Confidence appears to be the missing ingredient as we head, already(!), into the second half of 2025.

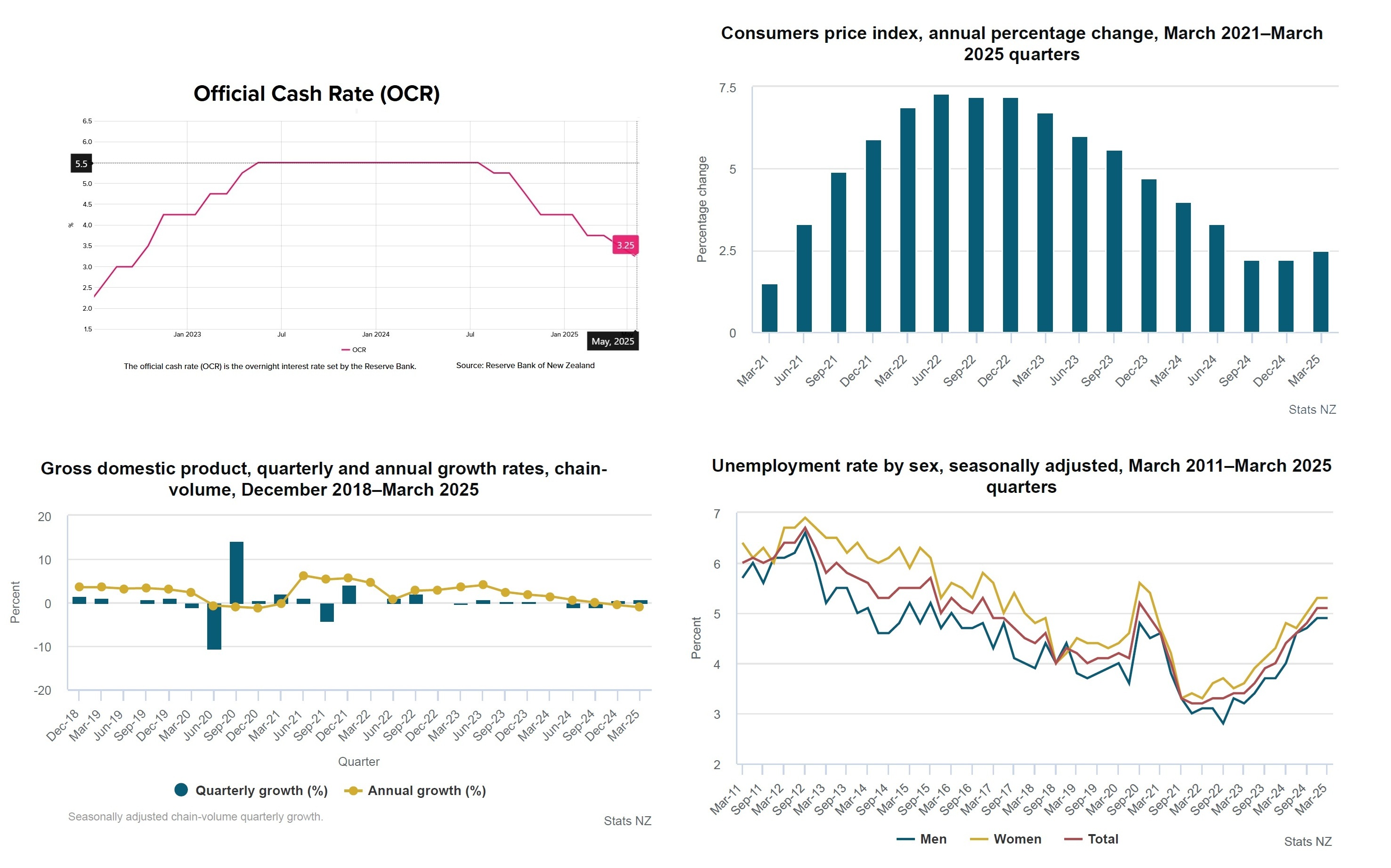

Going back to the second half of last year, the Reserve Bank’s decision to start cutting the Official Cash Rate (OCR) from the cycle-high level of 5.5% in August 2024 appears to have prompted a round of what might be termed ‘relief confidence’ within the country.

