Housing markets in some parts of the world are looking vulnerable to "even a modest rise" in interest rates - and New Zealand is pinpointed for attention in new research done by independent global economics researcher Capital Economics.

Capital Economics senior economic adviser Vicky Redwood says property markets "are the weak link" when it comes to the impact of tightening monetary policy.

"A modest rise in interest rates might only cause price falls in a few obvious candidates. But rates might have to rise only a bit further than we expect to cause more widespread falls. While this would not cause a second global financial crisis, it would still weigh on economic growth in the countries concerned and could cause interest rates to start falling again in some places.

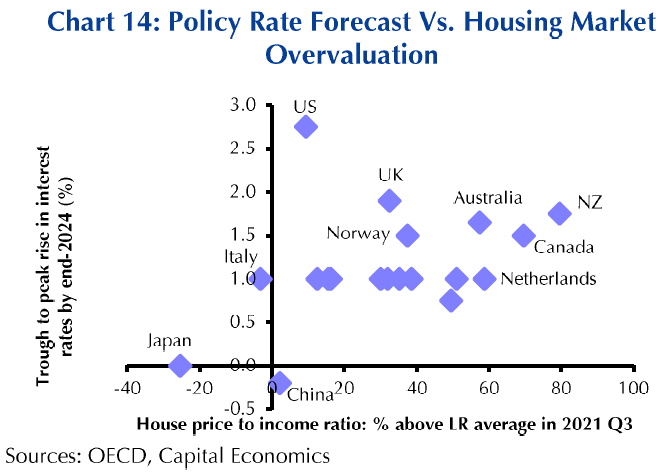

"...Housing markets in some areas look vulnerable to even a modest rise in interest rates; we are most worried about Canada, Australia, New Zealand and Hong Kong. And there is a risk that interest rates will need to rise above their equilibrium in order to get inflation under control. In that case, we could be looking at more widespread falls in prices."

In fact Capital Economics Australia and New Zealand economist Ben Udy said in early January 2022 that he thought falling house prices in New Zealand would lead the Reserve Bank (RBNZ) to actually start DROPPING interest rates again from next year.

And he is sticking to that view.

"New Zealand’s high share of fixed mortgage rates won’t insulate the housing market from RBNZ rate hikes. Indeed, we’re sticking to our view that house prices will fall this year and cause the RBNZ to reverse course next year by cutting interest rates."

He's expecting the Bank to hike rates at every meeting this year, lifting the Official Cash Rate to 2.5% (it's 1% now).

"Home sales have slumped to a level consistent with prices coming to a standstill before long. If anything, the slump in home sales means that house prices could start falling even earlier than our current forecast," Udy says.

