ANZ

Macquarie analysts highlight the difference between what banks pay retail deposit customers and what private bank customers can obtain via negotiated rates

14th Jun 22, 9:31am

Macquarie analysts highlight the difference between what banks pay retail deposit customers and what private bank customers can obtain via negotiated rates

BNZ raises most of its fixed home loan rates, but rather surprisingly trims its 2-year offer to match Kiwibank and Westpac. It also raised TD rates. HSBC also raised all its fixed mortgage rates

14th Jun 22, 9:15am

13

BNZ raises most of its fixed home loan rates, but rather surprisingly trims its 2-year offer to match Kiwibank and Westpac. It also raised TD rates. HSBC also raised all its fixed mortgage rates

Term deposit rates are rising, but not as fast as either wholesale rates or home loan rates

13th Jun 22, 11:39am

31

Term deposit rates are rising, but not as fast as either wholesale rates or home loan rates

This week's release of March quarter GDP figures is likely to reflect the impact of the surge of Omicron - but the immediate prospects are for a future slowdown in any case

13th Jun 22, 10:16am

15

This week's release of March quarter GDP figures is likely to reflect the impact of the surge of Omicron - but the immediate prospects are for a future slowdown in any case

Analysts eye US$1900/oz as the signal gold is going to move up. But rising real rates and a stronger USD are capping the upside in gold prices. Geopolitical risks and emerging stagflation should see haven flows

11th Jun 22, 9:28am

2

Analysts eye US$1900/oz as the signal gold is going to move up. But rising real rates and a stronger USD are capping the upside in gold prices. Geopolitical risks and emerging stagflation should see haven flows

Although home loan rates for a one year term are settling around a tight level, competitive pressures are opening up variances for longer fixed terms, and for cash incentives

10th Jun 22, 9:50am

23

Although home loan rates for a one year term are settling around a tight level, competitive pressures are opening up variances for longer fixed terms, and for cash incentives

Reserve Bank outlines sale process for the bonds it bought as part of the quantitative easing programme at the start of the pandemic

9th Jun 22, 9:50am

21

Reserve Bank outlines sale process for the bonds it bought as part of the quantitative easing programme at the start of the pandemic

ANZ raises their fixed home loan rates to the highest in the current mortgage market, underpinned by rising policy rates that are raising wholesale rates

7th Jun 22, 5:22pm

51

ANZ raises their fixed home loan rates to the highest in the current mortgage market, underpinned by rising policy rates that are raising wholesale rates

Heartland Bank makes a surprising floating rate cut to 3.75%, the only sub-4% rate left in the mortgage market. But fixed rates are rising and this is the first time since 2018 that there are now no fixed rates below 4%

3rd Jun 22, 10:05am

9

Heartland Bank makes a surprising floating rate cut to 3.75%, the only sub-4% rate left in the mortgage market. But fixed rates are rising and this is the first time since 2018 that there are now no fixed rates below 4%

ANZ's Chief Economist Richard Yetsenga on government fiscal policy, inflation and 'the climate new normal'

1st Jun 22, 1:52pm

4

ANZ's Chief Economist Richard Yetsenga on government fiscal policy, inflation and 'the climate new normal'

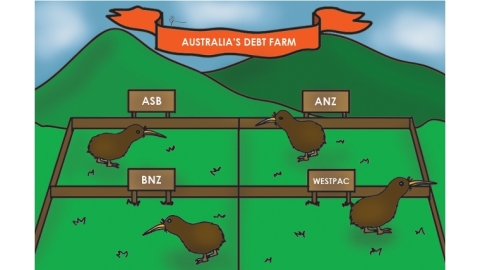

ANZ's big profit, BNZ's super low cost to income ratio, and milestones for ANZ & ASB's mortgage books features of the big five banks' March quarter

1st Jun 22, 9:18am

1

ANZ's big profit, BNZ's super low cost to income ratio, and milestones for ANZ & ASB's mortgage books features of the big five banks' March quarter

[updated]

The downbeat results from the ANZ Business Outlook survey suggest that the RBNZ may have to rethink its OCR hiking plan, according to BNZ economists

