Central banks in several countries will be forced to reverse course on tightening interest rates as their economies either go into recession, or teeter on the edge of it, independent global economics researcher Capital Economics says.

Capital Economics has done a crunchy update on the global economic picture - and it's not a pretty one.

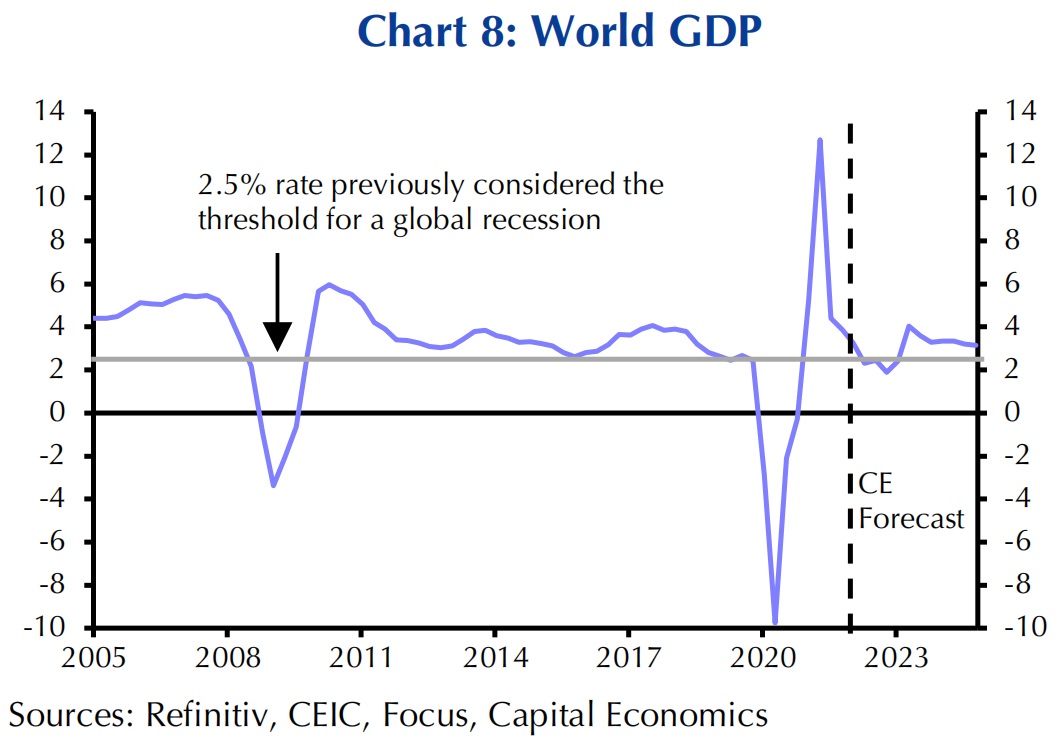

In fact the economists have revised down their global GDP forecasts and they are forecasting several countries will go into recession.

They anticipate recessions in the euro-zone and the UK and expect the US, Canada, Australia and New Zealand to avoid economic contraction only narrowly.

"If a technical “global recession” is avoided, this will be largely thanks to a moderate post-Covid rebound in China and relative economic strength among the major commodities producers. Inflation is likely to prove more persistent than in the recent past, so the widespread and aggressive monetary policy tightening cycle has further to run. But this will add to headwinds to growth and ultimately force several central banks to reverse course in 2024 or even before," the economists say.

As stated above, they don't see either New Zealand or Australia going into recession - but only because they think the central banks in both countries will change course.

"The US will suffer from a contraction in residential investment and further weakness in consumption, despite its relatively low levels of household debt," the economists say.

"Canada, Australia and New Zealand will be hit even harder by housing downturns. Indeed, our view that all four will narrowly avoid recession is predicated on the assumption that central banks recognise this economic fragility and begin to cut rates again as early as next year."

Capital Economics is forecasting a 15% house price fall in Australia - but 20% in New Zealand.