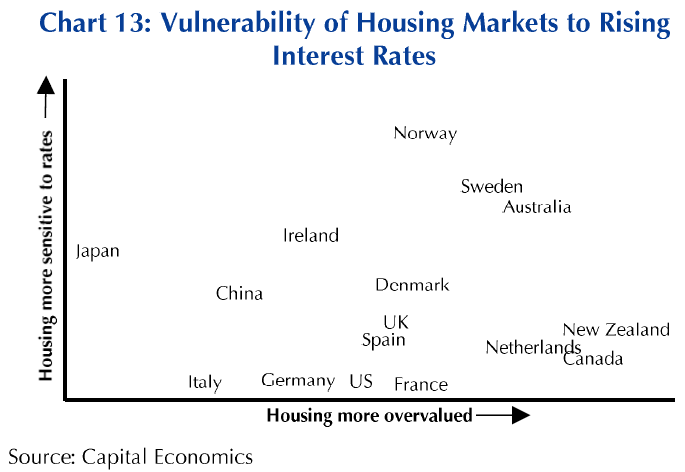

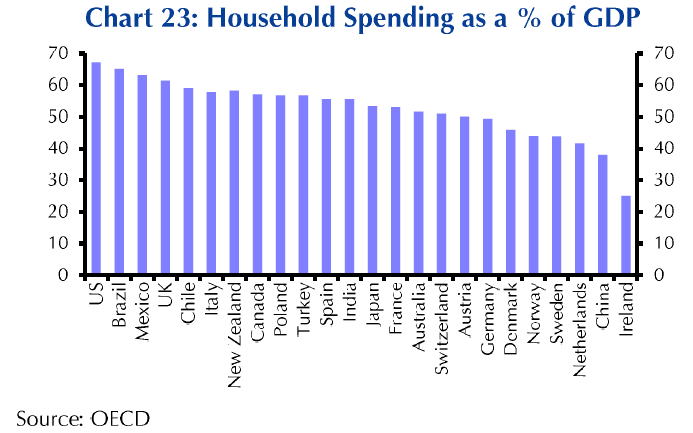

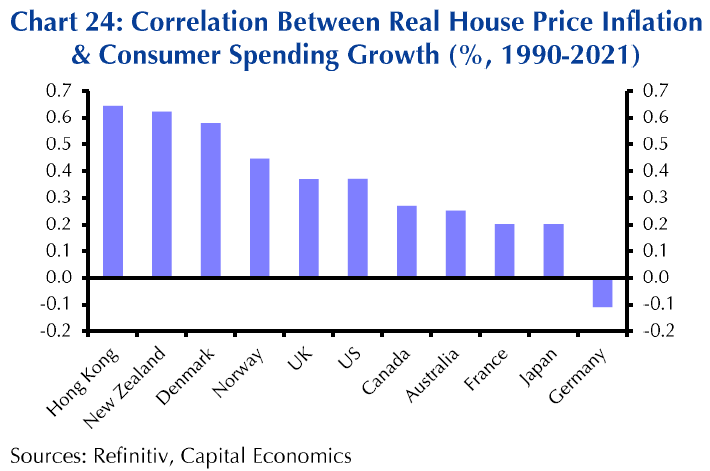

Vicky Redwood says that countries differ in how vulnerable their economies are to house price falls.

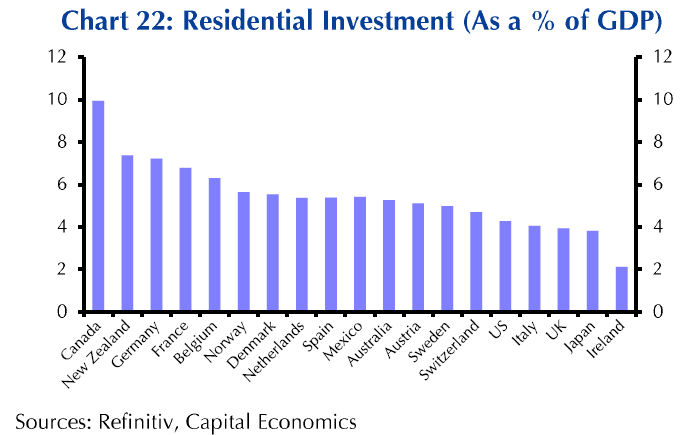

"Most at risk would be those that have relied heavily in recent years on residential investment (especially Canada) and those where the links between house prices and consumer spending are strongest (such as New Zealand)."

Redwood says property "looks overvalued" in some countries.

"For property markets in these places, even a modest rise in interest rates may well therefore prove too much.

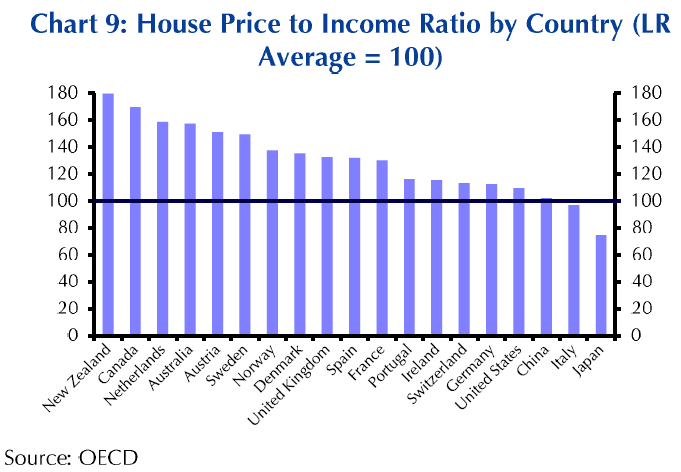

"Chart 9 shows house price to income ratios relative to their long-run average for the biggest economies for which there are comparable data.

"While the equilibrium is likely to be higher than this long-run average, those that are furthest above their long-run average are most likely to be overvalued.

"Most notable is New Zealand, where the house price to income ratio is almost double its long-run average," Redwood says.

She notes that the latest data are for 2021 Q3 and rapid house price rises in the past few months and declines in income as government support has been withdrawn will have pushed up the house prices to income ratio further in the US in particular.

She says while it is not Capital's "central forecast", there is clearly "a significant risk" that interest rates end up rising above their equilibrium rates in order to get inflation under control.

"In that case, we would probably be looking at more widespread falls in house prices."

She says the "good news" is that even widespread property price falls would be unlikely to cause another global financial crisis. The rise in house prices over the past decade has not been accompanied by a prolonged loosening in credit conditions. Accordingly, household debt as a share of income has been stable and at a much lower level than seen ahead of the financial crisis.

