So, are we beating this inflation thing, or is it beating us?

We'll get some answers this Friday (January 23) when Statistics NZ releases December quarter Consumers Price Index (CPI) figures.

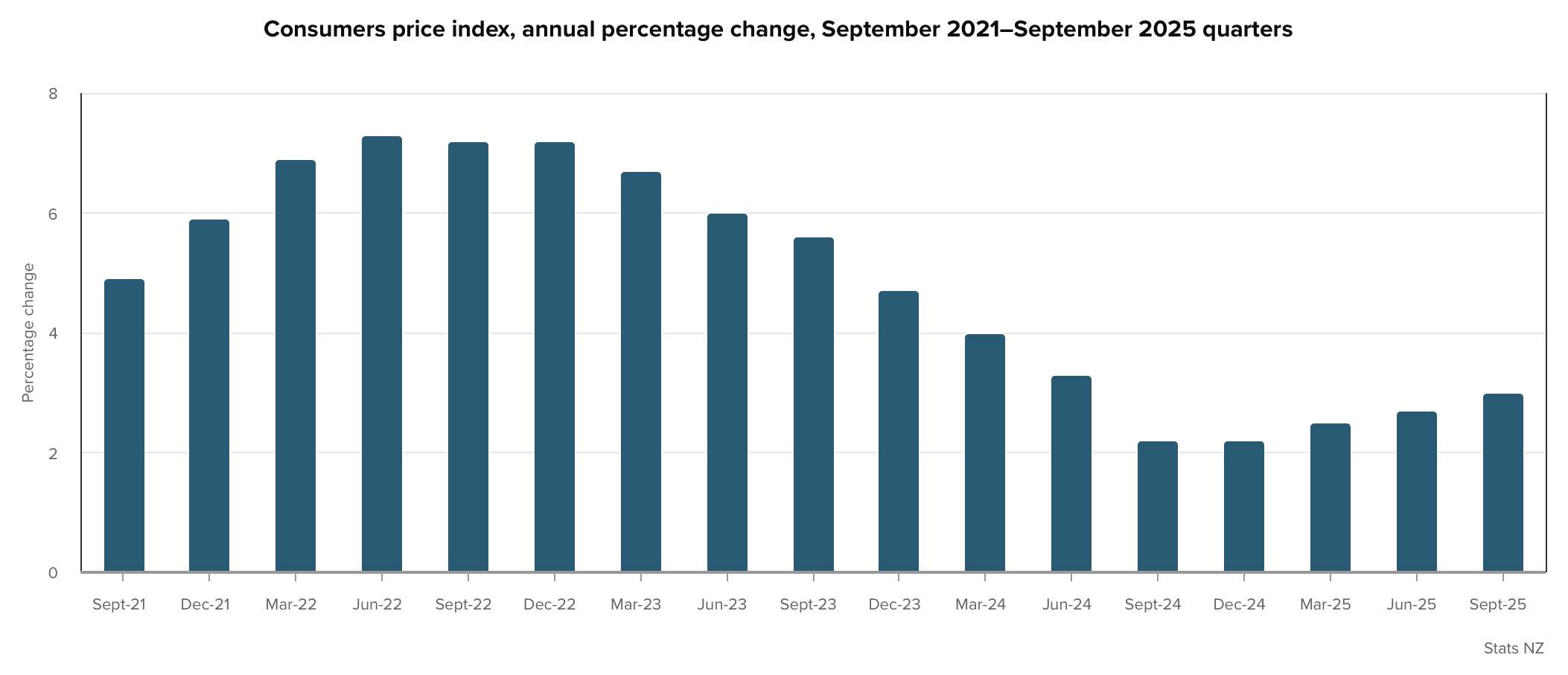

If we recall, the September quarter CPI showed annual inflation of 3.0%, up from 2.7% in June.

