By Gareth Vaughan

The Christmas decorations are up and the sun is shining. That means 2019 is just around the corner.

And as thoughts turn to the New Year, I'm eagerly awaiting two reports that'll be crucial to the New Zealand economy. There's also a consultation process that will be very influential, and one chart I'll be keeping an eye on in 2019.

Of course, there'll be many other things to watch next year too, both domestically and internationally, but for the purpose of this article I'm going to focus on the two reports, one consultation and one chart.

Report 1 - the Tax Working Group

The final report from the Government's Tax Working Group (TWG) is due in February. This to me is shaping up as potentially the big political issue of 2019.

Will the Michael Cullen-led group actually recommend the Government adopts some sort of comprehensive Capital Gains Tax (CGT)? Albeit as comprehensive as it can be whilst excluding the family home and probably creating numerous loopholes.

And if they do and Labour is keen to implement it, will Winston Peters and NZ First get on board?

There will be some fascinating politics played around this issue within the Coalition Government. Labour's plan is to pass any required CGT related legislation before the 2020 election, with changes coming into force on April 1, 2021. That means Labour needs the support of Peters, who has previously been a staunch CGT opponent.

So what sort of deal could be done? Will there be tax relief in other areas that Peters could embrace if a CGT is recommended? Remember Finance Minister Grant Robertson wants measures included from the TWG that could result in a revenue neutral package.

One issue I keep coming back to is if the TWG is going to recommend a CGT and Labour is determined to push ahead with introducing it, has a deal already been done with Peters? If not there could be a lot of egg on Labour faces if they want to introduce a CGT having gone through the painstaking TWG process only for Peters to then turn around and refuse to back it.

Or could it be that the TWG will just dump the CGT in the too hard basket?

Report 2 - the final report from the Australian Royal Commission on banking

The final report from Australia's Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry is due from Commissioner Kenneth Hayne on February 1. Given the close economic relationship between New Zealand and Australia, and the fact the Aussie owned ANZ, ASB, BNZ and Westpac control 88% of NZ banking system assets, this report matters on this side of the Tasman.

Of course we've also had the Financial Markets Authority (FMA) and Reserve Bank probe of bank conduct and culture, and the FMA report on bank incentive structures.

One of the big issues to emerge from this work is the FMA's demand for pay incentives linked to sales to be completely abolished. In March next year the FMA will ask all banks how they will meet this expectation, and will publicly report on their responses.

Abolishing sales incentives completely is a massive move for the financial services sector. Among the many questions this raises is what will it mean for mobile mortgage managers, and how will it impact on mortgage broker remuneration? Remuneration issues are front and centre in Australia ahead of Hayne's final report too. Across the Ditch there's talk of introducing a a fixed fee-for-service remuneration model for brokers, possibly with the payment split between the bank and the customer.

What could this mean for competition? An Australian Productivity Commission report on financial system competition, issued in June, noted mortgage brokers can make the home loan market more competitive by increasing consumers’ knowledge of loan products and exerting competitive pressure on lenders on behalf of consumers. Furthermore it said brokers enable smaller lenders to diversify and compete with bigger rivals that have larger branch networks.

Nonetheless the Productivity Commission recommended trail commissions should be abolished, commission clawbacks should not be allowed beyond two years, and that passing clawbacks on to the borrower should be banned. Interest.co.nz understands that in NZ typically 100% of commission can be clawed back if the borrower repays or refinances within 12 to 15 months. This then drops to 50% through to month 26, with no claw backs beyond that.

In Australia the Productivity Commission estimates brokers originate about 54% of all new home loans. In NZ it's nearer 40%, with 36% of home loans from ANZ, NZ's biggest bank, broker originated as of September 30.

Consumer NZ raised broker commissions in a submission to Parliament's Finance & Expenditure Select Committee this year. Expect to hear more on these issues in 2019.

Responsible lending's also a key focus of the Royal Commission, with some observers suggesting the regulatory crackdown could be the catalyst for a credit crunch in Australia where house prices are already declining. What impact could this have on NZ?

The consultation process - bank capital adequacy requirements

The Reserve Bank cops plenty of criticism. Some is deserved and some comes with the territory. Every now and again it digs its heels in, asserts its and NZ's independence, and makes a worthy and brave call. One example of this was forcing Westpac to locally incorporate in NZ back in the noughties. Another was introducing the loan-to-value ratio (LVR) restrictions on high residential mortgage lending in 2013. A third example could be its push to significantly increase banks' capital adequacy requirements, thus making the banking system better able to cope in a crisis.

Should this proposal go ahead, NZ banks will need to find somewhere in the vicinity of $20 billion of new capital over five years. As credit rating agency Fitch has pointed out, the Reserve Bank plan goes well beyond the international norm, is highly conservative by international standards, and would be positive for banks' borrowing profiles. But it could also see lending rates increase as banks seek to recoup a return on their shareholders' capital invested, which in tum could reduce lending growth.

The banks, however, are not just going to accept the Reserve Bank proposals at face value. They will lobby against them and fight them. Key in this will be ANZ, ASB, BNZ and Westpac. The Reserve Bank is proposing to narrow their advantageous capital position over their smaller NZ owned rivals. They will not be happy about this and the likely hit to their profitability it entails.