"Having been propped up by low interest rates and bond yields for over a decade, property markets will certainly be tested as monetary policy tightens. How they fare will depend in large part on just how far interest rates rise and what impact quantitative tightening has on financial conditions.

"We think that most property markets can cope with a modest rise in interest rates. But there is still a huge amount of uncertainty about how high interest rates will need to go to bring inflationary pressures under control, uncertainty that has only been exacerbated by the further inflationary pressures stemming from the current war in Ukraine. And property prices do not look to be in a good place to withstand much bigger rate rises than we expect. That poses a downside risk to our forecasts for economic growth; in some countries, it is quite possible that weakening housing markets are what prompt interest rates to start falling again."

101 Comments

7% interest rates this year is very likely. But a -30% Crash in home prices is a certainty.

It's Monday, not permitted to spoil spruikers day and week ahead

Not going to happen. Rates need to go beyond 7% for that to happen. The effect is exponential beyond 7% and the RBNZ will not let it happen but instead your wallet will still get hit from the other direction which is high inflation. Have you not already learned the lesson from Covid ? I did. The RBNZ and the government step in and start throwing money about like there is no tomorrow. RBNZ already dragging its heals on rate rises, its going to take until next year to get where rates should be right now.

I don't think it will happen either.

But I think a 15-20% fall is a real chance.

It's a certainty, 2022 said so

a real chance? Auckland is at -19% from the peak already.

Carlos, I have to agree. This has been shown time and again by consecutive governments with covid only being the latest example.

Fact:

Actually the effect is logarithmic, not exponential.

The effect from 2=>5 is much more than 5=>8

Opinion:

I don't think they have what is needed to stop what is going to happen.

Houses in nz are going down a lot, and a lot, like a lot.

and fast

Houses in nz are going down a lot, and a lot, like a lot.

That's probably correct. But for me the better questions are: how fast, how long will it stay at the trough, and how quickly will it recover?

my opinion?

I guess the cost of an house is costant. but not absolute.

How much an house costs? as much as a normal household can get from a normal bank.

so let's make 1M 3% as a base, to make it simple I am not considering deposits so it is a bit far fetched

1000000 = bank believe you can pay 4216 per month

so, if bank keep thinking the same

at 7%

it will be 635000

1M - 635k = 365000

so I am expecting a final outcome of circa -36.5% in 18 months

5% + or -

I think you are spot on. The politicians always argued that this was a supply problem and that if more houses were built prices would fall. The truth was that it was a bubble driven by easy credit and preferential tax rules. People paid as much as they could borrow not what the house was worth. Now the money tap has been turned off, prices will fall, speculators will leave the market and normal people with steady incomes (nurses, teachers etc) will be able to buy a house again.

Probably splitting hairs really, peoples ability to repay is not purely based on those numbers its based on income spread. Very few people are the top earners and the vast majority will have stretched themselves to the very limit at 6-7% rates so the effect beyond that is as good as exponential. In real terms you would look at about an 8% threshold as a total collapse and serious defaults occurring in the housing market and it would be game over. It impossible to say the exact number but in theory the pain starts at 7.1% home loan rates.

Good points. And anyone with a modicum of morality must ponder these and the quote in the article: "we’re sticking to our view that house prices will fall this year and cause the RBNZ to reverse course next year by cutting interest rates." House prices are philosophically and practically simply not allowed by our governors to go down.

This market manipulation to benefit asset holders looks absolutely morally bankrupt. Taking from the poor (and their wages and savings) constantly, to give wealth to the already wealthy. Protecting speculators from risk by throwing young working folk and elderly folk dependent on savings under the biggest of buses.

It is high time we as a country recognised the moral problems in what we have been doing, living beyond our means by running up a debt we bank on passing to the next generations.

This market manipulation to benefit asset holders looks absolutely morally bankrupt. Taking from the poor (and their wages and savings) constantly, to give wealth to the already wealthy. Protecting speculators from risk by throwing young working folk and elderly folk dependent on savings under the biggest of buses.

WELL, "to be fair" PM Ardern did put her cards on the table by saying she wanted 'house prices to increase' and that such increases were 'expected'.

Even after the failure of the much lauded KiwiBuild, Labour was elected with a majority. Many of my fellow "young working folk" voted for Labour - twice!

You don't see me on interest.co.nz complaining about house prices because when people show me who they are, I believe them.

NZ has a propped up housing market and that's the government's policy. Do I think it's a moral policy, NO! Do I think it's an advantageous policy for "young working folk", NO!

Do I believe PM Ardern is living up to her above PUBLIC statements to electors, YES! You can't have it both ways; you can't vote for increasing house prices, then complain about the price of housing.