Last Friday's monthly release of Selected Price Index (SPI) figures, which contain around 47% of the CPI ingredients, showed some higher than expected inflationary pressures and as a result, major bank economists tweaked their forecasts for the CPI figure up a little.

Most expectations have settled for a figure of 3.0% for the coming Friday's figure, though I don't think anybody will be too surprised if its a little higher than that.

Well, the Reserve Bank might be a bit surprised, given that it has forecast a 2.7% figure - but in fairness that pick was made in November before much more recent information was available.

And of course these figures are of great interest to the RBNZ, given that it is charged with achieving inflation between 1% and 3%.

If we recall, in the wake of the pandemic disruptions, inflation charged away from mid-2021, reaching a peak in June 2022 of 7.3%.

The RBNZ brandished its main inflation weapon the Official Cash Rate, hiking it all the way from the pandemic emergency setting of 0.25% to a high of 5.5% by May 2023. The consequent sharply higher mortgage rates crimped spending and ultimately took the steam out of the economy, leading eventually to a recession.

But we got inflation down. It dutifully trotted back into its 1% to 3% box in the September 2024 quarter, actually falling as low as 2.2%. Within that 1% to 3% range the RBNZ explicitly targets 2% inflation and it looked in late 2024 as though that was going to be achieved. But events haven't panned out like that.

The big drops in inflation that were seen during 2024 were in large part driven by so-called tradable inflation (think imports and things like oil prices), while the domestically generated (non-tradable) inflation was slower to react. Well the domestic inflation has continued to fall - albeit not as quickly as would have been liked (and shoppers can quickly point to the fact that annual food price inflation was still running at 4.0% as of December). And this stubborn domestic inflation has now been joined by firming tradable inflation as well, with petrol prices notably rising.

So, assuming the annual inflation rate at the December quarter comes in at 3.0%, if not even a touch higher, where to from here?

Well, that's the interesting bit.

New Reserve Bank Governor Anna Breman fronts her first Official Cash Rate review on February 18. This will give us our first serious reading on what to expect. Is Breman a dove? A hawk? Neither? We'll get some clues from the tone, particularly of the accompanying media conference after the decision is released. And I'll have more to say on what we might expect closer to the time.

This may therefore be the moment to bring in some of the major bank economists and see what they are expecting from the inflation figures.

The Kiwibank economics team of chief economist Jarrod Kerr, senior economist Mary Jo Vergara and economist Sabrina Delgado, are picking 3% annual inflation.

"Increases across some of the more volatile items of the [CPI] basket are likely to keep the headline rate elevated. But under the surface Kiwi inflation remains soft with further cooling in domestic inflation expected," they say.

"While such a read [of 3% annual inflation] would top the RBNZ’s 2.7% forecast, we don’t expect the overshoot to set off any alarm bells at the Reserve Bank. Continued strength in imported inflation, exacerbated by a weaker Kiwi dollar, is the main culprit. And we’ve seen increases in some of the more volatile and seasonal prices, including petrol, airfares, and accommodation. We’re expecting tradable inflation to have lifted 2.4% over the year. Domestic price pressures, however, continue to cool given excess capacity in the economy. We expect non-tradables inflation eased to 3.3% from 3.5%. And we expect core measures of underlying inflation to continue following the same downward path."

The Kiwibank economists say while Friday’s release "will show some annoying hot spots of lingering inflationary pressures" the underlying trend should still be one of disinflation.

"Spare capacity still teeming in the Kiwi economy should see further generalised cooling in domestic inflation over the medium term. While a forecast recovery in the Kiwi dollar this year should relieve some of the offshore inflationary pressures. Put together we continue to expect inflation to fall back to the RBNZ's 2% [targeted] mid-point over 2026."

ANZ senior economist Miles Workman, also picking a 3.0% figure, says stronger inflation than the RBNZ's November MPS forecast is likely to keep the RBNZ Monetary Policy Committee [which makes the OCR decision] cautious, "but with underlying inflation still going the right way, the bar for delivering anything other than a hold [at the current 2.25% OCR rate] in February remains high".

