By David Hargreaves

If would-be first home buyers are worried at all about the immediate future of the New Zealand housing market, their actions aren't showing that.

The FHBs are continuing by the month to get a bigger share of the mortgage monies advanced as the investors now take more of a back seat.

I opined similarly on this topic last year, and the trend of the FHBs climbing in has continued and expanded since.

In January the FHBs, with $700 million borrowed, accounted for 17.3% of the mortgage money advanced, which is the highest proportion for that grouping since the Reserve Bank started publishing such figures in mid-2014.

The FHBs are individually borrowing more than others too. According to the January figures there were 1771 FHB borrowers, accounting for 9.4% of the total 18,774 borrowers in the month.

So, yes, that's 9.4% of the borrowers by number accounting for 17.3% of the money borrowed.

New rules

January was the first month in which the new rules relaxing the affecting the permitted levels of high loan to value ratio (LVR) loans took effect and this is somewhat visible in the new figures.

Of the $700 million borrowed by FHBs, some $280 million was for mortgages where the deposit made up less than 20% of the value of the house being bought.

That means 40% of the money the FHBs borrowed in January was for high LVR loans. That's the highest such ratio since the figures began being compiled in 2014.

Now, yes, given the LVR restrictions have been with us since 2013 and they originally permitted banks to advance only 10% of their new lending on high LVR mortgages, it's not too surprising to see the FHBs hitting a new high in terms of the proportion of high LVR borrowing - now that the banks can advance up to 20% of new lending (since January) for high LVR mortgages.

So, it's understandable, but nevertheless a bit disconcerting to see the FHBs piling in with large mortgages relative to their deposits at a time when certainly Auckland is looking a bit wobbly. Much of the rest of the country is still experiencing fairly buoyant conditions - but remember, Auckland did have at least about a two-year lead on the rest of the market when it came to the bull conditions we saw earlier this decade. Where Auckland goes, the rest of the country's housing market will probably go eventually.

Everything counts

In terms of what the FHBs are borrowing for individual mortgages, dividing the $700 million advance to the FHBs in January by the number of loans taken - 1771 - gives an average-sized mortgage of $395,000.

Believe it or not, that's actually down a little on the average-sized FHB mortgage as of January 2018, which worked out at about $403,500. Given the ratio of high LVR loans is higher this year, one would have to suspect that there's an 'Auckland effect' in there, in that there are presumably fewer Auckland mortgages. And Auckland mortgages of course are by the nature of Auckland's median price that much bigger than in the rest of the country.

But, still. A mortgage of $395,000 for a first home buyer is not something to be contemplated without a few deep breaths. And remember, that's an average, so, a fair few people will have borrowed MORE than that, while others will have borrowed less.

Where are people finding the money from for deposits?

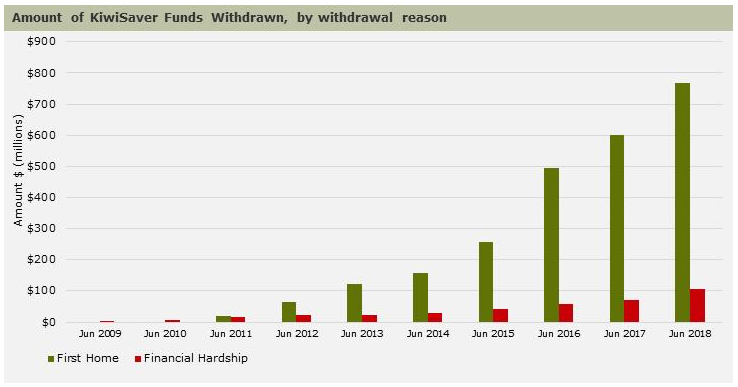

A glance at the Inland Revenue Department's KiwiSaver Statistics gives a reasonable clue.

As you can see, the chart above is for the June year, but the upward trend has continued since June 2018, with the January 2019 first home withdrawals up 6.5% compared with the same month a year ago to $59.4 million.