Many "young working folk" are structuring their finances and life choices around a delusion, rather than reality.

Agree. Many are realising that voting for either tinge of Natbour is largely voting for the same attitude to house prices - that they are only allowed to go up - albeit Labour may ask investors to contribute more to funding society's services alongside working taxpayers (whereas National is more keen to give them a free ride).

I do wonder at the independence of the politicians vs. a very strong influence of the advisory bodies steeped in a particular ideology, e.g. Treasury and Reserve Bank. I question whether John Key and Jacinda Ardern were both initially sincere and serious on the housing crisis but were advised, persuaded, convinced, that house prices are economically only ever allowed to go up.

:)

House prices haven't really increased, the NZ Dollar's purchasing power has just decreased through excessive credit-creation.

The delusion really is that house prices have increased. In such a situation you'd diversify out of the NZ Dollar.

TVNZ's Q+A panelists believe increasing benefit levels.. to support past mortgage-lending-largesse?.. is the answer? Scary this show is funded by the tax payer!

See: Q+A segment https://youtu.be/Mk6uDoQfA94

Carlos67 - You spoke to soon .

https://www.interest.co.nz/personal-finance/114945/wholesale-swap-rates…

2022, "7% interest rates this year is very likely. But a -30% Crash in home prices is a certainty"

Just change your name to 2023 at the end of the year if you're wrong so you don't need to be accountable

The spruikers indicate that is potential for further rises, irrespective of interest rate rises

Hi DGM, (well-named)

If you made the effort to investigate what is actually going on, you'd find out that the top end of the housing market remains buoyant. Record prices are still being recorded.

But continue living under a rock if you wish to.

TTP

We are talking about the overall market in aggregate, most of the time.

There will always be some sectors / locations that do better or worse than others.

The top end of the market usually remains fairly robust through most economic conditions. But it's only 5-10% of the market.

The top end of the market usually remains fairly robust through most economic conditions

Where on earth do you get this stuff? Eg. the top end market in the main centres fell dramatically in 88-91. It also sagged noticeably in 2007-2009 and again in 2014 in Wellington

Very different economic contexts.

Hey TTP - Here's a quick (and narrow) investigation of what's going on in the top-end of the market... in Palmy

There's a market manipulating spruiker who wants $800k+ for his 2 bed penthouse apartment - he didn't get any offers last week at tender so it's now priced by negotiation

https://www.trademe.co.nz/a/property/residential/sale/manawatu-whanganu…

It would be a record if he got it, but he's dreaming as the same size apartment in the same building is for sale at $495k - and this one might even have views of the windmills

https://www.trademe.co.nz/a/property/residential/sale/manawatu-whanganu…

Speaking of rocks... what's in his head? It must be costing him a fortune to keep it staged with all that rented furniture. Maybe he needs to have a hard word to his ego

Tui Billboard "i have a penthouse in Palmy"

Tui Billboard #2 - "the housing market remains buoyant"

Property "Brokers" - enough said

Price fall starts after acceptance, which comes after resistance/denial. It is still hard for many vendors to accept the reality though prices are still high and getting good return, depending when one purchased the property,

A colleague bought an investment property in Manurewa for $620000 in May 2020. Earlier was getting appox 1.2 million for that house, which he still did not sell at that time. Now that he is selling will still be getting anything between million to 1.1 million but he is unhappy for loosing 10% to 15% from the peak instead of being happy with 50% to 60% gain - human nature.

Earlier greed prevented from selling but now fear is making him sell at best available price as expecting price to fall further after being in denial mode for sometime. Meaningfull price fall is still to go.

Why would anyone want to sell their precious property less than what one's values it in their own eyes?

If it was valued $1.2m, he/ she should hold onto the property for the next 20 years until they can get that price.

I agree. I have been watching a number of properties now. Two didn't sell at auction and are now being sold "by negotiation". Two others were being sold "by negotiation" and have now been priced. The surprise came this weekend when a priced property has now been repriced by a 10% decrease (Marlborough).

It's like those peps saying that smoking is good because they have a relative that is 90 years old and still smoking.

Those are outliers.

statistically almost meaningless when you need to make a trend

TTP you don’t seem to get it average earners cannot afford to buy million plus houses with rates about to takeoff it will be only a matter of time for a crash to erase all gains from last 3 years. Remember once the base crumbles the top end will crash quickly.

whose living under a rock?

Eyes wide open, evaluating the potential risks.

Prices are already falling and rates have a long way to go.

Lots of upside risk to rates due to the upcoming mountain of climate change costs that need to kick in (inflation).

No real relief expected in wage growth, the middle income belt of most developed countries has been been getting squeezed for half a century now.

