Summary of key points:

- RBNZ monetary tightening stymied by currency depreciation

- Burgernomics: Big Max Currency Index

RBNZ monetary tightening stymied by currency depreciation

Reserve Bank of New Zealand Governor, Adrian Orr would be the first to tell you that he cannot control the value of the NZ dollar in the big bad world of global forex markets. However, he can lower and raise interest rates to respectively loosen and tighten monetary policy/conditions to keep inflation between 1.00% and 3.00%.

Interest rate changes or anticipated future interest rate changes do impact on exchange rate values.

In changing interest rates, the RBNZ seek to influence both demand and prices in the economy. Because New Zealand is an export-based economy who imports just about everything, the NZD exchange rate movement plays an important part in the transmission mechanisms through the economy to influence demand and prices: -

Tighter monetary policy to reduce inflation:

- Higher interest rates increases cost to borrowers, therefore at the household level they have less money to spend on discretionary consumer goods i.e. reduces consumer demand to reduce inflationary pressures.

- Higher interest rates (in theory) causes a higher NZD value, which reduces the prices of imported goods and petrol pump prices, thus decreases tradable inflation.

- Higher interest rates and a higher NZD value hurts profitability in the export sector and slows the overall economy, reducing inflationary pressures.

Looser monetary policy to increase inflation:

- Cutting interest rates puts more money in borrowers pockets to spend, therefore increasing consumer demand in the economy, which in turn pushed up prices.

- A lower NZD value from lower interest rates increases the cost of imported consumer goods to increase tradable inflation.

- Lower interest rates and a lower NZD value is good news for the export industries, they invest/expand and hire more people. The economy grows at a faster clip, putting pressure on resources/capacity utilisation which increases inflation.

In recent years the economic shock from Covid lockdowns has disrupted the norm in respect to the control of inflation. Extraordinary monetary stimulus through near-0% interest rates and money printing in 2020 caused asset/spending bubbles in 2021 that have added to the well-documented supply-side inflation problems.

The RBNZ commenced their monetary tightening cycle in October 2021 to bring inflation back into the target band.

To date, that plan is not working out too well.

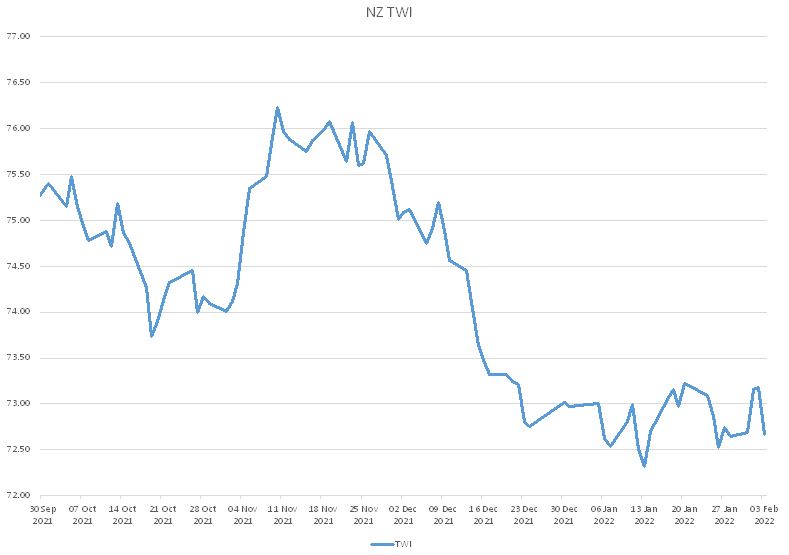

The Kiwi dollar appreciated on its own accord very briefly in late October 2021 in response to the RBNZ tightening. However, since early November it has been one-way traffic the other way for the NZD. The overall Trade Weighted Index (“TWI”) value has depreciated 4.9% from 76.25 to the current 72.50 (refer chart below). The NZD/USD rate is down 8.0% from the highs of 0.7200 to 0.6620 today. Against the AUD, the Kiwi has depreciated four cents (4.2%) from 0.9700 to 0.9300. As the majority of our imported consumer goods are denominated in USD and AUD, the local prices will be increasing due to currency depreciation, in addition to the continuing shipping and supply chain cost increases being passed-through to consumers via higher prices.

Greater forces have been at work to weaken the Kiwi dollar and therefore undermine the RBNZ’s objective of reducing inflation. The across-the-board depreciation of the NZ dollars tells us that to some degree foreign investors have lost confidence in our economy, sharemarket and Government. How else do you explain a weaker currency value over a period that the RBNZ are overtly tightening monetary policy? The exchange rate depreciation since November has resulted in monetary conditions in the economy being mush looser than what the RBNZ were anticipating. That suggests that Orr may need to get a bigger monetary tightening stick out at his next meeting on 23 February.

