"It's the economy, stupid," was a famous political slogan in Bill Clinton's ultimately successful 1992 US presidential campaign. And as 2026 gets underway in this New Zealand election year, the economy is likely to be an important factor in determining the outcome.

We saw some notable economic data this week, some of which suggested signs of life in the economy. At the same time, a political poll, very early in election year, suggested a tight election outcome is on the cards.

On the face of it, news of some improvement in the economy should be good news for incumbent politicians.

However, four questions come to mind.

Firstly, how much is the economy really improving?

Secondly, will stronger/improving economic data flow through to voters actually feeling and believing things are getting better?

Thirdly, if inflation pushes through the top of the Reserve Bank's target, which it might do, will we see an Official Cash Rate (OCR) increase, or even increases, before the election?

And fourthly, looking overseas, what the heck is going to happen in the world this year and what impact might it have on NZ?

On the data and economic indicators, the New Zealand Institute of Economic Research's Quarterly Survey of Business Opinion suggested business confidence was at its highest level since 2014.

Quotable Value (QV) said "clear majority" of the areas it measures recorded quarterly growth in residential property values, indicating "value movements are now occurring across a broader range of regions."

The latest BNZ-BusinessNZ Performance of Manufacturing Index (PMI) recorded a seasonally adjusted PMI for December of 56.1, with a PMI reading above 50.0 indicating manufacturing is generally expanding and below 50.0 that it's declining. This was 4.4 points higher than November, and above the survey's average of 52.5.

Statistics NZ reported 35,969 new homes consented over the year ended November, a 7% increase on the year ended November 2024.

Those sets of data are encouraging, especially given the headlines last year about high numbers of New Zealanders leaving the country, albeit these numbers were dropping by year's end, high levels of company liquidations and rising unemployment.

Meanwhile, Friday's Statistics NZ Selected Price Indexes (SPI) raised concern Consumers Price Index (CPI) inflation may have ended 2025 above 3%, which is the top of the Reserve Bank's target band.

While the Westpac-McDermott Miller Employment Confidence Index rose 3.9 points to 93.8 in the December quarter, its highest reading since March 2024, it remains subdued with a level below 100 showing more households are pessimistic about the outlook than optimistic.

And then there was consumer spending data from Worldline's payments network during December. This came in at $4.702 billion, down 0.2% on December 2024.

Roy Morgan's political poll suggested the election outcome will be tight. It had the National-NZ First-ACT government coalition winning 62 seats, and the Labour-led Opposition winning 58 seats. It also showed 2.5% support for The Opportunity Party, and 4.5% of those surveyed not naming a party.

In terms of elections, a humming economy, or even an improving one, typically benefits incumbents. However, after an economically tough couple of years, will enough people believe things are getting better for them even if the data says they are?

Politicians will, of course, highlight what they think will benefit their cause. And there were aspects of this week's data both government and opposition politicians could sell to the public.

Hot on the heels of the SPI release, Labour's finance and economy spokesperson Barbara Edmonds trumpeted big increases in some key food prices.

“Today’s statistics show grocery prices continuing to climb, while wages fail to keep up. Milk is up 15.8 percent, beef steak has jumped 21.7 percent, and white bread has surged a staggering 58.3 percent in just a year.

“These aren’t luxuries, they’re the basics families rely on. New Zealanders are working hard, but under National they’re going backwards.

The SPI also noted a 12.2% increase in annual electricity prices, and a 17.5% rise in gas prices, highlighting power prices remain a key cost of living issue.

Meanwhile, National's Small Business and Manufacturing Minister Chris Penk was quick to trumpet the improved PMI.

“This is an incredibly positive signal, as a PMI reading above 50.0 indicates the manufacturing industry is generally expanding. The data suggests New Zealand manufacturing growth is outperforming major economies including the United States, China, Japan, the United Kingdom, and Australia,” Mr Penk says.

