If it seems quiet out there in housing market land - that's because it is.

The latest Reserve Bank monthly mortgage figures show that fewer than 15,000 mortgages were issued last month.

That's a record low for a June in the time this specific data has been collected - which is only since 2013. But it's a June record by some distance, beating the previous low of a little over 21,000 in that month in 2019.

In June 2020 - just after the lockdown - there were nearly 22,000 mortgages issued, while in the same month a year ago there were 26,000 as the market was at that time just beginning to lose its roar a little.

The June 2022 month follows a recent pattern of declining mortgage numbers issued. However till this month the decline has also been accompanied by a rising average size of mortgage.

Maybe with the rising interest rates we are seeing, some kind of limit has now been reached.

Last month the average-sized mortgage fell from the record high of $408,000 in May to $405,000 in June - but that figure is still nearly 24% higher than the average-sized mortgage in June 2021.

The total amount of money borrowed in June was just over $6 billion, which was well down on the massive $8.5 billion in the same month a year ago, but it compares reasonably with the around $5.4 billion both in June 2020 and June 2019.

First home buyers are keeping comparatively active in the market, borrowing over $1.1 billion in June 2022.

The average size of the FHB mortgages dropped as well, from the record high of $595,000 in May to $588,000 last month.

According to the RBNZ, the share of new mortgage commitments to first home buyers increased slightly, from 18.2% in May to 18.3% in June, while the share of new commitments to other owner occupiers decreased 1.1 percentage points from 64.2% to 63.1%. The share to investors increased from 16.6% in May to 17.4% in June. Investors borrowed just over $1 billion.

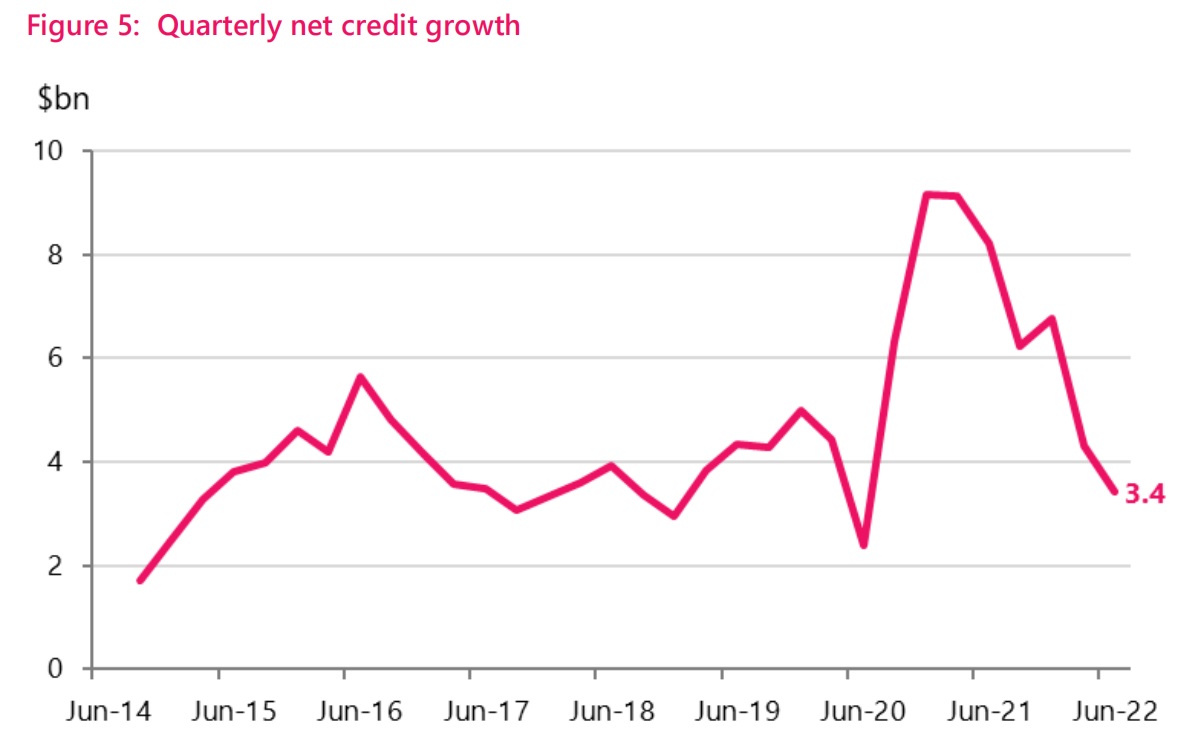

Separate quarterly figures for the period to June showed that mortgage credit grew by just a net $3.4 billion (to a total of $334.8 billion), which apart from the pandemic-affected June quarter in 2020 is the slowest growth in nearly four years.

As some means of comparison, the December quarter in 2020 saw mortgage credit rise by a net $9 billion.

The RBNZ provided this summary of the June mortgage figures.

27 Comments

A flaccid withering.

🍆⤵️

Hardly a surprise

Edit - the numbers are in the link to the summary at the bottom of the article

So mortgage brokers and agents all having a significant financial handbrake. Credit pulse indeed

A lot of experienced brokers are exiting the industry due to the increased compliance burden. End result will be less mortgage advice for New Zealanders as transactions don’t take place. What a disgrace.

https://tmmonline.nz/article/976520533/fap-programme-inches-forward

What's a disgrace, was that we let this mess get to this point in the first place.