Only people that should be buying now are those that really really need to, or if you buy/sell in the same market.

"New Zealand’s high share of fixed mortgage rates won’t insulate the housing market from RBNZ rate hikes. Indeed, we’re sticking to our view that house prices will fall this year and cause the RBNZ to reverse course next year by cutting interest rates."

Exactly, what I've been saying for months. It's great to see the thoughts of a non-biased economics consultancy without vested interest- such a thing is pretty much non-existent in NZ.

Following cuts next year as the property market and economy will have slumped big time, I don't think the OCR will be any higher than 1.5% by July 2023.

Unlike ANZ who see it at circa 3.5%....Just remember and note that prediction folks! Got that 'ANZ fanboy' P8???

I disagree that it will get to 2.5% by the end of this year. Even if my prediction of 1.75% is wrong, I struggle to see it getting over 2.0 / 2.25%. I think they will take one or two pauses in the second half of the year.

HM

As you have said . . . . we need to wait and see.

I note that your Ouija Board is now confirming 1.0 to 1.5%. :)

This of course goes with your inflation done by 2022 (unlikely if RBNZ is hesitant) and interest rates back to 2 to 3% within two years.

Edit: I see you have edited your comment re 1.0 to 1.5% . . . . and ANZ were saying 3.0% when you labelled them fools.

Cheers

My late 2021 prediction was for the OCR to get no higher than 1.75 in 2022, and then to be cut back to circa 0.5-1% by July 2023.

I certainly now see the chance that the OCR will get up to 2.25, before being cut back to 1-1.5% by July 2023.

I maintain that ANZ are in lala land.

You need to consider what's happening over the next decade -> the cost of climate change will keep the inflation pressures high for years to come. My view is that rates of 1's, 2's, 3's where a long term deviation. We are more likely to see 7-8+ then back to last years free money.

Inflation is here to stay. Rates going up only from here.

And a massive correction will only affect those who have bought sold in the last 2 years. Most of us will be just fine...

We'll see TTP. Hope you remember my track record and my 2019 prediction of a housing slump in 2022-2023...

Anyway, I have a home and am happy. I've said before that I have plenty of budgetary 'fat', and even more so when I learnt last week that our imminent Homestar 6 rating could land us a 1% discount off our mortgage when we re-mortgage late this year.

I do worry though for FHBs who bought in the second half of 2021. Many could well be deeply into negative equity by late 2022, and having to refinance at much higher rates...

HM

"Hope you remember my track record and my 2019 prediction of a housing slump in 2022-2023..."

You are sounding desperate . . . . make sure that you can distinguish between guessing and considered rationale.

The housing market over the period 2020-21 years was a reflection of Covid and consequential historic low interest rates and most commentators are currently predicting a fall from the result in the 35%+ spike in growth . . . so nothing to take from now calling a fall now.

Your 2019 call was based on the 2019 housing market level . . . unless of course you and your Ouija Board factored in Covid. I see that your current predictions of the fall will only take the market back to around its 2019 levels so you are not consistent in your comments.

Remember you and your Ouija Board calls: inflation gone by 2022, maximum for OCR is 1.75% (not restricted to 2021), interest rates to return to 2 to 3% within two years . . . mind you, I see you trying to wiggle out of these.

Cheers

Just to clarify some misrepresentations (you are a specialist in those right?)

You are sounding desperate . . . . make sure that you can distinguish between guessing and considered rationale.

- The 2022-2023 call was considered and based on historical observations and several other things: bitter that I was right?

"and most commentators are currently predicting a fall from the result in the 35%+ spike in growth . . . so nothing to take from now calling a fall now. "

In fact, P8, few commentators (other than fellow 'DGMs' on this website) were predicting falls or at least falls of significance as of late last year. I am not 'calling a fall now', I was calling it as early as Spring last year, and my end of year pick was falls of 5-10% as my central scenario, followed by falls of 10-20% as second most likely outcome. As of late last year, Tony Alexander was saying flat or small gains, Ashley Church was saying small gains, ANZ was saying only 3% falls, at least one other bank was saying small gains etc etc.

'Your 2019 call was based on the 2019 housing market level . . . unless of course you and your Ouija Board factored in Covid.

That is irrelevant / wrong. My 2019 call was not based on the 2019 housing market level at all. It was in fact largely irrelevant. It was based on what I thought would happen in 2022/2023 independent of what was happening in 2019.

I see that your current predictions of the fall will only take the market back to around its 2019 levels so you are not consistent in your comments.'

The final point of that comment makes no sense. In terms of the first part of it - I don't actually have a firm current prediction, other than I think a 10-20% fall is now more likely than a 5-10% fall. And again you are wrong - a 10-20% fall would only take us back to late 2020 / early 2021 levels, not 2019 levels. A 5-10% fall would only take us back to mid 2021 prices.

