Today's Top 10 is a guest post from Kiwibank chief economist Jarrod Kerr.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz.

And if you're interested in contributing the occasional Top 10 yourself, contact gareth.vaughan@interest.co.nz.

See all previous Top 10s here.

In my last Top 10, I talked about risks. All of those risks remain at large. Last week, we put out our outlook for 2019 and beyond, see Hood the hawks. And again, the risks were prevalent. 2019 will be another interesting year, and everything will play out in the financial markets. Investing in this world is particularly difficult. Here’s the Top 10 things worth watching, at any given point in time:

1) Treasuries, Tr(i)umphant Trumpisms, and fake Truisms.

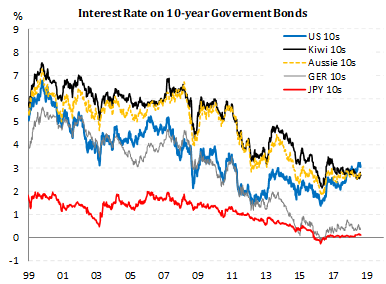

An interest rate is the most beautiful of market beasts. An interest rate encompasses everything we know in financial markets. An interest rate includes expectations for future monetary policy, and therefore growth, inflation and a little forgotten something called term premium. Term premium is currently negative. You see, savers are meant to demand positive term premium for the time value of money. But as beautiful as the interest rate beast is, it can be manipulated. Quantitative Easing, is better known as the unbridled printing of money to buy all things beautiful – i.e. interest rates. QE slashed interest rates and slayed the inner dragon of term premium.

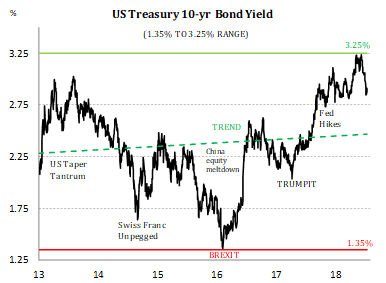

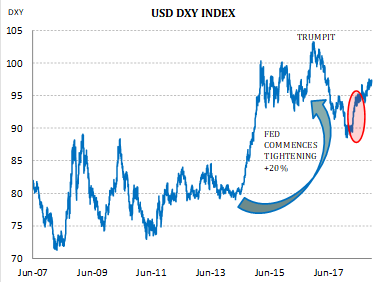

The most important gauge for US, and even global sentiment, is still the US 10-year. A yield of 2.9% shows a lack of conviction in future growth, and fear of contagion. Trump’s tax policies gave a sugar-rush to equity markets and expectations. The market is telling us the sugar-rush is coming to an end. Love him or hate him, there’s barely anyone in-between, Trump is a populist President at war with the world. And the world’s buyers of US Treasuries are hiding for safety.

If we end 2019 with a 10-year US Treasury yield of 3.25%, where I thought we’d be today, the world would have fought its way through its many challenges. If we end at today’s 2.9%, we will remain in disbelief. Anything below 2.5%, and we’d be facing a potential recession in the US, and abroad.

Let’s now look at the fake truism of the US Treasury interest rate curve shape.

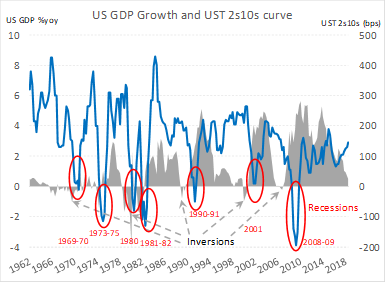

2) The perversion of inversion.

The curve, normally explained by the difference in 10-year to 2-year interest rates, has been a useful leading indicator of recessions. The US curve is on the cusp of inverting. The 2s10s curve has dropped to just 13bps. So the US Government can issue 10-year debt at just 13(ish) bps above 2-year debt. And why wouldn’t they?

