BNZ head of Research Stephen Toplis is raising the spectre of the dreaded stagflation after the latest ANZ Business Outlook Survey (ANZBO) provided another very down beatbeat snapshot of how NZ business inc is feeling.

"...The survey confirms diminishing growth prospects are being accompanied by heightened inflation and an excess demand for labour. In other words – stagflation," Toplis said.

"The big question is, how weak will leading indicators of growth have to be for the Reserve Bank to feel comfortable its targets can be met?

"The RBNZ has confirmed it intends further 50 basis point rate increases [to the Official Cash Rate]. It is difficult for us to ignore its determination to do so and today's ANZ survey should do little to change its course of action given its stated concerns.

"Nonetheless, we remain strongly of the view the economy’s wheels are beginning to fall off and that, ultimately, the Bank may have to rethink the pace and extent of its currently anticipated tightening cycle," Toplis said.

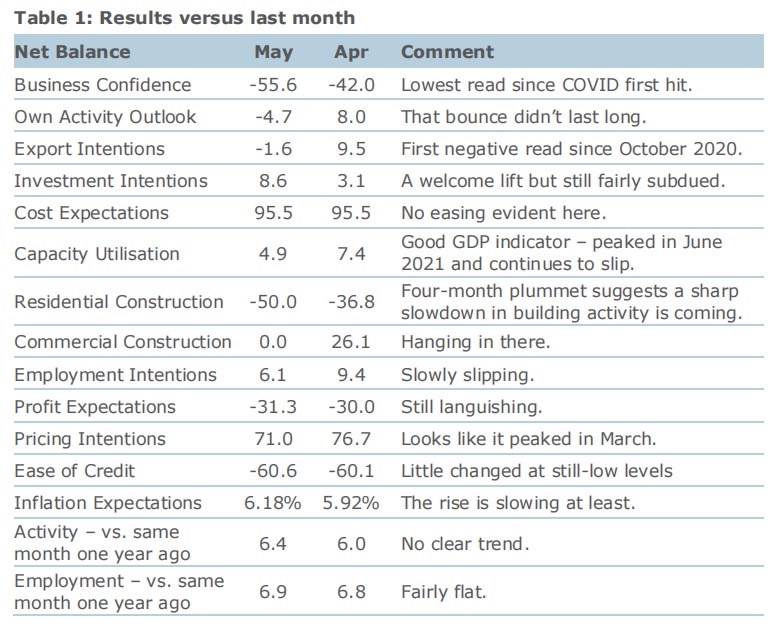

In the ANZ survey, the residential construction sector was sending "dire signals", while across all industries inflation expectations for the year ahead, at 6.2%, are "far too high" according to ANZ Chief Economist Sharon Zollner.

Business confidence fell 14 points in May to -55.6 (the lowest reading since Covid first hit in 2020), while own activity fell 13 points to -4.7.

BNZ's Toplis noted that the RBNZ was “confident” the New Zealand economy can avoid a hard landing.

"We are not so confident. Our forecasts contain just a modest recession but the risks of something much deeper are rising by the day. Today’s ANZ Business survey clearly highlights this. If the RBNZ does push the cash rate to 3.9%, as it projects, the odds of a significant economic correction will be further elevated.

"It is our central view that the peak in New Zealand’s cash rate need not be any higher than 3.5%. Today’s survey leaves us feeling even more comfortable with that view. It is also our view that in the current environment the RBNZ could be more conservative in its approach to interest rate setting. Yet it is not.

"The rational for not being so is that it needs to be certain its targets are within reach. To be so it wants clear signals that inflation is on its way to 2.0% and the labour market is softening towards maximum sustainable employment. Alas, it will not get these signs from today's survey." Toplis said.

Also commenting on the latest survey results, Westpac senior economist Ratish Sanchhod noted that "the times they are a-changin’…and not for the better".

"Nervousness is widespread across sectors. However, it’s notable that sentiment in the residential construction sector has plummeted. That’s not necessarily a reflection on the current state of demand. In fact, this morning’s consent numbers signalled a large pipeline of planned projects.

"However, many building firms are struggling with rising costs and shortages of materials. In addition, the downturn in the housing market will be raising red flags about the outlook for demand over the next few years," Ranchhod said.

