Summary of key points: -

- EUR/USD sideways shuffle continues

- Russians have already achieved their objective with Ukraine

- RBNZ need to stand up and address underlying inflation sources

EUR/USD sideways shuffle continues

US equity markets have settled down over recent weeks following their tumble in January in a delayed reaction to a more hawkish Federal Reserve.

As a direct result, the Kiwi dollar has also stabilised in the lower 0.6600 to 0.6700 trading range. However, daily volatility has not reduced with the NZD/USD exchange rate jumping about following the marginally higher than expected US inflation for January released on Thursday 10th February.

Largely following the Euro and Aussie dollar against the USD, the Kiwi initially ramped higher from 0.6650 to 0.6730 when the FX markets took the view that the European Central Bank may have to hike interest rates as fast as the Fed, thus strengthening the Euro.

The EUR/USD rate almost hit $1.1500 at one point during that day’s trading, however it just as quickly re-traced its steps and fell away to $1.1350. The NZD/USD rate in tandem returning back down to 0.6650.

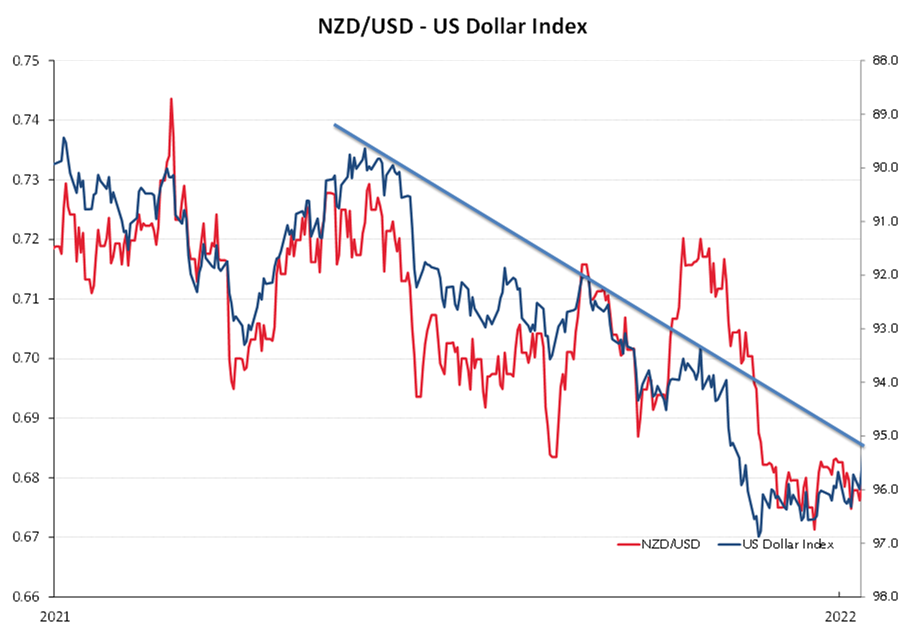

Whilst the NZD/USD rate movements have been dominated by the USD side of the equation over the last 12 months (reflected in the NZD/USD rate closely tracking the EUR/USD rate), that does not necessarily mean that local NZ economic factors have been totally dismissed as influencing the Kiwi dollar value over the next 12 months.

It appears that the global currency markets are still attempting to work out whether the Fed pushing US interest rates up this year is already fully priced-in to the US dollar value, or not.

The view of this column over recent months has been that the upcoming US interest rate increases are indeed fully factored-in already and the USD will end is strengthening trend.

The flickering of the EUR/USD exchange rate up and down between $1.1500 and $1.1150 since October 2021 points to the FX markets being very undecided as to whether the USD has come to a turning point. We will back the old adage that when the Fed actually raise rates (which will be next month), the US dollar generally starts to weaken from that point as all the buying of USD’s has already taken place beforehand in the expectation.

The sideways shuffle in the EUR/USD that confirms the market indecisiveness will not continue forever.

A crunch time for the USD may be looming as it fails to continue its upward momentum on the USD Currency Index. A weakening in the USD on its Index from the current 96.0 level to below 95.20 would break its uptrend of the last 12 months (refer chart below). Events that would be candidates to be that catalyst that causes USD selling will be; weaker than expected US economic data, the Fed going at a slower pace than what the markets are currently pricing and the ECB bringing forward their lifting of interest rates this year

Russians have already achieved their objective with Ukraine

Geo-political tensions are often represented in currency market movements. We have not seen the USD strengthen on the back of the potential invasion of the Ukraine by Russia, which is the traditional response of FX markets to the possibility of war.

Perhaps the Russians have already achieved their objective from their sabre-rattling, that is to get the oil price up to help their economy. It should be positive for equity markets and the Kiwi dollar when the Russian eventually de-escalate their military build-up.

RBNZ need to stand up and address underlying inflation sources

It is very clear that National Opposition Leader, Christopher Luxon and Finance Spokesman, Simon Bridges intend to shift the dial on the economic and political debate this year away from COVID and onto our inflation problem.