For the year to June 2018 there was $769 million withdrawn for first homes. In the seven months since a total of $544.6 million has been withdrawn for first homes and if that overall pattern continues then we would be heading towards $1 billion being withdrawn in the year to June 2019.

So, the KiwiSavers are digging into their retirement money in order to then buy houses with large mortgages.

That such sizes of mortgage can be contemplated is down to the persistently low interest rates. But it is to be hoped that people taking out these mortgages do their own 'sensitivity analysis' and have a look at the consequences if interest rates did turn. I did a little quick checking on interest.co.nz's mortgage calculator.

Bills, bills, bills

These things are a bit arbitrary, and of course many people will be able to fix mortgages for a period up front. But for illustrative purposes, let's suppose someone took out a $395,000 mortgage for 30 years, paying monthly, at what the RBNZ gives as the current average floating mortgage rate, namely 5.85%.

This would cost $2330 a month ($27,960 a year), which works out at $537.69 a week.

The good news is, nobody expects interest rates to go up in the foreseeable future. So, anybody who can manage that now can keep managing in future.

But what if the global sky falls in and rates take an unexpected hike?

If floating mortgages went up by one percentage point to 6.85% a $395,000 mortgage would be costing $2,588 a month, $31,056 a year, or $597.23 a week.

Amp up the volume more with a two percentage point rise, to 7.85% and a $395,000 mortgage would cost $2,857 a month, $34,284 a year, or $659.31.

Put another way, a one percentage rate increase would increase mortgage servicing costs by 11.1%, while a two percentage point rise would increase the annual mortgage bill by a whopping 22.6%.

So, a "2% rise in interest rates" as such things are always inaccurately described would in fact increase servicing costs by damn near a quarter, which would be a worry.

Now, I don't want to scare anybody, but it is worth remembering that average floating rates were over 6.7% less than four years ago, while in and around the Global Financial Crisis of 2008 they were close to 11%.

Anything goes

Just because there's currently no reason at all to believe that interest rates won't go up (and indeed, our largest bank, ANZ, thinks the next move will be down) doesn't mean there's no chance at all they never would go up.

That's one thing to worry about.

The other is the dreaded negative equity. Obviously the bigger the deposit a buyer has, the more leeway they have if house prices come down. Anyone borrowing say 90% wouldn't have to see too much of a downturn to see their equity being eroded.

Now, negative equity is not a huge problem per se, providing everybody keeps their jobs and doesn't have to renegotiate the mortgage - IE they can keep servicing the mortgage.

But that brings us to the prospect of a general slowdown in the economy and rise in joblessness. That could also be a killer.

Essentially in New Zealand we need three things:

- Interest rates have got to stay flat (or even drop!)

- The economy's got to stay reasonable with ongoing low levels of unemployment

- House prices have not got to start seriously falling (and a fall of say 10% would start to become problematic for high LVR people)

Putting on my rosy coloured spectacles, I would say, fingers crossed, there's a fair chance all three of those things will come to pass, which would be wonderful. But they might not. Such is uncertainty when you live in a small island country totally exposed to global volatility.

The risky time for someone with a big mortgage is in the first few years. After that, even if there isn't much or any capital appreciation, they should hopefully be building some equity through repayments.

After all that has been said though, this is a risky period we are going through right now. And we just have to hope that the FHBs won't end up on the wrong end of that risk. Because that would be bad for our country.

90 Comments

Great article. The Kiwisaver withdrawal stats has caught my eye. If financial markets turn again like they did between Oct > Dec last year then fund levels will be lower and less to pull out for a mortgage. If we have an actual financial market correction then we might see a lot of FHBs caught out for a deposit. As a soon to be FHB i am aware of the need for a growth Kiwisaver to just get enough of a deposit for a house.....

You just have to get on with your life, no point worrying about a housing crash that may never happen. If your a couple and both have good jobs its still doable if you both have realistic expectations and are prepared to pull your head in for the first 10 years .If you not prepared to take the short term pain for the long term gain, keep renting.

Your point is garbage and doesn't take into account the fact we're now already three years overdue for a correction, which could happen tomorrow, it could happen in five years time.