There had been earlier fears that interest rates could stay higher for much longer. So, there was a resurgence of surface-level confidence in late 2024, which fed into the start of this year.

However, it was brittle, and as we hit the halfway point of 2025, it seems the confidence is wavering again.

Whether the confidence to spend and invest will truly return during the remainder of the year will be key in deciding if this year marks the beginning of an upturn, or simply marks another period of marking time.

The search for recovery

The big question for this year was always going to be how quickly or otherwise our economy might start to recover from the high interest rates (raised so the RBNZ could combat inflation that went as high as 7.3% in mid-2022) and from the resultant recession, which saw our economy (as measured by GDP) contract by 1.0% in both the June and September quarters of 2024.

As is much talked about, there’s a fair lag on us seeing some of our economic data. That means in terms of discussing what’s happened so far in 2025 we need to spend a bit of time talking about late 2024.

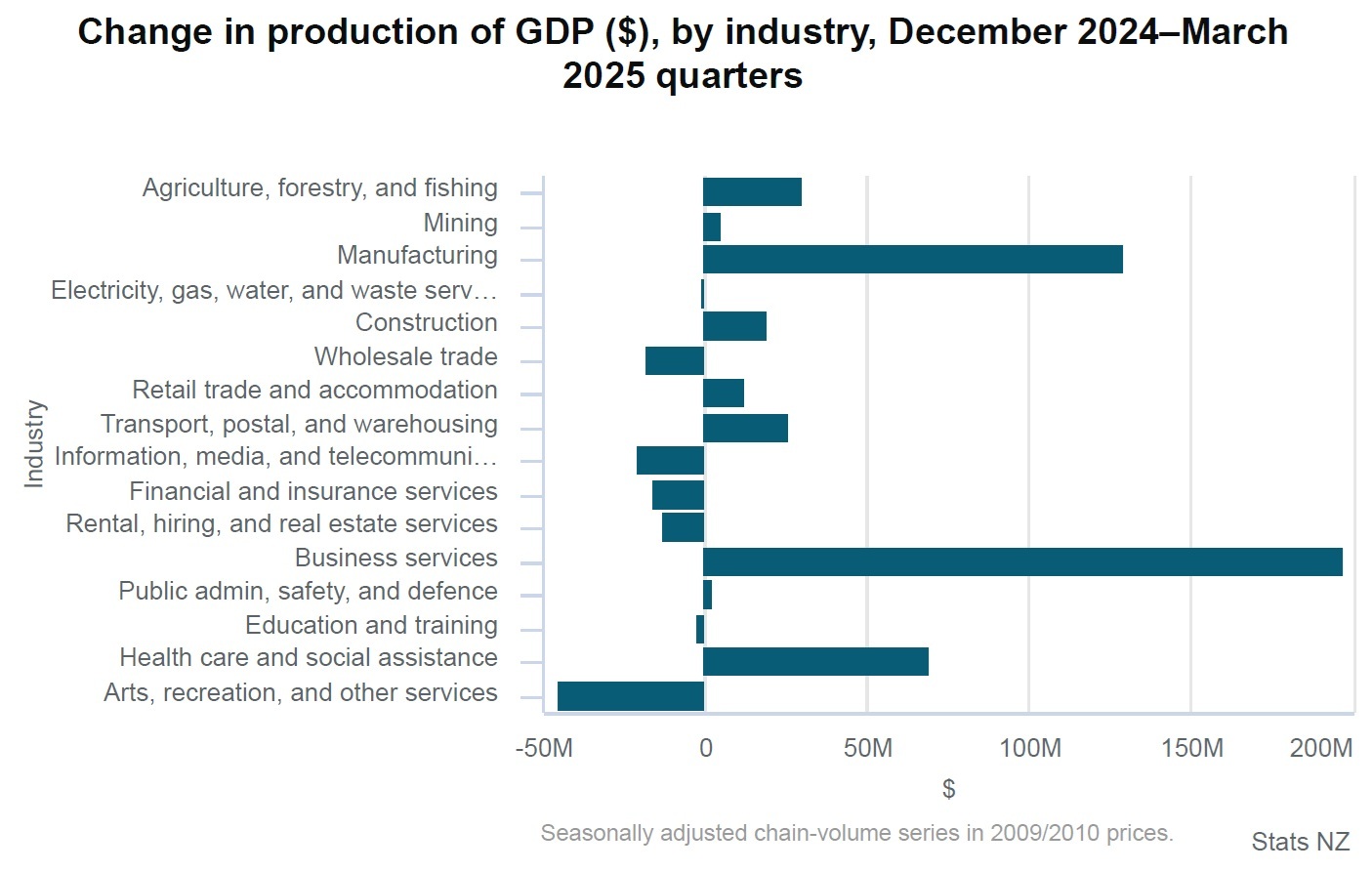

GDP figures for the December quarter (not released till well into March 2025) showed we had emerged from recession, with a 0.7% lift (subsequently revised down to 0.5%). This was followed by a 0.8% rise (announced last week) for the March 2025 quarter. That 0.8% figure was double what the RBNZ forecast.

So, happy then? No. That’s because lower-level ‘high frequency’ data is suggesting that the ‘pause’ button might have been pushed in the June 2025 quarter that’s about to end (and for which GDP figures won’t be released till September).

After an apparently relatively bright start to the year, confidence has dropped again.

It’s an open question how much of this pausing in the economy has been directly prompted by the ‘Liberation Day’ tariff bomb dropped at the start of April. I would say a lot.