It’s

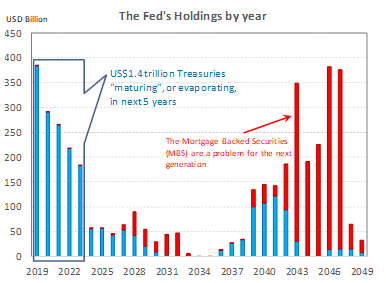

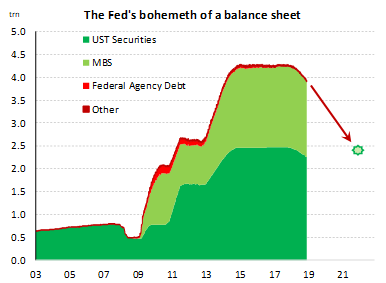

So what the Fed should do is hike 2 times more to 2.75%, and pause. In the process of pausing, keeping short end rates where they are, they can simply allow their balance sheet to unwind. You know, that behemoth of a US$4trn balance sheet inflated by US$3.5trn of printed cash. Allowing the balance sheet to reduce, by letting owned bonds roll off and evaporate, will allow term premium to return out the curve.

The Fed believes the US2.5trn in US Treasury purchases took off over 100bps from the US 10-year interest rate. Some of that will return, steepening the curve (lifting 10s relative to 2s). That’s the genius. In stopping cash rate hikes, Trump will grow less aggressive against the US Fed. And a steepening curve will (hopefully) quell mechanical recession fears based on inversions. Normalising policy was always going to be like landing an A380 at Wellington airport with 8 on the Beaufort scale, earth shifting on the Richter scale, and concerns with runway length.

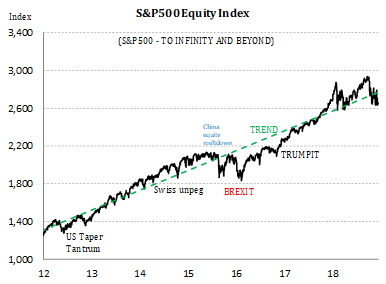

3) It’s the E in P/E that makes equities hard to value.

US corporate profits margins are at record highs. But expectations have turned sharply from expecting big profits, to expecting declining profitability. Trump’s policies inflated expected earnings (E) and fuelled the stock market. Tax cuts do that. But rising interest rates deflated expected discounted cashflows. Yes, everything comes back to interest rates.

Many managers have grown cautious with the expected rise in US interest rates and valuations were looking stretched in September. From here, the outlook is unclear. But the S&P 500 will tell us how the world is balancing out over 2019.

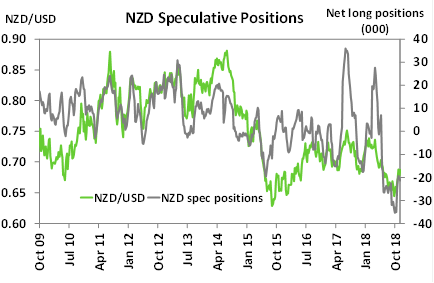

4) The Kiwi flyer gives us risk sentiment, globally.

95% of trading in Aussie and Kiwi dollars is speculative, not required by actual trade in goods and services. Global investors, hedgies, punters and algorithms – you know, the machines – use Antipodean currencies to express global views. If the world is good, the Antipodean currencies will be higher. If the world is tearing itself apart, well, they’ll be pushed off a cliff. They’re also used as a proxy for Asia. You may not be comfortable in trading Yuan, for example, as the liquidity might not be good enough, or you might not like the fact it’s manipulated managed. But most of all, they have good history since floating in the 1980s. And it’s all about the data.

If you think the world is bulled-up and on a tear, geek talk for all-good, then you buy Antipodean currencies. Or, if you think the world is bulled-up and on a tear, and you’re limit long up to the eyeballs in equities, geek talk for you own too many, you may consider a hedge in Kiwi dollars. Why? Well if the world is good, you make money in your equities. If Trump hits a red button, then at least you’re “short” in Kiwi dollars pays off massively as you lose money hand over fist in equities. That’s a hedge.

So basically, if the Kiwi ends next year higher, we’re in a better world. Because we will be talking about RBNZ hikes in 2020. If the Kiwi ends the year materially lower, below 60c, then Trump didn’t make it onto your Christmas card list again next year. We have the most beautifully volatile currency in the world, and it tells us more than we like to admit.