“The success of manufacturing is central to the health of the New Zealand economy. The sector directly employs more than 220,000 people, contributes around eight percent of GDP and accounts for 60 percent of our exports./p>

Ultimately will people feel the economy is improving for them, in the areas that matter to them, and anecdotally will they hear it's doing so for the people they mingle with and care about? Will people feel better off, or will cost of living issues remain front of mind for many?

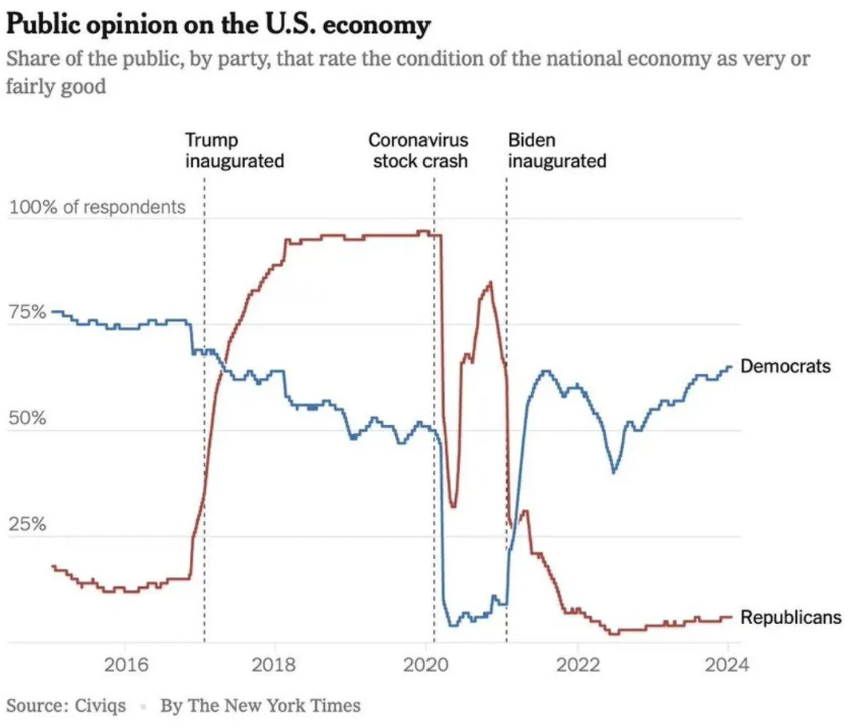

We are all products of our own environment, experiences and beliefs. Political leanings, influences, and where we get our news and information from come into too. While NZ's not as polarised as the United States, witness the NY Times chart below, in the social media age this is a bigger factor than it once was.

At the last election, as people battled high inflation and cost of living challenges, Christopher Luxon and Nicola Willis pledged to "fix the economy."

Leaving aside the limitations of how much influence politicians actually have, now Luxon and Willis are Prime Minister and Finance Minister, how the public perceives how challenging cost of living issues still are, is likely to be important. To what extent have they improved since 2023?

Luxon and Willis have cheered Reserve Bank OCR cuts, and claimed credit for lower inflation.

Thus any OCR increase in election year would not be good news for them. An early indication of whether inflation may be a fly in the ointment for Luxon and Willis will come on Friday, January 23, when Statistics NZ releases the December quarter Consumers Price Index.

Interestingly this week we saw central bank independence in focus. New Reserve Bank Governor Anna Breman threw her support behind US Federal Reserve Chairman Jerome Powell, who is under attack from President Donald Trump. Foreign Minister and NZ First leader Winston Peters promptly told Breman to stay in her lane.

So if the data is suggesting, as the election nears, that an OCR increase should be made, will the Reserve Bank push ahead and do it?

Trump, of course, adds a significant layer of uncertainty and unpredictability over the global economy and geopolitics, which could have significant impact here in NZ.

It could even be that whatever the local economy's doing, a fractious international picture becomes the focus of election attention. International events may overtake, or exacerbate, domestic economic concerns.

While 2026 remains a very young year, it appears to have a sense of the dramatic and there are numerous existing and potential flashpoints. (Think Venezuela, Iran, Greenland, the Israeli-Palestinian conflict, Russia's war in Ukraine and US-China relations).