And, in noting the rise in year-ahead inflation expectations from 5.9% to 6.2%, he said that will be "unwelcome news from the perspective of the RBNZ, who have emphasised the pressure on inflation expectations as a key reason for their recent large increases in the OCR".

ASB senior economist Mike Jones said the question is not whether the RBNZ will eventually get on top of inflation, but more what will need to be sacrificed to get there.

"On this score, the news from the May ANZBO wasn’t flash. It’s not just higher interest rates. The general explosion in costs, supply problems, difficulty sourcing staff, and squeezed profitability are all combining to push business sentiment to extremely depressed levels.

"Risks of a hard landing continue to rise," Jones said.

"...Long story short, business confidence is at recessionary levels. So is consumer confidence. The post Omicron-peak bounce is yet to arrive and the longer confidence remains mired at these levels the higher the chance the RBNZ will have to sharply downgrade the GDP growth view delivered only last week. Indeed, even our own much weaker GDP view is on thin ice.

"Still, this won’t shake the Bank off it’s plan to keep rapidly hiking interest rates. Inflation remains public enemy number one. Indicators of such remain far too high, and there’s plenty more interest rate work to do."

In terms of the detail in the latest ANZBO survey, ANZ's Zollner noted that “inflation and cost pressures remain intense".

"One-year-ahead inflation expectations lifted again, and at 6.2% are far too high. The rate of increase has eased, but the RBNZ [Reserve Bank] needs to see inflation expectations fall.”

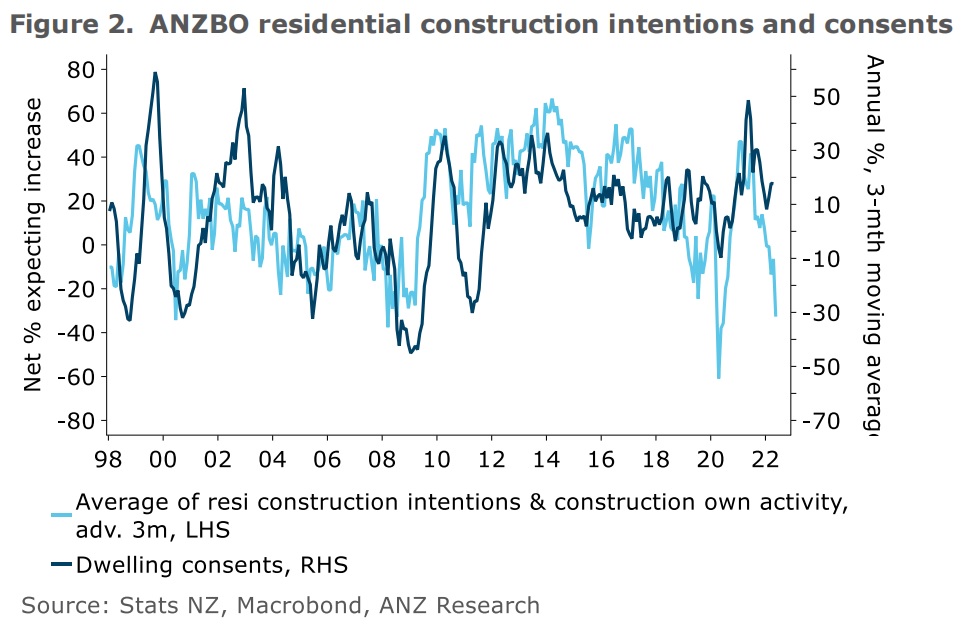

The outlook for residential construction "is deteriorating rapidly", Zollner said.

The chart below shows the average of two forward-looking ANZBO indicators for construction: residential construction intentions, and expected own activity for the construction sector.

Zollner says the average has a slightly stronger correlation with consents than either measure alone.

"The two series generally move closely together, but the latter has not fallen as sharply in recent months.

"At -15.4 it’s certainly well off its peak, but it’s not sending such dire signals as expected residential construction is, at -50.

"Note the fall in early 2020 was due to lockdown, and a repeat of that V-shaped recovery is therefore unlikely. The data suggests the issuance of consents (and ultimately, building activity) is about to fall sharply. What is unclear, however, is how much of the fall is due to weaker demand, and how much is shortages of building supplies."

