Our colour coding in the table below tells the story of small but relentless rate reductions across all institutions.

Over the past month the yellow shading (below 4%) has extended broadly. Rate offers in the 4% range have shrunk, as have those over 5% (pink shading)

These shifts herald the arrival of the Depositor Compensation Scheme (DCS), where the taxpayer stands behind deposit rate offers from Authorised Deposit Takers (ADT).

Among the big banks there are now only two offers in the market for 4% rates for terms two years and shorter, one from ASB (for 6 months), and one from Westpac (for 2 years). Neither are likely to last very long.

For the challenger banks, sub 4% rates are spreading, but there are still a range of choices. Every one of the eight in our summary table have a 4% or better offer out to two years at the moment. They too are not likely to last long.

The options are more limited for the community non-bank institutions, but most of these six have some 4% or better offers.

It is in the finance company sector that 5% or better offers are still widely available. The best in this group is a 5.5% offer for a one year TD. But even though it doesn't show it in our table, these non-bank finance companies have been the ones to push through the largest rate reductions over the past month. So the premiums currently on offer may shrink further.

And the reason is the DCS. In eight days there will be zero risk of loss for any saver for all deposits up to $100,000 at any of the institutions listed in these tables. The taxpayer guarantees that, and will make good if any of them fails for any reason.

So why would you not chase the highest rate on offer among them? At present you could earn up to 45% more from the highest non-bank deposit taker (NBDT) for a one year term deposit, than at most main banks. That means you are walking away from $1700 per year gross for every $100,000 deposit in this edge example.

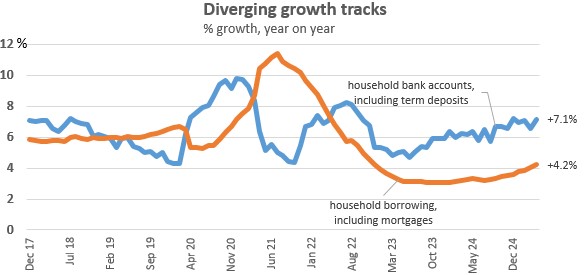

A key background reason banks don't value customer deposits like they used to is that loan demand is weak and household customer deposits (current accounts, savings accounts and term deposits) are swelling faster that the reason to have them.

If you rely on term deposit interest for part of your income, the lower rates go, the more attractive a switch will seem. There may be historic memories lingering about the risks of depositing with NBDTs, but that risk has now substantially passed, and can be managed by splitting investments between institutions.

When you invest, always check how interest is compounded. Depending on how much you are committing, compounding more often is materially better. But some banks advertise their "interest at maturity" rates different to their compounding rates, which for some can be set a little lower. Both Kiwibank and Rabobank do this, although most other main banks don't.

Use the calculator at the foot of this article to see the differences.

We should also point out that after-tax returns can be enhanced for some savers with higher tax rates, by the choice of PIE structures. Not all institutions offer these, but most of the main banks do. For a nine month bank offer, they can be boosted by about 30 basis points going this way. In some cases that will make up any difference, or more.

Always ask a bank for a better rate. Many bank staff have discretion to offer more than the advertised rate. (And check your bank's app offers as they too are often enhanced to retain you). But in this environment don't get your hopes up for a positive response. Carded rates are likely to now be the 'best rate', except in quite special circumstances.

Use the term deposit calculator here, or the one below the table, to calculator your expected net after-tax returns.

The latest headline term deposit rate offers are in this table after the recent changes over the past month. The pink background colour-code indicates 5%+ rates still available. The yellow colour code for those under 4%. Bolded rates are the "best-bank" (currently all from China Construction Bank), the highest carded rate from any bank at this time.