The Reserve Bank is seeking submissions on its consultation paper by March 29, and expects to make final decisions by June 2019.

The Reserve Bank capital proposals and FMA demand for an end to sales incentives are sea changes for the NZ financial services sector. Also keep an eye out for whether the Government puts any meat on the bones of the suggestion it could establish a legal duty to make banks consider a customer's long-term outcomes. This is another potential sea change. So buckle in and hold on to your hats. We may be in for a wild ride.

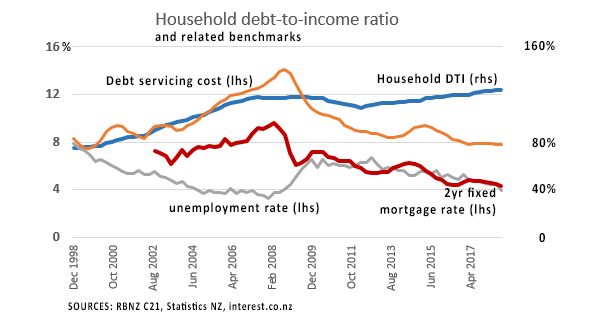

The chart - can we keep household debt servicing costs under control?

David Chaston made the chart below specifically for this article. We'll be updating it in the future. Why it matters is because although household debt is at historic highs, as long as interest rates and unemployment are so low, meaning debt servicing costs are manageable, NZ and its economy should continue to truck along okay. Assuming, of course, no major overseas crisis or meltdown intervenes.

All in all 2019 is shaping up to be another interesting year.

*This article was first published in our email for paying subscribers early on Thursday morning.See here for more details and how to subscribe.

80 Comments

Seems like economy was simpler years back:

https://www.unz.com/mhudson/the-vocabulary-of-economic-deception/ by Michael Hudson

Nice interview, I like that Michael Hudson.

Are you certain Labour’s plan is to pass CGT legislation before the 2020 election? I was under the impression they would campaign on it to get the mandate for it to be introduced for the 2021 tax year. Guess there isn’t enough time for the bill to pass before the tax year starts in April 2021? If they do plan to introduce legislation before the election it makes a bit of a nonsense of their claim that changes will be done under mandate, even if the changes wouldn’t come into effect or be given royal assent until after the election. Edit: I see Jacinda has previously said tax legislation will be introduced before the next election, news to me, Winston’s base is going to hate him even more if he goes for it.

Let me guess what Winston will ask for: hmmm, maybe a zero percent rate if the taxpayer is a natural person who holds a super gold card on any assets disposed of to fund retirement? It would be sad if it weren't so predictable.

He's going to support it. He supported the international migration compact after years of sabre-rattling about migration. He is as two-faced as they come. The only guessing game is what additional perk will he offer his already well-off boomer voters to keep him in charge and to still be kingmaker following the next election?

I think the reserve banks decision will be significant if it moves interest rates.

https://www.nzherald.co.nz/personal-finance/news/article.cfm?c_id=12&ob…

If interest rates go up 0.5%-1% that will be huge for the housing market. And by huge I mean it will tank it.

Stop falling for media hype

Falling mortgage rates in 2019 more likely.

Falling rates of people taking out mortgages... Yeah, you could be right.

I don’t see how this is possible but maybe I’ll be proved wrong. Perhaps a global meltdown but then the housing market will have bigger problems than interest rates.

Anyone with a Kiwibuild sized mortgage would see an extra $90 per week in interest payments on a 1% interest rate increase. I’m sure most will be able to afford it as the banks measure to a higher rate, but that’s $90 less per week in potential consumer spending.

Key in this will be ANZ...

I see what you did there

I’d like to see an article explore what strategies the banks would employ if their capital requirements were markedly increased. The market behaviours of their better capitalised competitors would give an insight. Are they more expensive to borrow from? Do their shareholders get the same rate of return? If NZ remains alone in this move and returns on capital are higher elsewhere then I would expect to see the offshore banks shift their focus elsewhere. If I were a current shareholder in the banks I’d be very unhappy. Ultimately this may make the banks move towards utility type risk profiles. I’m not sure I’d want to be a shareholder while they adjust or rely on them for borrowings. Maybe the way forward is for Australian institutions to raise NZD deposits and lend to NZ based borrowers. Avoid the NZ banking market altogether?

Is there any way to slice it that doesn't result in higher mortgage interest rates and lower lending?

Cutting depositor returns can only go so far, then depositors go elsewhere to try to get a decent return on their money. Shareholders taking less dividend income.. again, not going to happen.

1. I’d like to see an article explore what strategies the banks would employ if their capital requirements were markedly increased.

Lobby like hell, draw in support from property industry and media, think blitz

2. The market behaviours of their better capitalised competitors would give an insight.

There are none.

3. Are they more expensive to borrow from?

They act as a pack - see below

note the hammering given to savers, widows and orphans! living on interest.

4. Do their shareholders get the same rate of return?

They share institutional investors, eg documented example, NAB/BNZ told not to compete on price.

5. If NZ remains alone in this move and returns on capital are higher elsewhere then I would expect to see the offshore banks shift their focus elsewhere.

NZ operations presently most profitable in world.