But sure, keep calling everyone else thick. Being the angriest bloke on the internet definitely makes your point even stronger, trust me.

S4AUhouse,

I have no skin in this game,having been mortgage free for 21 years-I will be 74 next month,but what you are saying is nonsensical. You are proposing that a young couple in Auckland looking to buy their first home,but with no intention of living in Australia,should nevertheless buy one somewhere in Oz. Why would any sane person do that? It might of course be sensible to delay their purchase in the hope/expectation of a further price fall,but that is a different proposal.

I suggest you lie down in a dark room till you recover.

Thats not a compelling stat. The change is debt is largely a mechanical response to the change in the long term expected average of interest rates. You need to show affordability is significantly different to 2008, which it isnt. We in circumstances that are actually about the same as 2007-08.

You said that I don't have a compelling stat, when I didn't mention a stat.... but then made a bold-face statement about affordability being ostensibly the same... with no compelling statistics to back that up.

1. The "affordability" reports I've seen on this website make heroic assumptions about deposits that people are putting down at the time of purchase. I don't believe FHBs and 2nd-rung purchasers have as much equity as is claimed - so they are more leveraged - and if not then their deposits are coming from KiwiSaver or parents, which obviously cannot be repeated and is not a fair representation of their capacity to be disciplined;

2. The Royal Commission showed that the Banks' HEM benchmarks are miles off estimating what people *actually* spend to fund their lifestyle. I can't see how NZ subsidiaries of those very same Banks have more advanced HEM estimates;

3. The risks of leverage after the "mechanical response" to lower rates (which I fundamentally disagree reflect "expectations" of anything long term - we're talking the most unsophisticated segment of finance consumers dealing with the most debt they've ever had in their lives and can't see past the latest carded 2-3 year rate) is massively heightened. There is any number of external shocks that could tip affordability at the moment... and guess what, that's exactly what tipped Ireland over.

So unless you can present anything more "compelling" than that, your statement isn't changing my mind.

You said: "We've got far more debt now than in 2007-08." and that is a stat. You didnt say a number, you did note a stat. To help you out, a stat is a measure of an attribute, and debt is an attribute.

Affordability is what drives prices, as i have noted, it is causing deposit issues. Thats part of what drives declining home ownership rates.

As to HEM, banks dont use your life style spending for the very obvious reason that you pay your home loan before you buy you buy a cheese burger.

Interest rates are not affected to any significant degree by FHB lololololol. The change in prices are driven by the marginal buyer and FHB are effectively a blunt constant forced affected only by what they can borrow. Rates are set by highly informed buyers and sellers.

Ireland was tipped over by one of the most obvious crashes anyone alive has ever seen. In 2006 almost every economist on the planet knew Ireland was screwed. You simply cant have property yields below the risk free rate of return.

I really hope others, especially younger people don't listen to that advice, go out there, take action, take your life in your own hands and make something of it!

Yeah, I bet you would.

I imagine lots of people with vested interests in maintaining the property bubble are saying the same thing.

Two rather debatable statements there, DH:

- "Where Auckland goes, the rest of the country's housing market will probably go eventually." Yeah, nah, Christchurch has not behaved in an Orc-like manner at all, and IMHO won't. Reasons include huge land availability, active competition between TLA's for residents (see Izone, which has well and truly eaten Christchurch City's industrial development lunch over the past decade), and the bigly bungled CBD which has prompted a relocation to Anywhere But. Generalisations like that just don't stack up...

- "The good news is, nobody expects interest rates to go up in the foreseeable future." Well, let's just give things a year or three and see how accurate That sentiment (for that's all it is) turns out to be.

Young people are naive about most things appart from the immediate past. Although exploratory in nature they will attempt to meet the cultural expectations of the status quo. Unfortunately the hard knocks can be when it is discovered that the "established interests" have no interest at all in their wellbeing. And rather are highly interested in how to exploit them.

True they are naive , they are often pre-occupied in pissing competitions with their peers , buying expensive cars , SUV's and boats, going on flash holidays and posting fun pics of social media, just to show off or create an illusion of "success" .