Zollner said by sector, the sharpest cooling in activity indicators this month was in the manufacturing, services and construction sectors. Retail and agriculture were more mixed.

In terms of inflation, Zollner said 'pricing intentions' are actually the better leading indicator for inflation. The net proportion of firms intending to raise their prices in the next three months remains sky high, but it has dropped both this month and last, down from a March peak of 80.5% to 71% (and it dropped more definitively in the late-May sample, to 63%). There was also a slight easing in anticipated cost inflation.

“Overall the data are consistent with CPI inflation peaking soon. Firms are also generally anticipating lower wage settlements next year than those seen in the past 12 months.

“Firms are worried about the economic outlook, but employment and investment intentions are holding up relatively well.

“Overall, there was good news and bad news in the May ANZ Business Outlook survey. The RBNZ will be pleased to see more early signs of cost and inflation pressures starting to top out, and a softer outlook for the highly stretched construction sector. On the other hand, margins are clearly very squeezed across the economy, and firms are increasingly worried about the economic outlook, as interest rates continue their relentless climb and the housing market screeches to a halt.

“The RBNZ has a very big job to do tackling inflation, and it seems likely that the OCR needs to go much higher yet. However, they are getting traction, and we expect rate hikes will revert to a more standard 25bp pace from August onwards as the balancing act between medium-term inflation risks and near-term growth risks becomes more nuanced than it is currently."

Business confidence - General

Select chart tabs

57 Comments

God how much does it cost to build a house here these days? As if it wasn’t expensive enough 5 years ago.

Looking at some of the drainage works the council are forcing on developers near us, I reckon they might be 200k per dwelling just on drainage and foundation. then every sheet of Gib costs a fortune, as well as framing etc are all up massively if you can get them at all. Then labour too. Yikes.

Watching a building site near a friend. It's been cleared for months. Maybe ~8 townhouses going there. No signs any actual building though.

There are two down our street started late last year, neither has made it past foundations yet. Hope they get finished and not just abandoned.

The wait on frame & truss at the moment is 6-9 months so not surprising that they are stalled at that level.

One has got a delivery of framing timber, I guess it quicker to build the frames on site.

Yeah much quicker to build on site at the moment (if you can secure the timber).

I've heard of sites just slowly building up with materials until they have everything they need on site before they begin so they don't get caught out.

We saw some thieves raiding a site of its framing timber a few months back. Called the police and watched them arrive and catch the fine gentlemen involved. Looks a bit suss when there are folk backing a truck up and wandering around with torches at midnight.

Love your work.

get ready to buy a cheap townhouse

More likely half a cheap townhouse

Yep big trouble when the cost of a new completed house is probably 20-30% higher than the market rate. Banks also know this and will adjust the lending as well, the builder does'nt want drop the price as they take a big hit, but then can't afford to hang on to it to wait for the market to turn. Big trouble.

Structural timber went up over 30% last calendar year, only been 6% so far this year. The supply is the main issue.

Being that we export a large proportion of our production haha.

We export a lot of logs, if they stayed here it wouldn't matter because we don't have enough mills to process it. 44 closed in the last 6-7 years off the top of my head.

Global capitalism has little interest in NZ's strategic concerns unless forced to.

When you replace 2 houses on large sites with 31 townhouses, as is happening around here, you have to do something about drainage, sewage and water pipes! You seem to be implying that the council is 'forcing' unnecessary upgrades on developers. Not so.

We are looking at a ~1.2m quote for 250 sqm (including large 2.5 non lined garage). Builder has said build time is now "at least a year". However we have already spent over $20k on resource/building consents and now the council wants to push back on the resource consents because we are moving some dirt (like 40m3). So that will be another $20k probably with new engineering fees and planning docs. And the council says we only have a year to complete the build from the issueance of a building consent (how we got that without resource consent is beyond me), which is already a month old.

It's quickly becoming a boondoggle of epic proportions that we probably won't be able to afford anyway as we don't have final figures yet to take to the bank (everyone is slammed doing quotes), and interest rates keep marching upwards. Our builder has 8-10 new builds on the go, most of them stuck waiting for gib etc. He normally only does 2-3 at a time.

I reckon the whole industry is sliding off the cliff...