Credit Suisse produces the best “risk sentiment” index in the world, in my opinion. And our currency leads their index. By the way, the Credit Suisse EM (emerging market) risk appetite index is in panic. There is contagion within the EM world that is linked to a stronger USD, higher US interest rates, and the end of QE (and thoughts of it in Europe). So that sucking sound you hear when you look up EM equities, is investors pulling out their funds.

5) EM contagion is not good, but expected.

Concerns around future growth does not just centre on developed economies, with emerging economies having a tough time in 2018 – in particular Turkey, Argentina, Venezuela and Brazil. Emerging market currencies have plunged and falling commodity prices are ravaging EM current accounts. When the US Fed hikes interest rates, and the USD rises, there is much pain for EMs to bear. That’s because their debt is denominated in US dollars and we have seen USD strengthen through much of 2018. Debt repayments become more expensive and (unlike NZ), EMs bear the currency risk, not the investors. When their currency falls, the local currency amount of USD debt required to be repaid lifts violently. And global capital is a fickle beast. Interest rates have been trending higher in the US. Emerging markets must now pay up to convince investors to stay in EM. A cost they cannot afford without the nominal growth to pay for it.

6) Italy’s debt is too big to fail.

Europe is a never-ending source of uncertainty. The ECB has a negative cash rate, and may enter the next downturn without an interest rate lever. So they may actually have to embark on MORE money printing, not less. And when that fails, they’ll have to invent new unconventional measures. Why? Well Brexit is more of a UK concern, but shows the door to others. Italy’s newly formed populist coalition government is facing off with the European Commission (EC) over budgetary constraints, exposing a potential debt crisis in the making. Italy argues that years of fiscal austerity have unnecessarily weighted down growth, and they’re right. Italy wants to be able to break the shackles of the EU’s fiscal rules to reverse the post-crisis malaise.

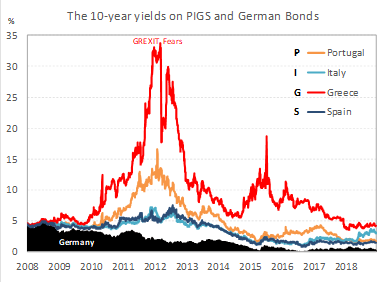

Finance Minister Giovanni Tria is aiming to lift Italy’s 2019 budget deficit to 2.4% of GDP and the EC is not happy. Italian government bond yields have shot up in a sign of investor risk aversion, making it more expensive for the Italian government to borrow. Adding more concern to the mix has been the Italian banks (a banking sector that is shaky) increasing their share of Italian Government debt as foreign investors take flight. A broader concern is the rising risk of a debt crisis emerging that draws in the whole EU, as Grexit did. The level of Italy’s Government debt is eye wateringly high at over 130% of GDP – remember NZ’s is around 20%.

Another complication is that Brussels will not want to be lenient towards Italy, as it could open the door for other highly indebted nations (PIGS) to try and spend their way out of trouble. The faceoff could send Italy towards the exit door. An Italian debt crisis is worth keeping an eye on. Greece, or Grexit, was the decidedly harsh precedent set for this very reason. When speaking of PIGS, Greece is a rounding error in terms of debt (~85bn), whereas the PIS in PIGS are impossible to bailout. Italy has the 4th largest bond market in the world. It’s hard to write down over 3 trillion in debt.

So watch Italian interest rates. And Italian bond yields are higher, as investors dump their bonds in fear of not getting their money back.

7) It's all about wage growth!

The strength of the Kiwi labour market confirms the strong economic growth already recorded. We’re growing at trend and will likely grow above trend next year. Inflation is finally running close enough to the RBNZ’s 2% year-on-year midpoint. Core inflation, which strips out volatile stuff like petrol, is a little more stubborn at 1.7%, but should move higher next year. The good news here, is wages are likely to rise in response to rising inflation.

