KiwiSaver has now been with us for 16 years - which is probably long enough for us to sit down and have another proper think about what we want from it and what it is really there for.

Along with another initiative of the late Michael Cullen, the NZ Super Fund, KiwiSaver can I think be seen as something that goes some way to solving our ageing population/retirement condundrum, but doesn't do the whole job.

That's no criticism at all of Cullen. You might have noticed it is virtually impossible to ever get our politicians to agree on matters relating to retirement and indeed taxation. Cullen, I think recognised that some progress was better than no progress at all. And he's to be applauded for that.

About 3.2 million of us are in KiwiSaver and the funds under management are now around $100 billion. So, it's really become quite a big thing.

However, according to the most recent KiwiSaver annual report from the Financial Markets Authority, for the March 2022 year, the average balance at that time was only around $28,000. You're not going to retire on that. Indeed there are some bon vivants out there who might regard $28,000 as a good night out!

But of course, that's just an average figure and people who haven't been in long would drag that figure down. Around a million members are under the age of 30. And the average figure would be higher now, given that the figure quoted above was from well over a year ago.

Still though, you've got to say it doesn't look as though many people regard KiwiSaver as the prime method for saving for retirement.

All of which leads us into the question of what we really want from KiwiSaver. And here's where I think we would benefit from a Government-level re-appraisal of what it is for and how it is best structured to achieve that.

The National Party's idea of allowing the under 30s to cash out KiwiSaver funds and use them for rental bonds, therefore turning KiwiSaver into a sort of slush fund, I think highlights the kind of ambiguity KiwiSaver has as a vehicle.

As far back as seven years ago I commented on the then rising trend of young people using ostensibly retirement funds (IE KiwiSaver funds) as deposits for first homes. And then as this trend continued, I had another go four years ago.

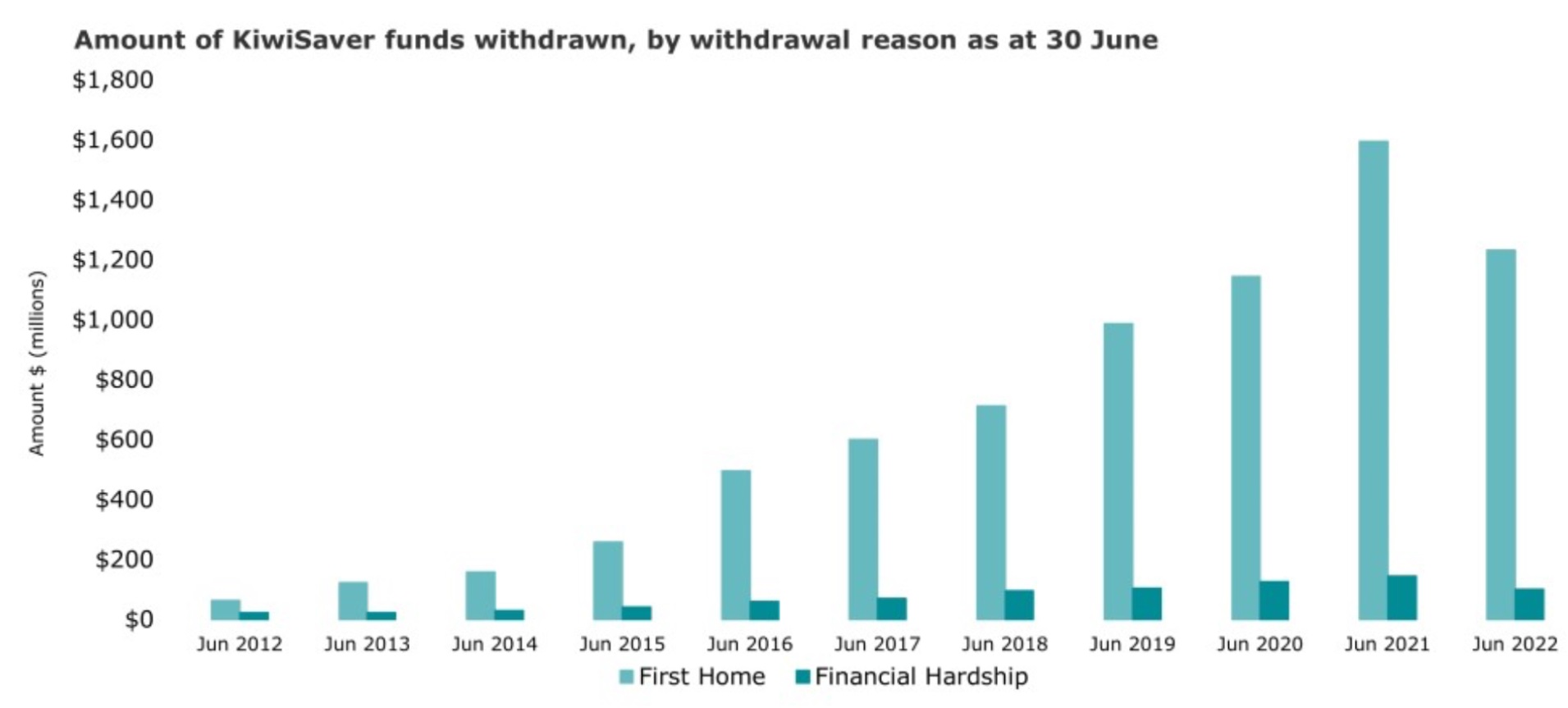

Just as a matter of curiosity, I checked out the most recently available withdrawal stats from the IRD.

