Summary of key points: -

- “Safe-haven” currencies a long way from Europe attract demand

- NZ economy: “The chickens are coming home to roost”

- Australian dollar gains likely to continue

“Safe-haven” currencies a long way from Europe attract demand

The expected and immediate global currency market reaction to Russia invading Ukraine over a week ago and the subsequent highly effective economic/financial sanctions against Russia, was a stronger US dollar against all currencies on safe-haven investment flows.

However, what has transpired over this last week as the invasion has rumbled on, is that only the Euro has continued to weaken against the USD, given Europe’s close proximity to the raging war.

Contrary to the Euro’s woes to $1.0900 against the USD, the Australian dollar and New Zealand dollar have made significant gains against the USD to 0.7370 and 0.6860 respectively.

The FX market price action tells us that investment funds exiting the Euro are not only buying US dollars, but also the Antipodean currencies as safe-haven destinations a long, long way away from Ukraine and Europe.

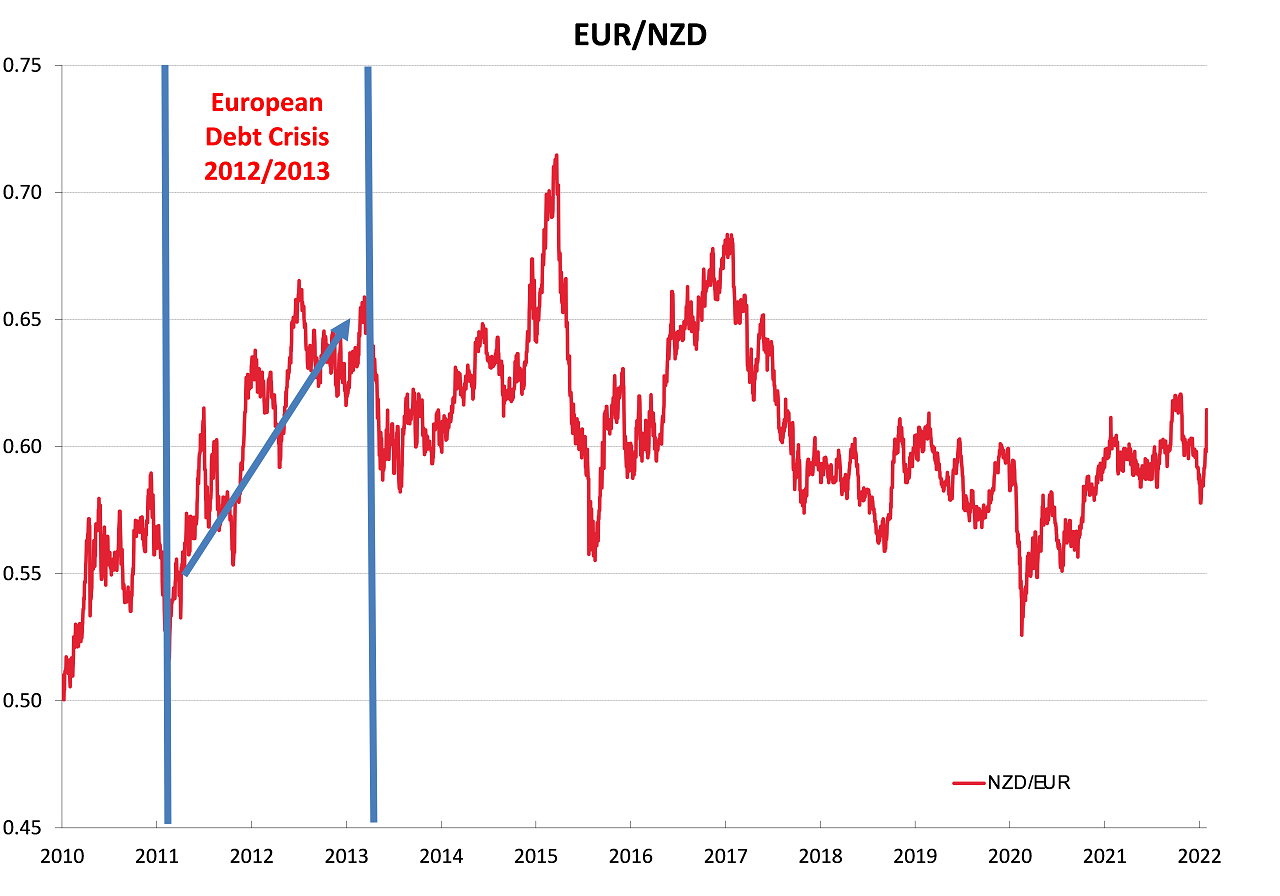

We witnessed similar FX market behaviour at the height of the Greek and European debt crisis in 2012/2103, the NZ dollar appreciating from safe-haven capital inflows coming out of Europe.

It may be too early to conclude that the same source of buying is driving the NZ dollar higher on its own accord this time around. However, the similarities in terms of elevated financial/economic/security risks in Europe and New Zealand being as far away as you can get are reasonably compelling.

In 2012/2103 (refer chart below) the appreciation of the NZD against the USD at the same time that the EUR was depreciating, resulted in the NZD/EUR cross-rate jagging dramatically higher from 0.5500 to over 0.6500. A month ago on 7 February the NZD/EUR cross-rate dipped to a low of 0.5780, today it is 8.6% higher at 0.6280. Further NZ dollar gains towards 0.6500 against the Euro appear likely if the Russian invasion continues and expands.