What you call established interests are simply the market taking advantage of this lavish spending spree by extending them the credit lines to do this.

Nah. I have directed many young (20ishes) to this site and a big chunk of em don't give a toss about Holden commodores or other baby boomer c##P. Most are way smarter. Its just the older mob are well established, house paid off, both getting nz super and both also working and doing b-all in a high paid job they can't get fired from. Its hard to go wrong for that generation - not smarts, dumb luck.

I'm in my mid-30s.

I don't care about a boat or expensive cars.

All I want is a family home so my son can go to a half-decent school, that's <30min commute (so I get to see said son) and my parents can visit every so often.

... and not pay 10x-12x my [pre-tax!] professional salary for the pleasure.... or 6x-7x our household income (2! pre-tax professional salaries)

Is that seriously too much to ask?

Turns out a lot of these family homes in school zones have been hoarded for rubbish yield and called an "investment".

I don't recall the previous generation ever having to contend with that... in fact, I don't know or have ever met a single baby boomer that was renting in their 30s.

And for all the whinging about interest rates in the 80s, most of them still managed on a single income.

Really.

Nowhere in the South Island caters to my profession.

Which is a bit of an issue... and probably the reason house prices are what they are there.

And again, hardly any Boomer I know has had to shift from where they grew up - 20 years ago I could have done my job in Christchurch or Wellington and then it all got centralised.

Why is it all of the sudden imperative for us to move??

There is no imperative for you to move, just some advice to open your eyes from someone who opened his own. I felt like you when I lived in Auckland. I'm now in the South Island, debt free, with a rewarding life, and fulltime work. I don't know what profession you are in, but if there is nowhere you could use your skills in the South Island, I would be amazed. One guy in my suburb works from home in a mid-level administrative banking role, visiting the Christchurch and Wellington branches once a month or so. He thought like you do, and earns more now working from home for the same employer. Another I know less well has a loss adjustment/insurance type role, running his own company from home while contracting to NZ and Australian insurers. If you don't mind saying what line of work you are in, I'll brainstorm for you.

Your post accurately describes gen-xers and baby boomers as well.

Are you one of those people that likes to tell themselves that everyone younger than you is stupider than you? As a former young person it was my experience that the older people who dispensed the most advice and held court were also the most wrong and knew the least.

No my IQ test suggests I am slightly left of centre on the Bell curve.

Of course we messed up when we were younger, I had debt that got me into a corner when rates went to 25%, nearly lost the house .

I also liked the flash cars , etc , but there was no pressure from social media to show off.

Difference was that credit was harder to get and way more expensive , so to get it , you needed an above average wage and a good credit record .

Of course we messed up when we were younger, I had debt that got me into a corner when rates went to 25%, nearly lost the house .

I also liked the flash cars , etc , but there was no pressure from social media to show off.

So to paraphrase - you were an idiot when you are younger, and you are extrapolating your own failures at self control onto all younger people because it makes you feel better. Really it has nothing to do with youth and all about terrible impulse control, short term thinking, and possibly just a lack of mental horsepower.

I've never been in consumer debt, at any age.

Boatman's mentioned his intelligence is slightly lower than average in his post above so maybe this played a part in his impulsive decisions?

Either way, we shouldn't judge. It's helpful knowing his background as it explains his worldviews and some of the commentary he's posted on this forum.

I've certainly never found millennial's to be frivolous. Most are hardworking and seem to be shunning a lot of the materialistic trappings of previous generations (perhaps by choice or perhaps by necessity).

Credit being harder to get was a really good thing.

It protected idiots from themselves and kept a lid on rampant speculators (again, idiots) running around cross-collateralising everything then declaring themselves geniuses and chastising anyone who ever ate an avocado.

Crazy advice to buy in 2019. Why would anyone in their right mind look to buy at the peak of what everyone seems to agree is a giant bubble. With whats happening with house prices in Australia and other parts of the world surely the best advice is hold for now to see how the next year or two plays out.