These show that withdrawals for a first home purchase peaked at around $1.6 billion in the June 2021 year. That was of course right at the peak of that crazy pandemic housing market surge. In the June 2022 year the figure dropped to around $1.2 billion.

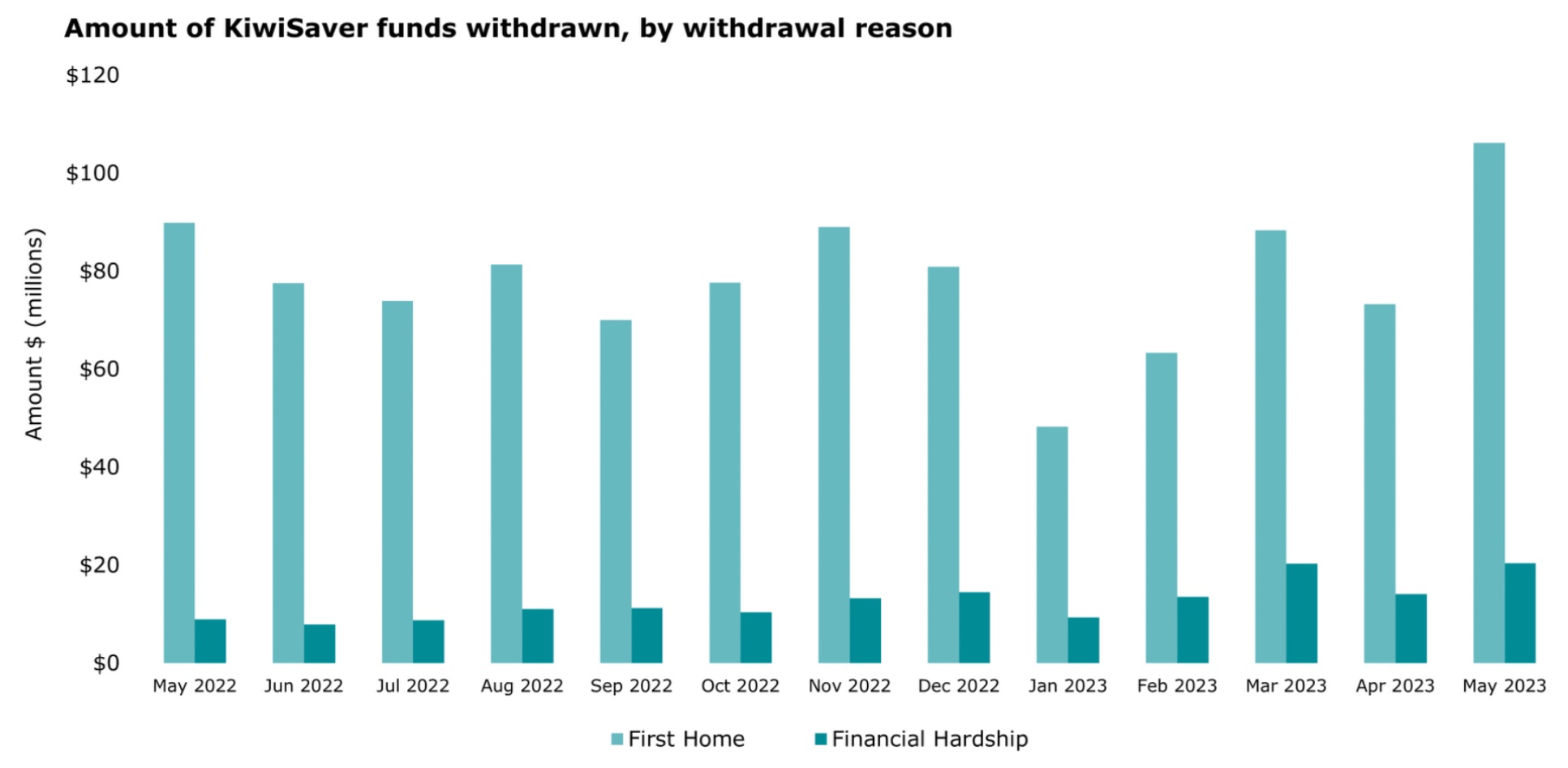

Figures for the year to June 2023 aren't yet available, but in the 12 months to May about $930 million was withdrawn for houses. What a difference a down house market makes. Interestingly though, the withdrawal for May 2023 was $106 million, which was the biggest such withdrawal in over 12 months.

Also of note in May 2023 was that the withdrawal for financial hardship was over $20 million - which was more than double the amount withdrawn for this purpose in May 2022.

Okay, so with all this money sloshing around, why not tip some into a rental bond as well? And how about the new mobile phone you need?

Well, why not? It is your money!

But it just goes back to the point of why have a retirement savings scheme at all if you are just going to turn the whole thing into open slather and then have people retire with a pile of IOUs in their KiwiSaver accounts.

Former colleague Jenée Tibshraeny made an erudite argument for why younger KiwiSaver members should be entitled to withdraw funds for house purposes - in her case with the intention of buying a house to rent it out.

I've never tried to argue with the New Zealand philosophy that buying houses is a good way to provide for retirement. Just look around. It clearly works for people.

What it comes back to, however, is that KiwiSaver cannot optimally be ALL things. It cannot be a piggy bank and a retirement savings provider.

If for example a young person signs up for KiwiSaver with the thought that they will buy a house in five years' time and use their KiwiSaver funds for the deposit, what do they do?