No-one knows with any certainty what the end-run will be from the Russian invasion of Ukraine, however plausible and alternative outcome scenarios have been summarised by the BBC as follows:

- Short war: Kyiv falls within days and the Ukrainian government is replaced with a pro-Moscow puppet regime. FX markets rapidly move on to the next event and recent USD buying against the EUR unwinds.

- Long war: Russian forces become bogged down and they struggle to maintain control across all of the Ukraine – ahla the 10-year Russian occupation of Afghanistan in the 1980’s that achieved nothing. No further impact on FX markets.

- European war: A Russian military mistake/miscalculation could accidently fire across borders into NATO member countries. NATO would automatically retaliate, and World War 3 may become a reality. The NZD and AUD likely to be viewed as safe-haven currencies alongside the US dollar.

- Diplomatic solution: A negotiated ceasefire is possible as Putin’s Russia suffers too much under the sanctions. Putin looks for a way out and the FX markets return to focus on what was driving them prior to the invasion.

- Putin ousted: If thousands of Russian troops die and the sanctions really bite, there may be a change of regime in Moscow as well as Kyiv. All US dollar buying over recent weeks reverses.

The EUR/USD exchange rate currently at $1.0930 has moved below a critical long term support point at $1.1000. If the Ukraine war ends quickly the Euro should recover back to $1.1300. If the war escalates into wider Europe, continuing Euro weakness to $1.0000 would result.

If the war does end reasonably quickly and normal FX market transmission is resumed, the Euro may benefit in the medium term from investment funds returning to Europe from the US. There were massive equity and bond investment fund outflows from Europe a number of years ago when they went to negative interest rates. As Euro interest rates return to positive territory later this year, those same funds may well return home.

NZ economy: “The chickens are coming home to roost”

The chickens are coming home to roost in more ways than you can imagine. The economy has just hit a major pothole as Omicron-related worker absenteeism has sent economic activity levels as well as business and consumer confidence plummeting to multi-year lows. Not having kids vaccinated in time and the Government stuffing up the supply of RAT tests is having a greater negative impact on the economy in early 2022 than most had forecast.

The warning signs were however identified late last year. Our 7th November FX Market Commentary report was headlined “Houston, we have a problem (the NZ economy)”. Our concern at that time was that we were not well prepared for the inevitable Omicron outbreak that was raging in Australia and that the 2020 and 2021 fiscal/monetary stimulus was being withdrawn and the economy may struggle without it.

Four months on, we can add on higher inflation (food and fuel) hitting retail spending, young people leaving in their droves for Australia, worker shortages more acute, mortgage interest rates doubling, house prices under pressure, bank credit considerably tighter and international airlines not returning to New Zealand for a long time killing of more tourism businesses. A depressing list of headwinds for the domestic economy.

The current Government does not even seem to recognise these risks and threats, let alone adjust economic policies to protect and counter. It is just our good fortune that our export commodity prices are so strong, and they are effectively counteracting the faltering domestic economy at this time.

Contrary to what you may expect, the NZ dollar’s value will not be damaged by these domestic economic problems. The Kiwi is under-valued vis-à-vis higher interest rates and higher commodity prices. The NZD also follows the AUD and the positive outlook for the AUD has arguably further improved over recent weeks. The RBNZ monetary tightening is already known and baked-in, whereas the RBA have yet to signal a change. The AUD will therefore outperform the NZD against the USD and that will result in continuing NZD/AUD cross-rate reductions to 0.9200.

Australian dollar gains likely to continue

Another rapid AUD recovery from 0.7100 almost 0.7400 against the USD indicates that there is a growing realisation in the global currency investment/trading fraternity that the high Aussie mining commodity prices and eventual interest rate increases point to substantial upside for the AUD.

Speculative positioning in the AUD/USD exchange rate remains heavily “short-sold” AUD and when the key chart resistance line at 0.7400 is decisively breached, the pent-up AUD buying to unwind the speculative positioning will be in large volume. Australia recorded another spectacular and record Balance of Payments Trade Account surplus in January of A$12.9 billion (well above prior consensus forecasts of A$8 to A$9 billion).

Scheduled speeches from RBA Governor Lowe next week will be closely scrutinised by the financial markets for any hint of changing their monetary policy stance. The RBA has been remarkably complacent about inflation risks so far; you have to question for how much longer they can hold their line.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

5 Comments

On Saturday I asked:

by Yvil | 5th Mar 22, 12:49pm

Who can explain to me why the NZD keeps climbing? As far as I know, in uncertain times money flows away from smaller currencies and into safe heaven currencies like the USD or CHF.

Thanks

Thanks for the article above Roger, very informative!

I think I replied that to your comment suggesting that NZD is following in the slipstream of AUD with high commodity prices.

Usually NZD falls during 'risk-on' economic times, but these are definitely crazy times.

Nz dollar climbs ameliorating imported inflation slightly but lowering export returns. I cannot comprehend why the increase in nz dollar as the economy is a basket case Australia has a large commodity base and is well positioned to take advantage of international market conditions for eg wheat and gas exports . No doubt some of the money flowing here is from Russian interests taking advantage of our lax financial controls. It seems a little premature to claim the financial controls are having much impact on Russia and Putin being ousted is very unlikely however some of his mates will be getting nervous.

Eventually, the NZ dollar will be impacted by the economic policies of the current government on the primary sector (more and yet more regulation), especially if Labour/Greens are re-elected. We are following in the footsteps of Venezuela and most Kiwis do not see it. The minimum wage in Venezuela was just raised 300% but even that does not compensate for their hyperinflation.

NZD doing phenomenally, gaining 10 percent on the € in a month! And no end in sight for the steady rise.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.