First home buyers had their highest share of the mortgage spoils last month, according to the Reserve Bank.

The RBNZ has been compiling mortgage figures by borrower type since 2013.

And the latest figures, for August 2022, show that the first home buyers (FHBs) have hit a record high in terms of their share of the spoils, with 20.8%.

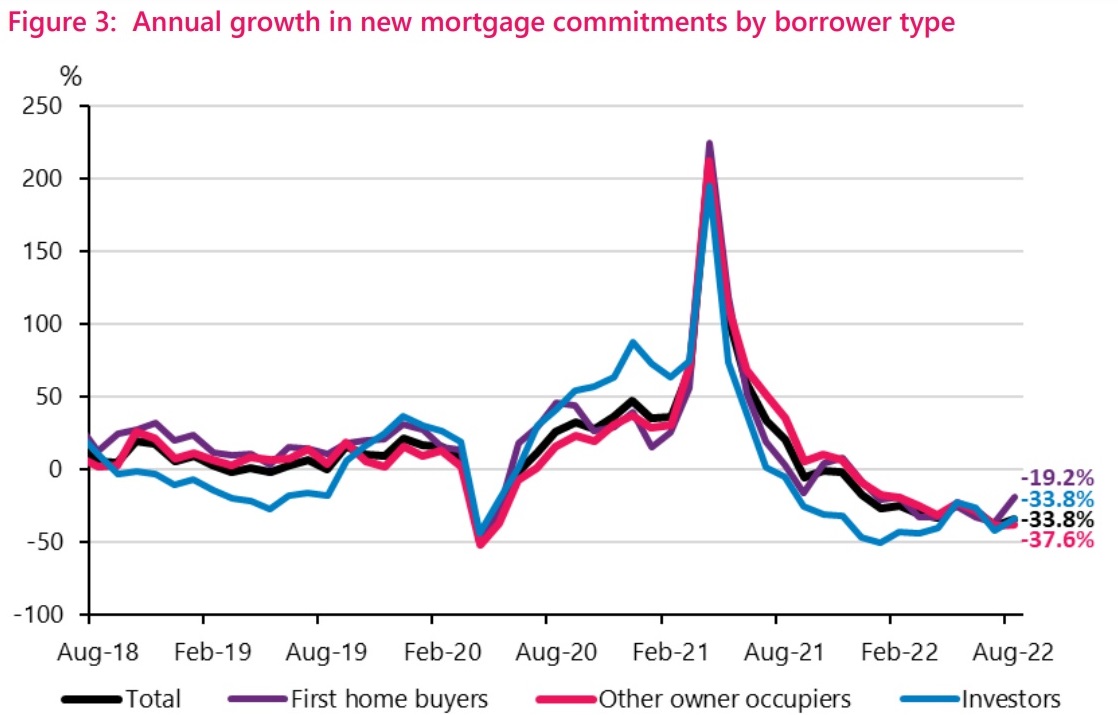

It does of course need to be stressed that the overall mortgage figures have slumped enormously since the massive buying and borrowing surge of 2020-21.

Indeed, the latest figures, showing total borrowing of $5.413 billion, are the smallest for an August month since the data series began.

The latest figures compared with $8.17 billion in August 2021 when the housing market was just beginning to cool off. And they compare with $6.875 billion borrowed in August 2020 when the market was just starting to really take off after the lockdown disruptions.

But the FHBs have nevertheless remained pretty staunch in their commitment to getting into a house. The $1.124 billion borrowed by the FHBs in August compares pretty favourably with the $1.391 billion borrowed by the same grouping in August 2021 - when you consider that overall more than $2.5 billion was borrowed that month.

Investors, who as a grouping has their lowest share of the total amount of mortgage money ever in July, had a slight increase in August, up to 16.7% ($905 million) from 15.8% ($852 million).

But this still pales next to the figures of 30%+ that this grouping has enjoyed as a share of the mortgage money during housing booms, particularly in the period around the middle of 2016.

The RBNZ said the average value of new mortgage commitments across all borrower types fell for a third consecutive month, down 5.5% from $379,061 in July to $358,263 in August.

The average mortgage size has now in the past three months dropped by some 11.5% - it was over $405,000 in June.

The RBNZ said there were 15,109 new mortgage commitments in August, up 6.0% from 14,251 in July.

However, compared with August 2021, new mortgage commitments were down 36.2% from 23,670.

And August 2022 had the lowest number of commitments for a month of August since data collection began in late 2013.

The RBNZ provided this summary of the figures.

17 Comments

Oh well, fewer people to compete with next year when the best deals will be out.

FHB - more in the market, is it good (Catching a falling knife) or bad, only time will tell.

Will this crisis replace what happened in late 1980s and/or will NZ replace Ireland as an example in relation to housing Ponzi - remember that Auckland had the highest and fastest jump in house value in pandemic - 43% -rest of the world was between 15% to 26%

They'll be better off than some who bought during the peak. However, they may see some or all of their equity evaporate.

Come on lambies.... this way to the slaughter-house.

Pretty meaningless data in terms of FHBs. As we all know, investors haves fleed the market.

Minus 20% in Auckland & Wellington versus peak probably means minus 20% in total mortgage amount. Yeah rates will rise but that might die very quickly. Who knows what tomorrow will bring? If Putin pushes the big red button, then you watch everything sky rocket down this end of the planet.

Its the 200,000 migrants who were recently granted Permanent Residency and are now legally able to purchase NZ residential property along with becoming eligible for Govt funding to buy their first home.

What will their current landlords do when they move out? Also most of them would need massive deposits as their incomes will struggle to service high interest rate loans

First Home Buyer grants eh...taxpayers subsidising property prices.

Plus KiwiSaver being able to be used, along with the tax credits, so that has also helped to increase prices.

It is like drawing two parallel lines Line

A which is FHB and Line B. If Line B is shorten Line A will be bigger by itself in percentage.

If the mortgage is joint and one of the borrowers has owned a home before but the other has not. Does the bank classify that as a FHB loan? Especially if the non home owner contributes Kiwi Saver funds to the deposit.

Mortgage rates have hit 7% in the USA from a low of 3%

The prophet's work knows no borders.

But unlike NZ, many of those people will be on a fixed long term rate like 30 years. In NZ FHBs are like a lamb to the sluaghter, as since the last bank removed the 7 year fixed rate, the longest mortgage term you can now fix at is 5 years.

Nice to see FHBers benefiting from the slow market.

Reminded of a quote I heard once "In a decade after experiencing the joy of capital growth some of todays FHBers will themselves become, what they previously despised the most, property investors."

Of course unless the DGM's are correct and the bottom falls out of the property market forever making owning a home super affordable ad infinitum, lol...

“The $1.124 billion borrowed by the FHBs in August compares pretty favourably with the $1.391 billion borrowed by the same grouping in August 2021”

Sorry David - totally misleading clickbait heading. The government’s policy has totally failed the housing market. Their goal was to increase housing for FHBs.

Your own figures show a 20% decline in FHBs for the year ending in August 2022. Nothing for the government to be proud of. Please make them accountable for this, not give them the impression their policy is working.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.