The next to raise mortgage rates is BNZ. And their increases are showing up a split in how banks are approaching these changes.

Despite long bond benchmarks seeming to top out for the moment, wholesale swap rates are still rising aggressively in the one to three year durations. In fact the two year swap rate reached 3.41% yesterday, the highest in seven years. The one year swap is now its highest in seven years as well at 2.84%.

Westpac is pointing out that 42 bps are baked in for the April 13, 2022 RBNZ Monetary policy review, so markets seem to be accepting a high chance of a +50 bps rise then. For the subsequent May 25, 2022 Monetary Policy Statement these markets have priced in another 44 bps, so coming to the view that we may get a further +50 bps rise then as well.

So in this context, it is a little surprising to see that BNZ did not change its one year fixed home loan rate, leaving it at 3.99% and matching Kiwibank's similar decision yesterday. At today's swap rate, that is a margin of just +115 bps (3.99% less 2.84%), an unusually low net interest margin (NIM) level for any bank. Typically they like to keep them around +200 bps. (The RBNZ Dashboard P3 shows Kiwibank's NIM at 2% and BNZ's also at 2%.)

Even their new two year fixed rates (Kiwibank at 4.85% and BNZ at just 4.69%) reveals margins of only +144 bps for Kiwibank and just +125 bps for BNZ.

You do wonder how long they can sustain such skinny levels.

There is less compunction raising longer term fixed rates, but both BNZ and Kiwibank have rate offers substantially lower than either ANZ or ASB for four and five year fixed rates.

BNZ's one year rate is unchanged at 3.99% and that is now a 20 bps advantage over ANZ or ASB. Their two year rate is now a +16 bps to +26 bps advantage over ANZ/Kiwibank and ASB. BNZ's new three year however isn't anything special, in the middle of these rivals.

BNZ seems to be eyeing an opportunity in this time of transition to snag some market share.

BNZ did not change their term deposit rates when they made these mortgage rate changes.

Westpac is not part of this review because they have not yet moved in this latest round. Their shift higher will no doubt happen very soon.

One useful way to make sense of these changed home loan rates is to use our full-function mortgage calculator which is also below. (Term deposit rates can be assessed using this calculator).

And if you already have a fixed term mortgage that is not up for renewal at this time, our break fee calculator may help you assess your options. But break fees should be minimal in a rising market.

New to interest.co.nz? We are in a drive to build our resilience. We would rather rely on readers' support than fickle advertisers, political public funding, or dubious multinational 'gifts'. We are not supported by the Public Interest Journalism Fund, NZ On Air, nor Google, nor Facebook's similar programs. If you appreciate this coverage, we can offer you ad-free experience. And great economic journalism, of course. Find out how here.

Here is the updated snapshot of the lowest advertised fixed-term mortgage rates on offer from the key retail banks at the moment.

| Fixed, below 80% LVR | 6 mths | 1 yr | 18 mth | 2 yrs | 3 yrs | 4 yrs | 5 yrs |

