Summary of key points: -

- Contrarian outcomes the new norm!

- Poor NZ economic performance will not hold the Kiwi dollar back

Contrarian outcomes the new norm!

Global geo-political and economic events over recent times have created a totally different environment in financial and investment markets to what is the norm or considered conventional wisdom responses in such situations. We are observing perverse and often contrarian outcomes in markets that no-one would have anticipated for early 2022.

Consider the following developments over recent weeks: -

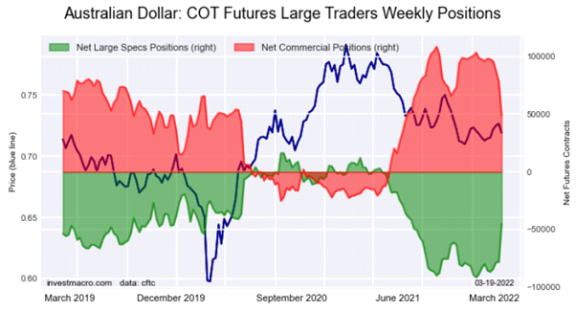

- Risk Currencies in Demand: In the past “risk” currencies such as the NZ dollar and the Australian dollar have been sold when there is uncertainty in the world and investors move into “risk-off” mode. Not the case on this occasion. The Russian/Ukraine war propelled both hard and soft commodity prices higher on top of the already elevated levels due to global shipping/supply chain disruptions from Covid. The NZD and AUD are not only appreciating on the back of rising commodity prices, but also an element of safe-haven buying by investors seeing the antipodean currencies as a safe place as far away from eastern Europe as you can get. Adding to the Aussie dollar buying at this time have been currency speculators actively unwinding large “short-sold” AUD positions against the USD as they now realise that the Reserve Bank of Australia will be forced to raise their interest rates against the inflation curse, just like all other central banks in 2022. The high level of short-sold AUD speculative positions has been highlighted by this column for several months now as a significant positive for the Australian currency value when the day came that they would be forced to unwind and buy the AUD’s to do so. That day has now arrived with the AUD spiralling up from 0.7100 to over 0.7500 against the USD over the last three weeks. Unsurprisingly, the Aussie dollar has out-performed the Kiwi dollar against the USD, reducing the NZD/AUD cross-rate to a 12-month low of 0.9270.

- Sell-of in Bonds: For many years investors have run for the “safe-havens” to secure their funds when there is turmoil in the world as we have today with massive Covid related disruption in supply chains and sky-rocketing oil prices due to the Russian/Ukraine war. Typically, US Treasury Bonds are considered the safest place to be and the buying demand forces bond yields lower (bond prices higher). What has been witnessed over recent weeks is the exact opposite response with bonds being sold and the US 10-year yields ramping up from 1.70% to 2.50% (2 ½ year highs). One explanation for the selling is that the holders of bonds have no confidence that the Federal Reserve are going to be able to contain and reverse the high inflation rate, therefore all interest rates have to move higher. A more direct cause is that the Fed themselves are soon to become sellers of bonds as they unwind all the bond assets on their balance sheet that they purchased through the QE/money printing in 2020. There are adverse consequences for the US economy from the much higher than expected bond yields. Most US home mortgage interest rates are priced off their 30-year Treasury Bond yield and the mortgage rates are now rapidly approaching 5.00% which will hurt discretionary consumer spending in the economy. No wonder US consumer confidence surveys have recently collapsed to levels below the difficult times in the GFC in 2009.

- Sell-off in the Japanese Yen: Traditionally, the Japanese Yen is considered another safe-haven destination when there is trouble in the world and/or market chaos. The Yen normally strengthens against the US dollar as the large Japanese investment houses bring funds home from offshore markets. Again we are seeing the opposite response. Since the start of March the Japanese Yen has tumbled 6% against the USD from 115 to 122. Global investors and currency traders are clearly not seeing the Yen as a place to park funds. The growing interest rate divergence between US and Japanese yields is prompting funds to depart the Yen for higher returns. Higher oil prices are also a big negative for the Japanese economy. For local exporters selling their product in Yen to Japan it has been a “double-whammy” currency pincer-move with the NZD appreciating against the USD and the Yen weakening against the USD at the same time. The JPY/NZD cross-rate has jumped from 75.0 in late January to 85.0 today, a 13% appreciation of the NZ dollar over a two month period. JPY exporters without sufficient FX hedging in place will be feeling considerable financial pain as a result.

- US Dollar losing its Reserve Currency status? The propensity of the US Government to rapidly impose economic/financial sanctions on countries that do not play ball is causing a re-think by a number of nations as whether it is prudent to hold their foreign reserve funds in US dollars. The Russians have realised that having all their offshore reserves in USD’s, which are now frozen, was not that wise. Asian countries would be right to review their policies in this respect to having a greater weighting of their reserve funds in Yuan or Euro’s and less in US dollars. The dramatic increase in oil prices denominated in USD’s is also prompting a shift in how oil is bought and sold. The Chinese are now buying oil from Saudi Arabia in Yuan (establishing Yuan price benchmarks) and Qatar is discussing selling its oil and gas to the Europeans in Euro’s. If there is less demand for US dollars for both investment funds and trade purposes, the outlook for the USD value cannot be overly positive.

Poor NZ economic performance will not hold the Kiwi dollar back

Whilst the outlook for the NZ economy has certainly deteriorated (as evidenced by the plunge in business and consumer confidence), it does not automatically mean that the NZ dollar will depreciate against the USD. The Kiwi dollar has already posted impressive gains from the lows of 0.6550 in late January to almost 0.7000 last week. The dominating drivers of the NZD/USD exchange rate, in order of influence, are the AUD/USD movements, our commodity prices, interest rates and the USD direction in global currency markets. The downgrading of our GDP growth for 2022 to somewhere around +1.00% does not really come into the forex equation. The NZD/USD exchange rate has already increased almost five cents in two months, another five cent lift to above 0.7500 on the back of the back-in-favour AUD is very much on the cards over the rest of the year.

Finance Minister, Grant Robertson’s budget in May is unlikely to impact on the NZ dollar direction. Alarmingly, the Finance Minister observes that the economy is in good shape, and he can therefore continue his expansionary fiscal policy. However, as the IMF and other economic forecasters have recently highlighted, increasing Government spending (all from borrowed money) at this time is very unwise as it just adds to inflation that the RBNZ are trying to curtail. Tighter monetary policy to be effective in combating inflation requires “mates” in the form of fiscal policy restraint. Unfortunately, the current Labour Government is oblivious to such economic paradigms and continue on with their belief that throwing money at problems automatically fixes them. The $2.5 billion programme for mental health announced three years ago being a case in point of policy failure as they are incapable of doing the “implementation” bit!

Local economic observers rightly see large differences in economic policy prescriptions from Labour and National political parties and factor that into how they forecast NZ’s economic performance. However, offshore currency traders and investors just see New Zealand as one big dairy farm with higher interest rates than elsewhere and buy the Kiwi dollar on that basis alone. A higher NZ dollar value also suits the RBNZ at this time to help contain imported inflation.

Short-sold AUD speculative positions have halved from 90,000 futures contracts to 45,000 contracts over the last two weeks.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.