So buckle in and get ready for what could be a rollercoaster ride.

22 Comments

Turbulence ahead, buckle in. Quite realistically this column describes an improving NZ economy and the unwelcome smoke on the horizon that could scuttle it. As always NZ needs to navigate carefully. The government has for two years held together as a coalition and needs another 10 months of that. In times of uncertainty the electorate will invariably lean towards stability. In particular that will coincide with the highly regarded capability of Winston Peters to well represent NZ on the world stage. The coalition too has through such as Messrs, Peters, Jones and Seymour been able to return fire in parliament resoundingly when the opposition has resorted to the tactics it employed when it was last in government which has not gone unnoticed by the population at large.

Doesn't seem to be translating into electoral support as measured by the opinion polls.

I think the Nats know they need a big bribe to get over the line, and it could be tax cuts. Not sure what other ideas they got.

Other ideas: rampant immigration and a property boom.

The government's trusty go-to, whether red or blue.

In the short term of a three-year Parliament, National has little to show for its pivot from housing to productivity. Tanking home values hasn’t led to a flood of investment in “highly productive” activity. In the long term, affordable houses may mean a better, more productive New Zealand; in the short term, it has most households rushing to stash their ever-diminishing wealth under the nearest mattress.

The most “highly productive” investment most New Zealanders made in this Parliament was throwing money into the S&P 500 by way of their KiwiSavers. Sadly, in that context, “highly productive” is a euphemism for bankrolling American tech firms’ ever more innovative ways for doing most of us out of a job. That’s a problem for Labour too – in a perfect world, its capital gains tax (CGT) would frighten investment from mouldy flats into the innovators who will build the next Xero. In the real world, investment is just as likely to be frightened into the hands of Elon Musk.

Some National MPs believe the Government could improve its Auckland prospects by restoring buyer confidence. No one votes for a National Government to crash asset prices and there’s a sense it may have overshot its mandate.

“. . . the highly regarded capability of Winston Peters to well represent NZ on the world stage.”

Definitely not. Peters has often demonstrated that he is a supporter of Trump.

A recent example is his recently chastising of RBNZ Anna Breman – one of 14 central bankers – who signed a letter supporting Jerome Powell as Trump weaponises the DOJ against Powell for maintaining the Fed’s independence.

There is urgent and serious need to stand up to Trump as he demonstrates no respect for either international law or any morality. Peters as Foreign Minister is not the one to influence or shape New Zealand’s response.

We don't even know exactly what is in the claims against Powell which I'm sure will come out as this develops - and what happens if the claims turn out to be legitimate?

Do all 14 central bankers apologise for poking their noses into a developing situation without all of the facts of the case?

Sure if it turns out to be bogus then Trump is a fool - but until then, why would you decide what 'team' you are on if you are an 'independent central bank' on the other side of the world?

Surely independent central bankers like the truth and justice - which if the US court system is sound, will be found - and one party or the other will have egg on their face.

Until then it seems crazy to me that people are jumping on the Powell or Trump party on this. Seems to me to be more 'I'm on the blue team so I hate Donald Trump regardless of what he does' narrative instead of truth seeking.

Nicely put.

Not an Independent Observer:

You need to get over your Maga bias and ridiculous rationale as illustrated by your bizarre comments the other day.

You argued that Powell, 72 years of age, needs to retire and enjoy his 72 million dollars.

You conveniently overlook and apply the same rationale to Trump who at 79 years old, has an inability to avoid falling asleep during Cabinet and press meetings, is prone to incoherent ramblings and is worth, not 70 million, but five billion.

A biased and ridiculous post.

On principle, Powell is standing up to Trump’s open attempts at bullying. Trump has attempted to pressure Powell to bend to his political whim rather than maintaining the independence of the Fed which is mandated to make decsions on economic not political considerations. Meanwhile Trump is seemingly lacking any morality being more preoccupied in personal power and increasing both his wealth and that of his wealthy friends.

