TWI

The Opening Bell: Where currencies start on Thursday, January 14, 2016

US mortgage applications jump; US targets cash laundering through property; China exports surprise; UST 10yr yield 2.13%; oil down, gold; NZ$1 = 65.6 US¢, TWI-5 = 71.2

14th Jan 16, 7:34am

16

US mortgage applications jump; US targets cash laundering through property; China exports surprise; UST 10yr yield 2.13%; oil down, gold; NZ$1 = 65.6 US¢, TWI-5 = 71.2

A review of things you need to know before you go home on Wednesday; Co-operative Bank lifts deposit rates, Auckland housing market cools, Harmoney chairman's surprise departure

13th Jan 16, 3:58pm

2

A review of things you need to know before you go home on Wednesday; Co-operative Bank lifts deposit rates, Auckland housing market cools, Harmoney chairman's surprise departure

US Crude oil reaches new 12-year low; copper sinks to 6-year low; PBoC ups defence of yuan; UST 10yr yield 2.13%; oil and gold fall; NZ$1 = 65.4 US¢, TWI-5 = 70.9

13th Jan 16, 8:10am

28

US Crude oil reaches new 12-year low; copper sinks to 6-year low; PBoC ups defence of yuan; UST 10yr yield 2.13%; oil and gold fall; NZ$1 = 65.4 US¢, TWI-5 = 70.9

A review of things you need to know before you go home on Tuesday; soft commodity prices softer, Kiwis flock to Australia - but only to visit, cheap burgers, higher swap rates, stable NZD

12th Jan 16, 4:00pm

14

A review of things you need to know before you go home on Tuesday; soft commodity prices softer, Kiwis flock to Australia - but only to visit, cheap burgers, higher swap rates, stable NZD

The Opening Bell: Where currencies start on Tuesday, January 12, 2016

12th Jan 16, 8:48am

The Opening Bell: Where currencies start on Tuesday, January 12, 2016

Oil price slumps on China share falls; air freight volumes rising; NZ winner in TPP; US Fed pays huge dividend; UST 10yr yield 2.18%; oil and gold fall; NZ$1 = 65.5 US¢, TWI-5 = 71

12th Jan 16, 7:34am

50

Oil price slumps on China share falls; air freight volumes rising; NZ winner in TPP; US Fed pays huge dividend; UST 10yr yield 2.18%; oil and gold fall; NZ$1 = 65.5 US¢, TWI-5 = 71

A review of things you need to know before you go home on Monday; Retirement villages boost building consents, renters increase as home owners decline, car sales strong & more

11th Jan 16, 4:02pm

19

A review of things you need to know before you go home on Monday; Retirement villages boost building consents, renters increase as home owners decline, car sales strong & more

The Opening Bell: Where currencies start on Monday, January 11, 2016

11th Jan 16, 8:47am

The Opening Bell: Where currencies start on Monday, January 11, 2016

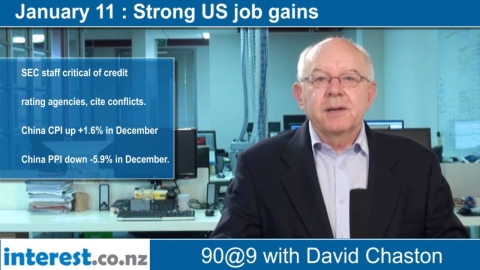

US non-farm payrolls rise almost +300,000; US inventories fall; SEC faults credit raters; China CPI rises; UST 10yr yield 2.12%; oil and gold fall; NZ$1 = 65.4 US¢, TWI-5 = 70.9

11th Jan 16, 7:13am

27

US non-farm payrolls rise almost +300,000; US inventories fall; SEC faults credit raters; China CPI rises; UST 10yr yield 2.12%; oil and gold fall; NZ$1 = 65.4 US¢, TWI-5 = 70.9

China gives up stock market fall limits; World Bank raises growth forecasts; Brazil in trouble too; Aussie trade dives; UST 10yr yield 2.19%; gold up again; oil down again; NZ$1 = 66.4 USc, TWI-5 = 72

8th Jan 16, 8:35am

91

China gives up stock market fall limits; World Bank raises growth forecasts; Brazil in trouble too; Aussie trade dives; UST 10yr yield 2.19%; gold up again; oil down again; NZ$1 = 66.4 USc, TWI-5 = 72

China's stock markets shuttered again following fast slump; Aussie building approvals tumble; oil falls to US$33/bbl; gold jumps to US$1,100/oz; NZ$1 = 66.4 USc, TWI = 72.1

7th Jan 16, 4:08pm

5

China's stock markets shuttered again following fast slump; Aussie building approvals tumble; oil falls to US$33/bbl; gold jumps to US$1,100/oz; NZ$1 = 66.4 USc, TWI = 72.1

US payrolls and service sectors expand; US trade deficit falls; Texas cow deaths; China trapped, yuan falls; US abandons 'fair value' rule; UST 10yr yield 2.20%; gold up; oil at 11 yr low; NZ$1 = 66.3 USc, TWI = 72.1

7th Jan 16, 8:31am

12

US payrolls and service sectors expand; US trade deficit falls; Texas cow deaths; China trapped, yuan falls; US abandons 'fair value' rule; UST 10yr yield 2.20%; gold up; oil at 11 yr low; NZ$1 = 66.3 USc, TWI = 72.1