That's 1.2m in build cost or build + land?

Build cost only, already have the land.

That's insane.

That must be a pretty high-end build, surely?

Yeah it’s a pity the business organisations can’t talk to the government and come up with a solution to fast track other plaster board products before many builders go broke….like we did with masks for covid.

But then you realise the GM of Winston’s Wallboards, Dave Thomas, was on the board of the EMA until a few years ago.

And then you realise now he’s replaced by a younger chap on the board of the EMA who is the GM of Winstone Agregates.

And then you realise the chair of the board is Andrew Hunt who was until recently on the board of the National party.

And then you realise the council has joined Business NZ who represent the EMA in Wellington and pays $20 grand a year in subs.

And then you realise the CEO of Business NZ is Kirk Hope and he was the CEO of the Bankers Association until recently.

And then you realise it’s all a bloody coincidence we haven’t made any progress in building houses in thirty years.

And then you all realise they all think that houses going up is a good problem to have.

And then you realise the whole country has been taken on the biggest swindle.

“So what” I guess!

It's all DOOM today!!!!

Yes interest.co.nz itself must have been taken over by the doom goblins (lol) who are now spreading their propoganda further and wider across society, scaring everyone from become rich by loading up with 10x income on debt and speculating on further house price increases.

I enjoyed Mick Ryan's article in the SMH , " the ingenius way Ukraine is beating Russia " ... that was informative and undoomy ...

Ukraine - the next building boom for Polish and Kiwi builders

... I had no idea what a complete demoralised shambles the Russian army are until I heard Mick Ryan being interviewed this morning by the Hosk ... Awesome news ! ... feeling good about that , very very undoomery ...

I'm unsure if the banks, economists & RB understand the lag between the various drivers of the economy and the time of their actual outcome. It is much longer than most anticipate

If OCR and therefore the cost of credit goes up, does this (a) increase borrowing costs for developers; and (b) put downwards pressure on the price that the developer can sell the house for?

So, higher OCR = increased cost of building houses + lower sales price = not many houses getting built.

But, then, is this not the point of monetary policy? You hike rates to slow down the economy, drop demand for goods with limited supply (e.g. gib board), and watch in wonder as prices miraculously reduce and make house building affordable again?

... they've created another $ 50 billion in debt ... thrown it into the economy ... and are now blaming events offshore for our inflation rate ... Robbo ! ... telling pork pies , that boy ...

Commercial banks have pumped over $200bn of credit into the economy in the last couple of years, but, yeah sure, let's focus on the $50bn that Govt spent basically making sure people got their wages.

The two are very much linked...

Haha yes - and even more alarming is that the cost of the programme that has created inflation and a massive asset bubble is ballooning as the outcome has led to the inflation and the OCR rise......

When the programme, designed to lower interest rates and soothe dysfunction in the bond market, was launched in early-2020, the Treasury expected it to be cost-neutral over time.

But now that interest rates are rising more quickly than expected, it estimates the net direct fiscal cost will come in at $5.1 billion.

https://www.interest.co.nz/bonds/114944/rising-interest-rates-could-see… (2 months ago)

Someone mentioned a cost of $1500 per family in NZ to pay the interest.... i would add to that the cost of increased mortgage rates, inflation on goods that we buy and the lost money for other stuff (hospitals, climate change etc) which this money could have gone towards.

Not to mention a potential recession and exodus of smart kids.

Marks out of 10 for the eComonic Covid response?

Well it has to be -5.1 out of 10 and getting worst by the day.

To point yeah, building houses will become more affordable. A lot of the price increases we have seen are here to stay for more complex reasons than a simple change in supply and demand,

Some houses being built now may be sold at a discount so the developer gets his money out, but looking forward it is building tap off until people can predictably make a margin that justifies their risk.

There will not be an ongoing flood of cheaper and cheaper housing because that implies people signing up to make bigger and bigger losses.

Surely that's the time for Kainga Ora to step in and build more and more. Employ the builders, create more houses. Better use of money than the crazy stimulation of the housing market and subsequent wealth transfer was.

I wish the government was that strategic, but they are not.

Another problem, unless they U-Turn massively, is that their minimum building standards requirements are usually much higher than what the private sector is building.