31st May 22, 1:24pm

57

The downbeat results from the ANZ Business Outlook survey suggest that the RBNZ may have to rethink its OCR hiking plan, according to BNZ economists

ANZ expects the OCR to peak at 3.5% in February next year and house prices to fall 11% this year

31st May 22, 9:32am

49

ANZ expects the OCR to peak at 3.5% in February next year and house prices to fall 11% this year

Kiwibank increases six-month & one-year mortgage rates, plus term deposit rates, other banks expected to follow

30th May 22, 10:36am

107

Kiwibank increases six-month & one-year mortgage rates, plus term deposit rates, other banks expected to follow

[updated]

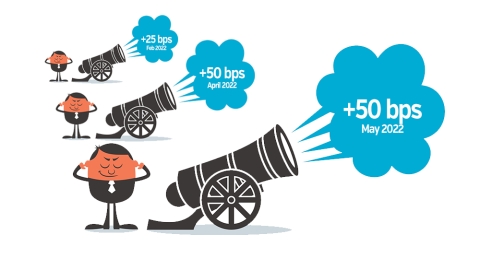

ANZ and BNZ join Kiwibank with increases to floating mortgage rates and savings rates following the 50 basis points OCR hike

27th May 22, 12:19pm

52

ANZ and BNZ join Kiwibank with increases to floating mortgage rates and savings rates following the 50 basis points OCR hike

RBNZ needs 'to inflict some damage on the labour market' in order to cool inflation, bank economists say

26th May 22, 10:03am

61

RBNZ needs 'to inflict some damage on the labour market' in order to cool inflation, bank economists say

Banks should be looking at providing four-fifths of the funding for the SME Business Growth Fund proposed in the Budget, says a leading SME advocate

24th May 22, 4:06pm

3

Banks should be looking at providing four-fifths of the funding for the SME Business Growth Fund proposed in the Budget, says a leading SME advocate

TSB follows up a cut to its one year home loan rate with a new cut to its two year rate

19th May 22, 9:32am

4

TSB follows up a cut to its one year home loan rate with a new cut to its two year rate

Gareth Vaughan looks at how and why a risk-off mindset is dominating at NZ's major banks

18th May 22, 1:52pm

1

Gareth Vaughan looks at how and why a risk-off mindset is dominating at NZ's major banks

TSB surprises the home loan market cutting its one-year fixed rate 'special' as term deposit rates continue to trend up

13th May 22, 9:33am

5

TSB surprises the home loan market cutting its one-year fixed rate 'special' as term deposit rates continue to trend up

[updated]

Yes, term deposit rates are rising and that is a good thing. But are these rises keeping pace with the wider financial world? We investigate

12th May 22, 6:36pm

27

Yes, term deposit rates are rising and that is a good thing. But are these rises keeping pace with the wider financial world? We investigate

Possible ANZ NZ anti-money laundering breaches referred to the Reserve Bank’s enforcement team

11th May 22, 5:00pm

7

Possible ANZ NZ anti-money laundering breaches referred to the Reserve Bank’s enforcement team

In their second edition of The Vault, ANZ commodity strategists think heightened geopolitical risks will drive investor demand for gold, and make it a good hedge against inflation despite a strong USD

10th May 22, 12:47pm

19

In their second edition of The Vault, ANZ commodity strategists think heightened geopolitical risks will drive investor demand for gold, and make it a good hedge against inflation despite a strong USD

ANZ NZ CEO says NZ's biggest bank to be ready for new RBNZ outsourcing requirements ahead of schedule, but would've liked to spend the money on customer services

9th May 22, 4:44pm

2

ANZ NZ CEO says NZ's biggest bank to be ready for new RBNZ outsourcing requirements ahead of schedule, but would've liked to spend the money on customer services

As the ANZ Group eyes splitting its bank and non-bank businesses into two, CEO Shayne Elliott, citing the example of Macquarie, sees no limit to the potential size of the non-bank group

5th May 22, 10:55am

3

As the ANZ Group eyes splitting its bank and non-bank businesses into two, CEO Shayne Elliott, citing the example of Macquarie, sees no limit to the potential size of the non-bank group