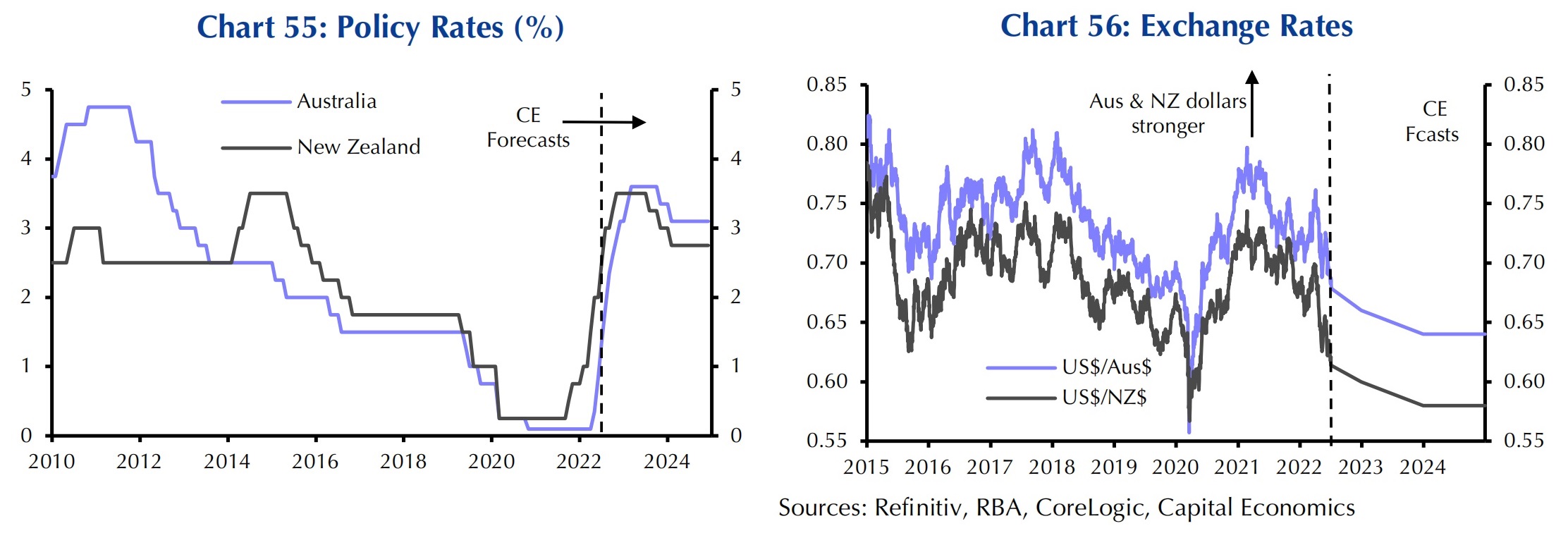

The economists say that both the Reserve Bank of New Zealand (RBNZ) and the Reserve Bank of Australia (RBA) "will slam harder on the brakes than most anticipate".

"As the ongoing housing downturns intensify, consumption growth will soften and dwellings investment will plunge. Accordingly, we expect both central banks to loosen policy next year."

They think inflation has already peaked in New Zealand (hitting an annual 7.3% as at the June quarter) and are picking a peak of about 8% in Australia. The expect official interest rates to go as high as 3.5% in both countries.

"And with inflation set to fall back towards central banks’ targets as supply shortages ease and commodity prices fall, we expect both central banks to loosen policy again before long. We have pencilled in 50bp of rate cuts by the RBA and 75bp of rate cuts by the RBNZ from next year. That suggests that the recent depreciation of the Aussie and the Kiwi [currencies] will continue."

The economists say the expected recovery in China later this year and continued strength among energy producers will boost global average GDP growth.

"But emerging markets will experience a further slowdown on the whole as most are hit by high inflation just like in advanced economies and interest rate hikes (which typically began sooner than in DMs) take a toll.

"In aggregate, we expect global growth of 2.5% this year, which is weaker than our previous forecast of 2.7% and meets the IMF’s old definition of a global recession.

"...Even against this gloomy backdrop, we think that the risks are skewed to the downside. Some of the greatest are to Europe, where a cut-off in Russian gas supply would prompt a deeper recession. More generally, supply shortages could worsen again, perhaps if renewed virus waves prompt restrictions in China which limit its exports. Finally, policy tightening could be more damaging than we anticipate if stubbornly high inflation forces central banks to keep interest rates higher for longer than we expect."

The economists say the good news is that inflation has probably peaked.

"We suspect that the recent decline in oil and agricultural commodity prices has further to run. And in any case, statistical base effects in energy and food CPI imply that their contribution to headline rates will drop even if prices hold at current high levels. But while inflation will fall, it will remain high by past standards, implying weak or even negative real incomes growth and a further squeeze on consumption."

Looking out to the future, Capital Economics says the pandemic "will not do much permanent damage" to the level of GDP in most countries, especially developed markets. Nonetheless, it will accelerate some of the structural trends that were already set to weaken the long-term growth prospects of emerging markets.

"This will result in global GDP growth easing to 2.5% by 2050. Meanwhile, central banks’ strong reaction to recent price pressures has reduced the risk of a sustained period of significantly higher inflation in future."