| for a $25,000 deposit June 23, 2025 |

Rating | 3/4 mths |

5 / 6 / 7 mths |

8 - 11 mths |

1 yr | 18mth | 2 yrs | 3 yrs |

| Main banks | ||||||||

| ANZ | AA- | 3.50 | 3.90 | 3.85 | 3.80 | 3.80 | 3.90 | 4.00 |

|

AA- | 3.60 | 4.00 | 3.90 | 3.90 | 3.85 | 3.90 | 4.05 |

|

AA- | 3.55 | 3.90 | 3.90 | 3.85 | 3.85 | 3.90 | 4.00 |

|

A | 3.55 | 3.95 | 3.90 | 3.80 | 3.90 | 4.00 | |

|

AA- | 3.50 | 3.90 | 3.85 | 3.80 | 3.90 | 4.00 | 4.10 |

| Kiwi Bonds. 'risk-free' | AA+ | 3.50 | 3.50 | 3.50 | ||||

| Rating | 3/4 mths |

5 / 6 / 7 mths |

8 - 11 mths |

1 yr | 18mth | 2 yrs | 3 yrs | |

| Other banks | ||||||||

| Bank of China | A | 3.75 | 4.05 | 4.00 | 3.95 | 3.95 | 4.05 | 4.10 |

| China Constr. Bank | A | 3.85 | 4.25 | 4.20 | 4.20 | 4.20 | 4.20 | 4.20 |

| Co-operative Bank | BBB+ | 3.50 | 4.00 | 3.90 | 3.90 | 3.90 | 4.00 | 4.10 |

| Heartland Bank | BBB | 3.60 | 3.95 | 3.95 | 3.90 | 3.90 | 4.00 | 4.15 |

| ICBC | A | 3.75 | 4.10 | 4.00 | 3.95 | 3.95 | 4.05 | 4.10 |

|

A | 3.55 | 4.05 | 3.95 | 3.95 | 3.95 | 3.90 | 4.00 |

|

BBB | 3.70 | 4.00 | 4.00 | 4.00 | 4.00 | 4.00 | 4.00 |

|

BBB+ | 3.60 | 3.90 | 3.95 | 3.90 | 3.90 | 4.00 | 4.10 |

| Non-Bank Deposit Takers | Rating | 3/4 mths |

5 / 6 / 7 mths |

8 - 11 mths |

1 yr | 18mth | 2 yrs | 3 yrs |

| Community institutions | ||||||||

| First Credit Union | BB | 4.00 | 4.25 | 4.25 | 4.25 | 4.15 | 4.15 | |

| Heretaunga Bldg Society | 3.65 | 4.05 | 4.00 | 4.05 | ||||

| Nelson Building Society | BB+ | 3.25 | 3.75 | 4.00 | 3.60 | 4.00 | 3.70 | 3.70 |

| Police Credit Union | BB+ | 3.70 | 4.00 | 3.95 | 3.90 | 3.90 | 3.90 | |

| UnityMoney | BB | 3.45 | 3.85 | 3.80 | 3.75 | 3.65 | 3.70 | 3.70 |

| Wairarapa Bldg Society | BB+ | 3.70 | 4.00 | 4.00 | 4.00 | 3.95 | 3.95 | |

| Finance companies | ||||||||

| Christian Savings | BB+ | 3.65 | 4.05 | 4.00 | 4.00 | 4.00 | 4.00 | 4.15 |

| Finance Direct | 3.75 | 4.50 | 4.70 | 5.10 | 4.15 | |||

| General Finance | BB | 4.10 | 5.20 | 5.30 | 5.50 | 5.25 | 5.10 | 4.65 |

| Gold Band Finance | BB- | 3.75 | 3.75 | 4.95 | 5.10 | 5.05 | 4.99 | |

| Liberty Financial | BBB | 3.95 | 5.15 | 5.15 | 5.20 | 4.80 | 4.80 | 4.70 |

| Mutual Credit Finance | B+ | 4.75 | 4.75 | 4.95 | 4.95 | |||

| Xceda Finance | B+ | 4.80 | 5.00 | 4.90 | 4.70 | 4.90 | 4.50 |

Term deposit rates

Select chart tabs

Daily swap rates

Select chart tabs

Term deposit calculator

4 Comments

The unasked - therefore unanswered question is: Whither debt?

It is unasked because economics is based on an ultimate falsehood; that infinite growth can support infinite debt-issuance. Such was not the case, but economics wrote its playbook in the early draw-down phase and has fiercely avoided adjusting to truths (real science) as impacts have intensified.

The real interest-rate, given the current state of our supporting planet, should be negative, as I have pointed out here, for many years. Whether debt - in total already unassuageable - gets jubilee-d or whether the system crashes, I can't say. But continue it can't.

Economics is not based on "infinite growth", just growth for the foreseeable future.

That graph showing how credit demand fell off a cliff in late 2021 is a reality check for how long it's going to take to get back to pre-covid levels.

At least you didn't say 'back to normal'.

But the point of the link I supplied upthread, is that it won't/can't 'get back'.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.