6. If I were a current shareholder in the banks I’d be very unhappy.

You should have got out 18 mths ago basis Mr Hulmes analysis

7. Ultimately this may make the banks move towards utility type risk profiles.

? more your present imagination/impression of bank risk may be understated

8. I’m not sure I’d want to be a shareholder while they adjust or rely on them for borrowings.

refer 6. not so much fun selling calls now.

9. Maybe the way forward is for Australian institutions to raise NZD deposits and lend to NZ based borrowers.

? Do you mean operate for the benefit of borrower and saver customers (widows and orphans) and for all NZ citizens?

10. Avoid the NZ banking market altogether?

Why would you be unhappy for them to go.

Credit unions and building societies can lend for houses,

Finance companies can lend for production and productive plant and equipment.

What is Australia's and Australian's natural talents?

Is Australia and Australians world famous for being the best bankers?

Best not to rule anything in or out.

Remember massive debt forgiveness occurred in NZ just 30 years ago!

Almost all ownership of banks and financial firms completely changed.

Henry, whilst I don’t thinkit will come to this, are you seriously suggesting that the likes of NZ owned banks, credit unions and finance companies can replace Australian banks to fund NZers requirements, including corporates. Yeah right, NZ Banks will be able access the global capital markets at current margins to fund the 20-25% that NZers can’t save locally to fund their own borrowings, and the last dollar in dictates the price of the retest - this issue is severely misunderstood in important by even some of the contributors here. The RBNZ will end up having to cut rates, but borrowers rates will still gop up in unless the requirements are moderated.

You will be amazed what can get done with a rated entity.

and a little transformation.

Bond markets are full up on the Ozzie names.

Global markets are chasing the underlying assets. its not like the marvelous Ozzie names enhances the mortgage book being bond funded - assuming global markets to be used.

- remember the loan comes first.

Corporate s don't need euro reversible trouser bonds. (and presently 70% to 75% of bank lending is home loan or property industry)

I appreciate that Henry, but quote me the NZ names and capitalisation that you’d be taking to the global capital markets to raise billions ?

Give it 12 months to have several S&P rated entities that would do the job.

There are first cut four local groups from whence these entities would rise.

Alternatively

If you what to go public

here is the legislative stating point:

http://www.cecaust.com.au/policy/CNCBBill/Draft_Legislation_for_Nationa…

Grant A,

Questions for you.

Answer both, or answer one,

your choice. take your time.

1. How are the Australians needed to run the show here in NZ? what do they do better, what do they know more of?.

2. How do Sydney & Melbourne HQs have our (New Zealand and New Zealanders) best interest at heart! when have these banks put New Zealand interests ahead of Australian interests?

Henry

1. Easy, capital and size compared with say the larger NZ owned banks such Kiwibank that can’t even raise enough capital to grow at levels its requires to become a notable player in this market, let alone try to replace some of the Aussie banks contribution to driving the NZ economy

2. Because they’ve been here longer than any NZ bank and treat NZ as a much valued part of their business (that is not just an opinion). But if you want to use that patriotic nonesense, when have Apple, Mobil, MacDonalds, Sony, Audi, you name them, put NZ interests ahead of US, UK, Japanese etc interests ?

Frankly Henry, the Aussie banks have a far far superior record of serving NZers financials interests than say the old BNZ and multiple NZ finance companies who inevitably cost the NZ tax payers and NZ investors millions of dollar in losses.

Thanks Grant for your best.

1. The gang of four dominance of the local market is not something that is only in being by being an Australian Bank or having Australian Bankers. If the Australian Banks and Australian Bankers were of such brilliance, why have they failed in banking business in UK and North America, or why has the Aussie banking Commission been held.

You seem more suggest that the innate Australian skill is in corning a market and crowding out local competition.

2 a. time being here has nothing to do with the question.

2 b. valued business, ?in terms of dividend flow (to them!). It is the massive dividend flows to Australia based off ponzi lending that have greatly weakened the financial system here in New Zealand, and now evidence the Reserve bank and Mr Orr are requirement that the NZ subs and branches be adequately capitalised.

NZ operations stripped of function

Further much banking business of New Zealand is dealt directly by Australian Bankers in Sydney and in Melbourne, with where the facility being booked more a tax consideration - large ag and corporate lending.

Also the use of NZ tax shield/ tax book by Melbourne and Sydney (the banks dialing up their own tax-rates paid to IRD in NZ), refer the Pref shares transactions and later massive payments to the IRD. Hundreds of millions repaid to IRD.

2 c, these companies you name are not banks, really not banks!!

Grant the Ozz banks take and have taken far more than they offer. The size of their take, makes any costs you calculate to NZ very small, very small Grant!.

So its a banking paranoia only that you have Henry. Your first point is nonsensical, point 2a likewise, point 2b name me a local for foreign company where earning profits is not an important KPI for staying in business (also please explain why organisations investing billions of dollars of capital and funding just about everything in NZ won't have a large $ profit (where does their ROE sit in the NZX Henry) - where does their current capital levels sit within the spectrum of global banks (low, medium , high) if the RBNZ sees the need to raise it further?)

I won't even bother responding to the tax issues since you seem to think that its only banks that try to legally optimism their tax positions.

But please don't respond at all Henry, prejudice and paranoia is impossible to reason with

Every time I see a comment one sided in favour of banks I look to the top and lo - it's Grant.

Do we think he is paid?