The higher interest rates and the much higher commodity prices over recent months point to the Kiwi dollar being seriously under-valued at 0.6620. There is currently a massive divergence in the strong historical correlation between our export commodity prices and the NZ dollar. Global FX investors and traders have voted with their feet in selling the NZ dollar down in recent months, telegraphing a clear signal that the Hermit Kingdom is regarded as being well behind other economies in the post-Covid era.

It will require a weaker USD and stronger AUD on the global stage to turn that negative NZD sentiment around. There are signs already that this is occurring. As global hedge funds and macro funds reduce their weighting of USD holdings this year, they will see the very positive Australian economic fundamentals (e.g. large Balance of Payments Current Account surpluses) as a good reason to switch their USD’s into the AUD. Alongside that action they are likely to recognise the NZ dollar under-valuation vis-à-vis our rising and high interest rates and commodity prices. A re-rating of the Kiwi dollar higher requires a catalyst to spark the NZD buying. The RBNZ statement on 23 February is likely to be that prompt.

Burgernomics: Big Max Currency Index

Embrace it or dismiss it as economic hogwash, the Kiwi dollar also stands as significantly undervalued on the well-renowned “Big Mac Currency Index” comparative. A McDonald’s Big Mac hamburger costs NZD7.00 in New Zealand and USD5.81 in the US, therefore the implied exchange rate is 0.8333. The difference between this and today’s actual exchange rate of 0.6620 implies that the NZD is undervalued by 20.5% against the USD. Even after adjusting for GDP per capita between the US and NZ, the NZD is still undervalued by about 6%.

Buying into the theory of Burgernomics has the Swiss Franc 20% overvalued against the USD and the Norwegian Krona 10% overvalued. A selection of currencies that come in as undervalued (like the Kiwi dollar) against the USD include the Euro 14.7%, UK Pound 17.1%, Australian dollar 22.4% and the Japanese Yen a whopping 41.7%.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

23 Comments

The thing about simplification is that we forget conveniently the white elephants in the room for the assumptions.

We can try raising rates; but so can the other countries that we trade with.

With oil being the major inflationary factor, raising rates will only momentarily move the NZD as traders will eventually realise that the same rising rates doesn't change the price of crude oil but instead puts NZ's economic recovery to a grinding halt.

What does the future hold for oil prices?

In mid 2020, people were getting paid to take oil, as consumption fell off a cliff and storage got overwhelmed. Production was dialed down. You would anticipate once global supply chains balance out that oil prices should flatten.

Excellent points.

It's a silly argument that people keep pulling out about raising our OCR to strengthen the NZ dollar. It's much more complex that that, our interest rates have been rising the past 3 months yet our currency weakening!

And as you say, a number of increases of the OCR to 2% or higher will decimate our economy, for possibly limited gain.

Another 75 BPs of OCR raises will do enough to quell domestic inflation, especially with the CCCFA and high prices starting to do that already (plus omicron).

NZD/AUD had been recently forecast as holding .96 over 2022. Now the NZD is dropping like a stone - down under .93 now - is this a judgment on a weak economic recovery or conditions over 2022 in NZ?

Good article. What's the market currently pricing for? To spook the market they really need to go in a notch higher. They have huge latitude on other mandates right now.

On the face of it, pricing in a total lack of of confidence in future OCR rises actually happening. Perhaps they are looking at the flow-on effect of rising interest rates on discretionary spending, and what a total collapse in consumer confidence would mean for our economic recovery and betting that RBNZ won't be able to move as fast as we might have wanted them to.

Which is a fine outsiders bet, given that people overseas aren't living with high inflation on low wages like the people who live here are.

Could they also be banking on omicron having quite a nasty economic shock once it finally arrives 'properly'?

Doesn't seem to have happened in other developed economies, most industries indicate it's slowed supply but not demand.

New Zealand has a few more interesting changes, including airline travel and ticket prices picking up as well as tourism restarting, that will likely add to inflation this year. However labour costs may be capped after October when cheap foreign workers can be exploited again.

Maybe it's had less impact on other economies partly because many of them have kept stimulus going?

Nz has started dialing that back months ago. Plus we have the CCCFA. The conventional wisdom is the OCR will keep being hiked. Perhaps a confluence of factors that people are seeing in our economy, with negative outcomes for our economy?

NZ might have high vaccination rates and this seems to have slowed the spread somewhat, but we also have very low natural immunity as COVID has not hit here hard, this may support higher short term rates of Omicron infection. Who can tell, clearly not our government who went on holiday safe in the knowledge that their 'world leading response' would stop Omicron from getting into the community (Oh Wait........ where are those RAT's we didn't order?)

The nz dollar has been weakening despite no rates rise from the fed , when they do eventually raise rates presumably this will.place further pressure on the nz to weaken more .

The NZD has been weakening because of expectations of rate rises from the fed. The raises are already priced in. Which way they move the NZD will depend on whether the fed meets expectations.

It all smacks of old school thinking about economics and the impacts of various policy factors as they traditionally worked prior to 2008. Ask Japan if those old school thoughts still work in a modern society!