I also believe saying interest rates will stay low for the foreseeable future is bad advice. With so much quantitative easing after the GFC surely there is large risk for strong medium term inflation. Mortgages are being taken out over longer and longer terms nowdays. I would think over a 30 year period when rates started at historical lows higher future interest rates is a certainty.

The risk for first time buyers now is huge and escalating. Expect boomers to start to try cash out now in a hurry as they realize their lucky run is near it's end.

"usually for around a two or three year period and then they go up again"

Says who? Ashley Church and his 10-12 year "rule of thumb"?

If anyone said that about any other asset class they would be hauled in front of the FMA.

Past. Performance. Does. Not. Predict. Future. Returns.

How slow do you need to say it?

This myopic focus on past trends in the NZ housing market is so beyond ignorant.

Past growth in the NZ housing market is fueled by a confluence of external factors at any point in time.

Will the past pattern of global growth continue?

Will China have another economic revolution that Australia (and NZ) can piggy back off?

Can Australia emerge from its debt apocalypse absolutely fine and not impact us (as one of our largest trading partners)?

Can Europe continue to avoid economic catastrophe with ridiculously high youth unemployment and all its major markets on the verge of recession.

What happens with Brexit?

Does the US trade war all end in roses?

Oh... that's right, who cares about all that stuff when we have such a great rule to rely on - 2-3 years "flattening" all that stuff will blow over and Auckland will double again over 5 years.

Amirite?

So much facepalm.

Oh yeah, and what asset manager ever peddles such a crude rule of thumb as that about any market?

Tell me so I never put money with them.

You're literally arguing semantics and 'only' mutual funds?

"Mutual Funds" is a big catch-all term for funds run by professional managers across pretty much any publicly traded asset class... "yeah our fund has a CAGR of 15% p.a. in the past 10 years so expect 4.0x your money in the next 10 years... based on our super incredibly smart rule of thumb for how our benchmark market works"

Nek minute, massive fine.

The statement 'is not a guarantee of future results' is used to explain that while past performance has been shown in studies to indicate future results of say stocks over bonds, it is not a guarantee that stocks will outperform bonds in the future.

The statement 'does not indicate future results' is a rule made by the SEC after it was proven that in the context of mutual funds a high performance fund is actually no more likely to perform well over a long period of time than a historically average fund.

Hopefully that explains why this is not semantics...

"If would-be first home buyers are worried at all about the immediate future of the New Zealand housing market, their actions aren't showing that."

Only the smart ones that manage to look through their nerves and take a long term view. The rest will make some or other excuse about falling knives, talk the market down on anonymous internet forums, and be kicking themselves in 10 years time.

BLSH, This is usually true, except in the circumstances of a speculative bubble, which we have. In that circumstance it's best to let it play out, then buy when affordability returns. Just look at the property bubbles around the world during the past 10 years. It's the turn of the countries that didn't go through it 10 years ago and managed to kick the can down the road: Australia, NZ, Canada, Hong Kong.

I’de love to do an experiment on this. We take two prospective first home buyers of the same age, education and financial circumstances. One takes your advice and doesn’t buy. The other takes my advice and buys a well-located terraced unit in Auckland today. We all meet in ten years time. The FHB that has the worst financial standing gets to punch one of us, their choice, in the face full force.

BLSH, That is what I did in Sydney 10 years ago, but I would def not recommend doing that in Sydney right now. Wait 2 or 3 years and get a real bargain, possibly back to levels of 5 or more years ago. I'm not saying wait forever, just that now is historically a particularly bad time to buy in Australia and New Zealand. There are other countries it would be a good idea to buy now, I'm just saying in our current circumstances, it unusually isn't a good time to buy. It's coming to the end of a bubble.

Maybe if you’re very lucky to find a few, but google Box Hill, Sydney. It’s currently the worst at -41%! Lots of first home buyers bought there too in new developments. Couldn’t lose. Further in towards the city centre, Gladesville down 20%. It’s difficult to put a positive spin on the escalating numbers but the spruikers are still trying.