When I previewed 2025 at the end of last year, I said we as a country needed to, as much as possible, not second guess developments stemming from the United States.

However, with the best will in the world, it’s hard to ignore a President intent on not being ignored and attempting to provoke responses through every action and utterance.

For businesses, uncertainty is the biggest enemy. Tell a business that things are going to be bad and detail exactly how and why things will be bad and businesses will actually react positively to that, roll up their sleeves, and get on with it.

But tell them ‘we don’t know what’s happening’ and paralysis sets in. Which means no spending. No investment. No bold decisions. Business. Goes. Backwards.

Evidence we have reached one of those moments is provided by the fact that both the performance of manufacturing and performance of services sector indexes sharply retreated in May. Then there’s the monthly electronic card transactions data, which shows retailing desperately struggling to get traction. Then there’s a housing market, which is recovering from the big slump of 2023 in terms of activity but is being weighed down by plenty of properties in the market.

On our toes

And in the meantime the aforementioned President is backing up increasingly out-there statements with some pretty out-there actions. We are on our toes. It is hard not to be, much as we might try.

In terms of the hard data of where our economy sits right now, we know that inflation as measured by the Consumers Price Index was 2.5% as of the March quarter. The RBNZ seeks inflation between 1% to 3% with an explicit target of 2%.

So, we are doing okay on inflation, but indications are (not helped at all by a 4.4% food price rise in the year to May), that we may well see annual CPI inflation blip to about 2.8% in the June quarter. Well, that's still below 3%, but not by a lot.