For the average, low-income household in New Zealand continuing rising costs is of much greater concern and impact than the mild Omicron strain.

There are no easy solutions to New Zealand’s inflation problem in 2022.

Increasing interest rates will reduce the demand side, however the majority of the price increases are coming from the supply side, namely: -

- Tradable inflation imported from offshore (oil, commodity prices, shipping, product shortages).

- Non-Tradable inflation generated domestically (local government rates, electricity, home-building costs).

The Prime Minister is blaming the increased inflation entirely on the imported tradable part. As has been the pattern with the current Government the “communication spin” seeks to divert blame elsewhere and does not tell the full story.

As this column has banged on about ad-nauseam for a long time now, non-tradable inflation has been out of control in New Zealand for many years, and no-one seems prepared to address the sources of that inflation and do something about it.

The RBNZ have a prime opportunity to apply their intellectual rigor and economic analysis to identify the core causes of the persistent non-tradable inflation in their upcoming 23 February Monetary Policy Statement.

Don’t hold your breath, they seem weirdly more pre-occupied with diversity and climate change as major issues. Regulation overload and Government policies are behind the constant price increases in local government rates and building costs.

Identical to the Fed, the RBNZ are arguably behind the 8-ball in lifting interest rates to control the rising inflation. The risk is that they are now forced to tighten monetary conditions too quickly to catch up, causing the economy to slow too abruptly i.e. a hard landing.

RBNZ Governor, Adrian Orr, to his credit, did foresee this current situation when he slashed interest rates to zero and printed money two years ago. He stated at that time that if the extraordinary monetary stimulus caused speculative asset bubbles and high inflation, it was a risk he needed to take and would deal with the high inflation when it occurred. That day has now arrived Adrian and you cannot be timid in dealing with it.

A more hawkish RBNZ in 10 days’ time will be positive for the Kiwi dollar.

Looking ahead, this year may turn out to be the classic “game of two halves” for the Kiwi dollar.

An appreciating NZ dollar over the first half as the RBNZ need to go harder than the market is expecting and potentially a weaker Kiwi dollar over the second half of the year as the economy underperforms under the weight of the tighter policy. Reduced consumer spending (due to higher mortgage interest rates), inflation and labour shortages will also contribute to the weaker economy.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

25 Comments

Mr Orr needs to make a significant change this week. His mandate is to manage inflation via OCR and reduce unemployment. Will he actually do his job because interest rates should be just over inflation...?

Based on track record change will be underdone...again.

The OCR should have already been at around 3% by now, and its peak should be at between 4 and 5% by end of this year or mid next year, if we want to keep any hope to control inflation. Not doing so now will force the RBNZ to go even higher later on.

Bureaucrats like Orr have a very big responsibility in their hands and they should be held accountable and responsible for their actions. There should be a law which should make them solely responsible if lives of people are destroyed in the long term due do their actions. Only then these bureaucrats will take decesions using brain cells.

He has just been listening to the government whose only worry is their own existence and get into power by hook or by crook. This government is not worried about the future of NZ.

The quality of my life as a lowly paid worker has really diminished in the last 5 years of this government. They have propped up the businesses, investors and basically every already rich person has become richer. They should be investigated for their actions.

If they do not raise rates now by minimum 100 basis points, then it's criminal. I want the food prices to go down so I can feed my kids a good and healthy meal. I don't want to keeep feeding them pre frozen stuff.

How about the remove gst from essential healthy foods, they can leave it on snacks and processed rubbish.

I would take anything which can bring the price to feed the kids down. Rent is going through the roof. The landlords are saying they are paying high prices to buy the houses so they will charge more.

This government was to build a few so I don't have to pay huge rent. Where are those please?

Gone in the pandemic payments to business?

A Labour Gubmint reducing tax? That goes straight to the Pool Room.....

How about just remove the tax on your savings instead ? FHB trying to save with large deposits are getting smashed at the highest tax rate. We used to have no tax on your savings back in the 80's. All governments do is put up disincentives for you to work and save in this country. This is very easy to do and could be done overnight compared to sorting the mess of GST on food.

Good point Carlos. I had forgotten about this incentive.

Be interested in how you go from this:

Increasing interest rates will reduce the demand side, however the majority of the price increases are coming from the supply side...

To this:

Identical to the Fed, the RBNZ are arguably behind the 8-ball in lifting interest rates to control the rising inflation (by reducing the demand!?!)

The domestic (non-tradable) inflation is coming almost entirely from home building costs, rent, rates and bills, car repairs and spares, and a bit of restaurant / takeaway prices. If you look at what is actually going on here you will find that Fletchers / Carters have used inflation as cover to increase the prices of building materials . This will be obvious in their profits. You will also find that firms - particularly building companies and vehicle repair companies have significantly increased their inventories to protect themselves from further supply chain shocks. They have passed the cost of this onto their customers (fair enough). This one off shift in prices to reflect the higher costs of holding bigger inventories will probably be a lasting legacy of the pandemic.

