May 2016 was a pretty hot month for the housing market in this country.

A record $7.287 billion was borrowed during the month. It was probably that month that inspired the Reserve Bank to slap 40% deposit rules on investors (a move that was announced in July 2016).

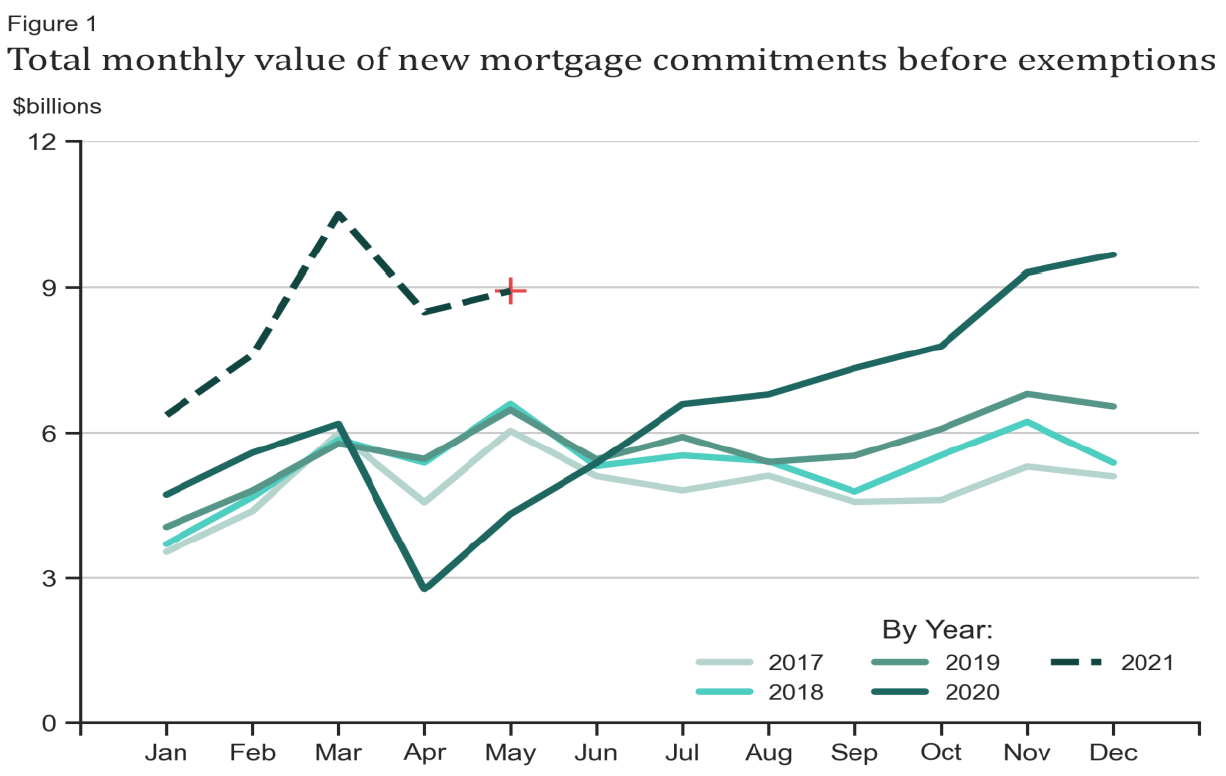

The record stood for some 51 months, finally getting broken as New Zealand was stirring itself from a lockdown in the midst of a pandemic.

Since that record was broken in September 2020, we've seen every month bar one break the May 2016 mark. The one month that didn't meet the old mark was January 2021. But nevertheless, the $6.36 billion advanced for mortgages this past January was very easily the biggest tally ever for this traditionally quiet month, and beat the previous record (set last year) by a whopping $1.646 billion.

With Reserve Bank figures showing that for May 2021 $8.92 billion was advanced for mortgages, this brought the total amount loaned in the first five months of this year to a spectacular $41.854 billion. It's not comparing apples with apples, but probably worth mentioning anyway that the total mortgage pile outstanding for the country as of the start of this year was about $300 billion.

The $41.854 billion figure up to May represents an average of $8.371 billion per month advanced this year to date - so, well ahead of that old monthly record of just under $7.3 billion.

