Summary of key points: -

- Short-term FX market factors outweigh NZ political risk for the Kiwi dollar

- Are past election results a good guide to subsequent NZD/USD movements?

- Climate change and irrigation present an economic opportunity

Short-term FX market factors outweigh NZ political risk for the Kiwi dollar

In the lead-up to New Zealand’s general election in just under a week’s time on 17 October, the foreign exchange markets are not displaying any great nervousness around this potential uncertain risk event.

The NZD/USD rate has remained stoutly within its 0.6500 to 0.6800 trading range over recent weeks with external, non-political influences dominating day-to-day movements.

Another push into the 0.6500’s last week (reaching a low of 0.6550 on 8th October) was largely prompted by RBNZ jawboning on how the new FLP bank lending facility will work to lower the banks’ funding costs and thus lower end borrowing costs.

The proximity of the election and the prospect of the Green Party holding the balance of power with far-left/anti-business economic policies is certainly a reason for the punters to go into the election “short-sold” the NZD.

However, any RBNZ jawboning or political risk factors pulling the Kiwi dollar down mid-week were soon swamped and over-powered by external forces that have driven the NZD/USD rate back up to 0.6670. A better than expected local business confidence survey result may have also played a part in the Kiwi buying.

Up until Friday 9th October there was growing confidence in the investment markets that the Republicans and Democrats would reach an agreement on the next US fiscal stimulus plan.

Share markets lifted and the US dollar weakened on the expectation of an imminent deal. The EUR/USD exchange rate has returned to above $1.1800, the weaker USD allowing the NZD/USD rate to increase.

However, subsequent news that the talks have again broken down with the Democrats rejecting the latest White House US$1.8 trillion offer as putting too much money at the discretion of the President and not doing enough to address the Covid pandemic crisis, will have the equity markets on edge this coming week as the stimulus package now appears less likely to be passed before the 3 November election date.

In the words of the House Speaker, Democrat Nancy Pelosi “This proposal amounted to one step forward, two steps back”. The equity markets reverting to “risk-off” mode because the fiscal package impasse will be negative for the NZ dollar.

Adding to the short-term Kiwi dollar revival to 0.6670 late last week was the PBOC’s pricing/setting of the Yuan/USD exchange rate to a stronger Yuan level of $6.6950 from the previous fixings around $6.7200. The PBOC has seemingly relaxed their tools to control the Yuan from weakening too far. A reserve ratio on the banks has been reduced, and they typically do this when there are no longer any concerns about currency weakness.

Looking beyond these two short-term FX market reactions, the Kiwi dollar remains vulnerable over coming weeks to US equity market weakness and political risk surrounding our election outcome.

Are past election results a good guide to subsequent NZD/USD movements?