The economists say the transition to green energy, "which should be accelerated by the war in Ukraine", will add to inflationary pressures over the medium term. What’s more, some of the structural forces that contributed to the low inflation era are now easing or reversing. However, policymakers’ renewed focus on fighting inflation suggests that it will only be a little higher in DMs over the coming decades than it was in the past one.

"Meanwhile, we expect real short-term rates to remain low by historical standards. This is partly because any rise in equilibrium interest rates is likely to be limited and gradual. And the higher levels of debt that are a legacy of the pandemic might act as a constraint on how far interest rates rise and for how long."

76 Comments

What do you expect, when we had a corruptly "K" shaped economic recovery from covid. Owners of real estate enjoyed 40%+ paper gains due to RBNZ/Govt policy and euphoria, while everyone else got jack. Adrian Orr looking out for his banking and rent seeking buddies.

Corrupt inequality always breeds resentment.

Out for blood... you try saving money for 7+ years and getting nowhere. People gleefully making millions on the housing market for years (and gloating about it) suddenly turn around and act the victim when the inevitable collapse happens.

Savers just want interest rates ABOVE inflation, to prevent years of sacrifice and hard work going down the drain, that's all. Not our fault if moron homeowners banked on continued erosion of money's real value, and extrapolating from that, a terrible future where hundreds of thousands are plunged into poverty and homelessness save a few who managed to climb the property ladder lifeboat. That's their choice. OUT FOR BLOOD?

There seems to be a gleeful undercurrent of people out for blood

I suppose average first-home buyers should just quietly accept the status quo and be happy for and proud of all those gleeful property investors who have been creaming it for years? I think you do not recognize how many people are simply hoping for a chance to raise their kids in an actual home, as opposed to some shabby rental. "Out for blood?" How melodramatic.

Yeah, you can't save the economy by killing it, well put. I hope OCR cuts are actually coming, it would be good but I am not convinced.

Regarding the article, I think 2.5% economic growth is too optimistic. Given recent collapses of equity markets, I think a recession is looming.

Honestly, the amount of hopium and copium being smoked by economists right now is mind boggling.

Lowering the rates would collapse the NZD. It would drive up inflation enormously as the dollar falls, exports will improve sure, but not enough to offset the crash. Rate hikes continue the crash of the housing market, but keep the NZD strong. The speculative bet which I am sure many have come to is short NZD, long USD.

I can see that. I just struggle to see a world where the NZD 'collapses' in value. It might have a small slide, but again, in my opinion, if NZ cuts rates at roughly the same time and rate as the USA, there will not be much of a change in the strength of the NZD.

Not saying that's the right thing to do. But I think this is what will end up happening starting sometime end of this year/early next year.

The only risk is that Powell will not be forced to cut the rates again because America has not the same overvalued housing mess as in New Zealand. The only way out of this is offering every home owner tax deductability of his interest payments in return for a capital gain tax when he sells the house to pay back the relievement on interest payments.

This is expected with currency debasement allowing the over-indebted to better service their mortgages and allow for greater credit accessibility for consumers to buy goods and services. With cheaper access to money, consumers would be able to take on more debt through credit cards and personal loans, which would potentially prop up the the retail and services industry.

The Capital Economics article is just their forecast and may or may not eventuate into reality.

A falling dollar means Kiwi consumers pay more at the checkout for both local and imported goods.

Don't worry about inflation though, Robbo has us covered. He proudly declared a few weeks ago that 81% of our population since 2020 has received some sort of welfare payment from his government.

We should all thank General Secretary Ardern and her comrades for the handouts.

That's because commercial trade between nations (primarily export and imports) in today's world makes up a rather small portion of global foreign currency exchange.

The biggest players in the global FX markets are mostly engaged in speculative trade: investment banks, hedge funds, pension funds, mutual funds and insurance companies. Even central banks make up less than 1 percent of daily currency transaction by value.

That's because commercial trade between nations (primarily export and imports) in today's world makes up a rather small portion of global foreign currency exchange.

Many people are not aware of this. Mind you, I don't know what the carry trade on plays such as JPY/NZD these days.

The reality is, the NZD is falling, despite or because of the fact that the OCR has been increased tenfold. How then would further OCR hikes "keep the NZD strong"?

In reality, nothing can keep the NZD strong at this point. It has been devalued by money printing, the consumer price inflation is only the effect of it.