Comparisons with last year are messed up by the fact that April and May 2020 were the lockdown-affected months.

But as some means of comparison, in the first five months of 2019 there was a total of just $26.54 billion advanced for mortgages at an average of $5.308 billion a month.

So, not that we needed telling, but it's hot out there at the moment.

The size of the mortgages has been increasing too.

Going back to that May 2016 record again, there we some 35,112 mortgages advanced (in terms of numbers of mortgages in a month - this is still a record high). The average size of those mortgages was about $207,500.

In the latest month of May 2021 (when there were 27,100 mortgages taken out) the average size was $318,000. That's actually a bit of a decline from the recent highs of about $335,000 per month and it will be interesting to see if that is to be the start of a pattern.

The size of mortgage on average spiked very noticeably during the big surge in the latter half of last year. In May 2020 the average sized mortgage was $275,000, but by December it had spiked to $337,500.

The low interest rates and the removal of loan to value ratio (LVR) limits obviously helped this surge. It will be interesting to see if the reintroduction of the limits - particularly more demanding deposit rules (back to 40% as of May) for investors either is now having an impact or will have an impact.

One clear impact of the renewed curbs on investors has been the upward spike again in the share of mortgage money going to first home buyers.

This grouping hit a high in terms of share of 20.4% of monthly mortgage money as of July 2020 but by earlier this year had dropped under 17%.

As of May 2021 the FHBs had taken their share back up to 19.7%, while in terms of the amount of money borrowed, the $1.757 billion the FHBs grabbed was the second highest ever. The highest was just a bit higher at $1.775 billion in March 2020 - but that was the current overall monthly mortgage record holder with a gobsmacking $10.487 billion advanced.

In terms of what the FHBs are borrowing - IE how much, the average-sized mortgage for the FHB grouping (3205 mortgages) was $548,000. That's up from just under $450,000 a year ago. The RBNZ published figures don't separate out the Auckland figures from national figures - but you can assume they are quite a bit higher.

All of these figures suggest perhaps the housing market is gradually coming off its peak of activity - but only slowly.

In its May Monetary Policy Statement, the Reserve Bank predicted house price inflation of 28.5% for the June 2020 year and then falling all the way back to just 0.4% in 12 months time. In terms of quarterly figures it projected that quarterly house price inflation will drop from an actual 7.9% in the March quarter, to an estimated 5.5% in the June quarter and then just 0.2% in the September quarter.

As I said in a column last week then, we would need to see signs the housing market is cooling considerably by the time the July housing sales and mortgage figures come in.

The May mortgage figures are really showing no sign of this kind of magnitude of slowing. And it will be pretty interesting to see what the RBNZ does if there aren't some more substantial signs of slowing soon.

62 Comments

The most breathtakingly stupid thing the RBNZ could have ever done was deliberately reignite the housing bubble. But re-ignite it they did and it's out of control.

It's now best to step back to a safe distance and enjoy watching the whole village burn down.

The most breathtakingly stupid thing the RBNZ could have ever done was deliberately reignite the housing bubble

Reignite the bubble? The bubble has been rocking along since the early 2000s. The ruling elite didn't set out to 'reignite' the bubble. They were more concerned about the the bubble caving in itself. They turned the dial to 11 because they thought they had to.

Since 1970*

Disagree. The inflation of house prices in the 70s and 80s was due to broad inflation. Wage inflation was similar. It was only around 2000 housing started to outstrip everything else.

Hi Brock Landers,

You write above: "It's now best to step back to a safe distance and enjoy watching the whole village burn down."

Presume you've become a tad disaffected, old chap....... Do hope your a_se isn't set alight when the village burns.

Take care.

TTP

His consistent rambling has become quite sad to read, on every single housing article.

You will be waiting a, life time. There is no fire coming, a flattening maybe, hell even a slight drop like 5%max but if you are waiting on a "bubble pop" your going to wait a while

Problem is, it's now such a large part of our 'wealth' that any 'burning down' is going to come with a shit-load of pain. High unemployment, bankruptcy, zero growth, high crime, poor health etc...

Earlier argument for not acting against speculators by controlling Interest Only loan was to wait and watch as policies announced earlier and LVR may have impact but now it is clear that is not having any impact and as still do not want to act, argument is that sometime in future may have impact.....something in future.....really.