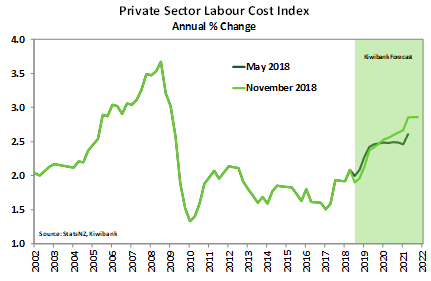

Wage growth is starting to rise thanks to the tight labour market, and the start of large minimum wage hikes. Further large hikes are in the pipeline. Some chunky hikes to the minimum wage will be needed if the Government is to hit its target of $20/hr by April 2021. The labour market should play its part in lifting confidence and spending over 2019. We are picking that wage inflation will begin to accelerate from around 2%yoy now to 2.4%yoy by mid-2019. We see further upside into to 2020s, see LCI chart.

We’d argue good workers are much more likely to get wages rises next year, than when they asked in prior years. Go on, prove us wrong. It’s worth the chat.

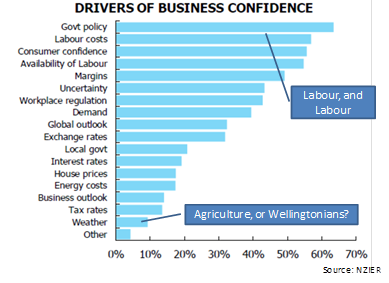

8) We lack confidence!

Businesses continue to complain of sharp labour pain. Businesses complain of Labour policies and labour shortages. Complaints that have yet to translate into weaker growth. But votes of no-confidence in the Labour coalition may restrict investment. And at this point in the cycle,we need more investment. The important measure of firms’ “own activity” sits below average. There is an element of protest voting against Government policy. The uncertainty generated out of the Beehive has persisted all year, especially in regards to labour market reform, tenancy reform and taxation reform. However, the strong economic data fails to match the downbeat business sentiment. Nevertheless, if firms continue to express displeasure, we could see a reluctance to hire and invest. We need firms to hire and invest.

Consumers’ expectations of future conditions have driven confidence lower. In contrast to consumer confidence, the labour market is surprisingly strong with the unemployment rate dropping to 3.9% in the third quarter. Employment growth is robust, and the labour force participation rate is at a record high 71.1%. The third quarter figures may have overstated things a bit. But what is clear, is that people want to work, and they are finding work.

General uncertainty seems to be playing a larger role, rather than the reality on the ground. But poor consumer and business confidence can easing become self-fulfilling.

9) The 3 Ps of property are positive.

And of course we all have an interest in housing.

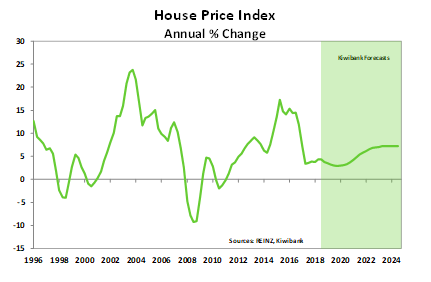

Population growth has slowed. Net migration is still elevated, but is gradually waning. In October annual net migration hit 61,700 a level last seen in 2015. And the down-trend now looks set in train.

The construction sector is no longer a primary driver of growth and hasn’t been since 2017. But tradies are still building full tilt, and will have to for the next decade to address the 100,000 housing shortage. The industry is unable to build at a much faster clip, given constraints on materials and staff. The high-profile failure of major construction firms, have only made matters worse.

Monetary policy is still in expansionary mode. The RBNZ even pushed the case for an OCR cut in August. We simply have a more dovish Governor. The stubbornly dovish bias is understandable given inflation has been too low for too long.- Extraordinary stimulus will remain in play. Mortgage rates hit historically low levels in November, as wholesale rates fell. The fall in lending rates is yet another positive development for households, with debt servicing costs down. And low rates support housing.

The housing market is well supported, and unlikely to experience a sharp Australian-style correction, in our view. Mortgage rates are very low, and the unemployment rate has dropped to 3.9%. NZ’s population has outgrown the supply of housing for the last 10 years. And while population growth is slowing, thanks to easing net migration, it will continue to grow. Eventually, the current shortage in housing will be addressed, but it’s a fair way off.