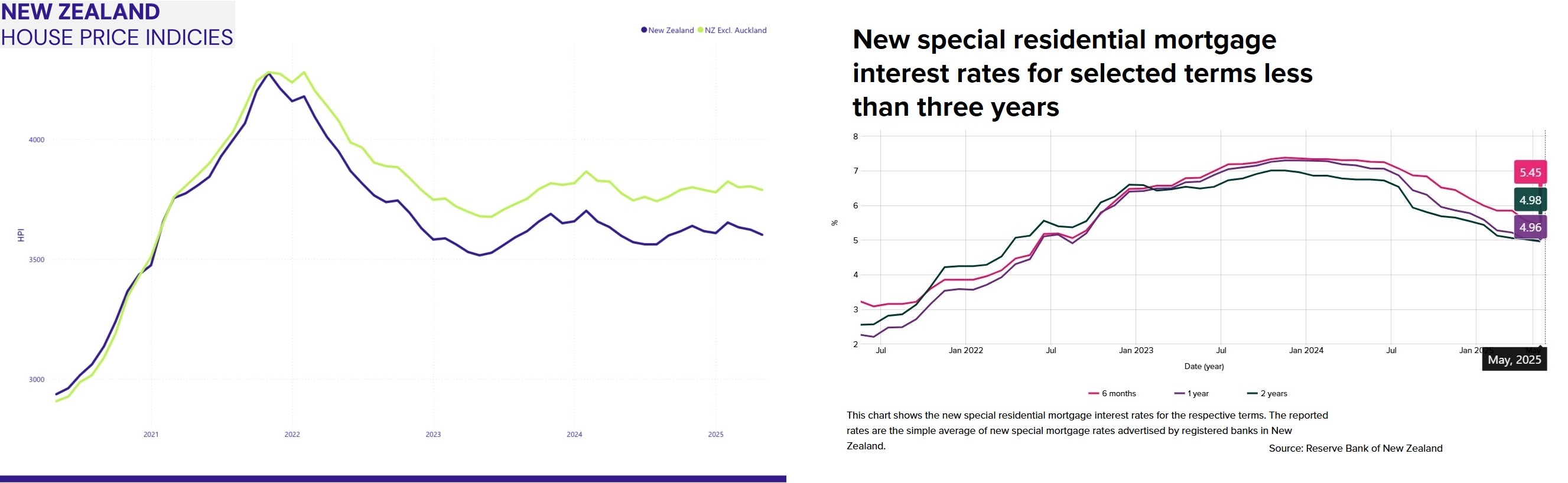

What happens then to the OCR? This is important. Mortgage rates have come down a lot since the middle of last year, but they might not come down much more without further meaningful drops in the OCR. Main bank economists are a bit split on this. Some are still saying the OCR will get down to 2.5%. Others are more leaning towards 3.00% as the bottom - and market pricing is tending to lean that way too (current pricing has a low point of 2.9% early next year).

Unemployment, having risen from 4.00% to 5.1% in 2024 paused at 5.1% in March, but the monthly Employment Indicators are suggesting there may be a bit more of a rise to come - and economists reckon that any decline later in the year is likely to be slow.

We think GDP will have slowed in the middle of the year. The RBNZ actually forecast a slowdown before the more recent ‘high frequency’ indicators showed as such, picking in May that the June quarter GDP would be 0.2%. Economists at the country’s largest bank ANZ this week cut their June quarter forecast to just 0.1% from 0.4%. So, not great. BUT at the same time the ANZ economists said they expect annual average growth to come in at 0.9% over 2025, rising to 2.4% in 2026, and 2.7% in 2027.

Then there’s that housing market. Late last year every person and their pet in the economics field was shooting for a price rise of 5% to 7% in calendar year 2025. But the sheer weight of houses for sale is forcing these guesstimates down. The RBNZ was actually the first off the mark on this as far as I can see, in February cutting its forecast of price rises down to 3.8% for 2025 from its November pick of 7.1%. In May the RBNZ trimmed that forecast further to 3.5%.

Now among the main bank economists, forecasts of about 2.5% are becoming the new 7% as the pile of for sale properties stubbornly refuses to shrink.

Until our housing market finds more buoyancy, it’s hard to see the confidence levels among the New Zealand public rising meaningfully.

There’s no doubt Kiwis are more encouraged to spend when the housing market is simmering (our trouble is we bring it to the boil too often for our own good).

So, as the first half of this year ends, I think we are in an interesting (but not in a good way) loop. We need more confidence, but where is that confidence going to come from?.

If the global situation continues to threaten to upend us, then the RBNZ may be forced to drop the OCR still lower. That would provoke more meaningful mortgage rate drops and produce more money in the pockets.

In such circumstances maybe more spending and investment will follow and by summer things will be looking better.

However, it has to be said that at the halfway point this is still a year that could ‘go either way’. I’m going to put the optimist’s hat on and say it will improve. The global situation will at least stabilise. Confidence will rise, people will start to spend, the economy will start to roll. That's what I think now. But I’m the first to concede I could be wrong.

15 Comments

Fiscal policy - the invisible unspoken phrase in NZ economic circles. In a fiat currency monetary system the government is a significant contributor to new money as it creates and spends debt-free before anyone else in the economy.

The major fiscal policy contributions from the current government have been: a direct increase in unemployment through reductions in the public sector and a deliberate erosion of business confidence by the termination of billions in current and future investment.

Unemployment is still rising, no sign of investment growth - the NZ economy is going nowhere. No need to concede being wrong on that.

Yes. Smoke and mirrors are deployed while Ms Willis takes the knife to everything in the background.

In a fiat currency monetary system the government is a significant contributor to new money as it creates and spends debt free before anyone else in the economy.