So what should the RBNZ do about non-tradable inflation? Put interest rates up and make everyone poorer - and achieve next to nothing? Perhaps they should have asked Govt to freeze local Govt rates? Or, pushed for a faster review of the building materials duopoly? Or paid everyone's broadband for the year?

I suspect you may not understand what non-tradeable means. A textbook definition is 'goods and services which cannot be imported or exported, or for which no competition exists'.

Several of your examples- car repairs, building costs - have one or both of import components and competition. So cannot be treated as non tradeable

Non tradeable traditionally covers all government services consumed domestically, natural monopolies such as ports, airports, power generation and distribution. Inflation in these sectors has long histories and large effects, because TINA.

Inventory holding costs are tradeable: the firm can opt for different items, from alternate suppliers, decline to hold inventory at all via JIT so there is competition. And many inventory items are imported, so definitely tradeable.

Using correct, universally accepted terms is essential on Interest discussions. Otherwise the conclusion will tend to be political point-scoring......

I understand the definition. If you look at the actual data, you will see that tradeable property maintenance materials account for about 0.05 ppoints of the yoy CPI, whilst non-tradeable property maintenance services account for about 0.1 ppoints of the yoy CPI (i.e. twice as much). Some of this is extra onsite labour costs, sure, but speak to a few building companies and they will tell you that they are spending an incredible amount of time and money chasing, securing, and storing a bufferstock of supplies - this cost is staff time, storage, fuel, transport services etc and it is showing clearly in the data.

Items such as car repairs will have both a tradable and non-tradable component, and this is accounted for in the tradable and non tradable inflation rates as calculated by the Stats Dept. The imported car parts themselves will be tradables. The NZ price-clipping on those parts and the labour component is a non tradable. The Stats Dept has this figured out.

A key feature of NZ inflation until recently has been that it has been heavily dominated by inflation in non-tradables. Tradable inflation has only picked up in the last six months. Right now, we have fired-up inflation occurring in both components. It could be a rough ride.

If the RBNZ wishes to control inflation there is no alternative to higher interest rates.

KeithW

we all hope for a strong and positive response to our ongoing problems with living costs,housing,infrastructure etc; but have learned to expect feeble and futile, message in a bottle type waffle.

Don’t hold your breath

That's for sure... don't have too much faith in Orr - we know this is a first class problem.

For the average, low-income household in New Zealand continuing rising costs is of much greater concern and impact than the mild Omicron strain.

Be careful, Mr. Kerr. Too many rational and level-headed observations like this, and you'll be lumped in with the those other fringe lunatics who refuse to show the proper MoH-mandated levels of fear.

You mean, the Deplorables?

The Prime Minister is blaming the increased inflation entirely on the imported tradable part. As has been the pattern with the current Government the “communication spin” seeks to divert blame elsewhere and does not tell the full story.

That's right, raising rates will not see much of an appreciation of the NZD to tamper the tradable inflation.

RBNZ should be well aware that crippling the local economy through miscalculated interest rate rise will almost certainly condemn the NZD to even a lowered point with bleak prospects of recovery for years to come.

They should go easy on the brakes while it's still raining.

What other tool do they have?

KeithW

They don't. It's a fiscal call.

You suggested removing GST on food and income tax brackets for the lowest earners.

I would suggest that this government on top of that, temporarily subsidise staple food and energy bills, build a forward supply on fuel and lower its taxes while waiting for the inflationary pressures to tide over. Opening the borders quickly will also prevent the country from being hit by Lewis curve prematurely.

RBNZ can then pegged on the Fed's move to gain safety of the crowd.

The world is volatile right now, it's hard to reverse macro policies twice in a short time.

If Covid response is the only thing you can boast about, then it's a sad thing because in many other areas, you've failed from doing nothing over five years in power. Now we've got runaway inflation, house prices and growing poverty...

In our current plight there is only one cause of our inflation, and that is the inadequate public health measures in China that allowed this pandemic to get underway in the first place. China was the source of the Black Death that wiped out between 1/3 and 1/2 of Europe's population around 1350... nothing has changed.

So, I think Roger and many others should stop continuously implicitly or explicitly blaming the Government as if they were responsible for this epidemic and our consequent financial difficulties.

I realize that as a democratic country everyone is entitled to their view, but this Government was democratically elected with by the majority of citizens and have the right to call the shots in conjunction with the advice of the best experts in epidemiology and economics.

No person has the right to cherry-pick some obscure 'advice' from any Tom, Dick, and Harry whom they happen to come across in their internet doodlings and parade it as 'expert advice'.

If any one watched the SuperBowl you couldn't fail to notice the lack of masks being worn. Stadium must hold at least 100,000. Something wrong here if that's the case over there. Is the public health system in California (and the other states) capable of handling all the Covid cases that arise and need hospital care or do they just shut the doors unless you have medical insurance.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.