Doesn't seem like it's a bad thing if they employ unemployed builders to construct dwellings even warmer and dryer than the private sector is building, though.

That is the point, yeah.

The problem is that we need targeted demand destruction, not universal demand destruction. We actually need those townhouses to go up. But if we could stop the endless unnecessary renovations of perfectly fine houses by people who think it'll 'add value', that would be the good kind of demand destruction.

The good news is that Kainga Ora will plough on regardless, and that's the housing that's most needed.

Overall I think we have a binary choice, between utterly destroying housing as an investment class for a generation or utterly destroying the last remnants of egalitarianism in our society and resigning ourselves to being the Brazil of the South Pacific. I'm perplexed by the number of 'lefties' in NZ who think keeping rates low to save some tradies' income is more important than avoiding feudalism.

Wow, Table 1 makes for truly awful reading!

I’d be happy to see a 50% fall in my house value if it cements the destruction of this government. Looks like I will get my wish on both fronts. We are living through a future text book episode.

"Residential construction sector sending 'dire signals', ANZ Business Outlook says"

Mr Orr please stop this experiment and drop OCR to near zero as what matters is construction and housing sector, it does not matter if inflation touches double digit.

Yes - who cares if most people can afford to buy food and housing.

Please care about your local developers / Real Estate Agents ... they have needs too (sports cars and Rolex watches have been affected by inflation too you know)

Hard to tell though in reality, there's been so much bottlenecking on supplies and so many developers caught flat footed by inflation. These are hardly normal market conditions.

One industry alone, plasterboard, seems to be dictating the speed of housebuilding in New Zealand.

Going to have to start building with stone and egg whites soon. Just because we have them.

Who owns the plasterboard company? Asking for a friend.

Translation: Infill townhouse developers doing 6-8 unit builds for the first time are about to get absolutely massacred OR will simply not go ahead.

The Williams Corp Rolex/Bentley brigade will be gone in 12 months time.

Great news, can’t stand them.

Lower interest rates and destroy the currency or increase them and wipe out 10% of leveraged mortgage holders. No brainer.

Got over the Champions League disappointment mate?

I really look forward to saying 'Told you so' in the next 12 months.

I've been calling a crash in residential property development for at least 12 months. Only been on the bank economist radars last 2 months or so.

I'm confident I'll also be proven right in terms of the OCR being slashed in 2023, once a deep recession kicks in by Spring 2022.

What I was clearly wrong on was how high the OCR will go this year, before it is slashed.

Gosh, Westpac's economists continue to astound me in their ignorance / incompetence:

"Nervousness is widespread across sectors. However, it’s notable that sentiment in the residential construction sector has plummeted. That’s not necessarily a reflection on the current state of demand. In fact, this morning’s consent numbers signalled a large pipeline of planned projects.'

Any economists worth their salt should know that building consent numbers are a massive lagging indicator, especially with the slowness of council consent processing over the past 6-9 months. Many of the consents approved over the past month would have been applied for in late 2021 / early 2022, when sentiment in the development sector was still fairly buoyant.

As I've said before, many developers will secure their consents given their sunken costs, even if they no longer intend to build (or don't for quite some time). At the very least, it might be something they can market as they look to on-sell their property...

If the OCR gets over 3% this year I will be impressed with RBNZs initiative in leading the way. 4% I will be well impressed and have more faith in a stable NZD.

David, how on earth can you match this lead in to the quote that follows??

BNZ's Toplis noted that the RBNZ was “confident” the New Zealand economy can avoid a hard landing.

"We are not so confident. Our forecasts contain just a modest recession but the risks of something much deeper are rising by the day. Today’s ANZ Business survey clearly highlights this. If the RBNZ does push the cash rate to 3.9%, as it projects, the odds of a significant economic correction will be further elevated.

The house building market does seem to have all but stopped - all we are seeing is momentum of existing builds - consents are down.

It will be the perfect storm. By next july when the new gib factory is working, and apprentices have finished training, there will be far too much capacity. Prices of new builds cannot come down due to increased paperwork & materials, insulation.

Interest rates increases are not needed.

But we will need more skilled people.

There is over double the number of houses and land for sale compared to last Nov. But reality hasn't sunk in yet. Another couple of months and we'll start to look at land bargains for when it does pick up again.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.