Well I have been in the past KH, two of them in fact as an ex-banker who actually knows something abour Banks and banking. But Is it better to just join the populist uninformed comment on here rather than call out some out for what it is.? On here no doubt ot is

Yes Grant, your earlier post was the better one.

For sure!

We are talking about banks. Just banks.

Just banks and facts

Here is what RBNZ say fact-wise:

https://www.rbnz.govt.nz/regulation-and-supervision/banks/consultations…

- this seems over and above the bail-in.

Tax-wise, fact-wise:

https://www.interest.co.nz/business/75906/asb-ird-mum-after-settlement-…

https://www.interest.co.nz/news/40814/banks-settle-structured-finance-t…

https://media.ird.govt.nz/articles/structured-finance-cases-settled/

The Commissioner of Inland Revenue, Robert Russell, and the Solicitor-General, David Collins QC, said they are pleased long-running tax disputes involving four major banks have been settled.

The BNZ, Westpac, ASB Bank, and ANZ National have agreed to settle cases with Inland Revenue by accepting liability for a combined sum that exceeds $2.2 billion.

The settlement, believed to be the largest commercial settlement in New Zealand's history, follows Inland Revenue's success in the High Court this year in two cases involving a particular type of transaction known as "structured finance".

Mr Russell said it had been Inland Revenue's long-held view that the transactions were tax avoidance.

"Our decision to pursue these cases has been shown to be absolutely right, and it has returned a very good result for the taxpayers of New Zealand."

and for students. This is the fact:

http://img.scoop.co.nz/media/pdfs/0910/WESTPAC_V_COMMISSIONER_OF_INLAND…

Result

[668] In the result, Westpac’s challenge to the Commissioner’s reassessments must

fail. The bank has failed to discharge its onus of proving that the Commissioner

erred, either in law or in fact. It may count itself fortunate that he did not, on his

hypothetical reconstruction, disallow the bank’s claim for its exempt income.

Summary

[669] In summary, I have found as follows:

(1) Westpac’s claim for deductions for the GPF were unlawful, and the

Commissioner is entitled to disallow them in entirety;

(2) In any event, Koch and the other three transactions were tax

avoidance arrangements entered into for a purpose of avoiding tax;

(3) The Commissioner has correctly adjusted the deductions claimed by

Westpac in order to counteract its tax advantage gained under an

avoided arrangement.

Judgment

[670] It follows that I dismiss Westpac’s applications on Koch, CSFB, Rabo 1 and

Rabo 2 for an order cancelling or varying the Commissioner’s amended assessment.

[671] Costs must follow the event. The Commissioner is entitled to judgment for

his costs and disbursements. While, of course, the parties may wish to advance

argument on the subject, I trust they will be able to agree. It may assist if I

provisionally record that, given the complexities of the issues and argument,

category 3C is the appropriate scale, and I would certify for three counsel. I am

conscious also that a number of interlocutory steps have been taken by both sides.

[672] In the event that counsel are unable to agree on costs, I reserve leave to the

Commissioner to file a memorandum on or before 3 November 2009 and Westpac to

file a memorandum in answer by 1 December 2009. Memoranda are not to exceed

30 pages in length. On receipt of both I will confer with counsel for the purpose of

arranging a fixture to hear oral argument. I trust, however, that a hearing will be

unnecessary.

[673] I must conclude by expressing my gratitude to all counsel and those who

assisted. Both cases were prepared and presented with great skill and care and the

arguments were admirable; in my view, neither side could have been better served.

In particular, I am conscious that I have rejected Westpac’s primary arguments on all

contested issues. That result, however, is solely a reflection of my findings about the

GPF and its consequences, and does not reflect on the submissions made by Messrs

Farmer and Green. To the contrary, the length of this judgment is a tribute to the

depth and quality of their arguments. Moreover, the spirit of co-operation and

goodwill between counsel, which was in the best traditions of the profession,

enabled the trial to proceed efficiently and cost effectively. It was a privilege to

preside.

__________

https://www.noted.co.nz/money/investment/wins-for-the-taxpayer/

https://thestandard.org.nz/whitewash-a-certainty-in-tax-haven-review/

In the biggest tax avoidance case in New Zealand history, where the four main Australian banks agreed on Christmas Eve of 2009 to settle $2.2 billion with the IRD, Shewan was adviser for Westpac.

The case was, according to Patrick Smellie, “notable for advice from a PwC senior partner at the time, John Shewan, that his client, Westpac, should be seen to be paying enough tax to satisfy public expectations”.

He suggested that tax should be about 15 percent of annual profits, compared with the then corporate tax rate of 30 percent. Westpac actually chose to pay a rate of just 6.5 percent.

*Disclosure; The sun is certainly not shining in Auckland today. But it was when I wrote this article. Merry Christmas everyone.

Will there be tax relief in other areas that Peters could embrace if a CGT is recommended?

Perhaps a provision that Capital Losses, incurred on good-looking but hopelesssly slow racehorses which turn into canned dog tucker, will be paid out in cash (used notes, naturally) by IRD?

Thank you DC for the great chart, whilst DTI, unemployment and Mortgage rate will get a lot of attention, the only line that really matters is the orange "debt servicing cost"

That might be the only line that matters for those already in the market. But DTI will certainly matter for the supply of new entrants to the market.

