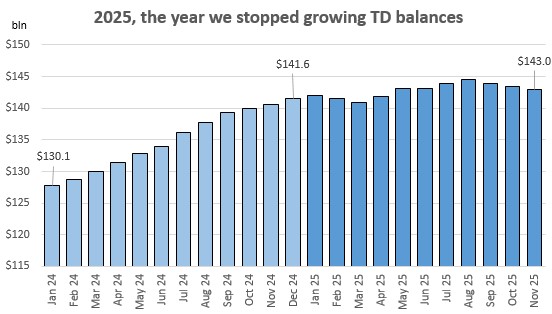

2025 was the year households stopped growing their term deposit balances.

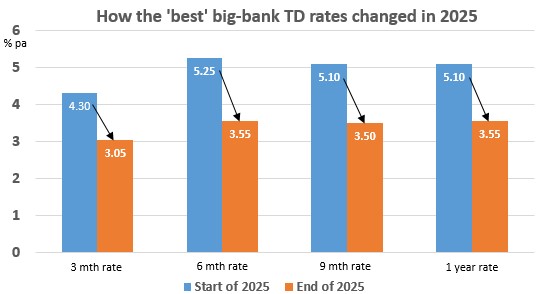

And interest rates offered by banks fell in the year.

Although residential housing capital gains were notable by their absence, other options grabbed the limelight. Notably precious metals, KiwiSaver and other funds management options, along with equity investments.

That left term deposits marooned as an unfavoured option.

Casting a pall over this option has been the lower rates.

Most savers using term deposits choose the less than one year terms, and those have faced the sharpest pullbacks. The end of 2025 may have seen rates rise, but they were at the longer and unfavoured end of the maturity profile. In the zone where savers are comfortable, the falls have been notable.

| How the key big-bank TD rates changed in 2025 | ||||

| 3 mths | 6 mths | 9 mths | 1 yr | |

| % | % | % | % | |

| Starting the year with … | ||||

| ANZ | 4.15 | 5.05 | 4.90 | 4.75 |

| ASB | 4.15 | 5.05 | 4.90 | 4.75 |

| BNZ | 4.10 | 5.00 | 4.90 | 4.75 |

| Kiwibank | 4.20 | 5.25 | 5.10 | 5.10 |

| Westpac | 4.30 | 5.05 | 5.00 | 4.75 |

| average | 4.18 | 5.08 | 4.96 | 4.82 |

| Best | 4.30 | 5.25 | 5.10 | 5.10 |

| Ending the year with … | ||||

| ANZ | 3.00 | 3.45 | 3.40 | 3.50 |

| ASB | 2.85 | 3.45 | 3.50 | 3.45 |

| BNZ | 2.90 | 3.45 | 3.45 | 3.55 |

| Kiwibank | 3.05 | 3.55 | 3.45 | 3.55 |

| Westpac | 3.00 | 3.45 | 3.40 | 3.50 |

| average | 2.96 | 3.47 | 3.44 | 3.51 |

| Best | 3.05 | 3.55 | 3.50 | 3.55 |

Part of this decline is related to the lower rate signals from the RBNZ during the year. The OCR started at 4.25% and ended at 2.25%. For short rates, the OCR is influential.

Also, on July 1, the Depositor Compensation Scheme kicked in. This protections comes at a cost to banks and NBDTs covered. While it opens up the safety of spreading deposits to covered non-bank deposit takers their costs for protection are risk-based, which limits how much premium they can offer.

And of course, no financial institution wants to raise funding (a liability to them) faster than they can place it as a loan. With muted real economy activity, loan demand has generally been low enough that the big banks didn't feel the need to bid up their offer rates.

When you invest, always check how interest is compounded. Depending on how much you are committing, compounding more often is materially better. But some banks advertise their "interest at maturity" rates different to their compounding rates, which for some can be set a little lower. Both Kiwibank and Rabobank do this, although most other main banks don't.

Use the calculator at the foot of this article to see the differences.

We should also point out that after-tax returns can be enhanced for some savers with higher tax rates by the choice of PIE structures. Not all institutions offer these, but most of the main banks do.

Always ask a bank for a better rate. Many bank staff have discretion to offer more than the advertised rate. (And check your bank's app offers as they too are often enhanced to retain you). We have been surprised to hear recently of even big banks agreeing to a small boost, when asked.

Use the term deposit calculator here, or the one below the table, to calculate your expected net after-tax returns.

The latest headline term deposit rate offers are in this table after the recent changes over the past three weeks. The yellow colour code is for those under 4% and has spread comprehensively. Bolded rates are the "best-bank", the highest carded rate from any bank at this time. The blue-coded rates are those under 3%. Bank offers of 4% or above are starting to reappear again.