Remember you and your Ouija Board calls: inflation gone by 2022, maximum for OCR is 1.75% (not restricted to 2021), interest rates to return to 2 to 3% within two years . . .

Again, misrepresentations. I said domestic, demand-side inflation (not external supply-side) will largely disappear in 2022 (so by 2023). Yes I said a maximum OCR of 1.75, I have acknowledged it might go higher, but definitely not north of 3% as per ANZ's views. And yep, I stand by interest rates to return to 2-3% within two years - as I think our economy and property market will have well and truly slumped by early 2023, as these international and unbiased economists say. They also say that the OCR will be cut in 2023.

mind you, I see you trying to wiggle out of these.

Since when have I wiggled out of things. Like anyone, I'll change my view if I see things changing, and admit where I got things 'wrong'.

I do think time will tell that you will be on the right side of history. I also do not believe that the OCR will be raised that much as all the Bank Economists currently predict. Also we should not forget that commercial interest rates are dictated by what is happening on the (international) bond markets. Our RBNZ Governor can not change much about that. I strongly believe that New Zealand weak position in fighting inflation lies with our domestic inflation. The last 15 years, 2007 -2022 it has been hovering between 2 and 4% while tradable inflation, outside the GFC and pandemic peaks, was mainly between 0 and 2 % and even negative -2% to 0% between 2012 and 2016. (see article Mary Jo Vergara Kiwibank)

This tells me that the New Zealand economy is not as efficient as the rest of the world because our markets labour, food, energy, land and so on are not efficient. This means that there will be allways a domestic price pressure in regardless of what happens in the rest of the world. (It is up to the government to"repair" those markets with the appropiate legislation! Not the central bank). Interest rates will allways be higher than in the rest of the world.

What I predict what will happen? Next year about 3 months before the election the Labour Government will re-install the deductability of interest rates but this time not for investors but for everybody. It will also come with rental subsidies for the ones who do not own a home. To (partly) pay for it the government will introduce a stamp duty or a capital gain tax and otherwise they will increase the deficit which will be paid for by the RBNZ buying bonds straight from the Treasury and not through the secundary market (to prevent the banks have access to cheap money and it starts all over again!)

Peter M so people with freehold houses will need to take out a mortgage against the house to obtain a government subsidy, what a great way to buy a new boat and car government pays Yahoo I'm in .

Property. It's our biggest welfare scheme, but just for the wealthy.

You get it Frank. By the time the government introduces this "solution" New Zealand, mid 2023, is already in the middle of a stagflation (Stagnated economical growth due to amongst others, low confidence created by subdued property prices with high domestic inflation) and desperate to kick start the economy. By that time the rest of the world has recovered from the pandemic and Ukrain shocks and we should start to import the lower tradable inflation again. To achieve that the government needs to encourage us to spend.

With this solution I assume that the government is not prepared to fix the effectiveness of the New Zealand markets and keep on creating a high domestic (=Non tradable) inflation.

Surely ANZ are just signalling. I don't imagine they believe their statement will come to fruition.

Who knows. I don't trust them, I think they are signaling / playing games.

However they portray themselves as 'independent' and 'objective' economists...

If they really don't think the OCR will go to 3.5, it's not really appropriate saying that's their objective forecast, is it?

It could only be appropriate if they are speaking from a moment in time and assuming no further change. Which is how I conclude all economic forecasting.

Interest rates will stay high for a very long time coming. The pendulum always swings. And there is some serious swinging to do before the market heals itself. This occurs in nature, it is natural, normal, predictable and very simple. Its just hard for people to believe when they have vested interests. Including economic consultancy groups. Don't buy into the Fake Future trick.

2022

"Interest rates will stay high for a very long time coming".

Nah. Housemouse says that they will be returning to 2 to 3% within two years. :)

Nice dig! Seems I've riled you up again.

And an independent, non-biased / non-vested interest, international economics consultancy says they will be cut in 2023.....

Well you did address P8 as TTP, you should stop that rubbish, it's very obvious they're not the same.

But yes, We are on the same page re interest rates coming down again in late 2023-2024

If P8 is anyone it's Yvil & vice versa...

Agreed, P8 and my views align a lot more than TTP's

👀

Actually it was typo - seriously. Which I corrected.

It’s nice you rate him. I don’t. He’s totally misrepresented what I have said on several occasions.

Would you care to apologise for your misrepresentations above? Or are you not man enough to?

