Summary of key points: -

- Currency risks for exporters ahead

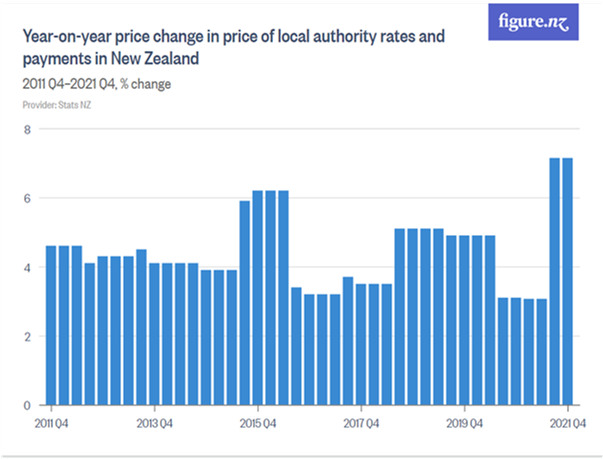

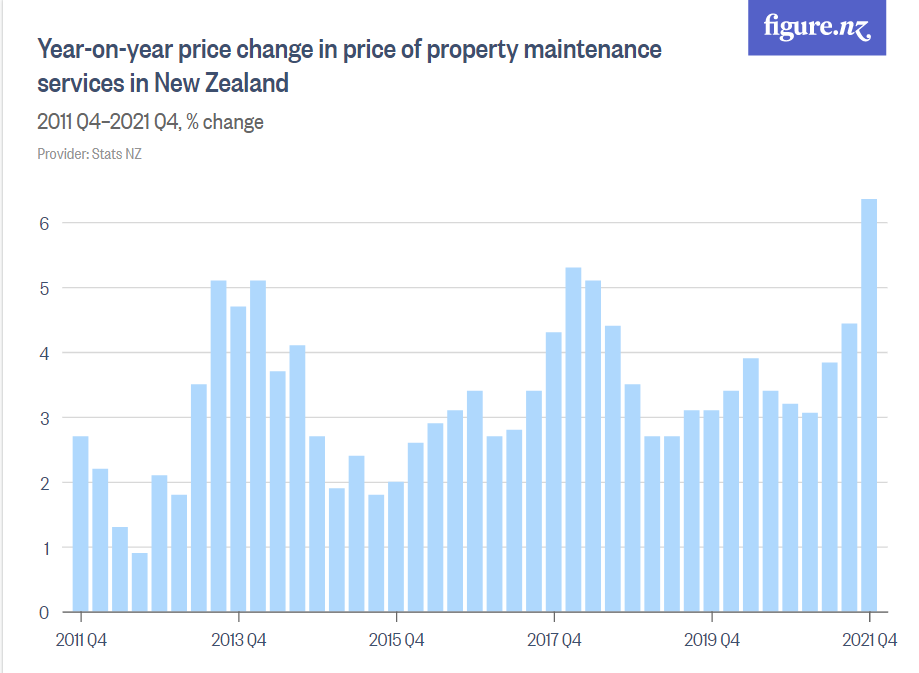

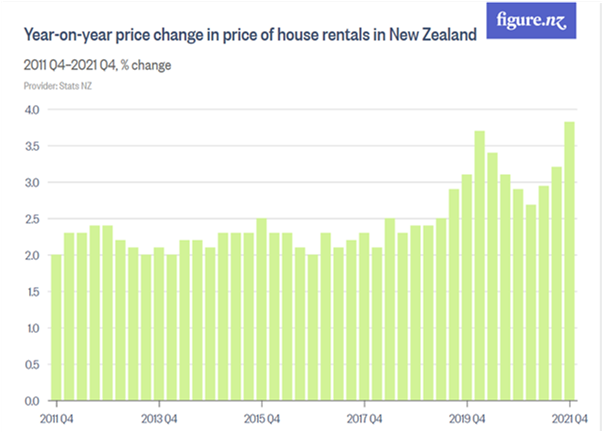

- Three price charts that evidence our long-running inflation problem

Currency risks for exporters ahead

Exporting companies across the industry sectors in New Zealand who are currently looking forward at their business plans over the next few years should not be complacent about the financial risk of the NZ dollar appreciating against all currencies from current levels.