This table only lists institutions covered by the Depositor Compensation Scheme.

| for a $25,000 deposit December 31, 2025 |

Rating | 3/4 mths |

5/6/7 mths |

8 - 11 mths |

1 yr | 18mth | 2 yrs | 3 yrs |

| Main banks | ||||||||

| ANZ | AA- | 3.10 | 3.45 | 3.40 | 3.50 | 3.60 | 3.65 | 3.90 |

|

AA- | 3.00 | 3.40 | 3.50 | 3.45 | 3.50 | 3.65 | 4.00 |

|

AA- | 3.00 | 3.45 | 3.45 | 3.55 | 3.75 | 3.65 | 3.80 |

|

A | 3.10 | 3.55 | 3.40 | 3.55 | 3.75 | 3.90 | |

|

AA- | 3.00 | 3.45 | 3.40 | 3.50 | 3.50 | 3.75 | 3.90 |

| Kiwi Bonds. 'risk-free' | AA+ | 2.50 | 2.50 | 2.75 | ||||

| Rating | 3/4 mths |

5 / 6 / 7 mths |

8 - 11 mths |

1 yr | 18mth | 2 yrs | 3 yrs | |

| Other banks | ||||||||

| Bank of Baroda | BBB- | 3.35 | 3.65 | 3.60 | 3.60 | 3.60 | 3.65 | 3.85 |

| Bank of China | A | 3.25 | 3.60 | 3.50 | 3.55 | 3.50 | 3.55 | 3.80 |

| Bank of India | BBB- | 3.25 | 3.70 | 3.70 | 3.70 | 3.80 | 3.85 | 3.85 |

| China Constr. Bank | A | 2.70 | 3.20 | 3.20 | 3.20 | 3.25 | 3.25 | 3.45 |

| Co-operative Bank | BBB+ | 3.00 | 3.50 | 3.40 | 3.50 | 3.45 | 3.70 | 4.00 |

| Heartland Bank | BBB | 3.00 | 3.40 | 3.40 | 3.40 | 3.40 | 3.45 | 3.60 |

| ICBC | A | 3.25 | 3.60 | 3.50 | 3.65 | 3.70 | 3.75 | 4.00 |

|

A | 3.05 | 3.55 | 3.45 | 3.60 | 3.70 | 3.70 | 4.00 |

|

BBB | 3.15 | 3.45 | 3.45 | 3.50 | 3.60 | 3.65 | 4.00 |

|

BBB+ | 3.10 | 3.45 | 3.40 | 3.50 | 3.50 | 3.75 | 3.95 |

| Non-Bank Deposit Takers | Rating | 3/4 mths |

5 / 6 / 7 mths |

8 - 11 mths |

1 yr | 18mth | 2 yrs | 3 yrs |

| Community institutions with DCS protection | ||||||||

| First Credit Union | BB | 3.40 | 3.65 | 3.65 | 3.65 | 3.70 | 3.70 | |

| Heretaunga Bldg Society | 3.05 | 3.55 | 3.50 | 3.55 | ||||

| Nelson Building Society | BB+ | 2.75 | 3.20 | 3.15 | 3.40 | 3.50 | 3.50 | 3.70 |

| Police Credit Union | BB+ | 3.10 | 3.45 | 3.40 | 3.40 | 3.40 | 3.45 | |

| UnityMoney | BB | 3.15 | 3.40 | 3.35 | 3.30 | 3.35 | 3.45 | 3.45 |

| Wairarapa Bldg Society | BB+ | 3.20 | 3.45 | 3.45 | 3.65 | 3.75 | 3.85 | |

| Finance companies with DCS protection | ||||||||

| Christian Savings | BB+ | 3.00 | 3.50 | 3.50 | 3.50 | 3.50 | 3.55 | 3.70 |

| Finance Direct | 2.95 | 3.55 | 3.55 | 3.55 | 3.70 | |||

| General Finance | BB | 3.50 | 3.70 | 3.80 | 3.90 | 4.00 | 3.80 | 3.80 |

| Gold Band Finance | BB- | 2.75 | 2.75 | 3.75 | 4.00 | 4.05 | 4.20 | |

| Liberty Financial | BBB | 2.95 | 3.60 | 3.65 | 3.80 | 3.80 | 3.80 | 3.80 |

| Mutual Credit Finance | B+ | 3.30 | 3.30 | 3.40 | 3.50 | |||

| Welcome | 3.60 | 3.90 | 4.00 | 4.05 | 4.10 | 4.20 | ||

| Xceda Finance | B+ | 3.50 | 3.50 | 3.60 | 3.60 | 3.65 | 3.75 | |

Term deposit rates

Select chart tabs

Daily swap rates

Select chart tabs

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.