Trump campaigned on retribution and on spurious claims has subsequently gone after those who oppose or speak out against him. A short list for you: James Comey, Letitia James, Jack Smith, Adam Schiff, United States senator, Mark Kelly, John Bolton, Federal Reserve governor Lisa Cook, Democratic representative Eric Swalwell, former New Jersey governor Chris Christie, former chief of staff Miles Taylor, and former director of the Cybersecurity Christopher Krebs among others.

Trump imposing tariffs “punishing” those countries who oppose him on his desire to control Greenland is just another example of how he operates.

It’s the way an autocrat operates.

"Donald Trump is asking countries that want a spot on his new “Board of Peace” for Gaza to pay US$1 billion (NZ$1.74 billion) which he will control, according to a report."

https://www.stuff.co.nz/world-news/360926114/trump-wants-nations-pay-1b…

I firmly believe All Blacks performance will be key for the incumbent

I can't envisage the NATO countries hit with 10% tariffs from 1 February, rising to 25% June 1, bowing to US pressure. At the heart of it is sovereignty.

These tariffs could be a greater global economic shock the the first Trump tariff announcement because they specifically target the US's NATO allies. To increase leverage, I wouldn't be surprised if Trump extended tariff punishment on other countries trading with those European countries, as he has done to countries trading with Iran.

Against such a backdrop, it's hard not to see NZ export earnings taking a significant hit. Which of course will negatively impact the domestic economy.

Now, in politicking, is not the time for populist posturing. If the next election is won on populist sentiments, it will be a tougher road ahead for rank and file Kiwis. Because if the US:NATO impasse escalates, NZ faces nasty economic headwinds.

Can you imagine a taiwan situation, no trading with china, nz nationalises banks and farming collapses.

NZD to 25c usd

That is exactly why NZ needs to stay neutral. Unfortunately the trumpster will more than likely tip the apple cart over and disrupt World trade. For Europe, already facing a front on threat, is being stabbed in the back. It would be like being in a fight and your best friend starts punching you in the back of the head.

Hopefully demand for protein out weighs politics. NZ needs internal stability now more than ever. I heard recently that NZ has some of the longest hours of work per week buy has one of the lowest productivity per capita. Increasing productivity would be a good start, regardless of who wins the next election.

TRUMP IS A SYMPTOM, NOT A CAUSE.

Yes, I was shouting.

The real economy is a material/energy throughput, entropic, and ends in low-grade heat plus wastes. We grew the experiment exponentially, within a finite arena. Of course the dominant hegemony was going to need to acquire or die. Of course all others - threatened with being subsumed - would object. And be derided (Bernays-derived propaganda).

We cannot play both ways, unless we offer to be slaves to the US.

But is doesn't matter much; GROWTH is hitting the wall, and with that many bets are off.

Exporters be happy. Those with solar and EVs be happy. Those binging on imported cars and TVs etc...not so much.

He seems to really be trying help the supreme courts case against his tariff use

Do you ever wonder just how much actual influence the NZ government now has over our finances, in amongst the international chaos?

Wouldn't the smart thing to do be work at developing a productive, mature, diversified economy that's rather less vulnerable to things going wrong with a few, narrow commodity items and a housing market?

The way we should have been doing for the last 40 years?

Rocket labs is still cheap, fill your boots

1 niche rocket company doth not a summer make.

In fact it is a discretionary activity, completely.

Soon to be history, sorry.

We will triage our available energy/resources; food first, other life-support second, wars over 'what's left' third.

Space took too much energy, for little/no return.

The author needs to watch unconscious bias. Referring in detail to the three parties in the coalition, but glossing over the worrisome parties the Labour Opposition requires to form a govt, being the Greens and TPM.

"It had the National-NZ First-ACT government coalition winning 62 seats, and the Labour-led Opposition winning 58 seats."

So do many commentators.

It matters not which party(ies) is/are in power; the physics of our human predicament overrides from here on in.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.