If you cut of the supply of new entrants what happens as the existing players find they have less competition, and eventually find the property they want?

Banks do not evaluate new loan applicants on DTI but on Income to Expense & Assets to Liabilities as they should

And when you assess servicability with an assumed interest rate of 7% it is effectively a DTI limit.

Sorry Pragmatist but that is incorrect, 7% is a cashflow measure, it has all to do with servicability. You're excused as few understand the difference between D ebt & E xpense. DTI is a misleading tool in an accounting sense because it compares D ebt (a measure of financial position at a given time) with I ncome (a measure of cashflow over a period of time)

And when the period is fixed, the interest rate is fixed, then it is effectively the same thing.

X amount of debt amortised at 7% over period Y results in a certain amount of cashflow required to service the loan.

So you reckon that if household debt/Income goes to ~200% over the next 20 years - the same increment as the last 20, and 2 years fixed rate mortgages go to 0%, that's all fine and dandy?

Have a look at that same graph recalibrated in RBNZ terms and tell me if that 200% will be immaterial WHEN interest rates finally turn - the reverse of 10 years ago! (They will, but not until we've found a bottom that is way lower than here - 0%? Who knows. But adding to Household Debt/Income from here IS life-threatening and all that matters!)

https://www.rbnz.govt.nz/statistics/key-graphs/key-graph-mortgage-rates

(NB: Look at that graph! What do you think has really kept the property market afloat in NZ since that 2008 peak? Answer: As with all asset prices since then - artificially reduced interest rates. Oh, and also note:

The graph above, in this article, shows Household Debt/Income at about 120%. That isn't what other sources for that stat are, as I've written before. It's closer to 170% than 120% !!! That would put Household Debt/Income, not at ~200% in 20 years, but 320%!

bw, I think we're saying the same thing, you talk about low interest rates since 2008 being the cause of asset inflation and you ask what if they rise in the future, that is indeed "debt servicing cost", the orange line which I said mattered the most

I disagree. Why?

Because previous generations got a boost from rapidly improving debt servicing cost. They bought houses in the late 80s/early 90s for bugger all at high interest rates/low prices. Then down go the interest rates and now they have low prices/medium interest rates. And then down to the interest rates again and they have low prices/low interest rates.

Compare that with people buying today. High prices/low rates. The rub though is if the interest rates go up it’s high prices/medium rates and they get crushed.

What’s the moral of the story? Don’t look at affordability solely based on current interest rates, look at it based on a reasonable estimate of long terms rates. If you do that then affordability is terrible.

Sounds to me like you agree with me when you say:

"What’s the moral of the story? Don’t look at affordability solely based on current interest rates, look at it based on a reasonable estimate of long terms rates"

That's debt servicability, the orange line

But didn’t you hear? They had 22%, or 26%, was it 29%, maybe 23% interest rates (I dunno it varies quite considerably depending on who’s telling the story) for a couple of years so they hang on to that little piece of courage. They also had a 2 year wage freeze (now why would a government initiate one of those?).

One aspect that doesn't get considered much in the media is the difference in the housing quality available to the first home buyer then and now. Back in the 60s and 70s the typical home was closer to 100 m2, now closer to 200 m2. Insulation.... well... back then insulation was very rarely used. Fittings and appliances, I think we have all seen a few homes with period installations. These homes get appropriately cast aside by all but the most desperate.

Standards have most definitely increased, which sadly has a price associated with the upgrades. Yes, things are different, which shows up in more aspects than simplistic price to income relations.

But you totally ignore the progress in technology that should have also bought the costs down. Hammer vs Nail gun. Z nails vs individual nails. Mobile cranes, panelisation, pre-nailed trusses etc

And the 200m2 now includes the internal access garage and storage.

It a bit like comparing a 1970s corolla vs a modern corolla.. the modern corolla is a world away from the old corolla, but yet they are both lower end fairly budget cars for their markets.

And the 200m2 is just the usual arbitrary square meterage used push the tired old narrative about how today's housing crisis is caused by young people wanting the huge flash houses with all the mod cons.... There are plenty of sub 100m2 house plans available through companies like A1 Homes,

indeed, look at everything kiwibuild.

Id say quality has significantly deteriorated over the years. It's not uncommon to find a 70's two story house fitted out with a nice solid concrete floor, copper pipes, brass window fittings, brass taps. The kitchen cupboard door hinges will be New Zealand made brass. Compare that to today, thin perhaps untreated timber floor, cheap Chinese made stainless steal hinges and fittings, polybutylene pipe throughout.

a) Will be very interesting to watch Peters on CGT.

Two-faced? You bet. Payback? You bet. Aren't you glad you're old? You bet.

b) Another point about the bank capital ratios increasing could be that the American banks see our banks as very safe & secure thereby lowering their wholesale rates to our boys (& girls) which could flow through to retail? Just a thought.

c) Wouldn't it be great if we could create a banking system worthy of world attention right here in NZ Inc? Imagine if the world thought that having their money stashed away in NZ was as safe & sound as Switzerland. Maybe Mr Orr is onto something?

https://www.thelocal.ch/20181030/swiss-banker-given-10-years-over-venez…

John Key wanted NZ to be The Switzerland of The South Pacific, and it's quietly been forgotten - for good reason!