Well, what they SHOULD do under those circumstances is get themselves into a fund with a reasonably cautious approach. After all, it would be no good to get into a fund that's investing in a load of 'high growth' stocks and then find that the market slumps big time - round about when the young person is wanting to take that deposit out. But a cautious approach, with a conservative fund, would be anathema to good retirement planning - albeit that it would be eminently sensible in a five year house-buying timeframe.

So, instead of a 40-45 year timeframe, perhaps, in which they could and indeed SHOULD be very bold with their choice of investments, our young person would be cautious and actually potentially lose the potential for greater returns in the long run. The short term need for a house trumps long term retirement planning. How many people have done this?

Yes, okay, hopefully the house is going to work out well - but my point here is why not have the best of both worlds? Why not be able to buy a house and stash cash with a long term focus? Is there anybody out there who seriously thinks they could have TOO MUCH money to retire with?!

There have over the years been suggestions that it would be a good idea for provision within KiwiSaver of a rainy day fund. And I think maybe this is the kind of direction in which we should be looking.

Maybe we do need to look at a split-fund or two-fund arrangement for members. One fund is targeted for buying a house and maybe the odd incidental like a bond, and therefore has a shorter term investment focus. The other fund is a 'don't touch at all' fund with that 40-45 year timeframe. KiwiSaver would be genuinely filling a role as a vital component of retirement planning if we took this approach.

Now, yes, the immediate question is how far can you stretch the member contributions? Well, maybe we would need to look at increasing the minimum contribution. And yes, I concede that could be contentious.

Really, it is up to us what we want. But with all the talk about a future crisis with the ageing demographic and with successive groups of politicians vacillating around retirement ages and the like, surely taking some decisive action around deciding just what KiwiSaver is and can accomplish, would be one positive thing we could do.

These issues around KiwiSaver have been bouncing around for years now and nobody has applied a firm hand to them.

If we keep having a bob each way with KiwiSaver then yes, we will leave ourselves open to politicians trying to win an election, spying a bit of cash sitting around in KiwiSaver funds, and saying, yes, okay, I've got a great idea what that money could be used for...

Either we are serious about planning for the long term or we are not.

101 Comments

Is there anybody out there who seriously thinks they could have TOO MUCH money to retire with?!

No, but I've seen from many a boomer that retiring with heaps of cash is fairly pointless when you've got a rotten prostate and zero motivation to do anything interesting.

The answer is likely to keep one eye on the future and one on the quality of your day to day lived experience.

That said every 16 year old getting into work of some form would be well served putting a hundred bucks away every week for their working life, let the compound interest do the work.

Yep a lot of these providers want you to be the richest person in the grave yard...they just keep clicking the ticket until you are there.

It is worth having available cash when you are old. Plenty of chances you will be fit and active. Do you really want to be huddled inside deciding between eating lunch, or turning on the heater.

Very wise words Pa1nter. If you can't retire with your health, then what was it all about?

Interest rates have been lower than inflation for several years now, when that's the case the compound effect isn't any good to you. In real terms every hundred bucks put aside in the year before the pandemic would be worth closer to $90 now.

Apparently the Australian Govt thinks so, and that's why they have moved to cap the balances in Super Funds to $3M. Clearly in Australia, lots of people have TOO MUCH money to retire on. I guess that's why they call it The Lucky Country, and why New Zealanders are flocking to move there again.

You must know a lot of unhealthy boomers. All of the ones I know are fit and healthy, get out and about a lot, and cautiously spend the money that they have saved over the last 50 or so years. A few are helping fill the coffers of retirement villages, but that's entirely their choice. ..

It's time people were able to withdraw their money from KiwiSaver without having to run the gauntlet

Completely missing the point of kiwisaver are we?

You can run your own KiwiSaver without the hassle, just put $50 away in the bank each week in a Rapid Saver account and never touch it. The only problem will be the never touch it part.

Yeah its the $521 a year from government and the employer 3% plus (I currently get 5% matched) you are missing. My wife was on a dollar for dollar up to 10% earnings (government one)

The $521 pa is chicken feed compared to the control you have passed over to the government.

As an employer I never turned down anyone getting an extra 3% instead of being in kiwisaver. I only stipulated that it go into a separate bank account, and they try to only use it for purposes that benefited their retirement. I also made sure that 3% bump wasn't swallowed up in subsequent salary reviews. Similarly I have never had an employer turn me down for the same. Public service employees are probably screwed in this regard.

As a public sector employee, I can confirm this. For me, if I put 3% of my salary into kiwisaver, I get a 'free' ~2% contribution from my employer (3% minus tax) and $500 on top of that. Unbeatable.

My other savings in excess of 3% go elsewhere where I have full control. If the employer matched a higher %, I would likely put in a higher % (and this is something we have been pushing for).

What control you have passed over to the govt.. they aren't the ones holding your money. Throwing the minimum to get the employer match and govt contrib is a no-brainer. Put the rest of your retirement savings in non-kiwisaver funds by all means, but a gauranteed 100% return (employer match) and $521 a year is something you should grab with both hands,

The government controls when you access it. That is soon to be moved out to 67 with a change of government. And because super will become even more unaffordable it is likely means testing will eventually come in, and I bet your kiwisaver balance will be caught up in that. Unfair, yes.

It's not how much you put in that matters, it's how much you get out.

The employer match is not 100% because you pay the tax on it. Look at your payslip. As per my post above, if you ask your employer to pay you the extra 3% in lieu of kiwisaver via a Total Remuneration contract, you aren't missing out.