| as at April 5, 2022 | % | % | % | % | % | % | % |

| ANZ | 4.45 | 4.20 | 4.55 | 4.85 | 5.15 | 5.99 | 6.09 |

|

4.49 | 4.19 | 4.75 | 4.95 | 5.29 | 5.89 | 5.99 |

|

4.19 | 3.99 | 4.55 +0.16 |

4.69 +0.14 |

5.25 +0.46 |

5.60 +0.61 |

5.80 +0.71 |

|

4.45 +0.26 |

3.99 | 4.85 +0.30 |

4.99 +0.20 |

5.45 +0.46 |

5.79 +0.64 |

|

|

4.19 | 3.99 | 4.29 | 4.55 | 4.89 | 4.99 | 5.09 |

| Bank of China | 4.15 | 4.05 | 4.35 | 4.55 | 4.75 | 5.15 | 5.35 |

| China Construction Bank | 4.15 | 3.95 | 4.35 | 4.50 | 4.75 | 5.09 | 5.20 |

| Co-operative Bank [*=FHB] | 3.79 | 3.69* | 4.19 | 4.50 | 4.75 | 4.99 | 5.09 |

| Heartland Bank | 3.49 | 4.05 | 4.25 | ||||

| HSBC | 4.09 | 3.95 | 4.49 | 4.69 | 4.89 | 5.04 | 5.19 |

| ICBC | 3.85 | 3.69 | 3.99 | 4.25 | 4.55 | 4.85 | 5.05 |

|

3.99 | 3.75 | 4.19 | 4.35 | 4.69 | 4.99 | 5.05 |

|

3.95 | 3.95 | 4.39 | 4.55 | 4.75 | 4.99 | 5.09 |

Fixed mortgage rates

Select chart tabs

Daily swap rates

Select chart tabs

Comprehensive Mortgage Calculator

18 Comments

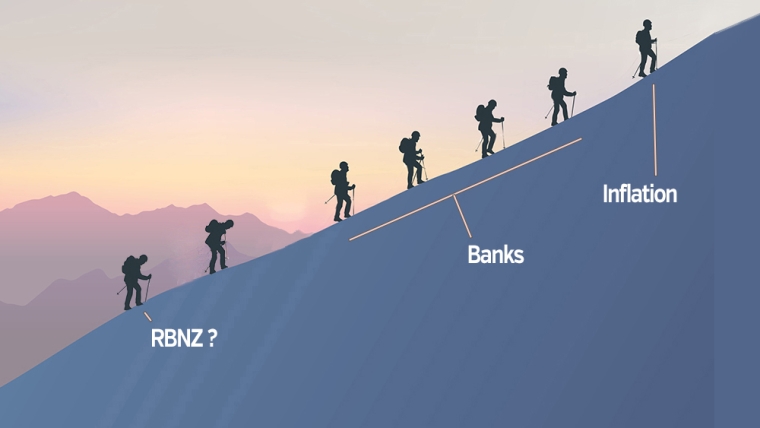

The speed of interest rates going up.

Nice graphic....sums the situation that appears to be playing out.

Will Westpac go even higher, setting off another round of increases?

The 1 year fixed mortgage rate is back to where it was in mid 2019.

The 2 year fixed rate is back to where it was in March 2018.

Median house price in mid 2019 was $580,000.

Median house price in March 2018 was $550,000.

So much for the path of "least regrets", to be coming out of Covid with higher rates than heading in and enormous mark-to-market bond loss is policy failure like none I have seen. Perhaps a little less virtue-signalling by Hawkesby and Orr and a bit more "central banking" would have been useful.

https://www.rbnz.govt.nz/news/2021/09/a-least-regrets-approach-to-uncer…

Agreed. A simple "do the math" reality. While we now have rampant inflation compared to that time, it is nothing that would justify the borrowing costs to pricing specuvestor now want. Vapor gains are eroding daily, just like the sand dunes in front of beachfront land...

Beachfront popcorn.

A lot of catching up to be done by RBNZ with the same old rhetoric we don't want to give knee-jerk reaction to inflation by a bigger raise like 0.50 bps.

Hypocrisy is their second name when it comes to reduction they can reduce even 0.75 bps.

Anyone notice all the warnings coming out around a new variant and potential restrictions if this spreads in NZ... who reckons Orr and Roberston will jump in to save the day for housing like 2020?

Newton's law of universal gravitation may prevent Robertson.

Can it counter Orr's Rule of Property Values, though?

Personally don't think either have keeping housing prices propped up on their to-do list, either now or in 2020. It was just an unforeseen consequence which looks obvious now, but really wasn't then.

The only reason apart from supply chains becoming more efficient and business decreasing prices, for rates to reduce would be recession & subsequent unemployment.

Doubt very much those circumstances, would increase house prices a hell of a lot.

If I had my time over in this life, or was given a second chance to go back in time, I'd start up a banking business.

It's a win / win.

Make cream when interest rates are dropping from the central banks ( why'd we never see sub 1% loans like the rest of the world does when OCR drops to 0.25%). i.e took their time dropping rates on the way down.

Then get the cherry on top when it bounces back the other way. "pricing in" future rates anyone....

Oh and did i mention the top 4 aussies banks profit 1 billion each a year. PROFIT, yes after all expenses and costs. Surely they could invest some of that into being competitive and investing in their customers. Nah its just shut down this branch, not open on weekends, yada yada. It's not making headlines but they are pushing the rbnz to drop using cash in the economy, as it currently is a dieing form of money and is a bit expensive to distribute and keep in circulation. cant make this up.

Oh and i forgot, the fricking RBNZ gave them access to 16$ billion lending at zero percent because of covid... and they say NZ isn't corrupt.

Fixed rates aren't priced off OCR, as David's article points out. Banks would lose their shirt and the financial markets would react badly if they funded a 5 year fixed rate with OCR borrowings... The relevant comparison is wholesale swap.

Note too - the "zero percent" money you refer to is at OCR rate, so now 1.25% and shortly enough it will be at 2.25%

The large profits are likely much more to do with NZers borrowing way too much to fuel the bubble than margins.

And then, if it's anything like Cyprus or Ireland, simply threaten the government into bailing you out with taxpayer money when your risk-taking goes pear shaped. Privatise the profits, socialise the losses. If the worst happens, we need a government with the cojones - or lack of good mates in banks - to do an Iceland, not an Ireland.

It is true that the banks' margins look skinny vs swaps but wonder whether they've got so much cheap funding from TDs and the RBNZ facility, that their true margins are somewhat more sustainable than it appears? TD rates still seem stubbornly low.

Most TDs are 6 months and most loans are 12-24 month fixed terms... so the treasurers at banks need to balance that duration risk using swaps presumably.

TDs remain where they were months ago and they are just not moving up in unison with mortgage rates. Huge lag time and banks are creaming it.

With that and Reserve Bank help they really are quite the recipients of NZ welfare.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.