Switzerland is a wonderful country indeed! The first world country of first world countries

They harbour illegal money, wouldn't have to tell you of all people

Naughty, naughty, they may not get a Christmas present lol

Banks are money creators if they need funds all they need is a borrower and they can create money.

Barclays got Qatar to borrow money, they created the money and Qatar used the money to invest back in Barclays

https://www.theguardian.com/business/2018/oct/26/barclays-avoids-trial-…

You can skip to 12 mins in. Prof Richard Werner

Andrew - why do you think they bother then with those messy term deposits, corporate and insto deposits, offshore borrowings etc ? Just to employ more people ?

Internal ratings-based approach

https://en.wikipedia.org/wiki/Internal_ratings-based_approach_(credit_r…

The Junk-Bond Market Pukes.

Risk is getting repriced. And rather suddenly. What are the real-world consequences? And how will it impact stocks?

https://wolfstreet.com/2018/12/23/the-wolf-street-report-junk-bond-mark…

“the Reserve Bank plan goes well beyond the international norm, is highly conservative by international standards, and would be positive for banks' borrowing profiles”

This could really be a niche market for NZ - the one sensible country amongst a bunch of nutters. Low government debt, safe banks, sounds like a great place to invest.

At first I thought this was a good point but it doesn’t make any sense.

First, my house is 110 sqm and built in 1970, it has been massively inflated in cost since it was built but hasn’t got any bigger.

Second, one of the biggest inflators of price has been land. In fact sections have shrunk in size so you pay much more for much less.

Third, we should be able to build a bigger house for the same price 50 years later. It’s called productivity and it is supposed to improve. The fact that we haven’t had much innovation and everything is being built by one man Banda is a real issue.

So yeah, larger houses might explain some of the price inflation but there are much bigger issues.

This was supposed to be in response to Yankiwi above.

There are many issues involved. One of which is the inflation in the housing expectations, hence the 100m2 very small house vs the current expectation for a 200m2 3 bdrm (or even 4 bdrm) house. I strongly suspect that your 100m2 house has been updated and modernized more than once over the approximately 50 years of ownership. Yes, the price of the underlying land has increased rather dramatically. Similarly, the currency has depreciated rather dramatically. In addition, the financing costs have decreased rather dramatically due to the much lower interest rates. The overall carrying cost for purchasing a similar home hasn't changed that much over time. Some have even argued that the total carrying costs have decreased for the FHB as a percentage of income although that is somewhat challenging to defend IMO. It is true that fifty years ago, the effects of inflation eroded the debt obligation after one went heavily into debt to make the FHB purchase. There were many very large negatives to this inflation that are neglected in the home price then vs now argument. I am rather certain that no rational person would advocate that we return to the massive inflation of that time period so as to erode debt obligations.

Do you have any evidence there is actually a 200m2 expectation with most buyers? Maybe with the well-off older couples moving up the ladder, but all the younger people I know would be happy with 100m2 and for most of them 2 or 3 bedrooms is enough, since most are only planning on one or maybe two children.

Yankiwi doesn't know what he/she is talking about. Smells like another one of those "us and them" generational comparative fictional pieces. Yankiwi's generation were so much more modest, toughed it out and were happy with everything average where as millenials are just a bunch of greedy, entitled scum that want the biggest houses with all the mod cons.

Yes, Much what I figured. Also hilarious because over on reddit immediately after posting that I was reading a thread about this stuff story complaining about how they are too big and kiwibuild buyers don't want standalone houses but apartments.

It seems kiwibuild buyers want 200m2 mansions and 70m2 apartments at the same time.. Or possibly, there are a range of desires, but for most city-dwellers they would be happy with far less than 200m2.

I think you'll find that builders have been building more of the 200m2 houses because once you've dealt with buying the land, consents and all the other necessary infrastructure, the only way to make money is put a big expensive house on it, because that is where your margin is. Possibly also more to cater to the recent imports that have multi-generational households far more often than NZers.

I'd recommend reading this article: https://www.oneroof.co.nz/news/boomers-v-millennials-which-generation-h…

Note the data regarding average house prices, as well as average household income, home price, and interest rate. Then, do the maths regarding mortgage cost with respect to income. Not that much different between 1978 and 2018. Also note the average house size in 1978 of 114 m2 vs 2018 of 175 m2.

No, the people back in the 70s didn't walk uphill both ways through the snow to get to school... although they also had their own challenges and home ownership wasn't just something to be plucked from a tree. I'd recommend reading through the entirety of the above article, and not dismissing the part of the narrative that is in disagreement with your current position.

As to the summary conclusion stated by one economist in the article that the only measure that is important is percentage of home ownership, that is rather amusing in its simplistic ignorance. More recent generations have become far more mobile, including significant OE travel. A conclusion about this mobility is the lowered fixity of home purchasing and increased necessity for renting. This is similar to the current generation assuming that they will shift between multiple jobs during their career, whereas the proverbial baby-boomer would expect to work for a single employer for the majority of their career. Generations are different, and some of the differences result in different outcomes. Maybe you think that one generation is greedy entitled scum... Do NOT project your opinions upon others. I think that all generations are different. My forebears had a different outlook than my generation, and the following generation will have a different outlook. Whether one generation is better than another, that is up to a historian to evaluate (with their individual biases). I personally do not think that there is much difference in opportunity between generations. There is more than a small amount of difference in the type of opportunity. Looking back to the '70s as an example, job mobility was quite limited as compared to today. There are so many differences... focusing on house price to income ratio as the only important factor is farcical.