Kiwisaver is a good option though for those who would otherwise do nothing about their retirement.

That's a good point. If there is to be means testing on Super then all those with KiwiSaver are stuffed. Many will miss out on super because there will be no way to easily avoid means testing. I knew there was more than one good reason I never enrolled in it.

If you're in a position to save a half-decent amount for your retirement (say 10%+), then I think this risk is small. I stick 3% in kiwisaver and invest much more than that myself - my shares outside KS are worth more than those within it. My plan if I retire earlier than the KS withdrawal date at the time would be to draw on my non-KS funds first, and the KS will be waiting for me when I grow into it. Not a problem.

No one is likely to be retiring early based on 3% contributions - so long as excess savings go elsewhere taking the employer and government bonus is a simple decision.

I don't understand why people would commit more than their employer will match unless they have serious problems with self-restraint or don't want to spend a couple of hours understanding how to invest their money outside of kiwisaver.

It would be insanity to save for retirement in a bank account (unless you are only a few years away from needing that money) - get it into a diverse portfolio of stocks, bonds, whatever. Give yourself a chance of beating inflation.

It's very cheap and easy to set up regular investments these days.

mfd

Or you could put it in a KiwiSaver account where those full time experienced people with knowledge could put it in "a diverse portfolio of stocks, bonds, whatever" KiwiSaver fund. Personally, I don't have the ego to rate myself to be able to beat those with the knowledge and experience . . . even with the management fees (off set by the government $521 contribution). I kind of see my self as a "heartland or club rugby" type of investor up against a "professional super-ruby" type investor . . . a kind of unfair competition which I would expect to loose.

Cheers

Oh, I agree - Kiwisaver is best for most people. Just pointing out that you can still invest in managed funds even if you are too conspiracy minded to put money in Kiwisaver itself.

The stats show that the vast majority can't beat a simple index fund, but some of us enjoy the game anyway. The new Sharesies option allowing individual stock picking up to 50% of the kiwisaver balance will be very tempting...

mfd

Yes, I agree with your sentiment.

Even though I am retired, I have a KiwiSaver account as you suggest and have other investments which is really part of an interest in keeping the brain active.

As an aside, being over 65 I can draw on my KiwiSaver account. I have my money laddered across three funds - from low risk with sufficient funds I may need in the short term to some (planning that I will be still breathing for some time) in long term growth funds. In retirement, an advantage of KiwiSaver, compared to term deposits, is that one can draw funds within five days without penalty.

So yes, I am a supporter of KiwiSaver.

I would have "ego to rate myself to be able to beat those with the knowledge and experience" (well not beat but at least match) since the average fund under performs the market, so basically worse than monkeys picking. When funds charge fees based the amount they outperform the market not the amount of money you have in the fund, and put their money where their mouth is and guarantee me if they under perform the market I get the difference back. If they truly believe they have skills it shouldn't be a problem.

Also before people point out some funds outperform the market that maybe true, but some monkeys will do the same, just like some pigs can pick the winner of the football world cup.

Yeah, but you don't get the govt contribution. Although rather than a weekly $50 into Rapid Save , putting it into a nasdaq fund or a global ETF would make sense..but as you say don't touch it whatever you do

We should open it up to offshore kiwis.

We should ask Australia to open up their Superannuation scheme to Kiwis.

It would be good to be able to contribute some money from pre-tax income to Kiwisaver, on the proviso that it is fully locked away for retirement with a view that those who retire with sufficient would not then get superannuation (which, as we are constantly reminded in the comment section here whenever anybody mentions trimming government expenditure, is our biggest expense - so why don't we take steps to address that?)

I fully appreciate that this would be "unfair" on those whose incomes make it harder to save, but surely the idea should be that if you are in a position to provide for yourself in retirement you are reasonably incentivized to do so (e.g. being able to save up to 5% of your pre-tax income per year in a 'Kiwisaver Plus' account) with super then being for those who are unable to do so.

Disclosure - I used my Kiwisaver balance to purchase a first home, and I now contribute the bare minimum to get the government top up as I don't see any advantage beyond that, and instead invest elsewhere. I guess that makes me a hypocrite here? I would, however, contribute more if it could come from pre-tax income as a form of incentive.

One of the biggest issues is the poor performance of majority of KiwiSaver funds and lack of product offerings.

Over the last 3 years I would hazard a guess most kiwis have had virtually no return (or even saw their KiwiSaver go down in value). Speaking personally after fees I have seen 0% growth.

By contrast, my UK pension has been increasing 10-15% pa. I could stick my money in saving account and earn 6-7%.

I fully agree that you should not be able to use KiwiSaver for buying a home. But it’s the smart thing to do, given mortgage rates currently.

Why should I pump money into KiwiSaver when there is no tax incentives, and the returns are so poor ?

Who is your provider? May be time to shop around - my Simplicity fund is up 17% over the last 3 years, a little less than my own portfolio returns.

The $500 government contribution is an incentive but fairly small. If your employer matches your contributions then it's truly a no-brainer.

We are set up quite different to pensions in other countries where tax is often not paid when invested, but when drawn down. Here, we pay tax on the way in and then it is tax free when we draw down. There are some reasons why this is a little worse, but I suspect a lot of people don't fully understand the differences.

We are set up quite different to pensions in other countries where tax is often not paid when invested, but when drawn down. Here, we pay tax on the way in and then it is tax free when we draw down. There are some reasons why this is a little worse

It's not a little worse. It's a lot worse.