You will always find reasons on why not to buy, I mean the whole planet is sitting on the cusp of a meltdown with climate change and that is before the possibility of Nukes, a virus or an asteroid so if your one of those types who is freaking out every time you turn on the news then just party hard and enjoy yourself but don't get to 65 and start complaining you cannot afford to retire because of your opulent lifestyle and then worse still, go green with envy at others who worked hard and made the sacrifices along the way because that shit really pisses me off.

It's true except when there are speculative bubbles, like now. It's good to buy but always best to do it when assets are cheap (ask Warren Buffett), and recognise with markets are highly inflated and wait it out. Contray to popular belief, property markets do not always go up (ask Japan) and bubbles burst. Affordability will return to the NZ market, it won't be 9 times income, or more, over the long term.

Let me qualify that by adding that it usually comes in the form of "house prices double every 10 years or so, even if there's a plateau or a dip for a while". That is not the case when it comes to a bubble and bust.

"We know from experience that property values roughly double in Auckland every 10 to 12 years, and based on this rule of thumb, I'm of the view that the next cycle will start in 2021/2022 and by 2026 or 2027 the median house price in Auckland could be around twice what it is now,"

https://www.interest.co.nz/property/93951/chief-executive-property-inst…

Quite an important qualification. Pointing out a rule of thumb based on past trends, while being quite clear that prices go both up and down, is very different to saying that property prices “always go up”. I 100% ageee with Church when he says that prices fluctuate up and down, but the overall trend is positive.

As an aside, I’ve been saying 2021/22 - Church has been reading my posts.

It would be good to wait until at least 2012/22 to buy, yes. It's 19 months into the Sydney decline and it's 13% down overall. The decline could last for 2-3 more years. There is no rush. It's won't suddenly bounce back. No doubt Auckland (and then wider NZ) will be similar.

Yes but up until the mid 90's incomes also increased so house prices had a historical parity with income of approx 3x income.

With that well and truly gone, house prices are now decoupled from economic orbit and are lost in space.

It would be interesting to calculate the time frame needed, with the different permutations of income rises and property falls or stalls for that 3x equilibrium between prices and income to be re- established.

This time is different in Auckland.

In previous market cycles, up to and including the 2000-2006 boom, Auckland people built housing at a similar rate to everywhere else in Australasia and then reset their pricing where they fell in line with everyone else in Australasia. So the people did not lose relative value and were still in the game with everywhere moving up & down at the same velocity.

In this boom our halfwit council decided restrict land supply to Auckland, which caused a great in rushing tide towards land cost increases and less houses got built. So now Auckland land prices reached into the inherent instability of other supply constrained markets - like Queenstown. In Queenstown there are mountains and lakes restricting land supply, creating highly variable boom/bust cycles (check the records).

But it gets worse, our utterly insane council have in the last two years opened up massive exurban land over supply. Expanding the city outwards at a phenomenal pace, the sprawl of Auckland is in overdrive. Which means Auckland now has a land supply glut similar to Christchurch. NZ market is still on the way up, but prices are falling in Auckland due to land over supply.

Should demand drop and the market turn, Auckland now has prices as vulnerable as Queenstown and land supply as wide open as Christchurch. The bottom might not be visible.

We've been through the share market crash in 87-91, then the dotcom/Asian crisis in the late 90's, then the GFC in 07-09 & lived to tell the tale. Nothing's perfect, never will be. If you're young & want to settle down, have a family, buy a home (rather than a house) then go for it. Sure, the housing market will correct sometime but if you're stable in character & employment, you'll work it out. That's part of the growing up process. Be brave but be sensible. You have time on your side.

Us older types have a lot to lose & not much time to repair the damage. We're a bit gun shy that's all.

That’s true, the young have time on their side for the ups and downs. Also, the more experienced you become at investing, the more you learn about actually being able to “buy low” when buying assets. So few people actually do that, as there is a LOT of fear in markets when assets are cheap, and it seems like they will never recover. When prices are high, it seems like they won’t fall. And so it has always been.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.