Far fewer, but still getting bigger.

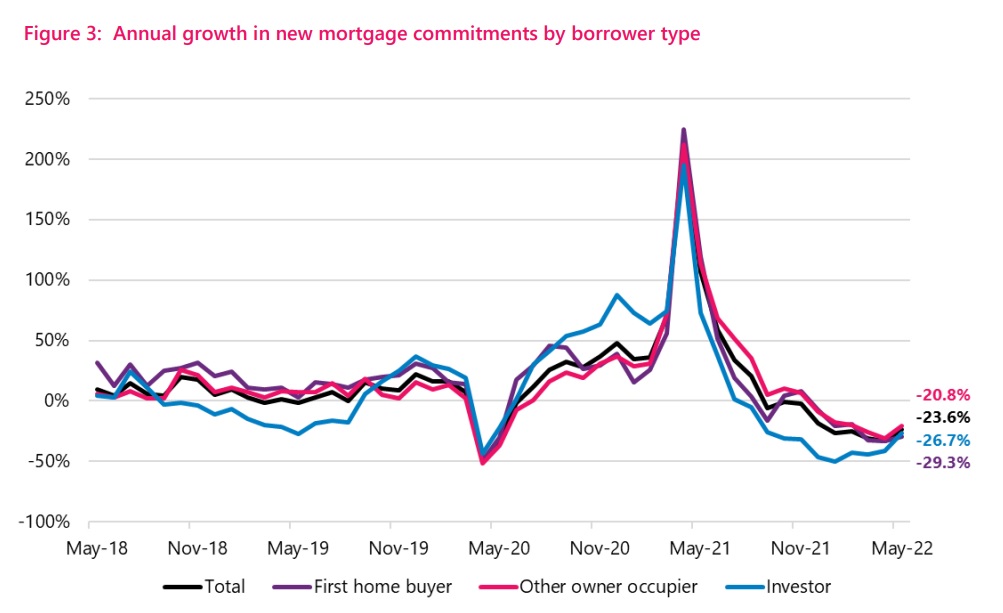

That's the new trend in the mortgage market as the latest monthly mortgage figures just released by the Reserve Bank show.

The figures show that in May the average-sized mortgage around the country topped $408,000, which is a new record, beating the previous high set just in April of this year. The average-sized mortgage is some 24% higher than the same time a year ago.

However, there were only 16,693 mortgages issued in the month - very low for a May. Only the figure recorded in May 2020, which was pandemic affected, was lower in a data series that dates back to 2014.

The total amount advanced in May 2022 for mortgages was a little over $6.8 billion, well down on the more than $8.9 billion in May 2021 when the market was just starting to come off its very high, high - in terms of activity.

In May of last year there were in fact 27,105 new mortgages issued. So, the 16,693 mortgages issued in May 2022 is down by well over a third compared with the same month a year ago.

Then of course the market was still hot, hot, hot. Now since November prices have been falling.

First home buyers are still hanging in there and this grouping too hit a new record high in terms of average size of mortgage, at nearly $595,400 - a figure that just shaded the previous record set in December 2021.

The FHBs borrowed over $1.2 billion in the month collectively, which made up about 18.2% of the total advanced, just down a little from 18.5% in April.

In May, investors borrowed a little over $1.1 billion. Their share of the total advanced was 16.6%, which was down from 17% a month earlier.

The RBNZ also provided this summary of the May mortgage figures.

7 Comments

Annualised lending growth has gone negative for the first time since May 2020 according to my calcs

The average-sized mortgage is some 24% higher than the same time a year ago.

I don't know what to say except good luck to borrowers and banks. God knows, they'll need it.

The banks won't need any good luck. Their profits are exploding.

Isn't it ironic, the banks are creaming it the whole time and the RBNZ decides when the party for the plebs is over?

Shouldn't the RBNZ take out excess stimulus that was pumped into those banks? After all they're going to pay directors, shareholder dividends etc. like never before.

There must be a way to explain larger average mortgages in this environment to first home owners.

I'm thinking that the lower income first home owners have dropped out of the market, resulting in lower volumes, and with them out, it leaves the higher income first home owners still getting their large mortgages because they still pass the tests, which pulls the average up. Sound about right?

I'm thinking the same.

Maybe less people are splitting their mortgages into multiple fixed periods? Opting for a full single fixed mortgage? Therefore the average "loan" size is increasing.

That feels about right.

Also, I suspect it depends on the stock that's being bid for by FHBs.

A 600k property (assuming the 20% constitutes the bar for a successful mortgage application) doesn't buy you much in terms of a an urban pad (i.e. it's entry level). Prices in the <$1m seem to be holding fairly well, with the negative frothiness being at the top end of the market.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.