The money supply is more impacted by private money - credit creation. Which in the Anglosphere is the Ponzi mechanism. The Bank of England admits this.

You're correct that the greatest amount of new money in the economy is created through private sector credit growth. But this is constrained by debt repayments and risks to both the lender and debtor. And low interest rates in a weak, contracting economy do not mitigate those risks.

Government spending, on the other hand, is only constrained by inflation risk - not debt repayments or tax revenue for that matter. Therefore, it can and should be used counter-cyclically to maintain a healthy economy. Especially when economic growth and inflation are both low.

FFS - still that nonsense?

Government spending, as eventually all spending, is on resources and energy. The combined 'spend' has been growing exponentially, and this is a finite planet. That is compounded by us extracting the best, first. So both forms of entropy increasingly apply.

Your comment is linear. Therefor - while perhaps correct as to the last few decades - invalid in the long view.

You cannot 'maintain a healthy economy' without resource and energy stocks, and without sink-capacity (for wastes).

Can I suggest you find the time to watch this? https://www.youtube.com/watch?v=DVp5YvMemaI

Those are valid points and I agree that eternal economic growth based on consumption and resource extraction are not ideal. My comment about government spending was within the context of the article which is questioning why there is no economic growth in the NZ economy based on 'mainstream' concerns.

I have confidence that there is a speculative bubble in assets from printed money sloshing around. Exaserbated in little ol NZ by the tax free nature of certain assets.

I have confidence that there is a speculative bubble in assets from printed money sloshing around d. Exaserbated in little ol NZ by the tax free nature of certain assets.

People need to understand that asset bubbles can be permanent. The ruling elite knows that. They know the power that they wield. But they can't make people specu-punt like in the past. That's the rub.

And where they're less knowledgeable is how the trade offs impact on the socio-economic landscape. Behind closed doors, they will be frustrated that the hoi polloi are not spending like drunken sailors like in the glorious pre-Covid days. Because without people living paycheck to paycheck, the ruling elite not going to get the results that they want.

"Until our housing market finds more buoyancy, it’s hard to see the confidence levels among the New Zealand public rising meaningfully"

I surely can't be alone in finding that rather sad. Houses should simply be for living in, not seen as a major part of the economy. The stupidity is that more most people, any gain they make is simply absorbed in the much higher price they have to pay for the step up the housing ladder. So who really benefits? The RE agents and the banks.

Until our housing market finds more buoyancy, it’s hard to see the confidence levels among the New Zealand public rising meaningfully.

The recurring narrative. The Ponzi is underpinning everything. But nobody wants to say it. We're running out of ideas.

If rising house prices are the be-all-and-end-all, we've got to be honest about it and think what can be done. Maybe we need to look what they're doing elsewhere. For ex, Queensland has just announced a shared equity scheme where marginal buyers only have to stump up a 2% deposit. And in Tassie, they've also announced they will boost grants for people building building new homes.

Sounds like state-sponsored sub-prime? Maybe. But at least they're doing something. Little point going all in and having no conviction.

It's not confidence we're running out of

https://www.youtube.com/watch?v=DVp5YvMemaI

But David reports on a 'discipline' which doesn't account for what we are running ever-shorter of.

Yes Power. At the WEF, Jane Goodall has suggested that we need to reduce the human population down to 500 million people, a drastic 93% reduction from today's numbers, to make the world a much better place.

That would mean most Aotearoans would have to go to the gas chambers (the Mowbrays and Graeme Hart, all current and ex-ABs, Jacinda Ardern would have exemptions). The problem is that the Maori population would need to be included in the cull. Nobody would be brave enough to make that call.

I'm not saying that - indeed it's almost a shoot-the-message/enger.

But I'm pointing out that the fiercely-chosen blindness of most journos precludes rational discussion.

Phoenix,

In any scenario where 80/90% of the world's population needs to be eliminated, perhaps you will be one of the lucky ones and rise from the ashes of humanity. She is not alone in her view, I can think of someone much closer to home who also believes that earth's carrying capacity is at best 1 billion, but seem somewhat reluctant to spell out just how this is to be achieved. Nor do they state on what evidence they rely for their figures.

Confidence? Yeah Nah.

What is needed is intention and skill.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.