OK sure, it is worse. But my point is, I wonder if all of those asking for tax relief on Kiwisaver contributions accept that this will likely go hand-in-hand with paying tax on the money you take out of your kiwisaver after retirement?

Does that mean paying tax on the chunk you withdraw for a house deposit too, or for a bond if the Nats have their way?

Realistically they can't change change Kiwisaver from tax upfront to tax on withdrawal because that would be grossly unfair to everyone who has paid into Kiwisaver so far.

Instead there should be two classes of Kiwisaver:

A: tax upfront

B: tax on withdrawal.

Allow people to contribute to either or both classes, and the balances of each class would be tracked separately.

Allow unlimited contributions to class A, but cap class B contributions to something like $20K - $30K per year.

Fine by me, so long as I'm not the one who has to explain the difference to the average Kiwi.

There are three opportunities for the govt to tax you. On your contributions, on the investment returns, and at Withdrawal. We currently are TTE (Taxed Contribs,Taxed Returns ,Exempt at Withdrawal), Other countries have various Schemes, ETT, and EET.

I'd prefer TEE, (or EEE, but that one will never happen). The difference between TEE and EET is certainty.. I'd rather put the money in knowing that the tax has been taken and whatever goes in is coming back out without tax, rather than put it in tax exempt and have an unknown level of tax coming out according to what the intervening govts decide to do with tax rates.. you might get lucky and tax rates drop, but I suspect with the aging population its far more likely to go the other way, tax those that saved for retirement to be able to pay those that didn't.

But with TEE you run the risk that Government change the rules in the future so that TEE becomes TET. With EET you don't have that risk.

I see that as very unlikely, that would be double dipping by the govt.

Why cant we have the Australian system? Compulsory contributions up to the concessional limit (currently $27.5k a year) are not taxed, extra non-concessional contributions are made out of post tax income. Earnings within the fund are concessionally taxed at 15%, and once over 60, withdrawals are tax free. Plus you can set up your own Self Managed Super Fund and invest how you like (within the rules). Kiwisaver is just a savings account that the Govt tells you you cant touch until you are retired, and offers zero incentives to use it rather than investing your own money yourself in things like residential investment properties. If you want people to maximise their retirement savings within an official scheme you have to make it attractive to them, otherwise it might as well just be used as a piggy bank.

It's not a little worse. It's a lot worse.

No, not if the tax rates are the same, it works out identically. The only reason taxing at the end would end up better is that when you are withdrawing in your dotage your withdrawal are likely to be at a lower tax band. ie while you are earning in NZ your are likely in the 30-33% tax bands, but if your kiwisaver withdrawals were your only income then you would likely be taxed in the lower tax brackets of 17.5% and 10.5%

That's the difference I was thinking of. The tax rate arbitrage makes quite a handy difference if you can pay 17.5% rather than 39% (not that I am troubling the 39% tax band myself)

KiwiSaver is a social service device. There should be no reason to tax it in any way.

Zero tax.

Especially when it's compulsory.

Hardly a KiwiSaver problem. The Aussie super funds have had exactly the same poor performance. My daughter and her husbands retirement plan in Germany has had negative balances over the last 3 years

Is the who thing not a $800 million fee cash cow for the big end of town? Odd the article failed to mention Arrdern's failed Kiwisaver $225 million tax grab.

FMA 2022 report - fees up 6.5% and returns down 90.2%. Nice work if you can get it.

i am 54 --survived massive heart attack at 49 parents died at 53 an 58 from heart -- its familiar and despite being fit and the right weight -- unlikely ot have a long retirement -- Split from my Wife -- i have 180K in kiwiwsaver - that if i could access i could buy a property and avoid selling the family home from under my wife daughter and three moko- - but the rules dont allow it

Having a home -- mortgage free or with a very small mortgage has to be a great option for retirement -- providing security of accommodation - and removing a major stress of renting with ever increasing rents , and possibly moving home every year at teh age of 65+

Time to review and understand that providing for your retirement -- can take many forms -- but secure long term accommodation is always the biggest +

That's what i said yesterday, if you hav'ent already used it for a first home deposit, why do they not let you take a % out for those later in life to help pay down a mortgage. A mortgage free or house with a very small mortgage is part of the retirement plan right. Sometimes life can throw you a few curve balls and it be nice to know if you have not already used your KS that you can use some of it to help with mortgage payments before you hit 65, if you need it, and the process should be fairly straight forward.

Because if you were allowed to take it out to pay down the mortgage how many would pay $100k off the mortgage, and then six months later refi and throw a Holiday/Boat/Caravan on tick? Or throw it on the mortgage first then take the kiwisaver withdrawal to pay it off.

We all know the answer is heaps, particularly amongst those that can least afford it.

I'll tell you what KS isn't - It isn't a store of wealth.

It's a bunch of forward betting-tickets.

If folk want to call that 'savings'....

Hey, for once I agree with you. KiwiSaver is for people that cannot save and need something like KiwiSaver. It’s also poor performing and you pay an bunch of fees just to have it. It’s also made available to you at the whim of the govt even though it is your own money. If the retirement age shifts look for the age of with withdraw to also change. It is a very very poor version of the Australian system. If pretax contributions were allowed people would be much more enthusiastic. Right now, there are heaps of members but you can be sure that many are not contributing or have just the default set up with a low contribution, to a default manager who is just clipping the ticket and eroding the value. The current average balance is 30k, which is terrible. It’s not going to help most people at all. It’s only helping the money managers.