"As always, the detail will be key in assessing the monetary policy implications. The RBNZ will be focused primarily on the signals these data provide regarding the trajectory of underlying inflation – particularly those emerging from non-tradable, services, and core inflation measures.

"Core inflation indicators produced by Stats NZ are expected to remain within the 1- 3% target band, with the weighted median, 30% trimmed mean and ex-food, fuel and energy measures anticipated to drop to close to 2%," Workman says.

ASB senior economist Mark Smith is picking a 3.1% inflation figure.

"After helping to dampen overall inflation in 2024 and early 2025, annual tradable inflation is climbing towards 3%," he says.

"Domestically generated inflation is slowing, with elevated costs keeping annual inflation rates above 3%."

Smith says economic spare capacity should work to eventually ease inflationary pressures.

"However, there is the risk that annual CPI inflation will remain somewhat firmer than the circa 2% expectation by the RBNZ over 2026.

"We don’t envisage the RBNZ will be in a rush to change the 2.25% OCR and have pencilled in 50bp of OCR tightening from early 2027, Smith says.

He says, however that the concern is that domestically generated inflation rates are close to plateauing at around 3%, with the risk that they accelerate as the economic expansion continues.

"We don’t envisage the RBNZ will be in a rush to change the 2.25% OCR, but caution that the RBNZ may step in if the NZ economy heats up too quickly."

Okay, so, back to me to finish.

At the moment financial markets are expecting the OCR to be on hold in February, but market pricing is suggesting the OCR may start to move up again in the September quarter of this year, with a 25 basis point rise in the OCR about 80% priced in by the start of September.

Any significant surprises in Friday's inflation figures would be sure to get that market pricing moving forward.

One thing is for sure. Further falls in the OCR now seem off the table.

20 Comments

If the RB shifts its rhetoric from dove to hawk the economy will tank. It doesn't have the strength to withstand a new tightening cycle. Let's see how much weighting the so called mandate really has on decision making.

People were saying the same thing a few years ago when inflation was on the rise and people, including central banks, were in denial about the need to raise rates again.

’The NZ economy will never survive if the OCR goes above 3-4%…if it goes above 5% it will be the end of the world and life won’t be worth living’.

Well those things happened and almost everyone is still here and ok.

Same applies to the current context. Increasing the OCR may actually strengthen the economy by eliminating bad debt from the system an getting back to basics (ie moving away from economic growth based upon debt speculation and asset price increases > productivity)

Yes - burning off those who Dddebt speculated is a good and necessary outcome. Its just happening slowly now at mortgage rates of 4.5 to 6% and still crashing housing market, not allowing Speculand the option of exiting, without major losses.

Some of the losses on forced sales currently, is eyewatering!

The punting Bag holders are being burned badly. They have FAFOed, in what is now a very stupid game of dddebt gambling.

So with NZ inflation now confirmed on the increase, a hike of the OCR to 4.5 to 6%% is required, as per the respected Taylor Rule.

-This will happen, just a case of is being fast or slow. NZ will probably need be to slow and need to hike the OCR higher for LOOOOOONGER.

Increasing the OCR may actually strengthen the economy by eliminating bad debt from the system an getting back to basics (ie moving away from economic growth based upon debt speculation and asset price increases > productivity)

What you describe as "bad debt" underpins the Ponzi. The banks understand this as non-performing loans. They don't recognize it as expansion of money supply allocated to non-productive purposes. They will argue that the Ponzi underpins the productive economy.

Just because they may choose to pop it up 0.25 doesn't indicate this will be the beginning of a tightening cycle again. It would be simply responding to the economic data of the time, something, which if done properly in 2020-2021, would have left us in a much better position as a nation. Instead we suffer confirmation biases, thinking each time will be the same as the last, and forego valid information to the contrary.