WMP falls -4.4% but other dairy prices rise; China battling to restore sentiment; US car sales hit record; Sydney house prices fall; UST 10yr yield 2.24%; gold up oil down; NZ$1 = 67 USc, TWI = 72.6

6th Jan 16, 8:30am

38

WMP falls -4.4% but other dairy prices rise; China battling to restore sentiment; US car sales hit record; Sydney house prices fall; UST 10yr yield 2.24%; gold up oil down; NZ$1 = 67 USc, TWI = 72.6

China equity markets suspended on -7% fall; China and US factories weaker, other Asian factories gain; US construction soft; Smith gone; UST 10yr yield 2.22%; gold up oil down; NZ$1 = 67.4 USc, TWI = 72.9

5th Jan 16, 8:24am

10

China equity markets suspended on -7% fall; China and US factories weaker, other Asian factories gain; US construction soft; Smith gone; UST 10yr yield 2.22%; gold up oil down; NZ$1 = 67.4 USc, TWI = 72.9

US jobless claims rise; China shifts tack; China services healthy but factories not growing; UST 10yr yield 2.27%; gold and oil down; NZ$1 = 68.3 USc, TWI = 73.6

4th Jan 16, 8:52am

21

US jobless claims rise; China shifts tack; China services healthy but factories not growing; UST 10yr yield 2.27%; gold and oil down; NZ$1 = 68.3 USc, TWI = 73.6

IMF sees a disappointing 2016; US house prices up +6%; Portugal trips up the NZSF; uranium sales rising; UST 10yr yield 2.31%; gold and oil down; NZ$1 = 68.3 USc, TWI = 73.5

31st Dec 15, 8:42am

30

IMF sees a disappointing 2016; US house prices up +6%; Portugal trips up the NZSF; uranium sales rising; UST 10yr yield 2.31%; gold and oil down; NZ$1 = 68.3 USc, TWI = 73.5

US confidence rises (even in Texas); China adopts the Accommodation Supplement'; Brazil in trouble; home loan approvals high; UST 10yr yield 2.27%; gold and oil up; NZ$1 = 68.7 USc, TWI = 73.9

30th Dec 15, 8:50am

2

US confidence rises (even in Texas); China adopts the Accommodation Supplement'; Brazil in trouble; home loan approvals high; UST 10yr yield 2.27%; gold and oil up; NZ$1 = 68.7 USc, TWI = 73.9

Panic selling in China's sharemarkets; strong investment fund flows; P2P regulation; Japan's rut deepens; US retail gains; UST 10yr yield 2.21%; oil's low parity; gold down; NZ$1 = 68.5 USc, TWI = 73.6

29th Dec 15, 8:49am

1

Panic selling in China's sharemarkets; strong investment fund flows; P2P regulation; Japan's rut deepens; US retail gains; UST 10yr yield 2.21%; oil's low parity; gold down; NZ$1 = 68.5 USc, TWI = 73.6

China pollution worse, flights canceled; US jobless claims low; Chinese house prices 'unaffordable'; Chinese outbound tourism booms; oil holds low; gold up; NZ$1 = 68.4 USc, TWI = 73.6

28th Dec 15, 9:00am

4

China pollution worse, flights canceled; US jobless claims low; Chinese house prices 'unaffordable'; Chinese outbound tourism booms; oil holds low; gold up; NZ$1 = 68.4 USc, TWI = 73.6

US durables flat; sentiment higher; personal income up; NZ housing debt rises faster, rural debt slower; oil prices turn up; gold falls; NZ$1 = 67.8 USc, TWI = 73.1

24th Dec 15, 7:58am

51

US durables flat; sentiment higher; personal income up; NZ housing debt rises faster, rural debt slower; oil prices turn up; gold falls; NZ$1 = 67.8 USc, TWI = 73.1

Speculators bet on oil price falling as low as US$15 a barrel; US home resales tank, US Q3 GDP comes in at 2%, more stimulus & longer yuan trading hours in China, bearish iron ore outlook, NZ$ above US68 cents

23rd Dec 15, 8:28am

24

Speculators bet on oil price falling as low as US$15 a barrel; US home resales tank, US Q3 GDP comes in at 2%, more stimulus & longer yuan trading hours in China, bearish iron ore outlook, NZ$ above US68 cents

A review of things you need to know before you go home on Tuesday; China hints at more stimulus, 4 more Fed hikes tipped, Maui pipeline sold, Commerce Commission in action, NZ dollar steady

22nd Dec 15, 3:59pm

13

A review of things you need to know before you go home on Tuesday; China hints at more stimulus, 4 more Fed hikes tipped, Maui pipeline sold, Commerce Commission in action, NZ dollar steady

Roger J Kerr sees much less chance of market interest rate decreases over coming years and says if borrowers are not already highly fixed, they need to act to get into that position

22nd Dec 15, 9:34am

4

Roger J Kerr sees much less chance of market interest rate decreases over coming years and says if borrowers are not already highly fixed, they need to act to get into that position

Brent crude falls to US$36/bbl, PwC warns banks may struggle to sustain record profits, European bankers in for more job losses ; UST 10yr yield 2.19%; oil hits rock bottom; NZ$1 = 67.7 US¢, TWI-5 = 73.1

22nd Dec 15, 8:09am

12

Brent crude falls to US$36/bbl, PwC warns banks may struggle to sustain record profits, European bankers in for more job losses ; UST 10yr yield 2.19%; oil hits rock bottom; NZ$1 = 67.7 US¢, TWI-5 = 73.1