Copy and paste the Australian superannuation scheme and charge politicians for treason should they dear tinker with it. Done.

Likewise with their Captial Gains Tax. They've worked out the quirks so that we don't have to. I've lived there and it's just part of life and not the end of the world like what National say.

You average DGM on here would not be happy with Australian Capital Gains:

There is a capital gains tax (CGT) discount of 50% for Australian individuals who own an asset for 12 months or more. This means you pay tax on only half the net capital gain on that asset.

Some assets are exempt from CGT, such as your home.

- If you owned an affordable housing fixed domestic residential property, such as a house, unit or apartment, the discount is 60%

In Australia you would use a Self Managed Super Fund to buy a residential investment property. Rental income is taxed at 15% and Capital Gains tax is 10%. The mortgage is also non-recourse.

The Aussies have a great Super Plan and well worth following

KiwiSaver can only ever be a nice-to-have for those who can afford to contribute to it. It should be an arrangement between worker and employer. The government should cease its $521-a-year subsidy. State contributions to KiwiSaver have been perverted by governments allowing them to be withdrawn by aspiring first-home buyers. Thus instead of helping save for retirement, state funds are adding to the pool of money going into the housing market, inflating house prices.

What New Zealand needs now is to restore the universal NZ Superannuation to the level of payment that assures a real retirement income for everyone as Robert Muldoon intended. (When he introduced it in 1977 married couples received 80% of the gross average wage.)

The top after-tax rate of NZ Super, the $496-a-week living-alone rate, is a survival rate for a retired person living in their own home with no mortgage. It is unsurvivable for someone renting who has no savings or other income: it barely covers the rent. The proportion of over-65 renters with no property and no savings is increasing year by year.

NZ Super needs to become a tax-free benefit equal to the after-tax living wage, now about $850 a week, for every superannuitant.

In exchange for that, to keep NZ Superannuation affordable, a surcharge or surtax needs to be reimposed on all other income: put everyone who applies for NZ Super on a separate tax scale that would tax all other income at a flat rate of 50%. This needs to include the imputed income of rent saved by living in one's own home (minus the costs of maintenance and insurance) to achieve balance between renters and home-owners.

So work hard, own your own home, but get less than someone than someone who pissed it away and rents?

Pass.

If you work hard and put money in the bank you pay tax on the interest / profit. But if you work hard and put money in your own home you don't pay tax on the "profit" of not paying rent (or the profit of capital gain). So there are some distortions.

So don't put money in the bank, which is the lazy thing to do. You can invest it in NZ/Aus shares and pay no tax on the capital gains. Ditto for investing in SMEs. Or invest in international equities and pay no tax on capital gains (but taxed on 5% of the asset value)

Minor point - on international equities you pay tax as if you had earned a 5% income, so the actual tax paid is ~1-2% of the total asset value. This might be what you mean but some might interpret it as paying 5% of the total asset value, which would be extortionate.

Yes you are correct - I didn't word that very well. Also that only kicks in if the total investment is over $50,000.

Neither of those two things are true. For international equities you pay a % of the net value of the equities if they NOT on a list of excluded equities. There are loads of these excluded equities on the AUS and (I think) UK exchanges, and then the 50K rules apply only to those parcels of equities that are on the non-excluded list. For equities on the excluded list you pay tax on the dividends as you would in NZ and the credits are transferrable to NZ as imputation credits just as if they were a NZ-based company.

The original post mentioned Aus/NZ shares as distinct from international presumably for this reason - as you say many (most?) Aussie shares are excluded from the FiF regime. Which is very handy, because we can easily buy ASX shares to get exposure to sectors that simply don't exist in NZ. I'm not aware of any UK shares being excluded but I could be wrong on that

You also have the option of investing in investment companies here that then invest offshore in the US and many other markets. These funds then seem to have a special status and they do not have to pay this 5% taxation on their total holdings. So, you can get around this taxation that way. Some of the fisher funds as an example.

I like the idea somewhat, but I think the net effect would be less people working past 65 and the state going bankrupt.

My dad is still working part time at 68, he likes the extra money, but tax him at 50% and it would barely make sense to bother after he pays to commute etc.

Alternatively, get rid of the government top-up but charge tax on withdrawal, at your marginal tax rate. That would help pay for the lost tax revenue while making the scheme more effective and attractive. Nobody loses?

Nah, you'd need a specific withdrawal rate for that to make sense. Between a final-job annual leave payout and a Kiwisaver cash-in, the amount of tax you'd incur would be hugely detrimental.

KS started well and the the gutless and vision deficient politicians failed to expand it as intended.

Back to the old economy where we just fight over who we take money off to give to somebody else.

But still KS has potential to be a great provider. If beefed up.

We as Kiwis - both as governments and individuals - really seem to lack the long term discipline to plan for retirement.

in 1975 Muldoon infamously killed the then fledging New Zealand Superannuation Scheme (considered one of the worst decisions ever), and then later contributions to the later NZ Super fund were stopped between 2009 and 2017.

Fortunately KiwiSaver funds are in the hands of individuals but governments seem hell bent on even eroding that by first cutting the government contribution, and then withdrawal for first home, and now it is mooted for rental bonds.

I am very fortunate. I have the old public service 6% + 6% (not 3%+3% as for KiwiSaver) defined benefit superannuation scheme. During my working life I saw the vast majority of my cohort withdraw either firstly for overseas travel or later for one’s first home. Probably less than 5% saw their scheme through to retirement. In retirement I’m now really comfortable with my inflation adjusted pension protected by Act of Parliament.