There is little to support that those traditional policy directives are continuing to have the traditional effects - NZ has indicated that it is going to significantly start raising rates and begun that journey -- but the $ has just sunk like a stone in the last month

We are well behind the Covid curve compared to the rest of the world -- and have yet to experience what its really like - or the disruption -- NZ will be chaos for the next three months - and the $ will only crash further in that time as we look more like a basket case economy. Covid is by far the largest market driver currently - be it production issues, supply line pressures, asset inflation from excessive QE and stimulous, followed of course by the increase in oil prices and of course the refined products (that we are no longer going to refine our own !!!!) - and Covid still has a few miles left in its legs

As for Big Mac economics -- Feels like this is where the Grant and Jacinda show gets their ideas -- no correlation for tax differences, economy of scale, competition, productivity - Gimmiky at best ! Same people BTW that ignored treasury and economists warning that pumping 14billion into cheap lending would raise house prices massively - because Labort knows better

strap in folks going to be a bumpy bumpy three months !

So you're a believer of the 50'000 CV cases in NZ by Waitangi day ?

No -- in fact i dont think we will get 50,000 cases in a single day ever! even if we did we dont have the capacity to test for them Yvil -- no with our %VAX rates and 1.5m recent boosters -- i suspect our case numbers will be smaller than the rest of the world -- especially as the draconian self isolation measures will prevent a massive amount of people from even testing - but we have NO slack in our system - especially our HGV transports -- so even a small amount of cases here will cause a huge amount of pain - with those very excessive self isolation restrictions

Always a good read Roger. Lots to consider from all directions, but the standout suspect is how our Covid is being managed by our govt. They're extending the pain for as long as they can, which is obvious to anyone with half a brain. This does not include their media, their propaganda-ists (the universities) or the state services. A similar thing is happening in both North American economies, and especially in the Democrat run states south of the border. Melbourne/Victoria & Western Australia are closer examples of high cost solutions by left-wing govts that have added massive debts for us, our children & their children, for very little reward for anyone, sadly.

I understand that left of centre govts want to look after the down-trodden & the sick, but we can now all see how unbelievably expensive this direction has taken us & will continue to be for as far as I can see, & probably for the rest of my children's lives, as well. We all have to toughen up people. We can't be wusses forever.

Red states are poorer and you're 50% more likely to die of covid.

So lefties are nanny state and overly cautious.

And the more Laissez-faire approach is objectively worse for the average person, but you get to cling to notions of freedum and liberty - although ironically it's usually more paranoia about these things being stripped from you.

A good article Roger.

I do believe that the effects of a rising OCR is by far outweighed by an economic "risk-off" sentiment worldwide, which leads towards funds being shifted towards "safe-heaven" currencies like the USD and the CHF, and away from a perceived "riskier" NZD, thus increasing the USD & CHF and lowering the NZD. The OCR cannot combat this much stronger force.

IMO.

The RBNZ or NZ government only have a limited power over the value of the NZD. The strength or weakness of the NZD is much more dependant upon the other currency it is compared to (usually the USD). This in turn is dependant upon confidence in the future of the economy. If confidence is high, money flows toward more marginal, riskier currencies like the NZD, if confidence is low, money flows towards the major safe-heaven current, being the USD.

To predict where the NZD is going in 2022, place your bets whether the worldwide economy is going to improve or worsen in 2022.

Most insightful comments of the thread. Roger Kerr just likes a hard NZ dollar no matter what the situation. Crushing the economy to bring inflation under control is old school Act bread and butter policy.

It is a US dollar story but on the New Zealand side of things, the terms of trade for dairy and horticulture have been good for a while now but logs and tourists not so much. Lumber prices are often a leading indicator. The other biggest factor is the govt attempted squashing of the housing market. A lower dollar might partly be the realisation by overseas investors that knocking the NZ construction industry out of the ring means dairy is the only thing left to keep the NZ economy going and that dairy by itself won't be enough to stop us sinking.

The govt and the RBNZ are withdrawing everything that made for growth this past two years so it stands to reason there won't be much growth in the future. Unemployment is low but unemployment is a lagging indicator.

The Australians are being sensible as per usual and not rushing to squash their economy before ensuring that growth is sustainable, unlike our own idiots.

Excellent point.

The across-the-board depreciation of the NZ dollars tells us that to some degree foreign investors have lost confidence in our economy, sharemarket and Government. How else do you explain a weaker currency value over a period that the RBNZ are overtly tightening monetary policy?

Surely, the depreciation of the NZ dollar has been caused by relatively attractive yields on bonds and securities in other countries (particularly US Fed). Capital was always going to flow out of NZ as other central banks started to tighten.

The question now is whether RBNZ will push interest rates up enough to attract investment back into NZD financial assets - making swing voting mortgagees furious, reducing aggregate demand, and increasing unemployment.

There was a time of course when exchange rates were determined by the desirability of real things exported by countries, and the confidence of investors in the continued ability of those countries to make desirable things. Those were the days.

not to bad i guess when you see the nzd has be debase/ lost 30-50% purchasing power on the local stage over the last two years.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.