouraging aspect of the RBNZ’s monetary policy statement was the highlighting of “competition” in the economy as being the major factor that keeps inflation low (hallelujah!). I have been banging on to the RBNZ for many years that they need to recognise and factor this in. Business firms have been experiencing several cost increases over the last 12 months; however the competitive environment in many sectors has meant that firms have not been able to fully pass on cost increase by raising prices. Ultimately, selling prices may have to rise as profits can only be squeezed for so long.

Naive NZ Government about to learn the hard way

Whilst rising commodity prices and a less dovish than expected RBNZ have been Kiwi dollar positives, the NZ Government’s recent handling of our relationship with our largest trading partner, China detracts from those positives. China’s recent and not so subtle economic retaliation against New Zealand due to our abrupt and pro-American ban on Huawei is not good news for the NZ economy. There are smarter ways to handle a delicate situation with the Chinese than “naively” banning their technology provider i.e. The Government expressing concern through diplomatic channels first. Like the sudden and Draconian banning of foreign investment in our oil and gas exploration last year, the current Government continues to shoot itself in the foot when it comes to understanding what side of the slice of bread is buttered.

Aussie dollar continues to defy the pundits

It is highly constructive and telling for future AUD movements against the USD that the Aussie dollar remains above 0.7100 despite all the recent negative news and forecasts for the economy/currency. Over recent weeks that AUD has not been sold sustainably lower, even though the RBA changed its monetary policy stance/forecast and worries abound about their housing market. The hedge fund speculators are already heavily short-sold AUD’s in anticipation of further depreciation. As that expected weakness in the Aussie fails to materialise over coming weeks, watch out for AUD gains to 0.7200 and 0.7300 as those same punters close-down (buy back AUD) their positions. Australian metal and mining commodity prices have increased significantly of late, the economic conditions for Australia will be vastly improved due to those price lifts and also if a China/US trade deal is agreed.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

3 Comments

Roger the Dodger.The NZD opened the month at 0.6918 against the USD , currently lower at 0.6855 ? The Aussie which you have repeatedly stated in your column , could not possibly go lower ( particularly with a surge in iron ore prices )against the NZD, hit a two year low last week. If everything globally is better why are so many central banks backtracking, including the RBNZ. .Average fuel prices on track to fall 10-12 percent on Q4/Q1 , lets see if inflation does not fall below 1.0 percent, or maybe its just rodgy data .

"Australian metal and mining commodity prices have increased significantly of late"

Yes. But not due to the Aussie economy, or even the Chinese one, doing better, but because of the dam disaster in Brazil, and

".. the economic conditions for Australia will be vastly improved due to those price lifts "

Mining revenue is almost insignificant to most Australians. It doesn't flow back into tax revenue or a resources rent tax etc. It benefits some small % of commodity exporters ( eg: Fortescue Metals) but their commodity boom is into the export stage now, and not construction - which would ( and did!) have shown a bigger 'improvement' to the economy.

El Toro!!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.