The NZD exchange rate is a measure of what our country's economy is worth as a whole. It is falling because the markets are pricing in economic decline in housing-dependent New Zealand. Further OCR hikes would not solve this problem, they would worsen it.

gnx, you should read up on Christ. And on many other things. Your contributions here have not been very substantial. Perhaps start with economics, this is an economic forum.

Or, better yet, start with Christ. You could look at the shroud of Turin or the Eucharistic Miracle of Lanciano and its study by Professor Linoli.

Or, after all, start with economics. This is a financial forum. In any case, please make sensible contributions.

If inflation is not under 2% to 3% what would be point of lowering interest rates as inflation will just skyrocket again and all it would do is push house prices up in New Zealand. NZD will tank pushing inflation even higher look around the world you will see what happens to countries that let their currencies devalue. Most of our population could not afford to buy a house from start on their income it’s is way overpriced we are already seeing society breakdown people living in cars crime climbing food banks being used more.

The company that wrote this are based in the city of london i think. Their economists world view is likely shaped by their own lives which will be high income, wealthy friends, etc. I honestly think they have no idea of the lower classes and think the reserve banks will act to defend their own way of life and also take no account of society at large.

Unfortunately.. i think they may be right as the reserve bank actions to date have followed such a line.

I agree! They don't have any boots on the ground telling them that we are already in a recession. The maritime AIS system was telling me this morning that 21 containerships of the Ever Given size (20000 - 23000 TEU's) are anchored of European ports waiting up to 4 weeks to start their return journey to East Asia and China. And they are not from one shipping company; all are affected! If the tradeflows were up than they should not have to wait so long!

If there is one thing that this recent financial turbulence has proven to everyone that has been watching, it is that the term 'Economist' needs to be taken with a grain of salt. More often than not they are not only wrong, but are simply pushing the agenda of the organisation that they represent to try and influence the outcome.

Economists are rapidly becoming the RE agents and used car salesmen of the financial industry.

Economists are rapidly becoming the RE agents and used car salesmen of the financial industry.

Sure, particularly if they're in the employ of or supplier base of banks. No disrespect to Cameron Bagrie, but his narrative has become quite DGM of late. Always came across as the glass half empty kind of guy and somewhat of a cheerleader. That's just my opinion.

All these economists talk as though the RBNZ is in control of interest rates.

It is not. Not really.

They need to read some Jeffrey Snider. Even Adrian Orr says:

We are a small economy and must accept the fact that saving and investment decisions in the rest of the world determine the bulk of our interest rate levels,” he said.

https://i.stuff.co.nz/business/126856502/adrian-orr-says-reserve-bank-o…

These "expert" economists seem to be about as accurate as old-time soothsayers and alchemists. They are wrong more often than not.

If you assume that everything in this article turns out to be correct ( I know a big if but just bare with me ) Then it actually offers a huge opportunity to those that have been wanting to get into the housing market. I mean huge!

think house prices falling 20%….that will mean closer to 30% in real terms. Then some decent cuts in interest rates that will undoubtedly bring the housing market back.

If you are wanting to buy your first home I would advise going to see a mortgage broker early on…ie now. Get everything sorted as it can take a while and get pre approved. Then start spending a lot of time looking and learning. That way when the right opportunity comes up you can take it with confidence.

For the love of god don’t just sit around waiting for a crash or for the market bottom to become obvious. Being proactive in this life is what pays off.

30% down would not even bring us back to 2020 levels, you have to look at income to size of debt and average wage couples income should only allow them to borrow around 400k so a long way to fall in Auckland. This will take a number of years to hit bottom but the speed of crash is accelerating.

“you have to look at income to size of debt and average wage”

There are three parts to this equation: price , income and the interest rate. Without all three you are not calculating anything. With Interest rates arguably the most important, as recent history clearly demonstrates.

Is Household disposable income increasing or decreasing? That is the key.

That's why relative measures are more important than absolute measures.

Eg, it doesn't matter so much that a house costs a million dollars if the household value to income median ratio is 3 to 4x.

A first year undergrad would surely fail his paper for an article like this.

Its an opinion with no real justification or historical precedents.

It basically says that 'reserve banks will overshoot their ocr target and start to see gdp drop then drop the ocr again to start the economy firing and save us from recession'

It mentions but then ignores the fact that inflation will remain high, that the kiwi dollar will still be falling .. and if the reserve banks did drop the ocr it will fall further..

So if i follow this further.. ocr drops, dollar drops, people spend inflation would soar house prices rise again.. And what then? They move the ocr back up again?

Methinx it is way over simplified and is way more complex than that and nz is already being forced now to structurally rethink the issues that made it so in order to escape our situation (immigration, investment alternatives to housing, social housing, affordable housing, healthcare, education, infrastructure...). At least labour is trying now.. luxon would unfortunately probably agree with the article as he owns 7 houses and wants to do best by his wealthy mates.