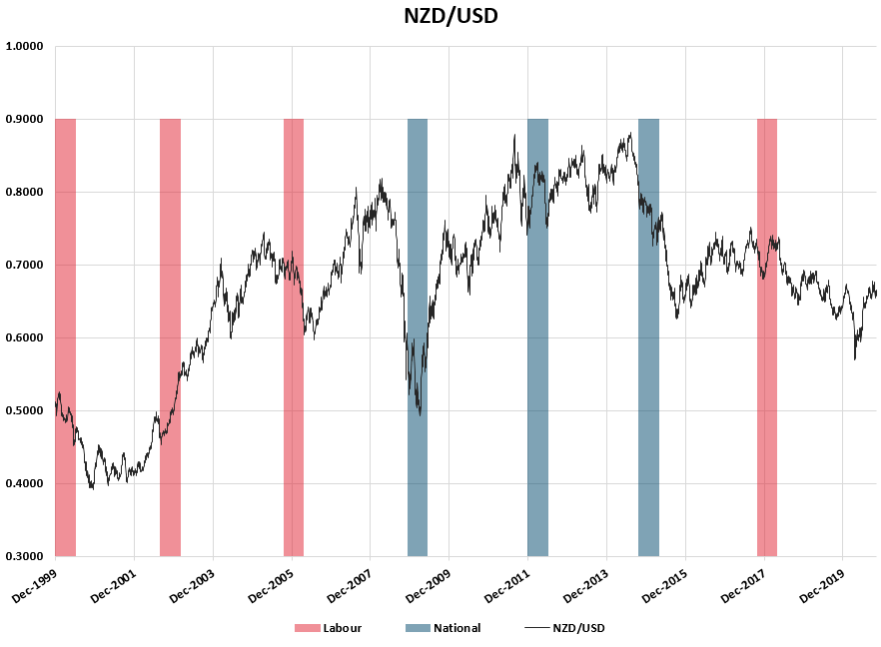

To understand and interpret how the NZD/USD exchange rate may move over the six-month period following a NZ general election we can observe what has happened over the last 20 years of election results. It is a mixed bag in terms of seeking clear precedents (refer chart below).

The election/re-election of Labour Coalition Governments in 1999, 2002, 2005 and 2017 resulted in: -

- Weaker NZD in 1999 as the FX markets expressed fears about the capability of Finance Minister Michael Cullen at the time. He turned out to be a very capable and prudent Minister.

- Stronger NZD in 2002 as house prices increased, monetary policy was tightened, and higher interest rates made the NZD an attractive investment destination.

- Weaker NZD in 2005 mainly due to a strengthening USD on global FX markets.

- Initially a weaker NZD in 2017 to below 0.7000 after the election, however recovery on higher export commodity prices by mid-2018. Thereafter, the NZD sliding lower on RBNZ interest rate cuts.

The election/re-election of National Coalition Governments in 2008, 2011 and 2014 resulted in: -

- Initially weaker NZD in 2008 as interest rates were slashed in response to the Global Financial Crisis. The economy was already heading to recession anyway from a drought and tight monetary policy. A rapid recovery from lows of 0.5000 to 0.6000 within six months as the AUD appreciated on rising mining prices due to Chinese infrastructure build (sounds familiar!).

- Stronger NZD in late 2011/early 2012 from 0.7500 to above 0.8000 largely due to the above reasons. European investment funds also saw NZ as a safe haven from the Greek debt crisis at the time.

- Weaker NZD in 2015 due to tumbling export commodity prices (whole milk powder). The ANZ Commodity Index collapsed 50% from 210 in early 2014 to below 90 by mid-2015.

The only conclusion from this analysis is that in terms of forces on the NZ dollar exchange rate, global economic/market factors totally outweigh the types of Governments we elect and the marginal differences they may have with economic policies.

Climate change and irrigation present an economic opportunity

Climate change is seen by many New Zealanders as the major issue and challenge facing our nation and most political parties have policies to address the problem.

Without adding to the debate on whether climate change is caused by man with carbon emissions or merely a tilt in the rotational axis of the earth in the solar system, perhaps we should be turning the issue on its head and seeing climate change as more of an opportunity than a problem.

Warmer, wetter and drier climatic conditions offer New Zealand the opportunity to grow fruit and vegetables it could not previously achieve.

We export food and the loss of international tourism means that we need to grow more food to export to enjoy the same foreign currency earnings.

Dryland farming areas in the east of both islands and in the far north will produce food if they have sufficient water in the dry summer months.

Harnessing and storing water for irrigation schemes should be the most important economic imperative for New Zealand to advantage from climate change.

Sadly, the likely new Labour/Greens coalition government will have policies to prevent this from happening.

The Public Works job scheme in the 1930’s Great Depression built the irrigation races that crisscross the Canterbury plains that is now one of the great food bowls of New Zealand.

It is time for our agriculture, business and banking leaders to stand up in a unified fashion to challenge and change the Government’s attitude on irrigation, as it offers economic salvation, jobs and thus improved standards of living.

We enjoy 95% non-fossil fuel electricity production in New Zealand because previous Governments (and their engineers) had the leadership and foresight to build dams, flood valleys and construct a hydro-generation plant under a mountain between a lake and fjord. We just need the same “bold and brave” and “can do” attitude in 2020.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.