I'll state strongly that there are times where not owning a home is more advantageous than owning a home. I owned a home for 20 years, sold in 2006 and rented for ten years for various reasons, one of which was that it was cheaper to rent than to own at the time, and for the location where I lived. The home I sold 12 years ago is still worth less than the sale price when one includes inflation. Home ownership isn't everything. Yes, I stopped renting and bought again almost three years ago, which again was a good financial choice as home prices starting increasing after being stagnant for almost a decade in our current location.

Size of the house is a largely irrelevant sideshow. According to this link below, the average wage earner made $157 per week by 1979 ($8164 annually) which suggests in 1978 the average household income in your link ($8204) was based on a single worker.

If the 2018 household income is $100,892 (from the Table in your link), but the average wage in New Zealand is $65,000 Click Here then this further proves it's much more difficult today to save for a deposit.

https://nzhistory.govt.nz/culture/the-1970s/overview

In 1975 the average weekly wage was $95 (equivalent to $920 in 2018). This rose to $157 by 1979, but because of inflation the average Kiwi was no better off. The minimum wage for adult workers was $1.95 an hour ($11.10 in 2018) and the average hourly rate was $4.52 ($26).

The hurdle is saving for the deposit, as I've laid out below. What is unknown is how many working adults make up the household income figure, is 2018 predominately 2 adults working whereas 1978 a working father and a stay at home mother? Just something to consider.

Used a 6 month compounding interest calculator, monthly deposits being 20% of Salary divided by 12.

Historical interest rates sourced from here -> https://teara.govt.nz/en/graph/23100/interest-rates-1966-2008

2018

H'H Income = $100,892

20% Deposit = $132,737

Time to save (20% take home @ 3.25% p.a) = 6 years

2008

H'H Income = $76,973

20% Deposit = $80,651

Time to save (20% take home @ 5% p.a ) = 4.5 years

1998

H'H Income = $49,093

20% Deposit = $36,238

Time to save (20% take home @ 7% p.a ) = 3.5 years

1988

H'H Income = $34,465

20% Deposit = $19,940

Time to save (20% take home @ 15% p.a conservative) = 2.1 years

1978

H'H Income = $8204

20% Deposit = $5940

Time to save (20% take home @ 10% p.a) = 3 years

A couple bits of data to consider. That interest rate for the past should be reduced to meet the interest available at the time instead of what was charged on mortgages. Using the mortgage rates for the 70s and 80s as synonymous with savings rates is false. If that was true then you should use 5. 25% as a savings rate for 2018.... for 1978 the error isn't big, your data source shows an average that is close to 9% rather than your stated 10%. the more important data point is the rapidly moving price target due to inflation in the past. If you started saving a 20% deposit in 1978, you needed around $6k. Three years later you needed $9k - $10k due to the effects of inflation.

The interest rates I used were based off the red line in the link I provided, the 6 month deposit rate. My 2018 rate is based on a Westpac 6 month term deposit rate.

Fair point about the inflation. It’s a bit like the past 9 years of house price inflation where house prices particularly in Auckland were appreciating faster than people could save a deposit for.

On the link, one can download the actual data instead of interpolating from the chart. For the year of 1978, the average was a 9.4%. For 1988 it was 13.8% instead of the 15% you listed. The chart appears to not be in full agreement with the underlying data. Yes, the moving target of achieving a down payment can be highly annoying.

When I saved for my down payment way back in the '80s, I was saving approximately 50% of my take-home pay until I had sufficient funds for a down-payment, and I was dealing with a similar moving target with home price appreciation being about 20% per year at the time. My frugal financial habits were shaped during that time. For example, it was more than 30 years later (just last year) before I bought my first television. I know just how hard it can be to save, and what one has to set aside in order to get a down payment in a reasonable period of time. Of note, was that the local peak happened less than two years after we bought, with the peak value being about 40% higher than the purchase price. Another two years after that, the value was almost the same as the original purchase price. For the following decade, the appreciation barely tracked inflation. The bulk of the full price appreciation happened in the final 6-7 years before we sold and returned to being renters for a decade. We cashed out at the right time. If we had waited another two years to sell, we would have lost 2/3 of the capital gains. To me, the moral of this is that one shouldn't become a home owner for the capital gain potential. One should buy a home to have your very own place to live, and you should not treat it as an investment. Home ownership has had rather poor returns in the long term as compared to more traditional investments.

Oh cool I didn’t really care to dig into precise data and to be honest the % here or there makes little difference.

In 2018 the average deposit for the average house is considerably more than the average household income for a year. Previous decades it was less than the household income. It’s also clear that in 2018 the average household income is considerably more than the average income, suggesting more hours are needed to be done today to achieve the average income than previous decades.

The real big difference today is we have low interest rates but high house price inflation. In the 70's and 80's there was high inflation, high interest rates and high house price inflation. You might have felt like the goal posts were shifting but at least your savings kept up. It's also quite clear from the below numbers that the household income is no longer based on a single wage earner yet the house price statistics are still based on this metric.