Jeez.

I don't think we understand how tightly wound the world got around cheap credit. Everything is fragile and it only takes a little bit of bad news for everyone to remember this. I think the consumer pullback, already underway, will be swift and brutal. The building industry is at the last chair on the titanic stage already.

Orr's time at the RB will be up next year. He will not hang around. He's stuffed his legacy in the last 4 years & National won't even consider him should they come to power. A lot will happen between now & then, however, & recent form says they have not been that great at doing the right thing. I suspect this 'poor form' will continue, especially with Rubbo along for the ride.

I agree. Perhaps we should distrust experiments, especially in the medical field.

Also, the interest rate drop to 0.25% with a subsequent tenfold hike in very short succession has rightly been called "experimental". I don't like experiments with the livelihood of people.

FWIW: "It pains me to say it, but (NZ) inflation is actually falling"

https://www.stuff.co.nz/opinion/129360366/damien-grant-it-pains-me-to-s…

Amateur stats exercise by Damien IMO. He could very well be right but remember that 'official' inflation data is still pretty much tea leaves:

1. Inflation as reflected by the CPI cannot be validated as the 'actual' increase in the cost of living for individuals, households, and firms.

2. Damien looks a decreasing nomimal % changes. This is directional at best and doesn't account for any 'margin of error.'

Of course, it is quite possible that inflation has peaked and we're potentially heading into a deflationary cycle. That would suggest that demand has fallen off a cliff. Only time will tell.

It seems to have become fashionable to believe that high inflation can be reduced with very little pressure on the economy; that it will simply drift down effortlessly if we simply give it the chance. And yet every country that has grappled with high inflation and successfully brought it down has found it a very painful process, as New Zealand did in the late 1980s and early 1990s. Wishful thinking does not change the underlying workings of the economy!

While there is much I agree with in this article, I actually disagree on one key point. That is, I actually think recession, and associated significant rises in unemployment, is a prerequisite for the RBNZ to halt and reverse its hikes. The RBNZ will require a significant rise in unemployment to allow it to halt and reverse OCR hikes. A significant recession will be necessary to raise unemployment significantly.

And I happen, unlike the authors, to think NZ *will* have a recession, unemployment will rise significantly and the OCR will be cut.

It will be a recession. Not because anyone wants one,, but because we binged too much at the debt feast. In times of geo political wrangling foreign debt is weakness, because people are going to ask for their money back... And then there is Taiwan. Xi has to act while there is all the distraction in Europe, and a basket case administration in the US.. what will happen to the dollar with the brics breakaway.. And we are currently running the biggest current account deficit in years... it can only be a recession.

We are a small economy and must accept the fact that saving and investment decisions in the rest of the world determine the bulk of our interest rate levels,” he said.

- Adrian Orr.

https://i.stuff.co.nz/business/126856502/adrian-orr-says-reserve-bank-o…

So are interest rates used to lower inflation. Or is inflation managed to lower interest rates. In debt based economies where growth is devastated by even the tiniest rises in rates(and these are really tiny), it would appear that the later is true. Then throw into the mix that elections are generally held in periods of falling interest rates(else a change in government), and you get a very sick picture indeed.

I think without much scrutiny, the government is trying quite hard to reduce CPI inflation:

- halt on the fuel tax

- half price public transport

- promoting shipments of gib supplementation

- pressure on petrol companies and supermarkets re: competition and pricing

I would like to think the government is doing it for us ‘the people’. And they might be to a large extent. But call me cynical - I think they want to get the CPI down so the RBNZ can stop hiking the OCR in election year, and even start reverse it. I don’t know, that’s a pretty cynical view isn’t it, and possibly unfair…

Dont need to read the article to weigh up whether a recession is coming...its here already , lower household income and spending relative to inflationary pressure (tick), lower buying power due to the dollar slide over the last 12 months(tick) Only fact left to consider is whether it will trend into a depression....early days into the recession but with whats going on outside of our shores its a no brainer that NZ will feel the wash...... reversing course (lower OCR, or QE) would be counter productive as it would require much more market stability than is present or forecast.

Richard Prebble is right on the money in his article in the NZ Herald today.

Recession + inflation = stagflation

NZ will be unable to avoid recession as it has no credible plan to pay back debt.

NZ has no credible plan to fix the supply constraints.

NZ has no credible plan to reign in spending.

LSAP has been a disaster. Heads should roll for putting NZ in this predicament.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.