Even DTI as a tool was just talked about and if serious need is to impliment now, not after few years.

If you had sold last August, you may have missed out on at least $200k.

If you didn't take a 100k and invest it in DOGE last August you've missed out on a few million.

Can't win em all eh.

If you didn't take a 100k and invest it in DOGE last August you've missed out on a few million

Good point. Everyone - including the ultra orthodox crypto-heads - has mocked the punters on ol' Doge as being the hillbillies of investing. But the same armchair critics think they're prudent decision makers when house prices and Bitcoin go to the moon.

It's not 'investing' though, it's just gambling, because especially doge but also bitcoin is a zero sum game. There is no value being created, every dollar you take out is one that someone else put in.

Isn't that true for pretty much all investments? Whenever you buy, you put in money. And whenever you sell, someone is paying for it (putting money in).

No. Real assets generate revenue/dividends/interest, so you can measure their true value by the future revenue streams. Bitcoin generates no income

So you don't count that revenue (rent, interest, dividends) as someone else putting in money? BTW there are interest generating crypto accounts.

Ahhh, true valuation of 'real assets' went out the door a looonngg time ago.

Then why are values so removed from income...oh yeah, printed speculation funds.

Same as gold then?

And more so real tangible assets that we all need to live in

"every dollar you take out is one that someone else put in"

Isn't that the same with housing profit and increased mortgages?

if you invest in property primarily for capital gain, then its not entirely dissimilar. But a property can generate an income stream, bitcoin does not.

But a property can generate an income stream, bitcoin does not.

Bitcoin does generate an income stream. So does gold.

What revenue stream does a 1kg brick of gold in someone's yard generate?

It's not 'investing' though

Why? Because it doesn't check all the boxes in your subjective understanding of what an investment is? Because Granny Herald calls it a scam? People invest in ETFs without knowing anything about the companies they're investing in. People invest in houses because they supposedly double in price every 7-10 years.

Because it's not creating any value for anyone - a house provides shelter, and a physical asset that exists (barring accidents, which can be insured against).

Investing in a cryptocurrency that can actually solve problems, such as ethereum, is more of an investment, because something can actually be done with it that provides value.

Bitcoin doesn't actually solve any problems (other than SHA256 hashes), there's no value being created. Everything bitcoin does is done far more cheaply, effectively and efficiently by other cryptocurrencies. Same for doge. That's why they aren't investing, they're gambling.

"Everything bitcoin does is done far more cheaply, effectively and efficiently by other cryptocurrencies." so why then is Bitcoin valued currently at $34K?

Because people like to gamble.

Why are shit box houses in Auckland worth $1m?

Price doesn't equal value.

Bitcoin solves a very big problem. The problem is an economic system based on credit and inflation, perpetually growing in a finite world. Bitcoin is deflationary. It brings the economic system back into the naturally deflating force of technology, and releases us from the mania of central banks shooting for steady degrading of purchasing power. It is sanity solving current insanity.

As I already said, there isn't anything unique or special about bitcoin - other cryptocurrencies do the same thing, but faster, cheaper, more effectively and more efficiently.

Yeah but the bank isn't lending Billions per month to buy Crypto is it ? There are figures on average mortgages, but the averages for Crypto would be interesting, what maybe $1000 ?

Yeah but the bank isn't lending Billions per month to buy Crypto is it ?

$100K is spare change these days. Early May, the ol' Doge had an ROI YTD of 12,000%.

That's without leverage sunshine.

JC

Your argument has as much validity as playing the roulette wheel . . . hindsight is a great thing when discussing the “what could have been” when gambling.

Those who put $100k in Bitcoin just a few months back are now looking at $50k.

Your argument has as much validity as playing the roulette wheel

Well that went over your head. I'm pointing out that the attitudes and beliefs of individuals such as yourself would have prevented you from the %12,000 ROI. And the people you ridicule would have been exposed to it.

Bitcoin is gambling. How do you tell ? People only tell you of the "Wins" and never the "Losses". Clearly anyone who got into Bitcoin recently has lost a shit load of money.