It can. Those towing to much debt and overpaying for assets will burn. No bad thing. Will the RBNZ do it's job or will it's international masters tell them to protect the ponzi at all costs.

Come on baby light my fire.

Can you elaborate on why food, fuel and energy are excluded from some of the inflation figures? It cannot just be due to seasonal variations.

Thank you

Can you elaborate on why food, fuel and energy are excluded from some of the inflation figures?

Not comprehensive but the most important thing you need to remember is that the CPI is simply a construct. It can be constructed, adjusted, and manipulated accordingly.

What you should understand is that whatever the real inflation may be, it's in the ruling elite's interest to have it understated. That way the monetary systems work in their favor.

While not denying your comment that others have an interest in manipulating our views of the economy, surely some institution (RBNZ/NZStats??) keeps their bases for calculating these stats the same over a reasonable period of time. Is there no legal or administrative framework that defines these things?

Aotearoa has a clear legal and institutional framework that effectively anchors inflation measurement to the CPI. Stats NZ makes periodic, incremental changes to CPI methodology, mainly around the basket composition, weights, data collection, and technical index formulas. They claim these changes are designed to keep CPI aligned with actual household spending rather than to "structurally suppress or inflate measured inflation."

Suppressing the CPI has political and fiscal advantages: understating inflation makes government, central bank, and corporate obligations cheaper in real terms and public discontent more manageable.

If we wish to control inflation then there are two areas that we need to address (and have failed to do for decades)....our persistent trade deficit and spending distribution. Monetary policy is incapable of addressing either (on its own) and the political class are either too invested or too ignorant to assist.

They should hike the OCR so council rates comes down and Woolworths lowers its prices.

Does not really matter how much the RBNZ hikes the OCR, World bond yields are rising strongly now and the JGB10s just hit 2.30% today.

Japanese Rates & Bonds - Bloomberg - Bloomberg Markets

So international money price is going up a lot in 2026.

No wonder, so may houses have just hit the market anew now in 2026........ its time to get out of financial dodge !

The best price is the one they will get today, come later 2026 to 2028, lower and lower is the choice.

Spruikers be pukers!

Does not really matter how much the RBNZ hikes the OCR, World bond yields are rising strongly now and the JGB10s just hit 2.30% today.

Good to see someone's paying attention. You understand well young Gecks.

Those sweating interest only betting inflation to save them will be sweating. Increased OCR equalsnegative capital growth.

🔥

New Reserve Bank Governor Anna Breman fronts her first Official Cash Rate review on February 18. This will give us our first serious reading on what to expect. Is Breman a dove? A hawk? Neither?

Anna might have to go back to Sweden for family reasons and not get on the return flight. What happens then? I doubt we have too many willing to step up to the plate unless they bump up the remuneration.

For all Trump's weaknesses, at the very least he's raised awareness that central bankers can be criticized and be held to account.

Interesting however, as he bites the hand that feeds him in many respects. He has benefitted greatly from the current Fiat system with the USD as the reserve currency, as did his father before him. He is making off like a bandit for all to see while president e,g comment about stocks etc. Does it serve him well longer term to do so? I think not, but bedamned with the masses for the sake of the few and he'll have a bunker or 10 to hied in when the proverbial hits the fan. Perhaps he is simply trying to influence a system that threatens him due to acting independently from his will.

Interesting however, as he bites the hand that feeds him in many respects. He has benefitted greatly from the current Fiat system with the USD as the reserve currency.

Trump wants a lower cash rate. And preservation of USD dominance is central to his “America First” doctrine, emphasizing its role in cheap financing, sanctions power, and global influence. However, he doesn't seem to be concerned if USD weakens.

Why would you be concerned about a weakening currency if you are prepared to seize any resource you desire?

Strange way of demanding USD dominance to continue as the worlds reserve currency, when his actions only drive other nations to look for an alternative solution. He is the epitome of risk, of which many seek to avoid when stability brings profit.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.