If the rest of the world are raising rates how will RBNZ lower them without making NZD crash creating higher inflation. You are dreaming if you think NZ can do whatever they want they will just follow rest of the world.only way housing market is going down and it could be a long wait till rates start reducing again.

Because NZ is not a lone basket case and the rest of the world will be doing the same thing in unison for the very same reasons.

The graphs in the article above show very clearly that the USA housing market is not at all sensitive to rate rises.

The FED could merrily raise rates much higher, for a long time, before they make much of a dent in their own housing market.

Possibly because many of them are on a fixed rate for the length of their mortgage?

I think you're right. As with the US, it's not uncommon in the EU to be able to fix for the life of your mortgage (i.e. 30 yrs). Imagine if we had such a luxury here?! It is yet another example of how much we pay through the nose compared to other countries.

The other thing to adopt would be non-recourse mortgages.

Agreed DTRH I fail to comprehend the argument that interest rates must fall to support house prices . This would have to mean inflation will be ignored and allowed to rise to whatever so house prices are maintained. What about the cost to everybody else nz dollar would be trashed and cost of imports rise leading to more inflation ultimately affecting homeowners through cost of living loss of jobs etc. This would be reckless in the extreme.

We need to be just ahead of the FED to avoid the worst impacts of tradeable inflation so you are right in the zone with 2%

While I agree a declining housing market and a potentially slowing or contracting economy would normally see the RBNZ start cutting in 2023, it's going to be awfully hard for them to cut rates with inflation as high as it's likely to be. Unless of course you think this current surge in inflation is "transitory"? But with all the money creation that's happened in the developed world over recent years, I strongly suspect we're about to see what strong and persistent inflation really looks like.

A house next door to me is on the market and has been interesting to watch. Surprisingly busy at open home on Sunday. A few observations compared to say last year when we have had similar houses for sale on the street, less people at the open homes but certainly a change in the 'type' of people. Last year it was mainly BMW's, late model SUV's, Audi's and the like, now its Mitsi Outlanders, vans, Mazda sedans etc.

FHB vs investor?

Don't worry about buying into the peak of one of the world's largest ever housing bubbles. 🫧

It's all just "fluctuations". 🤡

Or flatulation, which occurs in speculators as the FONGO builds, right before they FOOP their pants.

Poopcorn.

US Fed chair Jerome Powell indicates seven 25bp rate hikes this year and a possible 50bp hike in May.

Does anyone think New Zealand will be insulated from this?

It would be interesting to look at the CPI data in April.

If prices drop as much as some are predicting, then the new housing market is stopped, and prices for materials / land nd paperwork / development contributions already make them marginal.

And stopped means a LOT of people out of work.

And that doesn't solve the issue of the housing shortage.

How do you balance the need to make more new homes, but people can't afford them.

Then add in extra insulation and carbon costs and it's going to be a very interesting time.

The only way through is for govt to build all the new homes required, and sell them at a loss, or else rent them at a loss.

Neil21 so many people living in cars or 2 to 3 families in one house,prices for houses and rent getting beyond affordability of working families if government doesn’t start a building program this country will have more social unrest and child poverty will hit new highs.

Immigration stops, people leave - see Ireland post their bubble bursting.

People won't want to move here if there are no jobs and the housing market is crashing.

Perceived housing shortage rectifies itself as there is less demand for housing.

Ireland made one very critical mistake which was trying to save their banks. It would have proven far less costly and expedited the recovery just to form new banks, let the old ones be restructured as rapidly as possible, and then buy old bank assets for cents on the euro.

I predict we will make the very same critical error when the time comes

Surely not, politicians and banks are well separated and it's not like we have people moving back and forth between the two.

Reckon you are right and the obvious solution is for the govt to step in and immediately build 10,000 low-priced basic houses - it would save them a fortune in emergency housing and accommodation benefits. They could call it KiwiBuild.

Govt is incapable of building affordable house affordably. Kiwibuild proved that. And so does any other govt project.

The availability of workers is key (and to Kiwibuild). In a crash, the government could merely be the employer of last resort and pay builders to build.

Yes this would be a good idea, if a crash comes then employee those who come free on government funded social housing. German pre-fabricated housing would be a good model to replicate.

This would need to go hand in hand with government funded roading and infrastructure spending. We could call it the Ministry of Works.

When people talk about house prices falling, the main thing that is falling is land prices. This is the buffer that expands and contracts as the cost of building a house (ex-land) differs from the price of a finished house.

Bad news for developers who recently bought land at a higher price, but the economics of ongoing development adjust to some extent. The finished product will be cheaper, but the price of the land will also fall. This isn't to say there wouldn't be some degree of carnage as the adjustment is made - this is just how Capitalism works. The high cost incumbents fall away and the new leaner competitors swoop in (which may be the same builders with a different company name to escape their liabilities...)