The housing market has been contained by Government policy uncertainty and tough restrictions on investor lending. Investors are likely to stay cautious for a while longer. We still have a few policies in the pipeline, such as the removal of the negative-gearing tax loophole, and the debate around capital gains tax. The RBNZ has loosened LVR restrictions in November, see The RBNZ has lifted speed limits on lending. More easing will come. The minor LVR tweaks are unlikely to ignite loose lending or fuel house prices, the changes are for stability. Unlike Australia, our lending capacity has not been crimped by a Royal Commission.

10) The battle of two economic (and military) Titans.

The dispute between two economic titans worries all. The Trump administration’s ‘America First’ mantra is heard loud and clear. The Trump administration has pulled out of the UN human rights council, and stepped back from bodies such as the WTO and NATO. Trade disputes have started. To date, import tariffs have been lumped onto +US$250bn of Chinese imports. China has responded in kind. But on bilateral trade, China holds a losing hand. President Trump is threatening to increases tariffs on existing, and extent tariffs on an additional US$267bn imports if China refuses to alter its trade practices. Markets participants are rightly worried. The US-China trade spat is a moving beast, and markets still hold out some hope that a trade deal will be reached – similar to the ceasefire reached between the US and the Eurozone earlier in the year.

Talk from last weekend’s G20 produced a 90-day ceasefire. But the conditions of the ceasefire are near-impossible for China to accept in just 90 days, without losing face. The trade-dispute will most likely reignite in March. For NZ, the ongoing US-China dispute is concerning as we are heavily export reliant, and reliant on the smooth running of global financial markets. So far, the tariff wars are not yet reminiscent of full blown trade wars. The difference is country of origin. If a trade war were to develop, the US would start physically diverting trade away from China, not taxing trade. The potential for escalation scares us. The trade dispute is symptomatic of a larger, geopolitical, pushback on China. And we will hear a lot more about the Silk Belt and Road project, which excludes the US. The rise of China has coincided with a weakening in Western governments. The EU is dealing with their own mess, with French riots, Italian fiscal denial, and general weakness outside of Germany. The UK is paralysed into (and potentially after) Brexit. And even Australia has a new Prime Minister every year.

If left unchecked, we may find ourselves looking up at a full-blown trade war, geopolitical manoeuvring, and the end of the EU itself. It’s simply impossible to gauge the impacts, but they’re not positive. To date, the political resolve to hold trade and established regimes together remains.

We put this as a “thing to watch” in 2019. But it’s been a “thing to watch” since 2009, and may still be in 2029.

7 Comments

3 - sometimes P/E doesn't tell the full story. In the US P/E tells a story of madness and detachment from reality. In these mad times sometimes you would be better to look at dividend yields (and hope that the next dividend payment will still turn up).

When it comes to the capital gains the index is a better choice statistically. You just won't get the highs and lows that comes with gambling on publicly listed companies.

A good article ( even for a bank economist!) with well-reasoned arguments on both sides. Of note :

" An interest rate encompasses everything we know in financial markets. An interest rate includes expectations for future monetary policy, and therefore growth, inflation and a little forgotten something called term premium….The market is telling us the sugar-rush is coming to an end…"

But re China/USA ? ( and an equally good Friday read)

"The Communist Party was aggressively exporting a worldview that was hostile to democracy and actively sought to undermine it.

A new Great Game was afoot and the West had been slow to act. But it is acting now."

https://www.afr.com/news/world/asia/secret-meeting-led-to-the-internati…

Apologies, there was an issue and the charts weren't showing. They should be there now.

Love the 'bohemeth' title over the Fed's Balance Sheet graphic.

Boho on meth?

Thanks for a great read on a Friday morning. May we live in interesting times.

Will a new recession cause interest rates to drop again?

#4 - The NZD appears to my admittedly somewhat unscientific eye, to be losing some of the risk-on/off correlation. Perhaps due to our low government debt and low level of manufacturing exports? Just a thought.

An interesting and enjoyable read. I wish more writers would eschew partisan impulses and provide similar pragmatic, fact-based analyses.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.