1978

Average Wage = $157 per week or $8164 P.A - From Here

Average H'H Income = $8204 P.A (effectively the same as the average wage) - From Oneroof Article

Average House Price = $29,698 - From Oneroof Article

Average Deposit = $5939.60 (72% of the average wage) - 20% of above.

2018

Average Wage = $1250 per week or $65,000 P.A

Average H'H Income = $100,892 or an extra 22 hours per week worked @ average wage - From Oneroof Article

Average House Price = $663,688 - From Oneroof Article

Average Deposit = $132,737 (204% of the average wage). 20% of above

https://www.oneroof.co.nz/news/boomers-v-millennials-which-generation-h…

I seriously understand the issues here. I do have to say that the current situation is now low home price inflation, with a reasonable probability of negative home price inflation in the near future. This bodes well for future FHB'ers.

A big challenge of the high inflation of the past, is that interest that you earned was taxed so the effective return was at best almost keeping up with inflation and wasn't really making the nest egg grow.

Also note that the mortgage interest costs for the proverbial FHB assuming the average wage and average house price in 1978 consumed 34% of the household income. In 2018, the interest costs for the FHB are only 26% of the household income. Nowadays it is harder to get the down payment, and easier to make the payments once you buy.

As to single income vs dual income, yes, things change in a society over time. Some of this comes about via the various labor saving devices available now that reduce the requirement for a full time home-maker, as well as the increase in availability for working at home that allows for the person at home to earn a living. There are so many changes between generations. Focusing on only one aspect such as down payment savings doesn't capture the full picture. In some ways it is easier for the current generation, and in some ways it is harder. One should not ignore the positive aspects and only focus on the negative aspects.

You make some good points. House Price deflation will be good for future FHBers, assuming interest rates remain the same. If interest rates go up, then they are no better off and some of those who have bought in the last few years could find it very difficult when they go to refix.

It's easier to make the payments once you buy, sure, if you're working on a dual income household. If that household has a 2 year old (like ours does), then you're paying $200 per week in childcare (40 hours @ $5 an hour). Suddenly that extra $10k p.a. puts you back to 33% of household income just for 1 child on the average mortgage.

Very much agreed as to the issues about the costs of raising children. I suspect strongly that the increased costs have contributed to the decreasing fertility in NZ. It is another discussion as to whether this decrease is good or bad for society.

Thank you for largely keeping your discussion with me civil and polite, and confined to the various aspects that we each brought forward. This civility seems to be getting somewhat more rare.

IMO, if interest rates increase significantly, there will be far larger structural issues than just mortgage payment affordability. At some point, we may find out just how resilient this fiat currency thing is (or isn't)...

The 100m2 and 200m2 are rounded off values. The reality is a bit less delta, although the delta is still significant. A few seconds of google using the term "New Zealand house size history" finds this data set: http://archive.stats.govt.nz/browse_for_stats/industry_sectors/Construc…

Builders build what the market demands. Witness some of the high density developments around Christchurch that failed due to the market deciding not to support them.

I would go beyond the few people that you may know, and look at industry statistics. The plural of anecdote is not data.

Of course.. because First home buyer is synonymous with New Build!

Might help if your "data" was relevant.

I have to laugh at this... when I was young, the new developments were largely new families that were FHB. The current new developments in my neighborhood have a similar composition, largely FHB. Little has changed. It is more than just the size of the house that has changed over the decades. It is clear that some will not acknowledge truth. Such is life.

Well, you are right about some not acknowledging the truth.

Apparently in Yankiwi world FHB are routinely spending $1.3+ million on new build 4 bedroom 200m2 houses in Auckland. Must be all the boomers buying the apartments, and sub 100m2 houses on the outskirts of Auckland for $750k...

Or, alternately, Yan-kiwis entire premise of FHB having 200m2 expectations is complete bullshit.

Nzdan uses numbers and logic to make his point.

You use insults and lies to make your point. There is far more to NZ than downtown Auckland.

Not much point using logic when you will simply assert without evidence that FHB are the driving force behind new home builds, when the price of most new home builds, particularly the 200m2 ones are clearly out of FHB price ranges.

And you are that far out of touch.. $1.3m is going price for your fictional 200m2 FHB new build house in hobsonville point, which is nowhere near downtown Auckland : https://trademe.nz/property/residential/sale/auckland/waitakere-city/ho…

Long bay, again, nowhere near downtown Auckland..

https://trademe.nz/property/residential/sale/auckland/north-shore-city/…

Or down to a mere million if you go all the way out to Pukekohe..

https://trademe.nz/property/residential/sale/auckland/franklin/pukekohe…

Cars have also gotten bigger in the past 30 years. Seen how many more SUV's and Utes there are around? I reckon it's those greedy learner drivers that want all the big flash cars like their parents have, when I bought my first car it was a Hillman Hunter and it was falling to bits.

Even though the Nikkei's (1,000 point) sell-off on Christmas Day was intense, not everyone sees it as an emotional reaction by investors. For Satoshi Okumoto, the chief executive officer of Fukoku Capital Management Inc, it's a result of rational decision-making."It's not panic selling, it's calm selling based on cool-headed decisions," he said. ...In fact, he sees a risk that shares could drop to levels that would stun investors over the next few months..."

Not only shares, but all asset prices are also going to 'stun' to the downside - all of them.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.