Over recent years there have been regular pull-backs in the market spot rate of all currencies against the NZD to provide the opportunity to add to and extend forward hedging. Going forward, there is a real risk that those pull-backs will be both less numerous and a lot shallower than what has been the case over recent times.

The risk management rationale for exporters to maintain highs levels of hedging in the current and future environment is heavily centred around our cousins across the Tasman.

Based on superior economic growth performance in the post-Covid era, rapid increases in mining and metal commodity prices to record highs and the inevitable change of monetary policy stance by the Reserve Bank of Australia (“RBA”) to lift their interest rates this year, will all add up to potentially significant Aussie dollar gains.

In the author’s opinion, there is a much higher risk that the Kiwi dollar follows the Aussie dollar higher than the counter-risk that the NZ dollar depreciates on its own accord due the NZ domestic economy looking decidedly sick. The RBNZ and the NZ economy actually need a higher NZ dollar value to help alleviate the spiralling inflation rate. The forecast appreciation of the Aussie dollar will provide solutions to the high inflation problem, as the Kiwi dollar religiously follows the AUD.

The second risk to consider is in which direction the US dollar itself will travel over the next two years.

The US dollar has appreciated 10% over the last 12 months from 90.00 on the USD Currency Index to 99.10 currently. Prior to the Russia/Ukraine war pushing the USD higher over recent weeks, it appeared that the USD gains were running out of steam at around 96 on the index.

It has been the view of this column for some time that the FX markets have already fully priced-in to the USD value the upcoming US interest rate increases by the Fed.

The war has, for the meantime, prevented any of the inevitable USD weakness from currency speculators unwinding their long USD position built up in expectation of the US interest rate increases.

Latest US February inflation figures to an annual rate of 7.9% adds further fuel to the view that the Federal reserve need to go harder with monetary policy tightening and lift their interest rates by 0.50% next week.

However, given the wild volatility in equity, bond and commodity markets over recent weeks it seems unlikely that the Fed will risk scaring the horses at this time with a more aggressive hiking of interest rates.

The Fed is always conscious of not causing an equity market meltdown that reduces confidence and spending in the US economy.

In the short-term there may well be a downward correction in the USD value as the markets reflect some disappointment that the Fed did not increase by 0.50%.

In the medium-term, under the proviso that the Russian/Ukraine war comes to relatively quick end, the markets will focus on the Europeans being the next in line to end their monetary stimulus and start tightening policy.

Provided the uncertainty around Ukraine and European security reduces over coming months, the Euro should make a serious recovery from its current $1.0900 level back towards $1.2000.

The dual deficit problem for the US economy still stands as a major negative for the US dollar’s value over the next few years. To attract in foreign capital/investment funds to fund their deficits, the US needs a weaker currency value first, otherwise the funds will not come in. A return of the USD Currency Index to 90 from 99 would have the NZD/USD rate well above 0.7200.

The balance of probabilities for local exporters is reasonably heavily weighted to higher NZD/USD rate from AUD appreciation and general USD depreciation over the next 12 to 24 months. Stable to higher cross-rates against the Euro, Yen and Pound seems much more likely than moving lower. Exporters in Australian dollars will not be hedged to maximums of policy limits just yet at 0.9330, however the expected NZD under-performance against the USD relative to the AUD/USD rate movements should produce further falls in the cross-rate to 0.9200 and 0.9100 over coming months. Over the last seven years, NZD/AUD rates in this zone has been the time to push hedging percentages up to maximums.

Three price charts that evidence our long-running inflation problem

The “cost of living crisis” debate between our politicians over recent time has come about from the sharp increases in food and energy prices due to Covid, supply chain disruptions and labour market shortages. Add on the excesses of monetary and fiscal stimulus to the economy in 2020 and 2021 and we have the perfect inflation storm.

However, as this column has consistently highlighted, we have a more fundamental and long-running problem with inflation in the domestic economy that the authorities have failed to recognise and address.

The following three charts are just small samples from the Housing and Household Utilities component that makes up 28% of the NZ CPI inflation index. There is something totally wrong with the supply/demand equation to house our population when local government rates, rents and property maintenance costs increase by around 4% every year without fail. The causes of these constant price increase come back to Government legislation/regulation and Local Government land zoning.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.