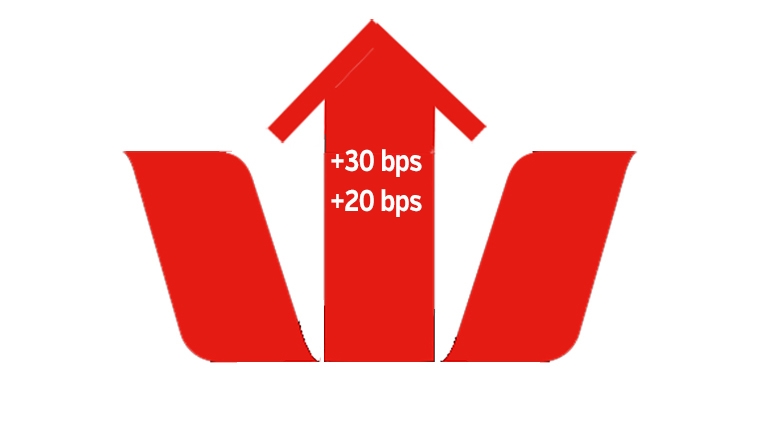

Westpac has jumped in with another home loan rate increase, pretty much matched in their case with across-the-board term deposit rate increases.

This is the third rise from them in April. The first was on April 7, the next on April 20, and now a week later today's next move up.

The net effect is that Westpac's one year rate is up +80 bps in April alone, their two year rate is up +40 bps in the month.

However, these rises take them to the lower band of the rates being offered by the major banks for home loans. In fact for the four most competitive terms (1 yr, 18 mths, 2 yrs, 3 yrs), Westpac now has the lowest overall offer set. The highest is ANZ, Kiwibank is next, and ASB and BNZ are essentially tied. Of course, no borrower chooses all these terms, so competitiveness is more specific in individual cases.

And of course, most banks will match a key rival - if your financials are strong.

The weight banks now place on the strength of borrowers' financial positions is much greater given most bankers now expect to be having to deal with rising borrower stress in the next six months or so.

Since the beginning of March, wholesale swap rates have risen substantially and they are not showing any sign of slowing down. Almost a full +50 bps is priced in to financial markets for the May RBNZ OCR rate review.

One useful way to make sense of these changed home loan rates is to use our full-function mortgage calculator which is also below. (Term deposit rates can be assessed using this calculator).

And if you already have a fixed term mortgage that is not up for renewal at this time, our break fee calculator may help you assess your options. But break fees should be minimal in a rising market.

Here is the updated snapshot of the lowest advertised fixed-term mortgage rates on offer from the key retail banks at the moment.

| Fixed, below 80% LVR | 6 mths | 1 yr | 18 mth | 2 yrs | 3 yrs | 4 yrs | 5 yrs |

| as at April 27, 2022 | % | % | % | % | % | % | % |

| ANZ | 4.65 | 4.55 | 4.90 | 5.25 | 5.55 | 6.35 | 6.45 |

|

4.49 | 4.49 | 4.85 | 5.25 | 5.55 | 6.35 | 6.45 |

|

4.39 | 4.55 | 4.90 | 5.25 | 5.45 | 5.79 | 5.99 |

|

4.80 | 4.55 | 5.19 | 5.39 | 5.55 | 5.79 | |

|

4.59 +0.20 |

4.49 +0.30 |

4.89 +0.20 |

5.19 +0.20 |

5.49 +0.20 |

5.79 +0.20 |

5.89 +0.20 |

| Bank of China | 4.25 | 4.65 | 4.95 | 5.25 | 5.65 | 5.85 | |

| China Construction Bank | 4.15 | 4.25 | 4.50 | 4.90 | 5.20 | 5.65 | 5.90 |

| Co-operative Bank [*=FHB] | 3.89 | 3.79* | 4.49 | 4.79 | 4.99 | 5.45 | 5.79 |

| Heartland Bank | 3.49 | 4.05 | 4.25 | ||||

| HSBC | 5.49 | 3.95 | 4.54 | 4.79 | 5.19 | 5.39 | 5.69 |

| ICBC | 4.39 | 4.09 | 4.35 | 4.79 | 5.19 | 5.65 | 5.89 |

|

4.49 | 4.19 | 4.69 | 4.85 | 4.99 | 5.45 | 5.95 |

|

4.19 | 4.19 | 4.69 | 4.95 | 5.29 | 5.45 | 5.65 |

Fixed mortgage rates

Select chart tabs

Daily swap rates

Select chart tabs

Comprehensive Mortgage Calculator

18 Comments

"7% interest rates this year, guaranteed"

- 2022

Don't.

Yep. I can now see the writing on the wall when the brokers told me REFIX NOW!!

Has he joined CWBW in the basement?

People in Auckland who paid way over value for house in last few years will be coming to terms with huge increases on mortgages and no way out. Once defaults start happening price’s will just crumble even quicker people will have to negotiate with bank and some will just go bankrupt.

People in Auckland who paid way over value for house in last few years will be coming to terms with huge increases on mortgages and no way out. Once defaults start happening price’s will just crumble even quicker people will have to negotiate with bank and some will just go bankrupt.

If your scenario plays out, everyone loses. House price falls affect all owners. They may feel less flush and forgo the spa pool. Less spent into the economy putting pressure revenues, profits, and incomes. It feeds off itself in a downward spiral.

No wonder they've been propping the bubble as much as they can.

Agree JC - but the longer you prop it up......well the eventual mess just gets worse.

If the bubble had been popped 5 years ago the potential for real harm would have been minimised. It is the belief you can prop the bubble forever that has caused this and is exactly what many warned against.

And the inequality propping it up has caused is probably causing more strife than a correction may have. How about those ram-raids and homelessness?

People who bought more than 3-4 years ago, when mortgage rates were about 5%, should generally be fine, if rates go to 6-7%.

Assuming they don’t lose their jobs when the economy tanks.

People are just going to hunker down and accept it and keep on paying the mortgage. What's the other option live in a tent somewhere? Business in retail and restaurants and cafes are going to fold. Anything discretionary and marginal will fold. As the saying goes money will be tighter than a fishes asshole.

I’d add speculative/leveraged property developers to that list Carlos.

I know a couple of people in that bracket who brought a brand new car last year, wonder how many others leveraged up on their house for consumer spending? Thats one of the risks that set up the GFC, but doesn't seem to be well understood here.

Are you sure they put the car on the mortgage?

I bought a new car two years ago and I didn’t put it on the mortgage. Neither did my best mate.

100% sure that they topped up their mortgage for this. To quote "rates are so good and my house value has increased so much" we are early 30s, we dont generally have a spare 50k lying around after buying a first home.

I bought a new car on the mortgage, black Friday 2019, still worth the same now as when I drove it off the lot. Your friends might not have lost capital yet.

It's going to be a while before defaults begin. With hordes and hordes of mortgagors having fixed their home loans for the next 1-3 yrs based on a previous Interest article, this will give them some relief from rising rates and make their household cash flows manageable in the meantime. Speculators hoping for a nosedive in house prices may be out of luck on this one. FHB may even just buy the dip and keep prices stable.

locked in 1yr rate of 4.23 from asb today for when my 2.19 expires mid June, it is what it is

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.