I am really concerned for the future - the current national superannuation scheme in its current form (due to lack of government commitment) is unlikely to be sustainable, and at a personal level, erosion of KiwiSaver.

As to superannuation we can really well learn from Australia.

1) Phase out withdrawals for first homes. This is stupid and has the effect of pushing up house prices, particularly at the lower end of the market. Actually fix housing though because this is one of many 'band-aids' that need to be ripped off.

2) Make kiwisaver investments in NZ assets tax-free, and international assets tax-deferred. If you want it to be a retirement vehicle you need to do this. As it stands there is no rational reason to put anything into the scheme other than the minimum amount required to reach the maximum employer and govt contributions. Past this point you are literally just investing in assets without agency, may as well grow a fund of the exact same assets with agency alongside your kiwisaver, which is what most responsible people are doing.

Why buy the S&P500 through kiwisaver where you can't withdraw or reallocate to private investments, when you could just do so in a parallel fund and maintain that flexibility?

The bond thing.... the bond thing is probably ok. This is just a personal responsibility thing. It's a couple thousand dollars at best (4 weeks rent) and perhaps you should need to demonstrate you couldn't fund this from your liquid assets first to access it. It really should be a last resort, ensure there's a roof over your head, type of thing. Net effect will probably be at the margin to reduce WINZ financial support payments somewhat which is good.

One option - Tenancy agency could just use a kiwisaver account as a bond - only withdrawing if needed

and of course they pay interest on your bond right so that your bond isnt just dead money?

The pool of NZ assets is too small, and of such low quality, that they should not be tax preferred as it would simply drive money into poor performing assets. If the aim of a retirement fund is to build a lump sum then global assets should be treated equally so that the money goes where it can earn the best return.

Yeah. I mean the point here is to also increase NZ productivity.

Look at any productivity commission report (or standard macroeconomics for that matter) and you'll see that the key to lifting real incomes in NZ is to increase capital/worker. This policy would do this. It would also expand that pool of assets you refer to so it wouldn't be so small. It would fund the infrastructure we need to unleash growth, fuel our companies (instead of just houses) creating jobs, opportunities, and raising incomes and real living standards.

It would go a long way to closing the wage gap with Australia.

Also of note in May 2023 was that the withdrawal for financial hardship was over $20 million - which was more than double the amount withdrawn for this purpose in May 2022.

That surprised me too. I had an acquaintance who was forced to sell his house when he had a family situation and couldn't keep up with the mortgage. His situation wasn't deemed desperate enough to withdraw some kiwisaver.

There's a lot of people being diagnosed with terminal illnesses and dying in 2023.

In the KiwiSaver conservative "cash" option, I can only around 1% return. Nothing like the 5.85% that most term deposits yield.

Then change it to a growth plan. And if you want predictability stay conservative.

Also term deposits were 1% until quite recently.

Why is it not a conflict of interest when a politician who owns seven houses want's to meddle in the housing market and is it not worse than another who only owns a few thousand dollars worth of shares?

Because the problem wasn't that he owned the shares, it was failing to declare them despite being reminded to over a dozen times. Nice attempt at misdirection though, maybe have a crack at the actual thing being debated this time.

Which show what a load of BS it is. Disclosing you have an interest in multiple rentals has changed what?

The whole saga is a distraction from the real issue of MP's pushing up house prices in spite of their own 'disclosed' interest.

A charade.

He probably owns loads of shares as well. He has to put his wealth somewhere and being diversified across asset classes makes a lot of sense. Or are you suggesting that only poor people should be allowed to be politicians?

There is a very simple solution to this issue:

https://en.wikipedia.org/wiki/Blind_trust

I'd probably allow exceptions for the main home and a second home (not rented out) because I'm generous. Could even hand over politician's assets to the Super Fund to manage - they tend to do a good job.

Yes, though there would be quite a high transactional cost in moving the assets and it may trigger and/or reset brightline tests, etc. (unless exemptions are built in for this purpose). Due to that the trustees would be unlikely to materially change the asset mix so the blind trust wouldn't be very blind.

We might have less poverty then.

The media seemed to imply otherwise, articles like "As Minister of Immigration, Wood was responsible for including telecommunications technicians on the immigration green list. This was something Chorus and other industry players had lobbied for. ". This would have been fine if he had disclosed them?

Which is more likely to cause a conflict, having a few thousand bucks of undisclosed shares or having $10 million of disclosed property?

They are two separate issues. Conflating them when convenient is missing the point. Someone who ignores civil service advice and who can't fill out forms correctly and makes repeated false declarations shouldn't be a Minister of the Crown.

Dragging anything else into is is deliberate misdirection.

It is an obvious, clear conflict of interest. But the rules allow this conflict of interest if properly reported, so it's absolutely fine.

Funny old system, isn't it? The only recourse we have is to not vote for those who put their own interest over that of the country as a whole - which I guess is working if you look at the Nat's polling results.

Isn't politics always a conflict of interest? It may not be financial, for example you may have religious beliefs that influence your decision making. At the end of the day its up to the voters to eliminate the dodgy ones, and I guess that is where disclosure comes in.

I would like Kiwisaver to be the early retirement option; Kiwisaver available at 65 while government super is only available at 70. You can save to retire early or not save and work to 70. It would give Kiwisaver a purpose, make NZ super more affordable, and just make the whole system feel robust and there for the long term.