Keep banging that drum Carlos..must be time for a new skin or stick? (Make sure you stock up)

Bitcoin is gambling. How do you tell ? People only tell you of the "Wins" and never the "Losses". Clearly anyone who got into Bitcoin recently has lost a shit load of money.

What a load of nonsense. Dollar cost averaging into Bitcoin in the past 6 months returned = -26%. P6M represents 5% of Bitcoin's price history.

The DCA ROI for past year is 68%. Past 2 years: 170%. Past 3 years: 328%. Past 5 years: 1,035%. Past 9 years: %29,168.

Wow, what an amazing store of value.

What was the dollar cost average return on investment of tulips?

"Westpac: Expect house price falls next year"

https://www.stuff.co.nz/business/money/300310350/westpac-expect-house-p…

Can we trust predictions from anyone nowadays? Westpac has a terrible track record (probably even worse than your average DGM). They predicted house price falls a year or two ago.

Nope. But if the "bank economists" are forecasting actual falls that's quite eye opening.

Hey no need to reply on this. I just simply post it here for people to see from a different perspective. It's totally inappropriate to call someone DGM for someone's opinion not even shared at all. lol calm down man.

I'm very calm. I'm actually one of said DGM's and my post was somewhat sarcastic.

I welcome different perspectives - but Westpac's predictions have been all over the place in the last few years.

No it’s very appropriate to be called a DGM as they are akin to a Suicide Bomber deludedly believing that burning everything in sight including themselves, will lead them to paradise

Sounds a lot like the property hoarders torching society.

Bank economists are employed to publicly advance the interests of their employers. The banks themselves, are political animals. As they won't criticize or depart from the Govt's agenda. So, naturally house prices will "fall next year", as that's what the Govt wants you to believe. Whether they do or not, is not dependent on the stated belief of bank economists.

You get it. Bank economists are part researcher / part media puppet. What I find quite bizarre about the banking culture is that you're easily expendable if you're not among the top brass (who are ridiculously overpaid and sociopathic). I'm not just talking about the foot soldiers on the front lines of the retail branches and the mortgage grinders. But even the economists can be thrown under the bus. Tony Alexander is a case in point. Cast off for spoiling the "brand".

Over a year ago, I read Westpac's Dominic Stephens predicting 20% falls. As a new entrant into the country I decided to rent for a year. There were other factors, such as being incredibly busy starting a new job and having a baby, but I expect my decision will easily be the worst financial move I ever consciously make. Don't listen to the economists. I did. Probably cost me 300-400k.

Also - where is Stephens now after his incredible misstep? Yuuuup, interning under Orr at RBNZ.

Hmmm suspicious. As if Westpac have tried to offload him after numerous bad predictions. That can't be good for their ahem 'credibility'.

What better place for him than the RBNZ?

Hmmm suspicious. As if Westpac have tried to offload him after numerous bad predictions. That can't be good for their ahem 'credibility'.

What better place for him than the RBNZ?

If you were born in the 19th century and bought a house at age 20 you would have made 10000x ROI. Also I guess you don't mean on an apartment in the Auckland CBD right?

All that borrowing has got to be inflationary, at least while it lasts.

Can't wait to pop the 30 y.o single malt this Christmas.

It is really good to see all appropriate actions taken by our leaders to stop the madness...

With Reserve Bank figures showing that for May 2021 $8.92 billion was advanced for mortgages, this brought the total amount loaned in the first five months of this year to a spectacular $41.854 billion.

What am I missing, the linked C5 data records up to April 2021?

That's about the same as total debt dairy sector. They called that high risk few years ago.

At least dairy produces something.

Forecasting lower future house price growth seems to be the Reserve Banks cookie cutter response to any increase, history will speak to their lack of forecasting success. I look ahead and I see many factors that will benefit house prices from ineffective government policy to the reopening of borders to immigration and tourism.

The longer the Reserve Bank keeps rates low the more likely they will need to stay low due to the debt overhang (hangover?) I mean they where already cutting pre-pandemic while the economy was humming along.

May 2016 was a pretty hot month for the housing market in this country.

A record $7.287 billion was borrowed during the month

Dunno why, but find it funny how a "hot month" is gauged by debt incurred, a hot month for the banks maybe?

No worries mate, RBNZ and the government will come to the rescue. Hose it down with market cooling endless cash.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.