That is the way, as it was in the post-war decades. The government subsidises the creation of a whole lot of affordable housing. That's how we ended up with such a high rate of home ownership by the 1980s.

There are many pieces to the puzzle and people need to realise that if the cost of a new build is FORCED to rise then the price of every house will rise. Obviously the immigration is another factor, this was not really something thrown into the equation until the end of the year and now its all back on in no time flat come April/May.

This is only true in a supply constrained market.

I'm more worried about the real, productive economy than housing.

There are essentially only two ways to reduce debt in an economy, repay it or write it down. If homeowners can't do the former then the latter becomes inevitable. Writing down bad debt is part of the normal market cycle.

Wow. We top or are the second most exposed on nearly every graph. This is and should be seen as a massive failure by the RBNZ.

Times are a changing. The ponzi bull run is over. Can the debt junkies survive the next few years at crush depth as the rates push over 7 and test 8-9%. Some will, but those exposed on interest only look doomed.

Popcorn is about blow the lid off.

It is a failure of the RBNZ, Councils, multiple Governments, and the failure of our own collective imaginations when deciding how to invest our money.

All the people that are responsible for this mess do not care, they are about to exit stage left as the curtain comes down.

Greed drove this looting, and many of the greediest may have made their escape with the loot already.

Yes they were all selling Nov 2021

Boy! if your highly leveraged you'd be fool not to off load your property now.

The Prime Minister's and Reserve Bank Governor's over the years have repeatedly confirmed on the record that the property market is not the Tax Payers responsibility.

The property industry is very scared, look at the soft language their using, as apposed when theirs a slight increase. They are currently telling their key clients to cash in now.

Now the stimulus is being removed, unemployment will sky rocket - their goes your cash flow (renters, mortgages) add on high regulation costs, interest rates and inflation...

Many SME's are waiting for the recently promised $13K handout and well close down straight after, another foolish waste of tax payers money by the Government.

The Prime Minister's and Reserve Bank Governor's over the years have repeatedly confirmed on the record that the property market is not the Tax Payers responsibility.

They've often declared that, but their actions have said something different.

Quiz of the day.

'we are most worried about Canada, Australia, New Zealand and Hong Kong.'

Can anyone see the common denominator has to why these countries have high house prices relative to income?

It would be "racist" to say it.

big down times acoming including WW3 get out while you still can!

I think we'll see the immigrations gates opened asap. Not a very well thought out process in the past & I'm guessing it wont be in the future either. However! The airlines will be back in business & we may even have some tourists back in town, so airbnb will kick-start again as well. How many spare bedrooms have you got? There could even be some Eastern Europeans being imported to relieve Western Europe of their latest refugee crisis, which would make a nice change from the Asian invasion of the past 30 years. Isn't it exciting?

lots of property trading rules right here https://www.youtube.com/watch?v=LiE1VgWdcQM

10% inflation this year? Is the RBNZ asleep at the wheel? Where should rates be at 10% inflation? I think that will be the discussion point late 2022

Perhaps they think mandate is when two blokes go out for dinner and a movie?

In fact Capital Economics Australia and New Zealand economist Ben Udy said in early January 2022 that he thought falling house prices in New Zealand would lead the Reserve Bank (RBNZ) to actually start DROPPING interest rates again from next year.

The RBNZ doesn't set "interest rates". It sets the OCR, which is one of many factors influencing the prevailing rates of interest.

If the OCR starts being used to try and manipulate house prices, it will quickly become irrelevant and ineffective as a monetary policy tool. Although there is a correlation, banks are not obliged to follow the OCR in either direction, especially not downwards. The cash rate will eventually need to return to levels more consistent with reality - and stay there - unless the Reserve Bank wants to sacrifice whatever remaining credibility it may have left.

Yes there is a high correlation between market rates and the OCR - and at present the gap is about as big as it has ever been. The two lines need to converge again for the central banks to regain control of the inflation narrative. It is like a stand off at present, trying to figure who is right...the market or the central bank. Looks like the market has just recently won with the announcements coming from the Fed.

If the OCR and swap rate trends don't converge once more, who is ever going to believe they have inflation under control and that they can control/influence the inflation narrative?

Chart 23 illustrates just how high a proportion of our GDP is represented by consumer spending. As we see interest rates rise this year, we can expect to see a sharp contraction in consumer spending. Rapidly increasing costs of living will only add to that downward pressure.

I have thought for some time that the RB would not be able to raise the OCR as far as many here think and this only confirms my thinking. My guess is that it will not go beyond 2%, though having watched the RB cut rates too far, they may make the same mistake going the other way.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.