Once you turn 65 and have enough money in KS to pay for NZ super until 70, you can choose to take early retirement. The government take enough money from your Kiwisaver to pay you NZ super for the next 5 years, and the remainder is made available to you.

The contract really should be that whenever the government of the day decides to alter the terms and conditions, then there is a window of time that you can close your kiwisaver account down and withdraw the lot.

This might make them think long and hard about constantly fiddling with it.

Although maybe National would just trigger this often and try pipe as much of those funds into property.

Cut and paste from my other post.

KiwiSaver is not a savings account, it is an investment which one doesn’t really have any real control of.

If you are young and saving up to buy a house then do it otherwise think twice as KiwiSaver more likely not going to exist in 30 years time….

Even if you managed to hang on to retirement your “savings” will become insignificant after inflation. Just imagine what $1 million can buy you in 30 years time and that’s if you have $1m in your KiwiSaver by then.

The system is designed to use your money to “support the market”, it is an idea.

I would be very happy to see KS being universal. Compulsory and bigger contributions. And because you can't withdraw it pre 65 the trade off should be that KS is tax-free.

No tax at entry, during, or exit. Zilch.

Can't see why any such social service instrument should be taxed.

Primarily because it would be a huge tax avoidance scheme for the wealthy who could afford to invest 60% of their income in kiwisaver.

You'd have to cap the tax free contributions at a sane low level at the very least, and tax the money if you did the whole move overseas for a year to transfer it out of the country trick. Otherwise the children of the well off would get jobs with the family business at 16yo, paying 100% of their income to kiwisaver while living rent and board free at home, by the time they graduate uni and head overseas on the big OE and/or ancestry visa type deal and transfer all that money out of KS, then a few years later when they come back there is the instant house deposit. I think those kids already get enough of a head start on the rest of us, no need to turbocharge it.

Pragmatically. Not hard to stop that. ie. Why allow the overseas transfer thing ?

Because people do leave the country permanently, no reason to complicate their life bt forcing them to have financial obligations in another jurisdiction.

But it can be done. No reason not to.

It would be a disincentive for skilled people to immigrate here.

See Australia. Tax free contributions capped at $27.5k pa. Can contribute another $110k pa out of tax paid income, up until your account balance is $1.9M. Earnings within the fund are concessionally taxed at 15% and a 10% capital gains tax, up until your account balance is $3M then normal tax rates apply. Withdrawals are tax free at 60 years of age. You cannot simply withdraw it unless for specified reasons, and you can only transfer it to a limited set of approved international superannuation funds who also comply with the no withdrawals until retired rules.

I'm late 50s, been with the same employer for about 25 years. I may be leaving that job soon.

Over those 25 years, the employer has offered a superannuation scheme which matches my contribution up to a maximum of 5% salary. That means, I put in 5% of each pay check and the employer also puts in 5%. If I leave the job, then I can withdraw the amount. I don't have to wait until I'm 65.

The incentive to join the scheme was simple: by forgoing 5% of my salary (and putting it in the fund), the employer would match it, effectively giving myself a 5% pay rise.

Point 1: I'm supremely glad that the employer offered this scheme. Otherwise, it's extremely unlikely I would have started saving for my retirement in my early 30s.

Point 2: The amount in my fund is about $400,000. That may sound like a lot, but I know it won't go far or last long. It's still pretty good, but I understand its limited worth. I figured out that this fund would not solve all of my retirement finances a while ago, and made sure to buy and own my own house, and also to make some additional investments. In short, I expect to be fine (barring climate collapse, or other catastrophe that affects all of humanity, or failing personal health, or some other disaster that can't be planned for.).

Moral 1: I would argue that it is "society's obligation" to provide structures and incentives to save for retirement. The alternative, and the cost of not doing so, is to create a cohort of elderly and vulnerable people who have no means of fending for themselves, which then becomes a big problem of society.

Moral 2: Don't like KiwiSaver? Then propose some alternatives. Society cannot leave it to individuals to save over decades for their retirements off their own bat - only the privileged few will manage to do that.

Moral 3: If somehow you can save 10% of your pay throughout a (say) 40 year working life, and if you can own your own house during this time, then that should help set you up well. I would regard this as the bare minimum. Great if you can keep working beyond that, but best to be prepared in case you're not able.

Hearty congratulations and warmest gratitude to Michael Cullen for his work on this, in establishing the "Cullen Fund" in 2001.

Worst decision ever by a politician in NZ was by Robert Muldoon to cancel the NZ Superannuation Scheme in the 1970s.

Great post Pythagoras.

Meanwhile the Australian Govt has raised the compulsory super contribution to 12%. Thats how you do it!

Probably not many people who could take a 12% hit off the top in their pay, let's be honest. Good luck getting the people living payday to payday (which is a lot of formerly comfortable middle class professions as well as your cleaners and labourers) to agree to forgo 12% of the money they need to get through.

Thats why it was phased in over time. And employers wore the increased cost, unless your employment contract was negotiated on a Total Renumeration basis and was Super inclusive (most aren't as base salaries are negotiated on a plus Super basis).

Labour created kiwisaver, and National therefore seem to dislike the scheme, and have been turning it into a joke. Firstly by allowing it to be used for a first home deposit which only put up house prices, as many FHBs could afford to pay a larger deposit. If they get back in, most under 50 will need to wait until 67 to withdraw it, which give 2 less years to use it, and means many won't get it at all if they die between 65 and 67. It is stupid that it is tied to pension eligibility.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.