Brokers, lawyers, agents, all clipping the debt ticket with business that are only viable of we continue to take on ever increasing amounts of debt.

Like all capital cycles this is healthy. Those that have strong services with good cash reserves will weather the storm and will be in a place to take advantage of reduced competition in the future.

Those in it to make a quick easy dollar... Are rightly pushed out the door.

This isn’t a capital cycle it’s due to nonsensical regulation imposed by incompetent politicians. The industry doesn’t rely on increasing loan sizes it’s based on volume of transactions. We’ve created a situation where borrowers are unable to switch between lenders so the winners are the banks who hold the existing loans because they can charge whatever they like (see net interest margins increasing) and the losers are homeowners.

The industry doesnt rely on increasing loan sizes?

REA and brokers are paid commission based on the size. As sizes have gone up, the percentage should have come down, so the $ paid remains static. But that didnt happen. So has the advice become more valuable? Or, is it just that more should be paid for the same work?

Any comment from you on the absurd commissions paid to brokers that add cost to the end user? Hard to see how $5k commission on the average sized loan is able to be justified. Brokers like to say it doesn't cost the customer anything, but that is disingenuous. That additional cost has to be paid via higher interest rates, just as the REA cost is paid through higher house prices.

You’re correct that the average commission has increased, but we still rely on volumes more than loan sizes. I can assure you that we are doing far more work than we did back in the glory days and for the same money relative to house prices. Liability has also increased thanks to our friends in government.

As far as broker commissions go? I don’t think there’s any additional cost vs direct channels but there may well be. There’s a lot more that goes into interest rates and bank cost models than the acquisition costs through one distribution channel though. Marginal cost models like brokers are probably more expensive in good times and much cheaper in times like now. The rent still needs to be paid for branches on Queen Street and Lambton Quay when there’s no business coming through the door.

What is so prohibitive about the registration process? In principle having advisors to the most significant financial commitment the average person makes registered and vetted seems sensible.

LOL - "more work" - does that mean no 'liar loans' anymore? I think being vetted and liable is pretty sensible, don't you?

re costs, I'd hardly call a circa 1% upfront cost marginal! Where do you think this is paid from? It will just get whacked on to the margin. Wasn't there >$80b in new lending last 12 months .. assume half or more is written via brokers = $350m odd in commission, and the incentive for a customer to borrow more than they need - a key reason why the Aussie Royal Commission slammed percentage based REM and were going to kill it before lobbyists got involved (as customers unlikely to pay their brokers like they pay their accountants).

For god sake, you brokers have to write a couple more lines of mitigants in your narrative and your fine. Agree the legislation is terrible but get over it and work around it like you do for all other aspects of the marginal deals.

Mate you’re in Lala land. That may be the end outcome for customers (who have never heard of, don’t care and don’t understand a single thing about the new requirements, even though they’re supposedly the ones who benefit), but in terms of what we need to do to get set up:

- Complete three Polytechnic papers

- Prepare and implement a policy handbook on all kind of esoteric topics

- Apply for a license from the FMA

It’s about a 3 month setup (in terms of hours spent, the process is longer) and then will be a month a year not doing deals and keeping regulators happy

Which all sounds like it’s not a big deal right? And it’s not really, but what it is though is a complete waste of time, especially for one man band advisers who are going to go back to doing exactly what they were before

The main differences are it will cost another 20k/year (not counting the time lost) and they take on more liability and bullshit paperwork.

Non-bank and investor loans will attract higher fees and first home buyer and refinance deals will quickly become uneconomic so they won’t get the support needed and either won’t buy houses or will pay more than they have to for their mortgages.

The entire point of all this was to make things better for customers. Instead the exact opposite is happening.

So your issues are more around the whole licensing requirements than poorly written amendments to CCCFA? I understand that and also think CoFI will be another painful barrier. Sounds like there maybe some opportunity to centralise the compliance aspects for brokers?

End result will be less mortgage advice for New Zealanders

Considering the general quality and cost of mortgage advice in NZ, this might be considered a win.

Sad and true. Consumers will be the end losers here, another unintended consequence.

No bumper profits for the Big 4 this year. RE agents and mortgage brokers aren't the big spenders this year.

Take comfort that the market will recover, and you did know that about the "ups and downs".

"The share to investors increased from 16.6% in May to 17.4% in June. Investors borrowed just over $1 billion."

Investors are very much in the picture, not dying as portrayed by lobbyists last year.

Do you know what the share of investors was one year ago? Would be good to know.

The slight increase month-to-month from 16.6 to 17.4% may not tell us much. That said, it is in line with Tony Alexander's latest release where he mentioned that investors are tentatively looking around.

That must be why brokers are suddenly calling me to "check in"

REINZ June report said 4721 sales for NZ in June. So does that mean approx 10000 of the 15000 mortgages issued in June were refinancing?

In a similar vein, I've always wondered how things are counted if you split your mortgage into several parts.

Typical situation where demand and supply are significantly out of kilter. Movement in the market will return once they are aligned - at a greatly lower price point than now. Long way to go down before the market gets back to realistic and sustainable levels.

The downturn has started anyone purchasing a property now will see deposit paid eroding and next year could be in negative equity. If you can just wait some places in Auckland dropping 4K a week.

0.1% increases or decreases to lending are just statistical noise. Not worth reporting unless they form part of a time series (of more than 2 points!)

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.