Fixed home loan rates are still inching lower, with the latest cuts from BNZ.

They follow recent changes from Westpac, TSB, China Construction Bank, and the Co-operative Bank.

Most of these changes are small, apart from those catching up to what others have already done.

But the interesting thing is that while these rates are dipping, wholesale swap rates are actually on a firming trend. See the chart at the foot of this article.

Since mid-April, when the one-year swap rate ended its long-running fall to 3.1% in April 2025 from 6% in October 2023, it has risen to 3.2% over the following 70 days. The two-year swap rate is up to 3.3%. Neither show any sign of turning lower any time soon. Global pressures are keeping wholesale rates elevated.

While neither trend is itself major, the divergence is growing.

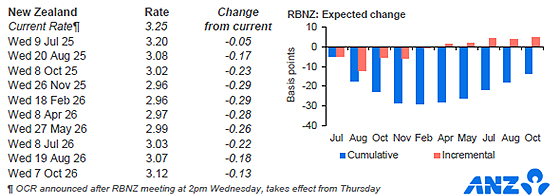

And financial markets no longer see any Official Cash Rate (OCR) changes until October at the earliest. And even that is subject to modification if markets become unstable from global events, including wars and stagflationary pressures in some of the major economies. This is ANZ's current assessment of what is priced into wholesale market money.

So with now-rising swaps rates, and little chance the OCR - now at 3.25% - will influence short rates down in the near term, the squeeze is on lenders. (And it won't help that inflation seems to be rising).

Why are they chasing fixed home loan rates lower when the cost pressures are rising? It's all about competition for mortgage market share.

The mortgage market is becoming a zero-sum game for banks. Mortgages are essentially commodities, and with almost all banks offering excellent customer service, the only lever left to pull to hold or gain market share is 'price'.

So pressure is on margins.

But there is one way banks can afford to go lower, and that is by trimming their savings and term deposit (TD) rate offers. And they are doing that. No bank makes a big move on TD rates any more. Rather they trim small amounts often. Over time that has the same effect without raising the ire of their depositor customers.

Some term deposit rates in the 6-12 month range are getting quite low. Most major banks are are offering less than 4% now, with ASB alone with a 4% six month rate. Meanwhile, 3.40% to 3.90% is where most of the others are. And savers should not be surprised to see these dip even further, especially if the home loan rate competition extends.

In fact, in 12 days, the Depositor Compensation Scheme (DCS) becomes active. That imposes fees on authorised deposit takers. It is unlikely they will just absorb those fees. They are commercial organisations and the DCS fees will embed as a cost of doing business and depress what they can offer for term deposits.

Perhaps there is a floor below what they can offer for term deposit interest rates - the Kiwi Bond rate, currently 3.50%. That is the theory, at least. But in practice don't be surprised if banks and some other authorised deposit takers test whether they can still raise funds from depositors at even lower rates. After all there is some annoying friction getting signed up to Kiwi Bonds, and the convenience of just staying with your bank (in your bank app) will be stronger than theory suggests. The 'replicating portfolio' is real.

Kiwi Bond rates may be the risk-free benchmark, but there is no rule that banks and authorised deposit takers can't offer less.

For banks, the headline arithmetic is mortgage rates at 4.90% and paying term depositors 3.90%. That is an unusually skinny rate set. Something will give.

Here is the snapshot of the lowest advertised fixed-term mortgage rates on offer from the key retail banks at the moment.

| Fixed, below 80% LVR | 6 mths | 1 yr | 18 mth | 2 yrs | 3 yrs | 4 yrs | 5 yrs |

| as at June 18, 2025 | % | % | % | % | % | % | % |

| ANZ | 5.29 | 4.95 | 4.89 | 4.95 | 5.09 | 5.79 | 5.79 |

|

5.45 | 4.95 | 4.89 | 4.95 | 5.15 | 5.59 | 5.69 |

|

5.29 -0.06 |

4.89 -0.06 |

4.89 | 4.95 | 5.09 | 5.39 | 5.59 |

|

5.29 | 4.89 | 4.95 | 5.29 | 5.59 | 5.79 | |

|

5.29 | 4.89 | 4.95 | 4.95 | 4.99 | 5.39 | 5.39 |

| Bank of China | 5.15 | 4.85 | 4.85 | 4.95 | 5.05 | 5.35 | 5.35 |

| China Construction Bank | 5.15 -0.34 |

4.85 -0.14 |

4.85 -0.14 |

4.95 -0.04 |

4.95 -0.44 |

5.99 | 5.99 |

| Co-operative Bank (*=FHB only) | 5.25 -0.14 |

4.85* -0.04 |

4.99 -0.10 |

4.99 | 5.25 -0.14 |

5.49 -0.10 |

5.59 -0.10 |

| ICBC | 5.15 | 4.85 | 4.85 | 4.95 | 5.05 | 5.35 | 5.39 |

|

5.45 | 4.95 | 4.95 | 4.95 | 5.15 | 5.39 | 5.39 |

|

5.49 |

4.95 -0.04 |

5.09 | 4.95 -0.04 |

5.29 -0.10 |

5.79 | 5.89 |

Fixed mortgage rates

Select chart tabs

Daily swap rates

Select chart tabs

Comprehensive Mortgage Calculator

6 Comments

"and with almost all banks offering excellent customer service"

😂

Still takes up to 3 hours to transfer cash from one bank to another in NZ.

Still don't have portable bank accounts in NZ, because, reasons

Back to a few years ago when it was to much effort not enough return to bother shifting money from a saving to TD

Any chance the banks might forgo some of their massive profits instead? Lol

Indeed David, interest rates on lending are indeed not all about swap rates or the OCR. Banks need to lend to make money...

Hmmm...based of their back to back to back record profits they are. Increased lending is probably more about bonuses.

It's not so bad. TD rates have dropped. So has inflation.

Anyways, savers of any sort, do better than borrowers.

Has anyone been successful in negotiating lower than the advertised rates recently? If so, how much? Looking at a new loan and thinking we will go long (5 years).

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.